India Lubricants Market Size and Trends

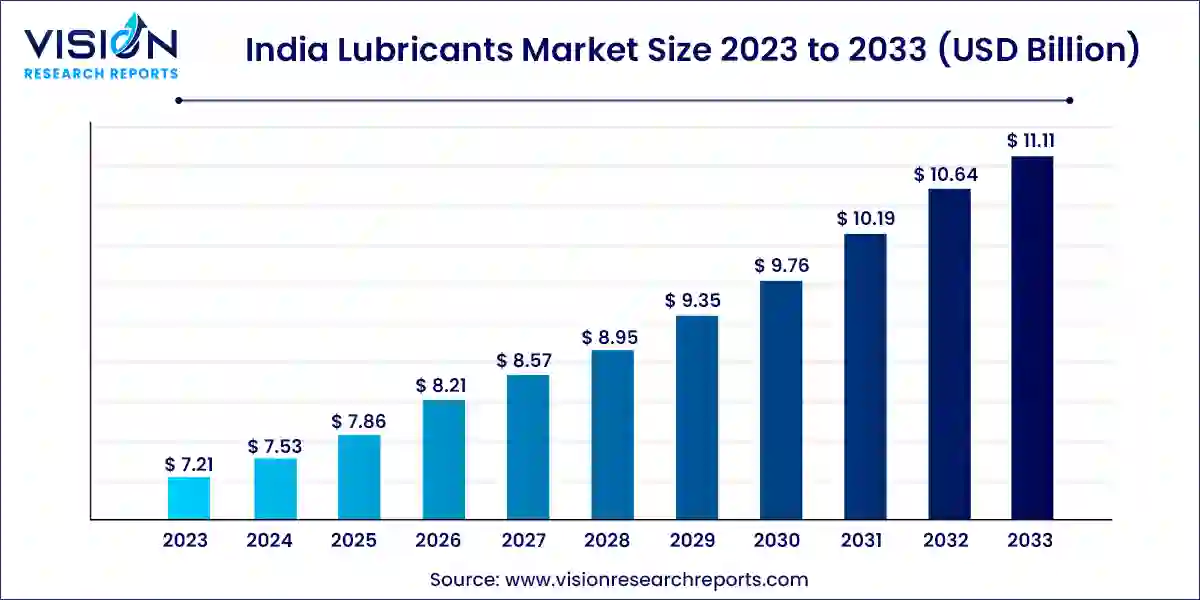

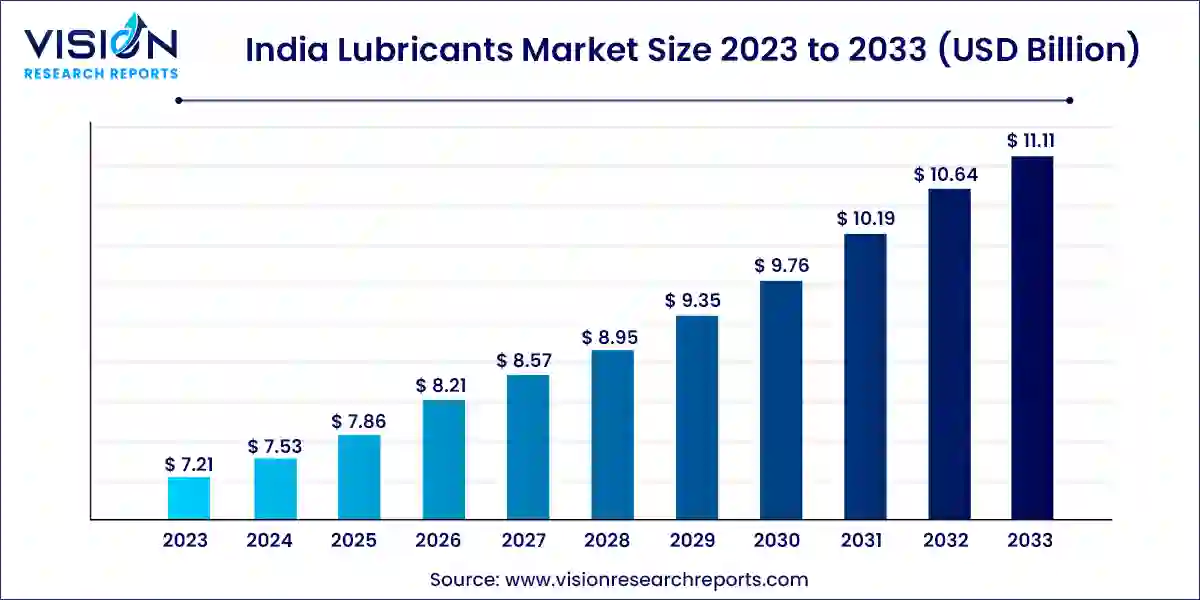

The India lubricants market size was estimated at around USD 7.21 billion in 2023 and is projected to hit around USD 11.11 billion by 2033, growing at a CAGR of 4.42% from 2024 to 2033.

Key Pointers

- By Product, the automotive lubricants generated the maximum market share of 58% in 2023.

- By Product, the aerospace lubricants segment is estimated to expand the fastest CAGR from 2024 to 2033.

India Lubricants Market Overview

The India lubricants market stands as a pivotal component within the country's industrial landscape, playing an indispensable role in ensuring the efficient functioning and longevity of machinery across diverse sectors.

