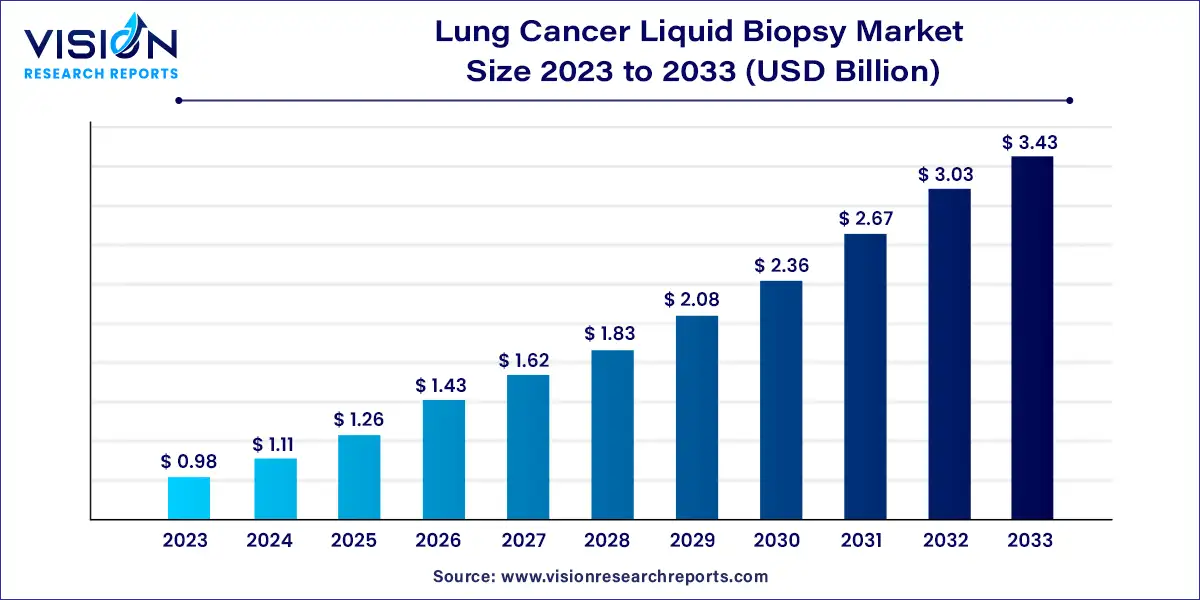

The global lung cancer liquid biopsy market size was estimated at around USD 0.98 billion in 2023 and it is projected to hit around USD 3.43 billion by 2033, growing at a CAGR of 13.35% from 2024 to 2033.

The lung cancer liquid biopsy market is experiencing significant growth and transformation, driven by advances in technology, rising incidences of lung cancer, and an increasing demand for non-invasive diagnostic methods. Liquid biopsy, a less invasive alternative to traditional tissue biopsy, uses a simple blood sample to detect cancer-related biomarkers, providing a promising approach for early diagnosis, monitoring, and treatment of lung cancer.

The growth of the lung cancer liquid biopsy market is driven by the technological advancements in molecular diagnostics, such as next-generation sequencing (NGS) and digital PCR, have significantly improved the accuracy and efficiency of liquid biopsy tests, making them more reliable for detecting cancer biomarkers. Additionally, the rising incidence of lung cancer globally has increased the demand for early and minimally invasive diagnostic methods. Liquid biopsy offers a non-invasive alternative to traditional tissue biopsies, which are often risky and uncomfortable for patients. Moreover, the trend towards personalized medicine, where treatments are tailored based on individual genetic profiles, is also driving market growth. Liquid biopsy enables precise monitoring of tumor mutations and treatment responses, thereby enhancing the effectiveness of targeted therapies. These factors collectively contribute to the expanding adoption and development of liquid biopsy technologies in the lung cancer diagnostics market.

