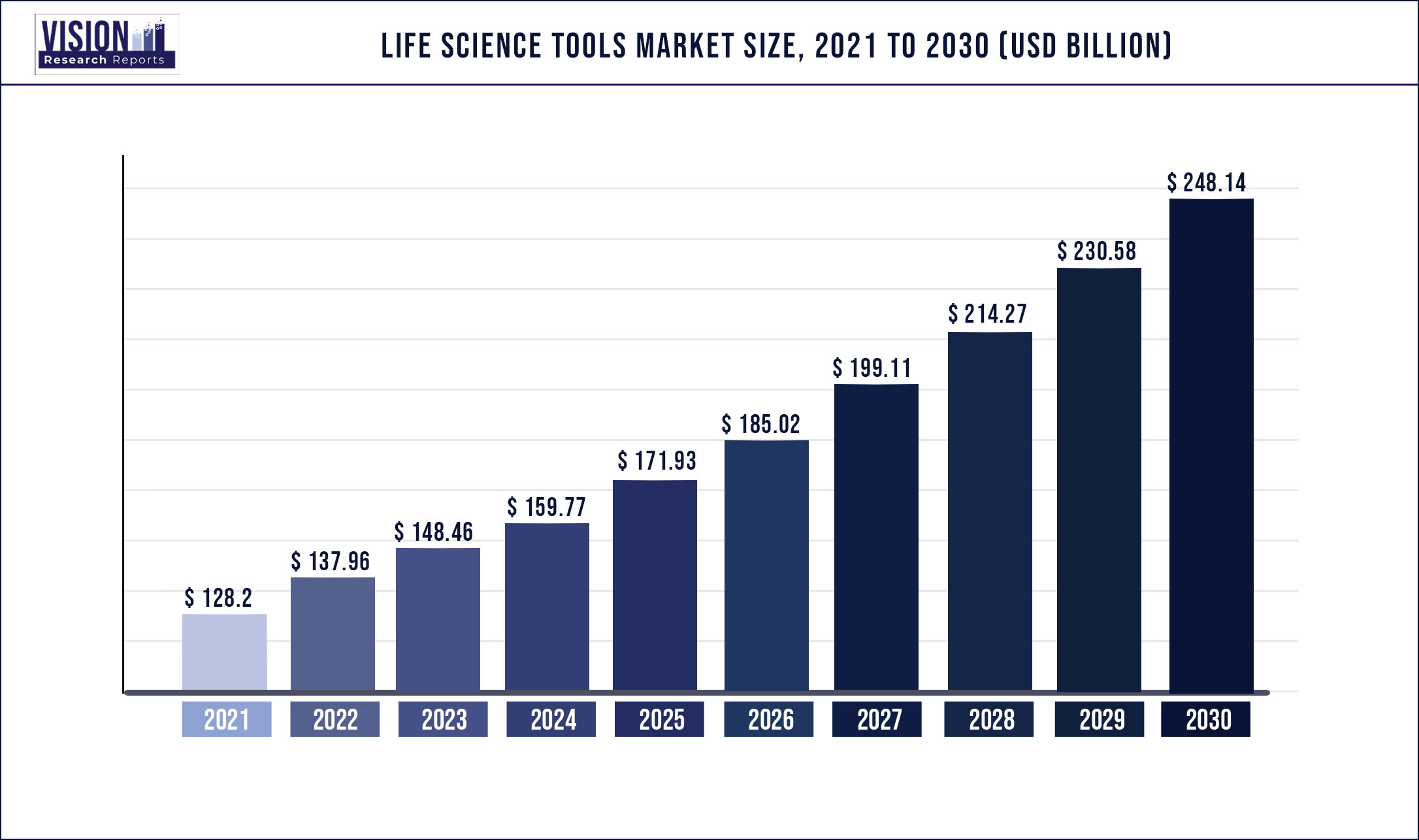

The global life science tools market was valued at USD 128.2 billion in 2021 and it is predicted to surpass around USD 248.14 billion by 2030 with a CAGR of 7.61% from 2022 to 2030.

Report Highlights

Growth can be attributed to a rise in government funding for life science technologies, demand for cell and gene therapies, an increase in the adoption of biopharmaceuticals, and growing competition among prominent companies in the market.

The exponential rise of COVID-19 cases globally requires rapid diagnosis for containment of the spread of infectious disease, which boosted the demand for life science tools during the pandemic and had a positive impact on the market. Rapid diagnosis of the infection, effective treatments, and preventative plans are essential for the management of cases during the COVID-19 pandemic. The current race for the development of cost-effective point-of-contact test kits and efficient laboratory methodologies for confirmation of SARS-CoV-2 infection has driven a new frontier of diagnostic innovation. During this pandemic, the U.S. FDA granted Emergency Use Authorizations (EUAs) to several diagnostic tests to make them rapidly and easily available for use. For example, in May 2022, the U.S. FDA granted a EUA to ID NOW COVID-19 2.0, a rapid in-vitro diagnostic test by Abbott Diagnostics Scarborough, Inc. Moreover, a wide range of commercial COVID-19 tests is available in the marketplace, which will further add to revenue generation.

