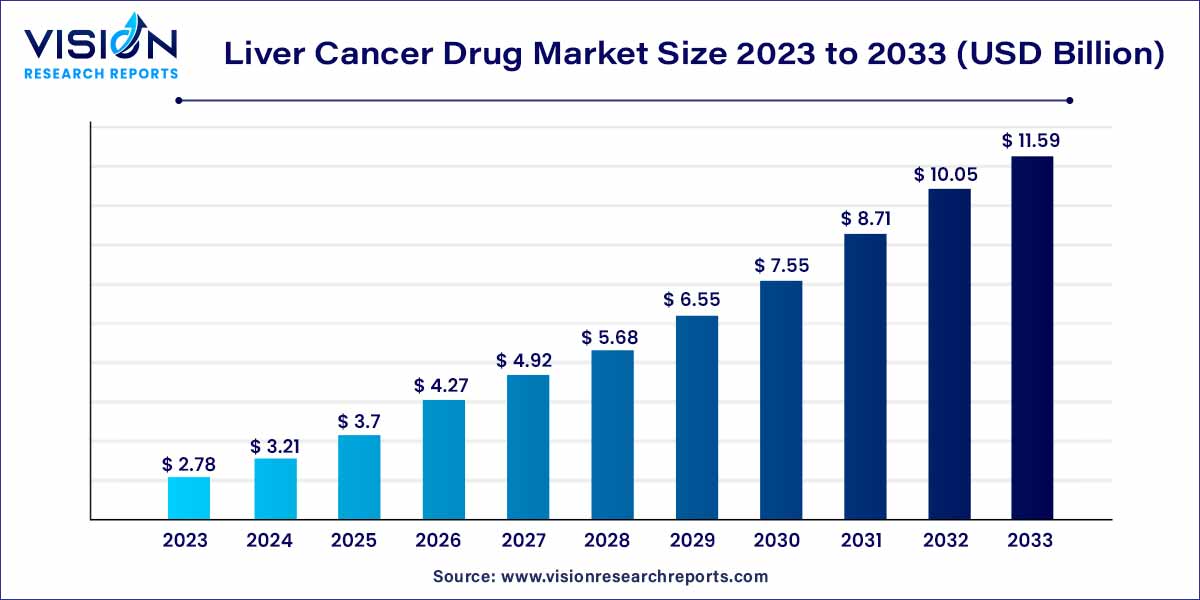

The global liver cancer drug market size was estimated at around USD 2.78 billion in 2023 and it is projected to hit around USD 11.59 billion by 2033, growing at a CAGR of 15.35% from 2024 to 2033. The liver cancer drug market is a dynamic sector within the pharmaceutical industry that plays a pivotal role in addressing the complexities associated with hepatocellular carcinoma (HCC). This overview delves into key facets shaping the market, from its current landscape to the factors driving innovation and challenges that underscore the need for advancements.

The growth of the liver cancer drug market is propelled by several key factors. Firstly, the escalating global incidence of liver cancer, attributed to factors such as chronic liver diseases and viral hepatitis infections, underscores the urgent need for effective therapeutic interventions. The continuous advancements in research and development by major pharmaceutical companies contribute significantly to the expansion of the market. The emergence of innovative treatment modalities, including targeted therapies and immunotherapies, has reshaped the treatment landscape, providing patients with more tailored and effective options. Strategic collaborations between industry leaders and research institutions further stimulate market growth by fostering a collaborative environment for accelerated drug development. The increasing recognition of immunotherapy as a promising avenue for liver cancer treatment has also played a pivotal role in driving market expansion. As the market continues to address unmet medical needs and capitalize on scientific breakthroughs, these growth factors collectively contribute to the dynamic evolution of the liver cancer drug market.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 11.59 billion |

| Growth Rate from 2024 to 2033 | CAGR of 15.35% |

| Revenue Share of North America in 2023 | 44% |

| CAGR of Asia Pacific from 2024 to 2033 | 17.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The targeted therapy segment held the largest market revenue share of 55% in 2023. The dominant share of this drug class is owing to factors such as targeted therapies being known to be more effective than traditional chemotherapy in treating liver cancer. In some cases, targeted therapies have been shown to prolong survival in patients with this illness.

