The global interventional oncology market size was estimated at around USD 4.11 billion in 2023 and it is projected to hit around USD 10.93 billion by 2033, growing at a CAGR of 10.28% from 2024 to 2033. Interventional oncology is a rapidly evolving field that integrates minimally invasive procedures to diagnose and treat cancer. Leveraging advanced imaging technologies, interventional oncologists deliver targeted therapies directly to the tumor site, minimizing damage to surrounding healthy tissues.

The interventional oncology market is experiencing substantial growth driven by an increasing prevalence of cancer worldwide is a primary driver, necessitating more effective and less invasive treatment options. Technological advancements in imaging and therapeutic equipment, such as MRI, CT scans, and ablation devices, have significantly improved the precision and outcomes of interventional oncology procedures. Additionally, there is a growing preference for minimally invasive treatments among patients and healthcare providers, driven by shorter recovery times, reduced risks, and improved quality of life. Investments in healthcare infrastructure, particularly in emerging markets, are also propelling the market forward by making advanced interventional oncology services more accessible.

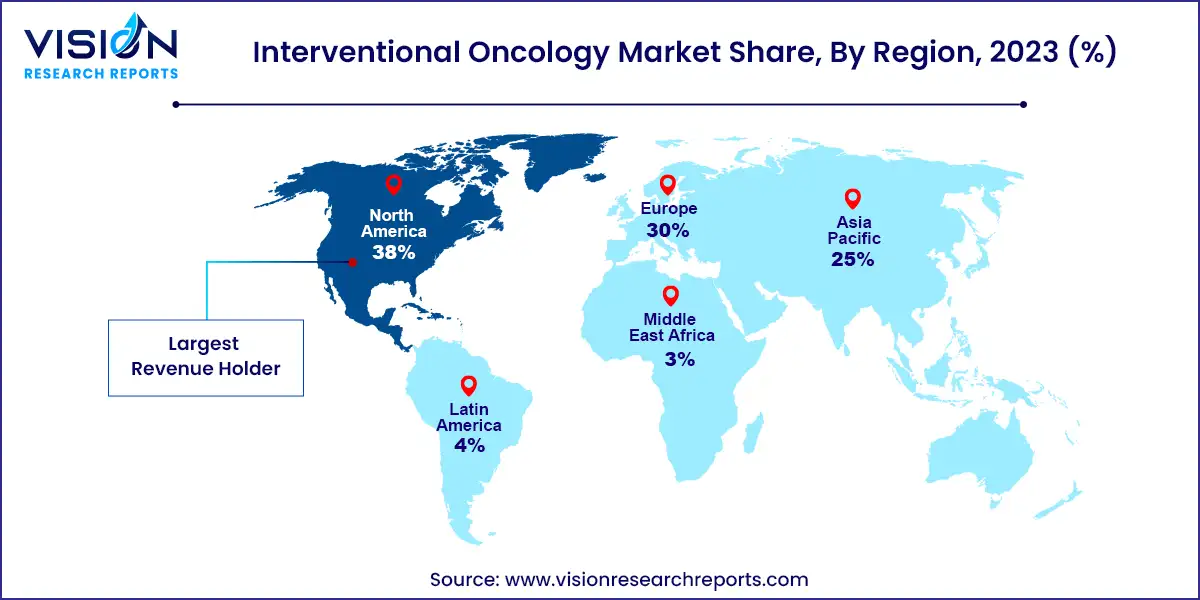

North America led the global market with a 38% share in 2023, driven by several factors including the presence of major market players, substantial healthcare expenditure, high awareness of minimally invasive procedures, a supportive regulatory environment, and a high incidence of cancer. The Canadian Cancer Statistics report from November 2023 highlighted cancer as the leading cause of death in Canada, with an estimated 239,100 new cases expected in 2023. This high prevalence fuels the demand for advanced interventional oncology solutions, contributing to the region's dominant market position.