Additionally, the life science tools industry is expanding based on the increasing investments by the government for the advancement of research and technologies. Organizations such as The National Human Genome Research Institute (NHGRI) and the National Institutes of Health (NIH) are actively funding various life science projects. For instance, the NIH funded USD 25 million for the ‘4D Nucleome Program’, which aims to understand gene regulation and cellular expression via the nuclear organization. Moreover, the U.S. government has funded several life sciences companies for R&D purposes. For instance, the Biomedical Advanced Research and Development Authority (BARDA) has planned to make awards worth USD 750,000 to facilitate the development of innovative technologies in the healthcare sector. Thus, the increase in government funding for life science research as well as technologies is expected to drive the market in the coming years.

Key players are also contributing to the growth of the market by providing advanced tools and techniques. Furthermore, companies are introducing new automated solutions in the market, which, in turn, provide lucrative opportunities for market growth. For instance, in February 2022, Covaris, LLC. announced the launch of truXTRAC FFPE Total NA Auto 96 Kit, a fully automated workflow comprising all necessary accessories, consumables, and reagents. This automated kit is powered by Adaptive Focused Acoustics (AFA) technology that allows both purification and extraction of RNA & DNA for FFPE (formalin fixed paraffin embedded) samples in 5 hours. The introduction of innovative solutions is expected to drive the market in the near future.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 128.2 billion |

| Revenue Forecast by 2030 | USD 248.14 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.61% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, product, end-use, region |

| Companies Covered |

Agilent Technologies, Inc.; Becton; Dickinson and Company; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Illumina, Inc.; Thermo Fisher Scientific, Inc; QIAGEN N.V.; Merck KGaA; Shimadzu Corporation; Hitachi Ltd.; Bruker Corporation; Oxford Instruments plc; Zeiss International |

Technology Insights

In 2021, cell biology technology accounted for the largest share of over 30.05%. The relevance of cell biology technology in drug discovery and the increase in NIH funding for cell biology are contributing to segment growth. Additionally, innovations in flow cytometry and liquid handling have led to an upsurge in the applications of cell-based assays for drug discovery. Furthermore, key market players have undertaken collaborative research efforts to reprogram newborn stem cells from umbilical cord tissue and blood into Induced Pluripotent Stem Cells (iPSCs). For example, in January 2022, EdiGene and Haihe Laboratory announced a strategic collaboration to develop platform technologies and stem cell regenerative therapies. The collaboration aims to explore novel biomarkers to optimize quality control for stem cell production. These collaborations are expected to drive the market over the forecast period.

The proteomics technology segment is expected to grow at a significant rate over the forecast period. Proteomics provides a complete understanding of structural and functional information of cells and this technology has allowed a comprehensive study of different types of proteins. This, in turn, helps in the analysis of a cell’s response to a variety of foreign bodies, including drugs. Identification of posttranslational modification has improved due to the development of high-resolution and high-mass accuracy mass spectrometers such as time-of-flight (TOF) mass analyzers. For example, in June 2022, Bruker Corporation announced the launch of timsHOF HT with an enhanced range and aims to revolutionize 4D proteomics and epiproteomics.

Product Insights

In 2021, cell culture systems and 3D cell culture segment held the largest share of over 15.04%. Research activities exploring the potential of cell biology have led to important advancements, thus contributing to revenue generation. An in-depth understanding of cell biology has become a key asset across laboratory workflows, opening new avenues of expansion in the market. Moreover, scientists in the life science field are eager to adopt new and advanced instruments, which is expected to further bolster the segment. This industry trend has also encouraged several key manufacturers to expand their instrument portfolios. For instance, Cytiva, BioTek Instruments, Horizon Discovery, and Seahorse Bioscience, among others, are aiming on introducing instruments relating to cell analysis, cell biology, and imaging.

Next-generation sequencing is anticipated to exhibit the fastest growth rate of 7.98% from 2022 to 2030. NGS systems allow massively parallel sequencing of genome samples. The systems are efficient in analyzing a large number of sequencing reactions simultaneously. In addition, simplification of NGS workflow and continued cost reductions in instruments and reagents are likely to boost the adoption of this life science technology. Moreover, with enhancement in bioinformatics, adoption of NGS is likely to grow in high- and even low-throughput research. For example, in February 2022, Beckman Coulter Life Sciences signed an application development agreement with Illumina, Inc. for the Biomek NGeniuS Next Generation Library Preparation System.

