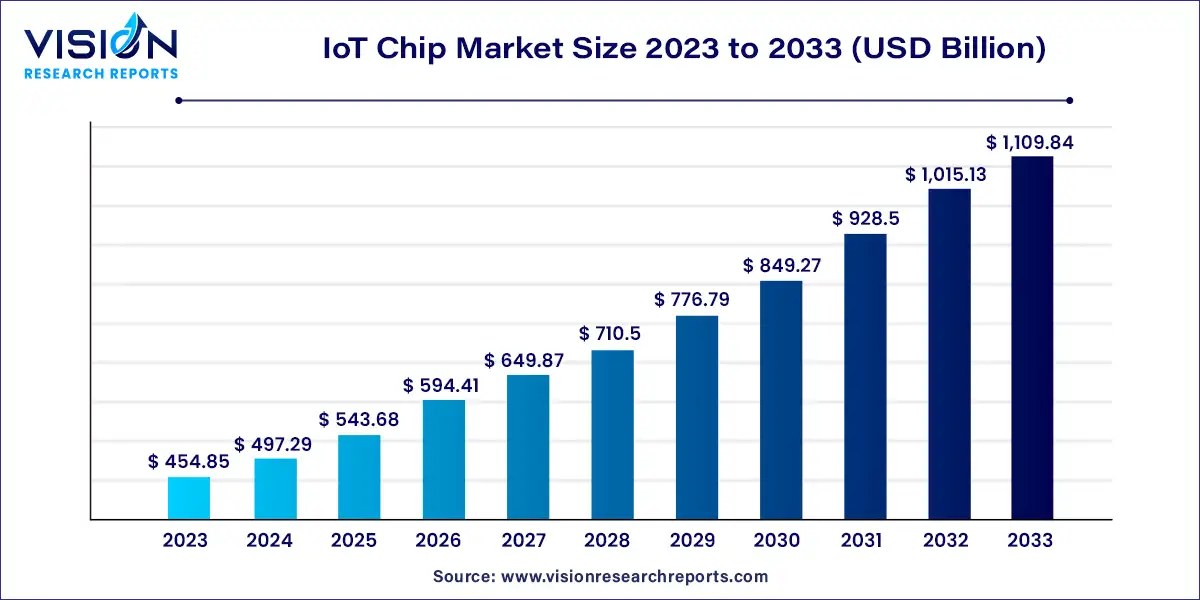

The global IoT chip market size was valued at USD 454.85 billion in 2023 and it is predicted to surpass around USD 1,109.84 billion by 2033 with a CAGR of 9.33% from 2024 to 2033. The Internet of Things (IoT) chip market is experiencing significant growth, driven by the rapid expansion of IoT applications across various industries. These chips, which are integral to IoT devices, enable connectivity, processing, and data management, supporting the seamless integration of devices into the digital ecosystem.

The IoT chip market is experiencing robust growth driven by an escalating adoption of connected devices across various sectors, including consumer electronics, healthcare, and industrial automation, significantly drives demand for advanced IoT chips. Technological advancements in chip design, such as enhanced processing capabilities, energy efficiency, and miniaturization, are further fueling market expansion by enabling more sophisticated and power-efficient IoT solutions. Additionally, substantial investments from both private and public sectors in IoT infrastructure and smart technologies are accelerating market development. The increasing focus on smart cities and the rise of applications requiring real-time data processing and connectivity underscore the growing need for innovative IoT chip solutions.

Advancements in Edge Computing:

Integration with AI and Machine Learning:

Focus on Energy Efficiency:

Expansion of 5G Connectivity:

Security Vulnerabilities:

Interoperability Issues:

Scalability Concerns:

Power Consumption:

