The global luxury SUV market size was estimated at around USD 171.89 billion in 2023 and it is projected to hit around USD 909.6 billion by 2033, growing at a CAGR of 18.13% from 2024 to 2033.

The luxury SUV market has experienced significant growth over the past decade, driven by increasing consumer demand for high-end, versatile vehicles that offer both performance and comfort. Luxury SUVs combine the ruggedness and utility of traditional SUVs with the opulence and advanced technology of luxury cars, catering to affluent buyers who seek a premium driving experience.

The luxury SUV market is experiencing robust growth due to the rise in disposable income among consumers, particularly in emerging markets, has led to increased spending on premium vehicles. As people achieve higher income levels, the demand for high-end, versatile vehicles like luxury SUVs has surged. Secondly, technological advancements have significantly enhanced the appeal of luxury SUVs. Innovations such as advanced driver-assistance systems, state-of-the-art infotainment options, and improved fuel efficiency make these vehicles highly attractive to affluent buyers. Thirdly, there is a noticeable shift in consumer preferences towards SUVs over traditional sedans. This preference is driven by the superior comfort, spacious interiors, and elevated driving position that SUVs offer.

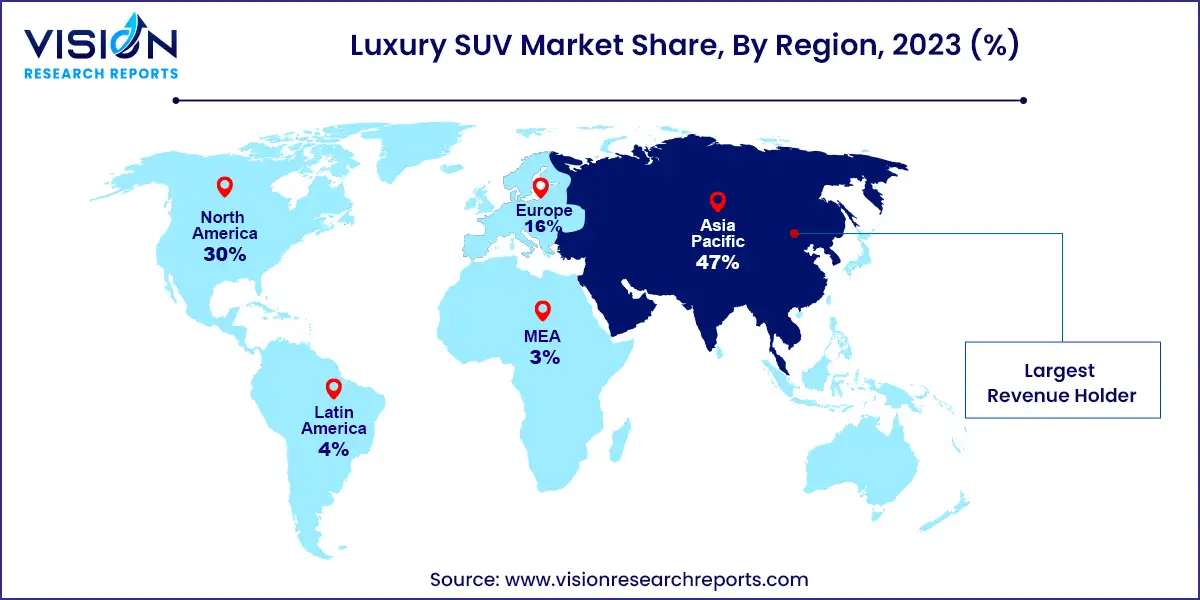

In 2023, the luxury SUV market in Asia Pacific dominated, accounting for 47% of global revenue. Key market drivers include the rapid rise in affluence and the expanding middle class in countries like China and India. Additionally, the aspiration for global brands and the influence of Western lifestyles enhance the appeal of luxury SUVs. High-end brands are perceived as status symbols, driving demand among affluent consumers in the region.

| Attribute | Asia Pacific |

| Market Value | USD 80.78 Billion |

| Growth Rate | 18.13% CAGR |

| Projected Value | USD 427.51 Billion |

The luxury SUV market in North America is projected to grow steadily from 2024 to 2033. The region's cultural preference for larger vehicles, especially SUVs, is strong. Consumers favor luxury SUVs for their spacious interiors, advanced features, and versatility, which cater to both family needs and personal preferences.

The luxury SUV market in the U.S. is expected to grow at a significant CAGR from 2024 to 2033. The U.S. market features diverse consumer demographics, including young professionals, families, and retirees, each with unique preferences. Luxury SUVs cater to these varied needs by offering a wide range of models and features.

In 2023, the mid-size SUV segment led the market, capturing 45% of global revenue. This segment appeals to consumers looking for a balance between advanced features and luxury. Manufacturers are enhancing the cabin experience with high-quality materials, ergonomic designs, and advanced climate control systems, which are expected to drive segment growth. Additionally, the option for buyers to personalize their vehicles with various trims, color choices, and accessory packages adds to the allure of mid-size SUVs, contributing to their growth over the forecast period.

The compact SUV segment is anticipated to experience substantial growth from 2024 to 2033. These vehicles are increasingly equipped with state-of-the-art technology, including Advanced Driver Assistance Systems (ADAS), connectivity features, and infotainment systems. These technological enhancements attract tech-savvy consumers who prioritize innovation in their driving experience. Furthermore, the rise of Internet of Things (IoT) and connected car technologies, such as remote diagnostics, over-the-air updates, and in-car internet connectivity, further boosts the demand for compact SUVs.

The ICE segment dominated the market in 2023, driven by the superior performance and power these vehicles offer. Luxury SUV consumers often prioritize robust engine performance and high horsepower, attributes exemplified by models like the Porsche Cayenne and Mercedes-Benz G-Class. These vehicles are renowned for their powerful engines, delivering an exhilarating driving experience that electric models have yet to fully replicate.

The electric segment is expected to witness significant growth from 2024 to 2033, influenced by stringent government regulations and incentives promoting electric vehicles. Policies aimed at reducing carbon emissions are motivating manufacturers to develop cleaner and more efficient luxury SUVs. Increased regulatory pressures and incentives are accelerating the global adoption of electric and hybrid vehicles. According to a European Environment Agency (EEA) report, the transition to electric and hybrid vehicles has markedly reduced greenhouse gas emissions, with electric SUVs alone cutting CO2 emissions by an estimated twenty million tons annually, contributing to the EU’s climate goals.

By Vehicle Type

By Propulsion Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Luxury SUV Market

5.1. COVID-19 Landscape: Luxury SUV Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Luxury SUV Market, By Vehicle Type

8.1. Luxury SUV Market, by Vehicle Type, 2024-2033

8.1.1. Compact

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mid Size

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Full Size

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Luxury SUV Market, By Propulsion Type

9.1. Luxury SUV Market, by Propulsion Type, 2024-2033

9.1.1. ICE

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Electric

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Luxury SUV Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

Chapter 11. Company Profiles

11.1. AB Volvo

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Tata Motors Limited

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Volkswagen Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Mercedes-Benz Group AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Isuzu Motors Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Aston Martin Holdings UK Ltd

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Toyota Motor Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Bayerische Motoren Werke AG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Nissan Motor Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. General Motors

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others