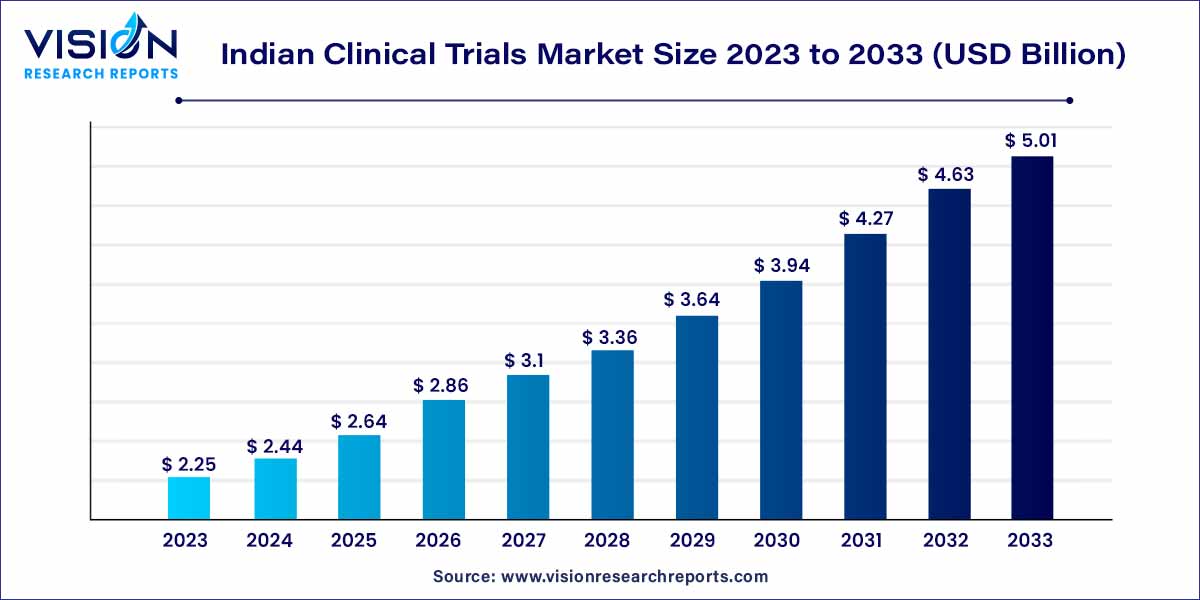

The Indian clinical trials market was valued at USD 2.25 billion in 2023 and it is predicted to surpass around USD 5.01 billion by 2033 with a CAGR of 8.34% from 2024 to 2033. The Indian clinical trials market stands as a dynamic and rapidly growing sector within the global landscape of medical research and development. India has emerged as a key player, offering a blend of diverse factors that make it an attractive destination for conducting clinical trials.

The Indian clinical trials market is propelled by a confluence of factors contributing to its robust growth. A pivotal driver lies in the expanding pharmaceutical and biotechnology sectors, characterized by continuous innovation and a supportive regulatory environment. The vast and genetically diverse population of India serves as a valuable asset, offering researchers an extensive participant pool essential for comprehensive clinical trials. The market's competitiveness is underscored by a cost-effective structure, making India an economically favorable destination for both domestic and international research sponsors. Furthermore, the nation's wealth of skilled medical professionals ensures the successful execution of trials, upholding the highest standards of medical care. Strengthening regulatory frameworks, global collaborations, and a commitment to ethical research practices further bolster the market's growth trajectory. As India continues to address challenges and enhance its clinical research ecosystem, it stands poised as a key player in shaping the future of global healthcare innovation.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.25 billion |

| Revenue Forecast by 2033 | USD 5.01 billion |

| Growth rate from 2024 to 2033 | CAGR of 8.34% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on phase, the market is segmented into phases I, II, III, and IV. The phase III segment dominated the market with the largest revenue share of 54% in 2023, owing to the cost-intensive nature of this segment. Phase III trials require a large patient population, which is one of the prime reasons for the high cost of this trial. Moreover, the studies in the phase last for a longer time, compared to phase I and II, which further improves the trial's cost and the market's segment share.