| Attribute | North America |

| Market Value | USD 1.56 Billion |

| Growth Rate | 10.28% CAGR |

| Projected Value | USD 4.15 Billion |

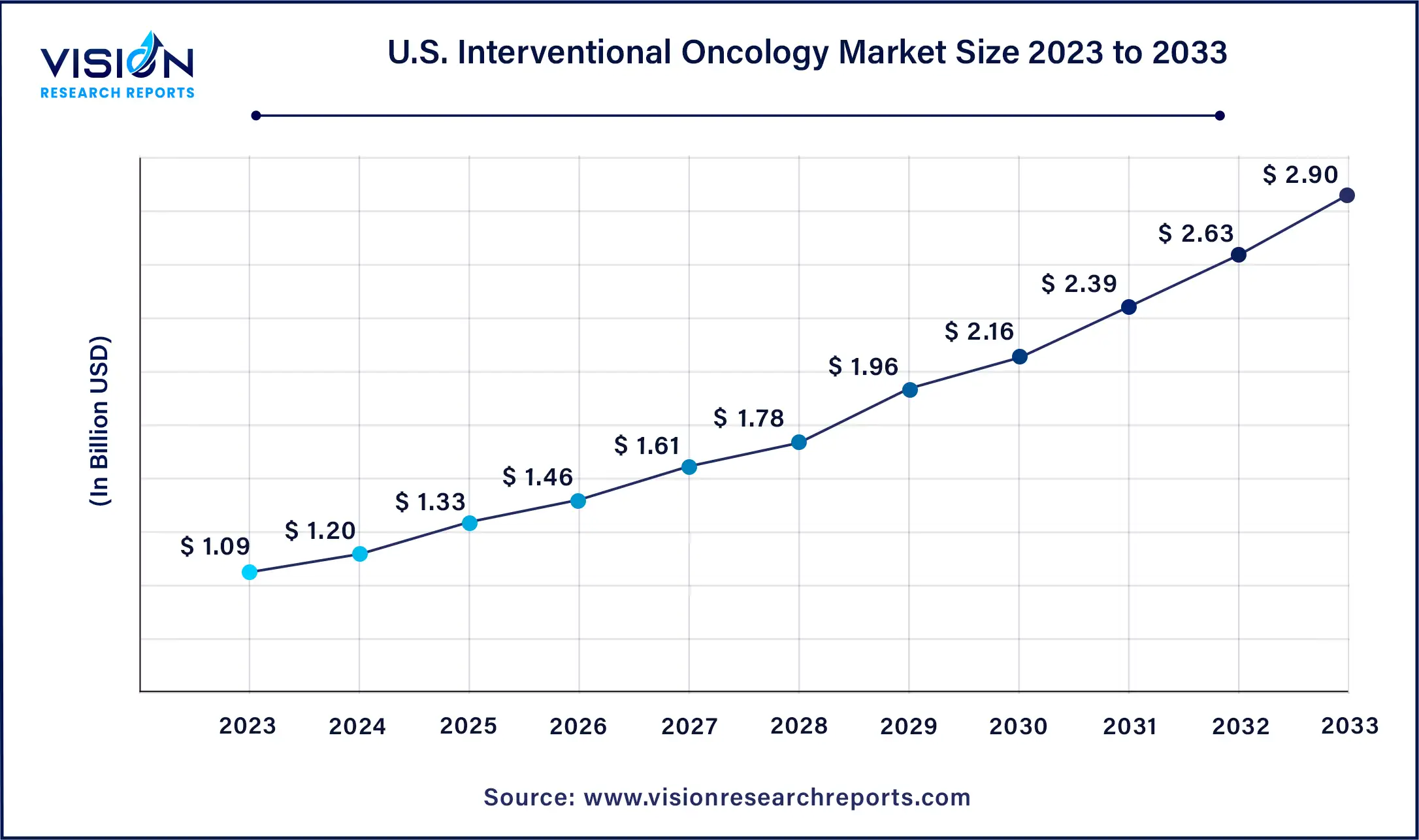

The U.S. interventional oncology market size was surpassed at USD 1.09 billion in 2023 and is expected to hit around USD 2.90 billion by 2033, growing at a CAGR of 10.28% from 2024 to 2033.

The U.S. is projected to experience substantial growth in the interventional oncology market. Key factors include the presence of major industry players, a supportive regulatory framework, and increased research and development efforts. Notably, in December 2022, the Society of Interventional Radiology (SIR) Foundation allocated $1.5 million in funding for four projects focused on embolization and interventional oncology research.

Europe Interventional Oncology Market Trends

Europe is expected to see significant market growth due to rising cancer rates, a shift towards minimally invasive procedures, an aging population, and increased government initiatives. According to a September 2023 report by the European Commission, approximately 2.7 million people were diagnosed with cancer in the EU in 2022, marking a 2.3% increase from 2020. Additionally, cancer deaths rose to around 1.3 million, a 2.4% increase from 2020. This rising cancer incidence is anticipated to drive the market's expansion in Europe.