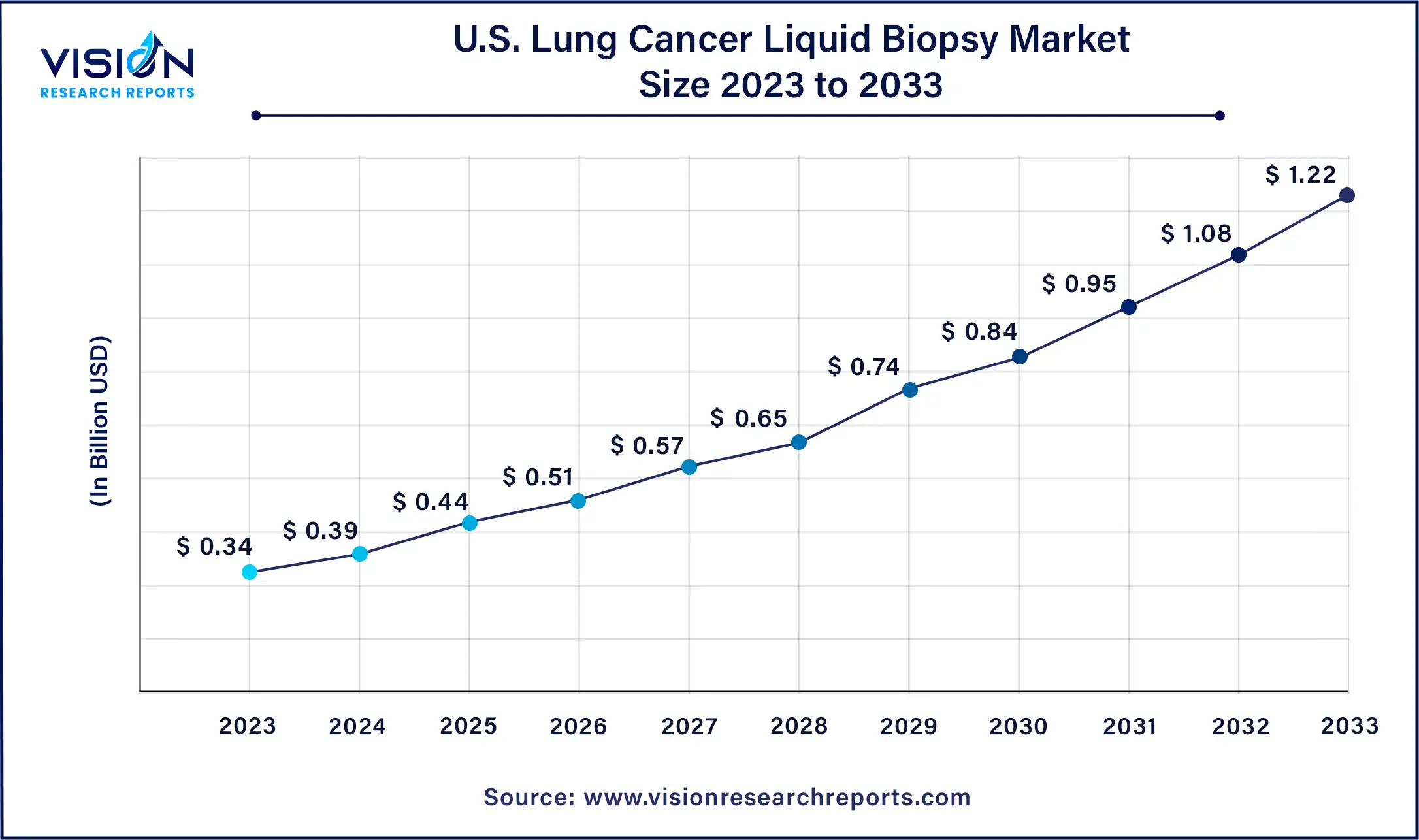

The U.S. lung cancer liquid biopsy market was estimated at USD 0.34 billion in 2023 and it is expected to surpass around USD 1.22 billion by 2033, poised to grow at a CAGR of 13.62% from 2024 to 2033.