End-use Insights

The healthcare segment captured the largest share of over 30.07% in 2021. Rise in adoption of proteomic and genomic workflows in hospitals to diagnose and treat various diseases is expected to fuel the growth. In addition, growing adoption of tissue diagnostic and NGS services in hospitals is expected to drive the market. Several hospitals and clinics are currently providing sequencing facilities to patients and are determining the use of advanced tools and technology in daily practice of medicine. Stanford Medicine is one such hospital that provides sequencing services to people who have a rare or undiagnosed genetic condition. Partners HealthCare in the U.S. is one of the first hospital systems to offer public genomic sequencing, analysis, and interpretation services. Genomic sequencing in a hospital or clinical setting is expected to improve patient care while lowering healthcare costs. Due to this, the healthcare segment is expected to witness the fastest growth in the years to come.

Biopharmaceutical companies are initiating large-sale genome sequencing projects in collaboration with community health systems and academic medical centers in the life science tools space. Grail, Inc., an emerging firm, is conducting studies to detect genomic fingerprints from tumors that can be detected in a blood sample, with an aim to identify cancer at an early stage. The growing interest of biopharmaceutical companies in genomics also results in significant revenue generation and thus is expected to drive the market.

Regional Insights

North America accounted for a dominant revenue share of over 35.02% in 2021 due to fast adoption of genomics, proteomics, oncology, and diagnostic screening in the region. The rise in the adoption of genomic medicine, biopharmaceuticals, diagnostic procedures, and novel technologies in the U.S. and Canada for diagnosis and treatment of clinical disorders is responsible for the market growth in the region. The region also leverages the presence of a large number of market players that are continuously engaged in the development of advanced tools for life science research. Furthermore, the presence of a well-regulated environment for approvals and usage of genomic and tissue diagnostic tests is expected to propel the growth of the market over the forecast period. Recently, in August 2021, COVID-19 Severity Test Screening using Agilent Cary 630 FTIR Spectrometer was launched by Agilent Technologies, Inc.

The Asia Pacific region will grow at the highest rate during the projected period. Investments and efforts by global companies in this region to utilize the untapped avenues and increase their presence will fuel the growth. For instance, in January 2022, FUJIFILM Corporation announced the acquisition of Atara Biotherapeutics T-Cell Operations and Manufacturing (ATOM) facility for USD 100 million to produce commercial and clinical treatments, including CAR-T and T-cell immunotherapies. Moreover, this region offers relatively inexpensive manufacturing and operating unit for conducting research. These factors are expected to play a major role in the expansion of life science tools and technologies in this region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Life Science Tools Market

5.1. COVID-19 Landscape: Life Science Tools Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Life Science Tools Market, By Technology

8.1. Life Science Tools Market, by Technology, 2022-2030

8.1.1 Genomic Technology

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Proteomics Technology

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Cell Biology Technology

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Other Analytical & Sample Preparation Technology

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Lab Supplies & Technologies

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Life Science Tools Market, By Product

9.1. Life Science Tools Market, by Product, 2022-2030

9.1.1. Cell Culture Systems & 3D Cell Culture

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Liquid Chromatography

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Mass Spectrometry

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Flow Cytometry

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Cloning & Genome Engineering

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Microscopy & Electron Microscopy

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Next Generation Sequencing

9.1.7.1. Market Revenue and Forecast (2017-2030)

9.1.8. PCR & qPCR

9.1.8.1. Market Revenue and Forecast (2017-2030)

9.1.9. Nucleic Acid Preparation

9.1.9.1. Market Revenue and Forecast (2017-2030)

9.1.10. Nucleic Acid Microarray

9.1.10.1. Market Revenue and Forecast (2017-2030)

9.1.11. Sanger Sequencing

9.1.11.1. Market Revenue and Forecast (2017-2030)

9.1.12. Transfection Devices & Gene Delivery Technologies

9.1.12.1. Market Revenue and Forecast (2017-2030)

9.1.13. NMR

9.1.13.1. Market Revenue and Forecast (2017-2030)

9.1.14. Other Separation Technologies

9.1.14.1. Market Revenue and Forecast (2017-2030)

9.1.15. Other Products & Services

9.1.15.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Life Science Tools Market, By End-use

10.1. Life Science Tools Market, by End-use , 2022-2030

10.1.1. Government & Academic

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Biopharmaceutical Company

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Healthcare

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Industrial Applications

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Life Science Tools Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.2. Market Revenue and Forecast, by Product (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Agilent Technologies, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Becton, Dickinson and Company

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. F. Hoffmann-La Roche Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Bio-Rad Laboratories, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Danaher Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Illumina, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Thermo Fisher Scientific, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. QIAGEN N.V.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Merck KGaA

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Shimadzu Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others