Asia Pacific Interventional Oncology Market Trends

Asia Pacific is forecasted to experience the fastest growth, with a compound annual growth rate (CAGR) of 11.55% from 2024 to 2033. This growth is attributed to the high cancer prevalence, developing healthcare infrastructure, and increased efforts to adopt interventional oncology procedures. For example, in June 2023, the FDA Oncology Center of Excellence (OCE) Project Asha was launched to enhance collaboration between the U.S. and India and to address regulatory and access issues related to interventional oncology trials. Such initiatives are expected to boost market growth in the region.

In 2023, the ablation therapies segment emerged as the largest market leader. Ablation techniques—such as radiofrequency, microwave, cryoablation, and laser ablation—are increasingly favored due to their minimally invasive nature and ability to target tumors while minimizing damage to adjacent tissues. These therapies present a viable alternative to traditional treatments like surgery and radiation, offering benefits such as reduced recovery times, lower pain levels, and fewer complications. The rising incidence of cancer globally is fueling the demand for these effective, less invasive treatment options.

The embolization therapies segment is expected to experience significant growth during the forecast period. These therapies, which involve selectively blocking blood vessels to deprive tumors of their blood supply, are gaining recognition for their effectiveness, particularly in treating liver cancer. The advantages of embolization procedures include reduced recovery times, fewer complications, and the ability to treat tumors that are otherwise inoperable. As patients and healthcare providers increasingly prefer minimally invasive approaches, embolization therapies are becoming more popular.

The vascular interventions segment held the largest revenue share of 39% in 2023. This segment includes a range of procedures such as transarterial chemoembolization (TACE), transarterial radioembolization (TARE), and percutaneous transhepatic biliary drainage (PTBD). Growth in this area is driven by advancements in minimally invasive techniques and the increasing prevalence of liver cancer. The appeal of these procedures lies in their precision targeting of tumors, reduced systemic toxicity, and improved patient outcomes. Key drivers include the rising cancer incidence, particularly hepatocellular carcinoma, an aging population, and ongoing advancements in imaging and catheter-based systems. Trends indicate a shift towards personalized treatments, with research focusing on combining vascular interventions with immunotherapies and other systemic therapies to enhance effectiveness. Additionally, innovations like drug-eluting beads and artificial intelligence in procedure planning are set to further drive market growth.

The liver cancer segment dominated the market in 2023. This segment is driven by the high incidence and mortality rates of liver cancer, especially hepatocellular carcinoma (HCC). In the United States, approximately 42,230 new cases and 30,230 deaths were projected in 2023, while globally, around 866,136 people were diagnosed in 2022, making liver cancer the sixth most common cancer. The need for advanced treatment options is critical. Interventional oncology provides effective minimally invasive techniques such as radiofrequency ablation (RFA), transarterial chemoembolization (TACE), and microwave ablation for liver tumors. Studies indicate that TACE can significantly improve survival rates in patients with intermediate-stage HCC. The adoption of image-guided procedures further enhances treatment precision, boosting market growth. Companies like Boston Scientific and Medtronic are investing in innovative devices for liver cancer, reflecting the segment's strong market potential.

The lung cancer segment is emerging as the fastest-growing area within the market. This growth is driven by advances in minimally invasive procedures and the high global incidence of lung cancer. The World Health Organization (WHO) reports that lung cancer is the leading cause of cancer-related deaths, with approximately 2.21 million new cases and 1.8 million deaths in 2020. This urgent need for effective treatments is fueling the demand for interventional oncology options such as microwave ablation (MWA), cryoablation, and image-guided biopsy. These techniques are particularly useful for patients who are not candidates for surgery, including those with non-small-cell lung cancer (NSCLC) who are not healthy enough for surgical intervention.

In 2023, hospitals accounted for the largest revenue share. Hospitals are well-equipped to perform interventional oncology procedures such as tumor embolization and ablation. Reimbursement policies in many regions are becoming more favorable for these procedures when performed in hospital settings compared to other healthcare facilities. For example, in December 2021, Singapore General Hospital (SGH) was the first hospital in Asia to achieve global gold standard accreditation by the International Accreditation System for Interventional Oncology Services (IASIOS). The specialty clinic segment is expected to grow the fastest over the forecast period. An increasing number of specialty clinics are focusing on interventional oncology, providing personalized care with dedicated staff specializing in these services. This trend makes specialty clinics an appealing option for patients seeking timely and high-quality cancer care.

By Technique

By Procedure

By Application

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others