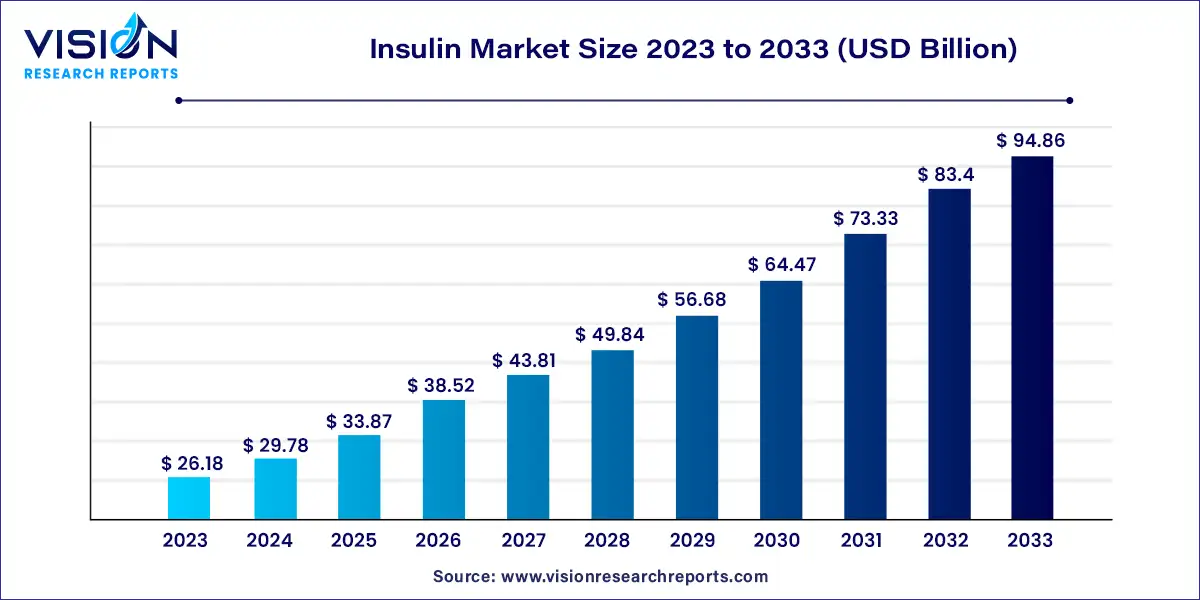

The global insulin market size was valued at USD 26.18 billion in 2023 and is anticipated to reach around USD 94.86 billion by 2033, growing at a CAGR of 13.74% from 2024 to 2033.

The growth of the insulin market is propelled by several key factors contributing to its expansion and vitality. One significant driver is the escalating prevalence of diabetes globally, with a surge in diagnosed cases necessitating greater access to insulin therapy. Additionally, advancements in insulin delivery systems and formulations have enhanced treatment efficacy, promoting patient adherence and driving market demand. Moreover, heightened awareness and proactive initiatives to manage diabetes risk factors, coupled with increasing healthcare expenditure, further bolster market growth. Furthermore, the advent of personalized medicine and precision therapies is revolutionizing diabetes care, fostering innovation and differentiation within the insulin market. These growth factors collectively underscore the resilience and potential of the insulin market to address the evolving needs of diabetic patients worldwide, while also presenting opportunities for continued innovation and market expansion.

In 2023, the long-acting insulin segment captured a substantial 49% share of the revenue. Long-acting insulin, also recognized as basal insulin, gradually releases insulin over an extended duration, aiding in the maintenance of stable blood sugar levels between meals and throughout the night. There's a growing interest within the insulin market for more convenient formulations, particularly once-daily and ultra-long-acting options, aimed at simplifying diabetes management and improving patient adherence.

The rapid-acting insulin segment is poised for notable growth, with an anticipated compound annual growth rate (CAGR) of 21.44% during the forecast period. Rapid-acting insulin, designed for swift absorption into the bloodstream, is typically administered before or after meals to manage post-meal blood sugar surges. Current market trends reflect an increasing demand for faster-acting formulations, offering enhanced glycemic control for individuals managing diabetes.

In 2023, the insulin analog segment dominated the market, claiming an impressive 83% share. Insulin analogs are synthetic insulin variants engineered to meet specific patient needs. There's a noticeable shift in the insulin market towards personalized diabetes management, with insulin analogs gaining popularity due to their customizable dosing and ability to replicate natural insulin release. This trend underscores the quest for improved glycemic control and better quality of life for individuals with diabetes.