In the United States, lung cancer liquid biopsy dominated the revenue share in North America. The country benefits from a well-established healthcare system equipped with cutting-edge technology, facilitating early detection and diagnosis of lung cancer. Liquid biopsies, which involve analyzing circulating tumor DNA (ctDNA) in the blood, offer a less invasive alternative to traditional tissue biopsies and can be performed more frequently. Additionally, heightened awareness about lung cancer and its early detection, driven by public health campaigns, medical conferences, and educational programs, prompts more patients and healthcare providers to opt for liquid biopsies as a diagnostic tool.

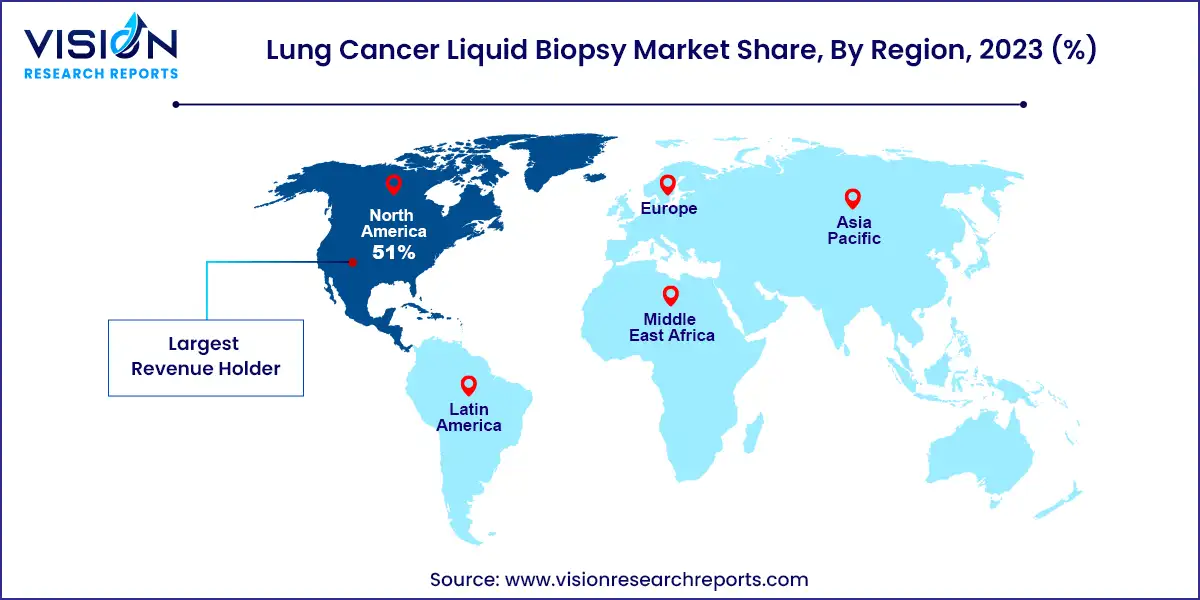

North America emerged as the dominant market, capturing approximately 51% of the revenue share in 2023. The region contends with a higher prevalence of smoking compared to others, a major risk factor for lung cancer, consequently leading to a greater incidence of the disease. With its advanced medical infrastructure, including specialized equipment and well-trained professionals, North America is well-equipped to conduct lung cancer biopsies. Moreover, the region generally boasts better access to healthcare services, including lung cancer screening and diagnostic procedures such as biopsies, potentially resulting in increased detection of lung cancer cases. These factors collectively contribute to a heightened demand for lung cancer biopsies in North America compared to other regions.

Asia Pacific is poised to witness significant growth from 2024 to 2033. Lung cancer ranks among the most common cancers in this region, with notably high incidence rates in countries like China, India, and Japan. This increased prevalence naturally translates into a greater demand for diagnostic procedures such as biopsies. Tobacco use, particularly smoking, amplifies the risk of lung cancer, necessitating more biopsies for diagnosis and treatment. Additionally, air pollution poses a significant concern in the region, with elevated levels of particulate matter and other pollutants contributing to respiratory issues and lung cancer risk. Consequently, there is a heightened need for lung cancer screening and biopsies to address these challenges.

