The global light-duty truck steering system market size was valued at USD 1.45 billion in 2023 and is anticipated to reach around USD 1.81 billion by 2033, growing at a CAGR of 2.23% from 2024 to 2033. The light-duty truck steering system market is a crucial segment within the automotive industry, focusing on systems designed to ensure precise vehicle control, safety, and driver comfort. These systems are integral to the performance and handling of light-duty trucks, which are widely used for both commercial and personal purposes.

The growth of the light-duty truck steering system market is primarily fueled by an increasing adoption of light-duty trucks across various sectors, including logistics and personal transportation, is driving demand for advanced steering solutions. Technological advancements, particularly the integration of electric power steering (EPS) and steer-by-wire systems, are enhancing steering precision and vehicle safety, further stimulating market growth. Additionally, stringent regulatory requirements related to vehicle safety and emissions are compelling manufacturers to develop and incorporate innovative steering technologies to comply with these standards. Consumer expectations for improved driving comfort and vehicle handling are also pushing the demand for sophisticated steering systems. Together, these factors contribute to the expanding market for light-duty truck steering systems.

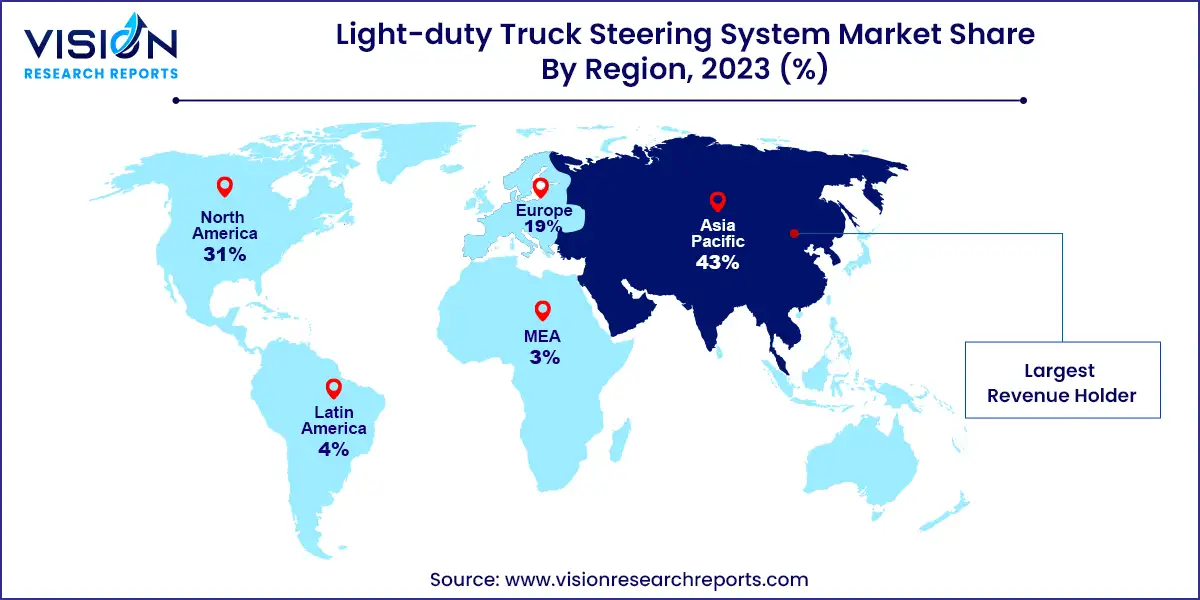

Asia Pacific held the largest revenue share of 43% in the light-duty truck steering system market in 2023. The market growth in this region is driven by rapid urbanization, industrialization, and the expansion of e-commerce, which is increasing the demand for efficient light-duty trucks. Emerging economies like China and India are experiencing significant growth in their automotive sectors, fueled by rising disposable incomes and government initiatives promoting domestic manufacturing. The region's increasing adoption of electric and hybrid vehicles is also impacting market growth, as manufacturers develop systems compatible with these vehicles. Additionally, the focus on vehicle safety and new regulations requiring advanced safety features are driving the adoption of advanced steering systems in light-duty trucks.

| Attribute | Asia Pacific |

| Market Value | USD 0.62 Billion |

| Growth Rate | 2.20% CAGR |

| Projected Value | USD 0.78 Billion |

The North American light-duty truck steering system market is projected to grow at the highest CAGR of 1.83% from 2024 to 2033. The strong demand for light-duty trucks, especially in the United States and Canada, is driving this growth. This demand is supported by a preference for pickup trucks for both personal and commercial use. The region’s robust automotive manufacturing base and advancements in steering technologies like electric power steering (EPS) also support market growth. Stringent safety regulations and consumer demand for enhanced driving comfort and safety features are driving innovation and adoption of advanced steering systems in this market.