The phase I segment is expected to grow at the fastest CAGR of 10.05% over the forecast period owing to significant R&D investments by global and local pharmaceutical and biotechnological firms. The country's demand for new treatments and biologics further contributes to the segment's growth.

The interventional trials segment held the largest revenue share of 41% in 2023 due to the large number of trials adopting this study design. This type of study design includes large randomized clinical trials and is considered one of the best study designs for detecting small to moderate effects of drugs. These studies also provide the best means of minimizing the confounding effect, thus improving their adoption compared to other clinical study designs.

The observational trials segment is expected to grow at the fastest CAGR of 8.53% during the forecast period due to its ease of conduct and level of control, making it a good option for countries like India, where the infrastructure for clinical trials may not be as well-developed. The increasing prevalence of chronic diseases, regulatory support from the government, and availability of the largest datasets for observational studies are driving the segment's growth.

The expanded access trials segment is anticipated to grow at a lucrative CAGR during the forecast period. Factors such as the growing incidence of serious diseases, demand for new innovative treatment options, and the country's high burden of chronic diseases are anticipated to fuel the segment’s growth. Moreover, owing to the COVID-19 pandemic, an expanded access study with convalescent plasma was used in India to treat patients with COVID-19. Such actions are further contributing to the segment growth.

The oncology segment dominated the market with the largest revenue share of 25% in 2023 and is expected to grow at the fastest CAGR of 10.5% over the forecast period, owing to the increasing prevalence of cancer in the country and the growing demand for advanced medical devices and cancer treatments. Cancer is considered one of the major causes of death globally and is expected to affect approximately 2 million people in India by 2040, according to the Cancer Tomorrow estimates. Most treatments for cancer are ineffective in the last stages of the disease, which is a key reason for the growing demand for new treatment options for cancer in the country.

The various measures and launches are driving the oncology market growth. For instance, in November 2023, the International Association of Oncology (AIO) in partnership with BioLEAGUES announced the 5th Indo Oncology Summit, taking place in Bhubaneshwar, India, on the subject “Cancer Care: Era of Precision.” In January 2023, the Indian government announced the launch of its first made-in-India CERVAVAC vaccine, a “Quadrivalent Human Papillomavirus” (qHPV) vaccine that helps prevent cervical cancer. In March 2023, Dr. AV Cancer Institute of Personalized Cancer Therapy and Research, Gurugram, launched India’s first Precision Oncology treatment center to make precision oncology treatment affordable and easily accessible nationwide.

CNS conditions held a significant revenue share in 2022. Many people in India are affected by neurological disorders like stroke, epilepsy, tremors, and Parkinson’s disease; the trend is similar globally. This is expected to impact R&D investments for clinical trials in the country positively.

By Phase

By Study Design

By Indication

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Phase Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Indian Clinical Trials Market

5.1. COVID-19 Landscape: Indian Clinical Trials Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Indian Clinical Trials Market, By Phase

8.1. Indian Clinical Trials Market, by Phase, 2024-2033

8.1.1 Phase I

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Phase II

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Phase III

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Phase IV

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Indian Clinical Trials Market, By Study Design

9.1. Indian Clinical Trials Market, by Study Design, 2024-2033

9.1.1. Interventional Trials

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Observational Trials

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Expanded Access Trials

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Indian Clinical Trials Market, By Indication

10.1. Indian Clinical Trials Market, by Indication, 2024-2033

10.1.1. Autoimmune/Inflammation

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pain Management

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Oncology

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. CNS Condition

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Diabetes

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Obesity

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Cardiovascular

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Indian Clinical Trials Market, Regional Estimates and Trend Forecast

11.1. India

11.1.1. Market Revenue and Forecast, by Phase (2021-2033)

11.1.2. Market Revenue and Forecast, by Study Design (2021-2033)

11.1.3. Market Revenue and Forecast, by Indication (2021-2033)

Chapter 12. Company Profiles

12.1. IQVIA HOLDINGS INC.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. PAREXEL International Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Pharmaceutical Product Development (PPD) LLC.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Charles River Laboratory.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ICON PLC.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PRA Health Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Chiltern International LTD.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Syneos Health Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SGS SA.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Syngene International Limited

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others