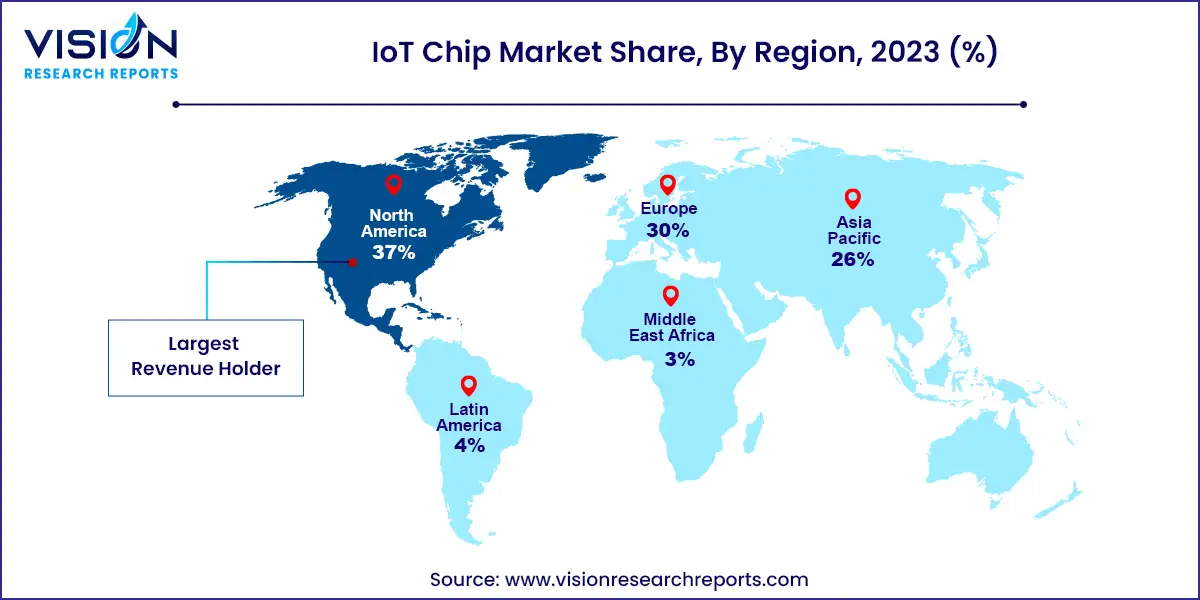

North America led the market with a revenue share of nearly 37% in 2023. This dominance is driven by a strong demand for connected devices in consumer electronics, healthcare, industrial automation, and smart cities. The region's emphasis on innovation and technological advancements further boosts market growth. Companies in North America, including major players like Intel Corporation and Texas Instruments, are leading the development of advanced IoT chip technologies, such as efficient processors, enhanced connectivity solutions, improved sensors, and innovative memory devices.

| Attribute | North America |

| Market Value | USD 168.29 Billion |

| Growth Rate | 9.35% CAGR |

| Projected Value | USD 140.64 Billion |

Europe IoT Chip Market Trends

In Europe, the market is anticipated to grow at a CAGR of over 7.03% from 2024 to 2033. This growth is driven by the rising adoption of IoT technologies across various industries, increased demand for connected devices, and the push towards Industry 4.0 initiatives.

Asia-Pacific IoT Chip Market Trends

The Asia-Pacific region is expected to see a CAGR of over 12.04% from 2024 to 2033. The region is experiencing significant advancements in processor technology, with IoT chip manufacturers developing more powerful and energy-efficient processors for IoT applications. This trend is enhancing the performance and capabilities of IoT devices across multiple industries in the region.

In 2023, connectivity integrated circuits (ICs) dominated the market, capturing a 26% share. This prominence is due to the critical role connectivity plays in IoT applications. As the IoT ecosystem grows, there is an increasing need for efficient, reliable, and energy-conscious communication between devices. Connectivity ICs provide the necessary hardware for various wireless communication protocols, allowing devices to connect and exchange data seamlessly via technologies like Wi-Fi, Bluetooth, and cellular networks.

The sensors segment is projected to experience the fastest growth from 2024 to 2033. This rise is driven by the expanding use of IoT devices across industries such as healthcare, automotive, manufacturing, and smart homes. Sensors are vital for gathering real-time data, which enhances decision-making and operational efficiency. Technological advancements, including smaller sensor sizes, improved accuracy, and reduced power consumption, are further accelerating their adoption in IoT devices. Additionally, the increasing emphasis on robust connectivity and communication in IoT systems is heightening the demand for sensors that support effective data transfer and device interaction.

In 2023, the consumer electronics segment held the largest market share due to the widespread integration of IoT technology into smart devices. IoT functionalities are now integral to a range of consumer electronics, such as smartphones, smart speakers, home appliances, and wearables. These devices utilize IoT chips to enable features like remote control, data tracking, and interoperability, thereby enhancing user convenience and experience. The rising demand for smart, interconnected consumer electronics, combined with a tech-savvy consumer base, has fueled the adoption of IoT chips.

The aerospace and defense sector is expected to see the fastest growth from 2024 to 2033. The sector is increasingly incorporating IoT devices for applications such as monitoring aircraft engine performance, tracking military assets, and improving soldier safety. These devices depend on specialized IoT chips for data processing and communication. The growing need for such devices is likely to drive the IoT chip market in this sector. Additionally, advancements in IoT chip technology are contributing to this growth.

By Product

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others