In Europe, the light-duty truck steering system market is primarily driven by stringent environmental regulations and a strong emphasis on vehicle safety and efficiency. European consumers’ preference for technologically advanced and environmentally friendly vehicles has led to increased demand for electric and hybrid light-duty trucks, which require sophisticated steering systems. The presence of leading automotive manufacturers in countries like Germany, France, and Italy, who are investing heavily in innovative steering technologies, further fuels market growth. Additionally, the push towards autonomous driving and the development of smart cities are encouraging the adoption of advanced steering systems that integrate with broader vehicle automation and connectivity features.

By type, the hydraulic power steering (HPS) segment led the market with a substantial revenue share of 57% in 2023. HPS continues to dominate due to its proven reliability, strong performance, and widespread use in the industry. This system delivers consistent steering feedback and robust assistance, particularly in vehicles requiring high torque, making it a favored choice for light-duty trucks. HPS operates by using hydraulic fluid to enhance the driver’s steering input, offering improved control and maneuverability. Despite the rise of newer technologies, HPS remains popular due to its established durability and the long-standing confidence of manufacturers and consumers in its performance under challenging conditions.

In contrast, the electric power steering (EPS) segment is projected to experience the fastest growth rate over the forecast period. This trend is attributed to the automotive industry's broader shift towards electrification and greater energy efficiency. Unlike HPS, EPS utilizes an electric motor to assist steering, eliminating the need for hydraulic pumps, hoses, and fluid, which results in lower maintenance costs and better fuel efficiency. The growing focus on reducing emissions and enhancing fuel economy accelerates EPS adoption, particularly as it aligns with trends toward more sustainable and lightweight vehicle designs. Technological advancements in EPS, such as variable assistance and integration with advanced driver-assistance systems (ADAS), also make it an appealing option for modern light-duty trucks, driving its market expansion.

Among vehicle types, the pickup trucks segment dominated the market with a significant revenue share of 68% in 2023. Pickup trucks lead the market due to their versatile use across various industries and consumer sectors. These vehicles are prized for their robust performance and capability to handle both personal and commercial tasks efficiently. High demand for pickup trucks, particularly in North America where they are a common sight, has resulted in a large market share for steering systems tailored for these vehicles. Furthermore, advancements in steering technology have led to more sophisticated systems that enhance the driving experience, sustaining the strong market presence of pickup trucks.

The vans segment has seen notable growth due to the rising demand for effective urban delivery and passenger transport solutions. With the surge in e-commerce, there is a greater need for reliable and agile vehicles to navigate urban areas. This demand has driven innovation in steering systems for vans, focusing on maneuverability, fuel efficiency, and driver comfort. Additionally, the growing market for electric vans, driven by stringent emissions regulations and increased environmental awareness, has further fueled the expansion of this segment. As both businesses and consumers prioritize sustainability and efficiency, the vans segment is expected to continue its robust growth in the global market.

In terms of sales channels, the OEM segment led the market with a dominant revenue share of 86% in 2023. The Original Equipment Manufacturer (OEM) segment's dominance is due to the rising demand for new vehicles and rapid adoption of advanced steering technologies. OEMs benefit from established relationships with automakers, allowing for the seamless integration of the latest innovations into new vehicle models. The focus on safety and efficiency in vehicle design has prompted OEMs to develop steering systems that meet stringent regulatory standards. As automakers aim to enhance vehicle performance and driving experience, the demand for high-quality, reliable steering systems from OEMs is expected to remain strong.

The aftermarket segment is anticipated to grow significantly over the forecast period. As vehicles age, the need for replacement parts, including steering systems, increases, boosting the aftermarket sector. Many consumers prefer extending the life of their current vehicles rather than buying new ones, leading to increased demand for aftermarket steering components. The segment also benefits from cost-effective solutions and the trend of vehicle customization among truck owners. Additionally, the growing presence of e-commerce platforms has made aftermarket parts more accessible, contributing to the sector's rapid expansion.

By Vehicle Type

By Type

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Vehicle Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Light-duty Truck Steering System Market

5.1. COVID-19 Landscape: Light-duty Truck Steering System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Light-duty Truck Steering System Market, By Vehicle Type

8.1. Light-duty Truck Steering System Market, by Vehicle Type, 2024-2033

8.1.1 Pick Up Truck

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Vans

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Light-duty Truck Steering System Market, By Type

9.1. Light-duty Truck Steering System Market, by Type, 2024-2033

9.1.1. Hydraulic Power Steering (HPS)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Electric Power Steering (EPS)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Electro-Hydraulic Power Steering (EHPS)

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Light-duty Truck Steering System Market, By Sales Channel

10.1. Light-duty Truck Steering System Market, by Sales Channel, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftersales

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Light-duty Truck Steering System Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Robert Bosch GmbH.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. JTEKT Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Nexteer Automotive Group Limited.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Knorr-Bremse AG.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. NSK Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Thyssenkrupp AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Showa Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Mando Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Zhejiang Wanda Steering Gear Co. Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. TRW Automotive Holdings Corp.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others