According to the European Society for Medical Oncology (ESMO), genome-targeted therapy, which involves using treatments tailored to an individual's genetic makeup, has shown promising advancements in recent years. In 2006, the estimated response rate to this type of therapy was 2.73%, indicating that only a small portion of patients experienced positive outcomes. However, by the end of 2018, the response rate had more than doubled to 5.48%, signifying a notable improvement in treatment effectiveness.

Furthermore, the progress in genome-targeted therapy continued in the following years, and by 2020, the estimated response rate further increased to 7.04%. This indicates that a higher percentage of patients treated with personalized genomic interventions experienced positive outcomes, offering renewed hope for more effective and precise treatments.

Based on drug class, the liver cancer drugs market is segmented into targeted therapy, immunotherapy, and chemotherapy. The immunotherapy segment is expected to expand at the highest CAGR of 17.35% over the forecast period. The segment is expected to progress rapidly due to factors such as the increasing prevalence of liver cancer. According to the American Cancer Society, in 2023, it is estimated that the disease will result in 29,380 deaths in the U.S., comprising 19,000 men and 10,380 women.

Among men, liver cancer is the fifth most common cause of cancer-related deaths, and for women, it is the seventh most common cause. Although the death rate from liver cancer more than doubled between 1980 and 2016, it stabilized between 2016 and 2020 for both men and women. These figures underscore the ongoing challenge posed by liver cancer in public health and emphasize the continued need for research, prevention strategies, and advancements in treatments to mitigate its impact on individuals and communities.

North America region dominated the market with the largest market share of 44% in 2023. The region is expected to continue its dominance during the forecast period due to factors such as increasing awareness regarding liver cancer, availability of reimbursement for liver cancer drugs, and strong research and development activities. According to the Centers for Disease Control and Prevention (CDC), cancer is a condition characterized by the uncontrolled growth of cells within the body. When this abnormal cell growth occurs in the liver, it is referred to as liver cancer.

Annually, approximately 11,000 women and 25,000 men are diagnosed with liver cancer in the U.S., with around 19,000 men and 9,000 women losing their lives to this disease. Over the years, the incidence rate of liver cancer in the U.S. experienced an upward trend but has recently started to decline. Despite this decline, liver cancer remains a significant health concern, and its impact on affected individuals and their families is substantial.

In December 2022, the Centers for Medicare & Medicaid Services (CMS) introduced a proposed rule for the Medicare Program in 2024 to enhance health equity and streamline utilization management in Medicare Advantage (MA) plans. The American Society for Radiation Oncology (ASTRO) is in full support of this rule, especially the provisions that require MA plans to follow National Coverage Determinations (NCD), Local Coverage Determinations (LCD), and traditional Medicare regulations, aligning with ASTRO's advocacy efforts. The CMS taking steps to reform MA would result in improved patient care and greater access to essential healthcare services.

Asia Pacific is expected to grow at the fastest CAGR of 17.63% during the forecast period. This is owing to the high prevalence of liver cancer in the region. As per the NCBI, in Asia, liver cancer is the fifth most common cancer form and the second most common cause of cancer-related deaths. In 2020, approximately 609,596 new liver cancer cases were reported in Asia, accounting for around 72.5% of the global incidence, with an Age-Standardized Rate (ASR) of 11.6 per 100,000.

Regarding mortality, there were about 566,269 liver cancer-related deaths in Asia in 2020, representing 72.4% of the total liver cancer deaths worldwide. According to a report by Cancer Australia, liver cancer ranked as the seventh most common cause of cancer-related death in the year 2020. It is projected to maintain its position as the seventh most common cause in 2022. In 2020, a total of 2,192 deaths were attributed to liver cancer in Australia, with 1,468 males and 724 females.

By Drug Class

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Liver Cancer Drug Market

5.1. COVID-19 Landscape: Liver Cancer Drug Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Liver Cancer Drug Market, By Drug Class

8.1.Liver Cancer Drug Market, by Drug Class Type, 2024-2033

8.1.1. Targeted Therapy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Immunotherapy

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Chemotherapy

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Liver Cancer Drug Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Drug Class (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Drug Class (2021-2033)

Chapter 10. Company Profiles

10.1. Bayer AG

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Bristol-Myers Squibb Company

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Eisai Co., Ltd.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Exelixis, Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Merck KGaA

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others