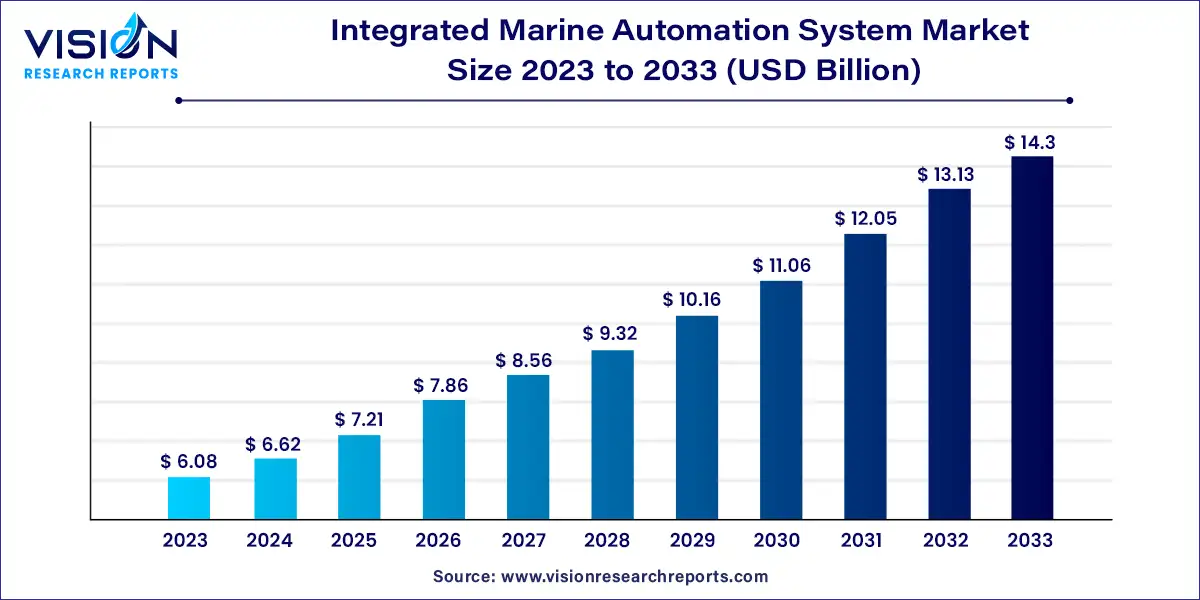

The global integrated marine automation system market size was estimated at USD 6.08 billion in 2023 and it is expected to surpass around USD 14.3 billion by 2033, poised to grow at a CAGR of 8.93% from 2024 to 2033.

The integrated marine automation market is witnessing significant growth due to the increasing demand for advanced automation solutions in the maritime industry. These systems enhance the efficiency, safety, and operational performance of vessels by integrating various subsystems into a single, cohesive platform. The market is driven by the growing need for reliable and efficient marine operations, stringent safety regulations, and the push towards digitalization in the maritime sector.

The growth of the integrated marine automation market is primarily fueled by an increasing adoption of advanced digital technologies and automation in the maritime industry. These technologies, including Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), are transforming traditional vessel operations by enhancing efficiency, safety, and decision-making processes. The push for greater operational efficiency, driven by rising fuel costs and stringent environmental regulations, is also compelling shipowners to invest in automation systems that optimize fuel consumption and reduce emissions. Additionally, the growing demand for safer navigation and the need to comply with international maritime safety standards are encouraging the integration of automation systems across commercial and defense vessels.