The blood sample-based segment led the market in 2023, capturing a revenue share of over 71%. This dominance is due to its non-invasive nature, repeatability, real-time monitoring capabilities, early detection, and cost-effectiveness. Blood sample-based biopsy tests can be conducted multiple times during a patient’s treatment without causing additional harm or discomfort. Additionally, liquid biopsies offer real-time updates on the patient’s condition, as they can be performed at any stage of the disease and throughout the treatment process.

The hospitals and laboratories segment captured the largest revenue share in 2023. These institutions employ specialized medical professionals, including oncologists, pathologists, and radiologists, who possess the expertise necessary to accurately perform and interpret biopsies. Additionally, hospitals and laboratories have access to advanced equipment and technologies essential for biopsy procedures and subsequent analyses. These facilities adhere to stringent quality control measures and safety protocols to ensure precise and reliable results. They also follow well-established protocols for handling biological samples, minimizing contamination risks, and maintaining sample integrity.

The specialty clinics segment is projected to register the fastest CAGR from 2024 to 2033. Specialty clinics focus on specific diseases or medical conditions, such as lung cancer, enabling them to develop a comprehensive understanding of the disease, its diagnosis, and treatment options. These clinics prioritize patient needs and preferences, offering personalized care and support tailored to each individual. This patient-centric approach can lead to increased patient satisfaction and improved adherence to treatment plans, thereby contributing to the growth of specialty clinics.

The circulating nucleic acids segment accounted for the largest revenue share in 2023. Circulating nucleic acids, especially circulating tumor DNA (ctDNA), can be detected at very low concentrations in blood samples, even in the early stages of cancer. Early detection of lung cancer significantly increases the chances of successful treatment and improves patient survival rates. By analyzing these circulating nucleic acids, healthcare providers can make informed decisions about treatment adjustments and more effectively monitor the patient’s response to therapy. Additionally, ctDNA carries valuable genetic and molecular information about the cancer, which can be used to identify specific mutations and biomarkers associated with lung cancer. This information helps healthcare professionals develop personalized treatment strategies and targeted therapies.

The exosomes/microvesicles segment is expected to register the fastest CAGR from 2024 to 2033. Exosomes and microvesicles can be isolated from a simple blood sample, making them ideal for liquid biopsy applications. These biomarkers reflect changes in the tumor microenvironment and cancer progression. Monitoring the levels of these vesicles in blood samples helps healthcare providers track disease progression and response to treatment, enabling timely adjustments to treatment plans.

The multi-gene parallel analysis (NGS) segment dominated the market in 2023 and is projected to grow at the fastest CAGR from 2024 to 2033. This growth is driven by NGS's ability to comprehensively analyze multiple genes, detect various mutations, identify actionable targets for personalized treatment, enable early detection, and monitor disease progression and treatment response. NGS allows for the simultaneous analysis of numerous genes, providing a deeper understanding of the genetic and molecular alterations involved in lung cancer. It can detect a wide range of genetic alterations, including single nucleotide variations, insertions, deletions, and copy number variations.

The single gene analysis (PCR microarrays) segment is anticipated to witness growth during the forecast period. The increasing use of PCR microarrays in lung cancer screening is expected to drive the growth of this segment. PCR microarrays are cost-effective compared to other genetic analysis methods, such as Sanger sequencing or next-generation sequencing (NGS), making them more accessible to patients and healthcare systems.

The therapy selection segment held the largest revenue share in 2023. Different therapies carry varying levels of risk and potential side effects. Healthcare professionals can mitigate the risks associated with biopsy procedures by selecting the most appropriate treatment for each patient. Therapy selection in lung cancer biopsy screening is essential for ensuring accurate diagnosis, minimizing risks, delivering personalized treatment, optimizing resource allocation, and prioritizing patient comfort.