India Lubricants Market Growth Factors

The growth trajectory of the India lubricants market is propelled by several key factors. Firstly, the country's burgeoning industrial sector, including automotive, manufacturing, and construction, drives substantial demand for lubricants. Furthermore, the expansion of infrastructural projects and investments in industrial infrastructure further stimulate market growth. In parallel, the automotive industry's momentum, fueled by rising disposable incomes and urbanization, contributes significantly to lubricant consumption. Additionally, technological advancements in lubricant formulations, such as high-performance synthetics and bio-based alternatives, cater to evolving consumer needs while enhancing efficiency and sustainability. Top of FormBottom of Form

India Lubricants Market Trends:

- Digitalization and IoT Integration: Integration of digital technologies, including Internet of Things (IoT) sensors and predictive analytics, is revolutionizing lubricant management practices. Real-time monitoring of equipment performance, condition-based lubrication strategies, and predictive maintenance models optimize operational efficiency, minimize downtime, and enhance overall productivity.

- Customized Solutions for Diverse Applications: Market players are increasingly focusing on developing customized lubricant solutions tailored to specific industrial applications and machinery requirements. This approach ensures optimal performance, longevity, and cost-effectiveness, catering to the diverse needs of end-users across sectors such as automotive, manufacturing, marine, and aviation.

- Rising Demand for High-Performance Lubricants: With advancements in technology and engineering, there is a growing demand for high-performance lubricants capable of withstanding extreme operating conditions, reducing friction, and extending machinery lifespan. This trend is particularly pronounced in sectors such as aerospace, defense, and heavy machinery, where reliability and efficiency are paramount.

- E-commerce Penetration and Direct-to-Consumer Models: The increasing penetration of e-commerce platforms and digitalization has facilitated greater accessibility to lubricant products for consumers and businesses alike. Market players are leveraging online channels to expand their reach, offer convenience, and implement direct-to-consumer models, thereby streamlining distribution channels and enhancing customer engagement.

Product Insights

Automotive lubricants led the market with the largest revenue share of 58% in 2023. The automotive industry in India continues to grow, fueled by domestic demand and increasing export opportunities. As production and sales of vehicles increase, the demand for automotive lubricants is increasing. India's growing middle class and increasing disposable incomes are contributing to the growth of automobile market. The passenger vehicles segment in Indian automobile industry crossed units 4 million sales in 2023. This trend is expected to continue, driving demand for automotive lubricants for maintenance and performance enhancement.

The aerospace lubricants segment is expected to grow at the fastest CAGR over the forecast period. The development of India's Maintenance, Repairs, and Operations (MRO) industry, supported by policy reforms aimed at making India a global MRO hub, presents significant opportunities for the aerospace lubricants market. The need for regular maintenance and servicing of aircraft engines and components boosts the demand for high-quality lubricants.

The global aviation industry's emphasis on improving fuel efficiency and reducing emissions influences the development and adoption of advanced aerospace lubricants. These lubricants play a vital role in enhancing engine efficiency and reducing friction, thereby contributing to fuel savings and lower emissions.

India Lubricants Market Key Companies

- CASTROL LIMITED

- HP Lubricants

- Indian Oil Corporation Ltd

- Shell

- Gulf Oil International Ltd

- Valvoline

- TotalEnergies

- Exxon Mobil Corporation.

Recent Developments

- In October 2023, Gulf Oil and S-Oil announced partnership to expand its footprint in India. Through this partnership Gulf Oil aims to expand its product offerings and market presence in the country while S-Oil has entered a strategic alliance to bolster its global supply chain and product offerings

- In October 2023, BPCL announced launch of two new premium synthetic engine oils for high end cars and bikes. The company announced launch of Mak TitaniumCK4, ultra-low emission diesel engine oil and Mak Blaze Synth for high end bikes

- In October 2023, Chevron announced re-entry in the Indian market after 12 years. The company announced partnership with Hindustan Petroleum, the strategic partnership will allow HPCL to market the company latest Caltex lubricants in India. Chevron is expected to be able to expand its product offering in the growing lubricant market using HPCL vast distribution channel

- In March 2023, ExxonMobil announced investment of USD 110 million to setup lubricant manufacturing plant in Raigad, Maharashtra, India. The new plant is expected to produce 159,000 kiloliters of lubricants annually to meet country’s growing lubricant demand. The strategic move allows company to make Indian market specific lubricants and establish market presence as provider of high-performance lubricants in the country

India Lubricants Market Segmentation:

By India Lubricants Product

- Industrial Lubricants

- Process Oils

- General Industrial Oils

- Metalworking Fluids

- Industrial Engine Oils

- Greases

- Others

- Automotive Lubricants

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

- Marine Lubricants

- Engine Oil

- Hydraulic Oil

- Gear Oil

- Turbine Oil

- Greases

- Others

- Aerospace Lubricants

- Gas Turbine Oils

- Piston Engine Oils

- Hydraulic Fluids

- Others

Frequently Asked Questions

The India lubricants market size was reached at USD 7.21 billion in 2023 and it is projected to hit around USD 11.11 billion by 2033.

The India lubricants market is growing at a compound annual growth rate (CAGR) of 4.42% from 2024 to 2033.

Key factors that are driving the India lubricants market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others