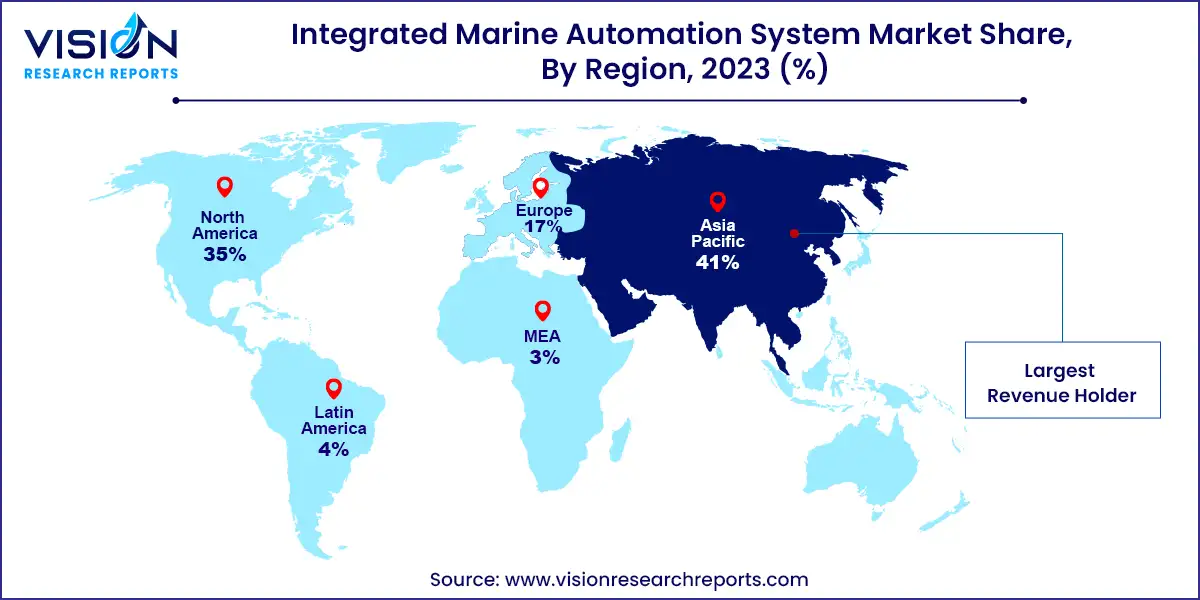

In 2023, the Asia Pacific region led the integrated marine automation system market with a 41% share of global revenue. This dominance is driven by the thriving shipbuilding industry in countries like China, South Korea, and India. The region’s growing economies and rising trade volumes require efficient and well-equipped vessels, which boosts the IMAS market. Government initiatives aimed at modernization and technological advancements further enhance the region's market position.

| Attribute | Asia Pacific |

| Market Value | USD 2.49 Billion |

| Growth Rate | 8.93% CAGR |

| Projected Value | USD 5.86 Billion |

Japan's integrated marine automation system market is expected to grow significantly at a robust CAGR from 2024 to 2033. Japan's prominent role in the IMAS market is due to its long maritime history and strong emphasis on technological innovation. Japanese companies are known for their cutting-edge IMAS solutions, and the domestic demand for advanced ship automation systems continues to drive market growth.

North America’s integrated marine automation system market is projected to grow steadily from 2024 to 2033. The region’s large commercial shipping fleet, coupled with growing defense budgets and investments in technological advancements, contributes to this growth. However, the presence of established shipyards in the Asia Pacific region may pose competitive challenges for North American manufacturers.

Europe Integrated Marine Automation System Market Trends

In Europe, the integrated marine automation system market is projected to grow at a notable CAGR from 2024 to 2033. Europe’s well-established maritime industry and significant growth potential in the IMAS market are key factors. Strict environmental regulations and a focus on fuel efficiency are driving the adoption of advanced automation solutions. Additionally, several leading IMAS manufacturers are based in Europe, which supports regional market growth.

In 2023, the hardware segment led the market, accounting for over 55% of global revenue. This segment includes critical physical components such as sensors, data acquisition systems, CPUs, and network infrastructure. Hardware’s dominance is attributed to the significant initial investment required to establish the core functionalities of Integrated Marine Automation Systems (IMAS). With ongoing vessel construction and upgrades, the demand for hardware remains robust.

The solution segment is anticipated to experience a higher compound annual growth rate (CAGR) between 2024 and 2033. This segment covers central processing algorithms, Human-Machine Interface (HMI) software, and specialized software for navigation, cargo management, and safety systems. The expansion of this segment is driven by the increasing complexity of IMAS features and a growing reliance on data-driven decision-making in maritime operations.

In 2023, the vessel management segment was the leading market contributor. This segment encompasses functionalities related to managing a ship’s operations, including navigation, propulsion, cargo handling, and communication. Vessel management solutions are essential for ensuring safe and efficient voyages. The segment is expected to grow significantly, driven by the integration of advanced features such as route optimization and predictive maintenance.

The power management segment is projected to grow substantially from 2024 to 2033. These solutions are focused on optimizing fuel consumption and power distribution throughout the vessel. The need for reducing operational costs and adhering to stricter environmental regulations is propelling this growth. As sustainability becomes more critical, power management solutions are likely to become increasingly important in IMAS.

In 2023, the commercial segment was the largest market player. The dominance of the commercial shipping sector in the IMAS market is due to the high volume of commercial vessels operating worldwide. The continuous pressure to cut costs and enhance efficiency in commercial shipping drives the demand for IMAS solutions.

The defense segment is expected to grow at a faster CAGR from 2024 to 2033. This growth is driven by the increasing complexity of naval vessels and the need for advanced automation capabilities. Rising defense budgets and the incorporation of new technologies, including autonomous systems, further support the growth of IMAS in the defense sector.

By Offering

By Solution

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others