The early cancer screening segment is projected to achieve the fastest CAGR from 2024 to 2033. Detecting lung cancer at an early stage significantly improves the likelihood of successful treatment and higher survival rates. Early-stage lung cancer is often more treatable, with a wider range of treatment options available to patients

The instruments segment held the largest revenue share in 2023 and is projected to achieve the fastest CAGR during the forecast period. Instruments like biopsy needles and bronchoscopes facilitate precise targeting of suspicious lesions within the lung, enhancing the likelihood of obtaining representative tissue samples for diagnosis. These instruments provide a safer approach by minimizing the risk of damaging surrounding healthy lung tissue and other vital organs. Additionally, instrument-based biopsies are typically more cost-effective than open surgical biopsies, making them a more economical option for lung cancer screening.

By Sample Type

By Biomarker

By Technology

By End-use

By Clinical Application

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Product Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Lung Cancer Liquid Biopsy Market

5.1. COVID-19 Landscape: Lung Cancer Liquid Biopsy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Lung Cancer Liquid Biopsy Market, By Sample Type

8.1. Lung Cancer Liquid Biopsy Market, by Sample Type, 2024-2033

8.1.1. Blood Sample Based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Others

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Lung Cancer Liquid Biopsy Market, By Biomarker

9.1. Lung Cancer Liquid Biopsy Market, by Biomarker, 2024-2033

9.1.1. Circulating Nucleic Acids

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. CTC

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Exosomes/Microvesicles

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Circulating Proteins

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Lung Cancer Liquid Biopsy Market, By Technology

10.1. Lung Cancer Liquid Biopsy Market, by Technology, 2024-2033

10.1.1. Multi-gene-parallel Analysis (NGS)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Single Gene Analysis (PCR Microarrays)

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Lung Cancer Liquid Biopsy Market, By End-use

11.1. Lung Cancer Liquid Biopsy Market, by End-use, 2024-2033

11.1.1. Hospitals & Laboratories

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Specialty Clinics

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Academic & Research Centers

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Lung Cancer Liquid Biopsy Market, By Clinical Application

12.1. Lung Cancer Liquid Biopsy Market, by Clinical Application, 2024-2033

12.1.1. Therapy Selection

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Treatment Monitoring

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Early Cancer Screening

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Recurrence Monitoring

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Others

12.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Lung Cancer Liquid Biopsy Market, By Product

13.1. Lung Cancer Liquid Biopsy Market, by Product, 2024-2033

13.1.1. Instruments

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Consumables Kits and Reagents

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Software and Services

13.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 14. Global Lung Cancer Liquid Biopsy Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.1.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.1.3. Market Revenue and Forecast, by Technology (2021-2033)

14.1.4. Market Revenue and Forecast, by End-use (2021-2033)

14.1.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.1.6. Market Revenue and Forecast, by Product (2021-2033)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.1.7.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.1.7.3. Market Revenue and Forecast, by Technology (2021-2033)

14.1.7.4. Market Revenue and Forecast, by End-use (2021-2033)

14.1.8. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.1.8.1. Market Revenue and Forecast, by Product (2021-2033)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.1.9.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.1.9.3. Market Revenue and Forecast, by Technology (2021-2033)

14.1.9.4. Market Revenue and Forecast, by End-use (2021-2033)

14.1.10. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.1.11. Market Revenue and Forecast, by Product (2021-2033)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.2.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.2.3. Market Revenue and Forecast, by Technology (2021-2033)

14.2.4. Market Revenue and Forecast, by End-use (2021-2033)

14.2.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.2.6. Market Revenue and Forecast, by Product (2021-2033)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.2.8.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.2.8.3. Market Revenue and Forecast, by Technology (2021-2033)

14.2.9. Market Revenue and Forecast, by End-use (2021-2033)

14.2.10. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.2.10.1. Market Revenue and Forecast, by Product (2021-2033)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.2.11.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.2.11.3. Market Revenue and Forecast, by Technology (2021-2033)

14.2.12. Market Revenue and Forecast, by End-use (2021-2033)

14.2.13. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.2.14. Market Revenue and Forecast, by Product (2021-2033)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.2.15.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.2.15.3. Market Revenue and Forecast, by Technology (2021-2033)