Conversely, the human insulin segment is expected to experience rapid growth in the coming years. Human insulin, derived biologically, serves as a fundamental component in diabetes treatment, closely mimicking the body's natural insulin production. The adoption of recombinant DNA technology for human insulin production is on the rise in the insulin market, enhancing its accessibility and affordability. This technological advancement aligns with the growing demand for cost-effective insulin therapies, particularly in developing regions.

In 2023, the Type 1 diabetes mellitus segment commanded the largest market share at 63%. For individuals with Type 1 diabetes mellitus, a consistent and reliable supply of insulin is imperative. Recent developments in this segment emphasize the advancement of delivery systems, such as insulin pumps and smart insulin pens, aiming to provide more convenient and precise insulin administration. Moreover, there's a notable focus on improving insulin stability and duration of action. The adoption of personalized insulin regimens and telemedicine solutions is also on the rise, facilitating better insulin dosage management and glucose level monitoring for patients with Type 1 diabetes mellitus.

Conversely, the Type 2 diabetes mellitus segment is expected to witness the highest growth rate in the upcoming years. The demand for Type 2 diabetes mellitus treatments in the insulin market is on the rise, driven by the escalating prevalence of this form of diabetes. Current trends in this segment involve the development of long-acting insulin formulations, convenient pre-filled insulin pens, and more user-friendly injection devices. The market is shifting towards patient-centric approaches, emphasizing self-management, education, and combination therapies to address the multifaceted nature of Type 2 diabetes mellitus.

In 2023, the hospitals segment is expected to dominate the market, holding a significant 77% share. Hospitals play a crucial role in the insulin market, serving as primary distribution channels for this critical medication used in diabetes management. Insulin is predominantly dispensed in hospital settings, catering to inpatients and those in urgent need of medical attention. Recent trends indicate a digital transformation in hospitals, with the adoption of electronic health records and automated medication dispensing systems, streamlining the distribution process. Furthermore, hospitals are increasingly prioritizing patient education on insulin administration and management, thereby improving patient care and outcomes.

Conversely, the retail pharmacies segment is poised for rapid growth in the forecasted period. Both brick-and-mortar and online retail pharmacies are pivotal in ensuring convenient access to insulin for individuals managing diabetes. These pharmacies offer a diverse range of insulin products for outpatient use, providing various insulin formulations and injection devices to meet patient needs effectively.

In 2023, North America secured the largest revenue share at 42%. The North American insulin market is characterized by a strong demand for diabetes management solutions. Insulin, crucial for individuals with diabetes, is experiencing a trend towards advanced delivery methods like insulin pens and pumps. Additionally, there's a growing preference for long-acting and ultra-rapid-acting insulin analogs, highlighting the importance of enhanced convenience and efficacy. The region also shows an increasing focus on personalized insulin therapies, emphasizing precision medicine approaches.

On the other hand, Asia Pacific is expected to witness the most rapid expansion. In this region, the insulin market is defined by its swiftly growing diabetic population. This surge in demand has driven the need for affordable and accessible insulin products, with biosimilar insulins gaining traction as cost-effective alternatives. Furthermore, Asia Pacific is transitioning towards telemedicine and digital solutions for diabetes management, facilitating improved patient care and access to insulin therapies, particularly in remote and underserved areas. Regulatory reforms and heightened awareness about diabetes care are additional factors shaping the insulin market in this region.

By Product

By Application

By Type

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Insulin Market

5.1. COVID-19 Landscape: Insulin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Insulin Market, By Product Type

8.1. Insulin Market, by Product Type, 2024-2033

8.1.1. Rapid-Acting Insulin

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Long-Acting Insulin

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Combination Insulin

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Biosimilar

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Insulin Market, By Type

9.1. Insulin Market, by Type e, 2024-2033

9.1.1. Human Insulin

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Insulin Analog

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Insulin Market, By Application

10.1. Insulin Market, by Application, 2024-2033

10.1.1. Type 1 Diabetes Mellitus

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Type 2 Diabetes Mellitus

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Insulin Market, By Distribution Channel

11.1. Insulin Market, by Distribution Channel, 2024-2033

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Retail Pharmacies

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Insulin Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Novo Nordisk A/S

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Eli Lilly and Company

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Sanofi

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Biocon Ltd

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Wockhardt

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Boehringer Ingelheim International GmbH

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Julphar

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. United Laboratories International Holdings Limited

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Tonghua Dongbao Pharmaceutical Co. Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others