14.2.15.4. Market Revenue and Forecast, by End-use (2021-2033)

14.2.16. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.2.16.1. Market Revenue and Forecast, by Product (2021-2033)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.2.17.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.2.17.3. Market Revenue and Forecast, by Technology (2021-2033)

14.2.17.4. Market Revenue and Forecast, by End-use (2021-2033)

14.2.18. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.2.18.1. Market Revenue and Forecast, by Product (2021-2033)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.3.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.3.3. Market Revenue and Forecast, by Technology (2021-2033)

14.3.4. Market Revenue and Forecast, by End-use (2021-2033)

14.3.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.3.6. Market Revenue and Forecast, by Product (2021-2033)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.3.7.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.3.7.3. Market Revenue and Forecast, by Technology (2021-2033)

14.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

14.3.8. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.3.9. Market Revenue and Forecast, by Product (2021-2033)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.3.10.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.3.10.3. Market Revenue and Forecast, by Technology (2021-2033)

14.3.10.4. Market Revenue and Forecast, by End-use (2021-2033)

14.3.11. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.3.11.1. Market Revenue and Forecast, by Product (2021-2033)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.3.12.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.3.12.3. Market Revenue and Forecast, by Technology (2021-2033)

14.3.12.4. Market Revenue and Forecast, by End-use (2021-2033)

14.3.12.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.3.12.6. Market Revenue and Forecast, by Product (2021-2033)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.3.13.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.3.13.3. Market Revenue and Forecast, by Technology (2021-2033)

14.3.13.4. Market Revenue and Forecast, by End-use (2021-2033)

14.3.13.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.3.13.6. Market Revenue and Forecast, by Product (2021-2033)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.4.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.4.3. Market Revenue and Forecast, by Technology (2021-2033)

14.4.4. Market Revenue and Forecast, by End-use (2021-2033)

14.4.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.4.6. Market Revenue and Forecast, by Product (2021-2033)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.4.7.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.4.7.3. Market Revenue and Forecast, by Technology (2021-2033)

14.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

14.4.8. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.4.9. Market Revenue and Forecast, by Product (2021-2033)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.4.10.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.4.10.3. Market Revenue and Forecast, by Technology (2021-2033)

14.4.10.4. Market Revenue and Forecast, by End-use (2021-2033)

14.4.11. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.4.12. Market Revenue and Forecast, by Product (2021-2033)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.4.13.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.4.13.3. Market Revenue and Forecast, by Technology (2021-2033)

14.4.13.4. Market Revenue and Forecast, by End-use (2021-2033)

14.4.13.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.4.13.6. Market Revenue and Forecast, by Product (2021-2033)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.4.14.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.4.14.3. Market Revenue and Forecast, by Technology (2021-2033)

14.4.14.4. Market Revenue and Forecast, by End-use (2021-2033)

14.4.14.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.4.14.6. Market Revenue and Forecast, by Product (2021-2033)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.5.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.5.3. Market Revenue and Forecast, by Technology (2021-2033)

14.5.4. Market Revenue and Forecast, by End-use (2021-2033)

14.5.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.5.6. Market Revenue and Forecast, by Product (2021-2033)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.5.7.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.5.7.3. Market Revenue and Forecast, by Technology (2021-2033)

14.5.7.4. Market Revenue and Forecast, by End-use (2021-2033)

14.5.8. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.5.8.1. Market Revenue and Forecast, by Product (2021-2033)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Sample Type (2021-2033)

14.5.9.2. Market Revenue and Forecast, by Biomarker (2021-2033)

14.5.9.3. Market Revenue and Forecast, by Technology (2021-2033)

14.5.9.4. Market Revenue and Forecast, by End-use (2021-2033)

14.5.9.5. Market Revenue and Forecast, by Clinical Application (2021-2033)

14.5.9.6. Market Revenue and Forecast, by Product (2021-2033)

Chapter 15. Company Profiles

15.1. Eurofins Scientific

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. MDxHealth

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. CareDx

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Immucor

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Thermo Fisher Scientific Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Menarini Silicon Biosystems

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Qiagen

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Guardant Health

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Exact Sciences Corporation

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Myriad Genetics, Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others