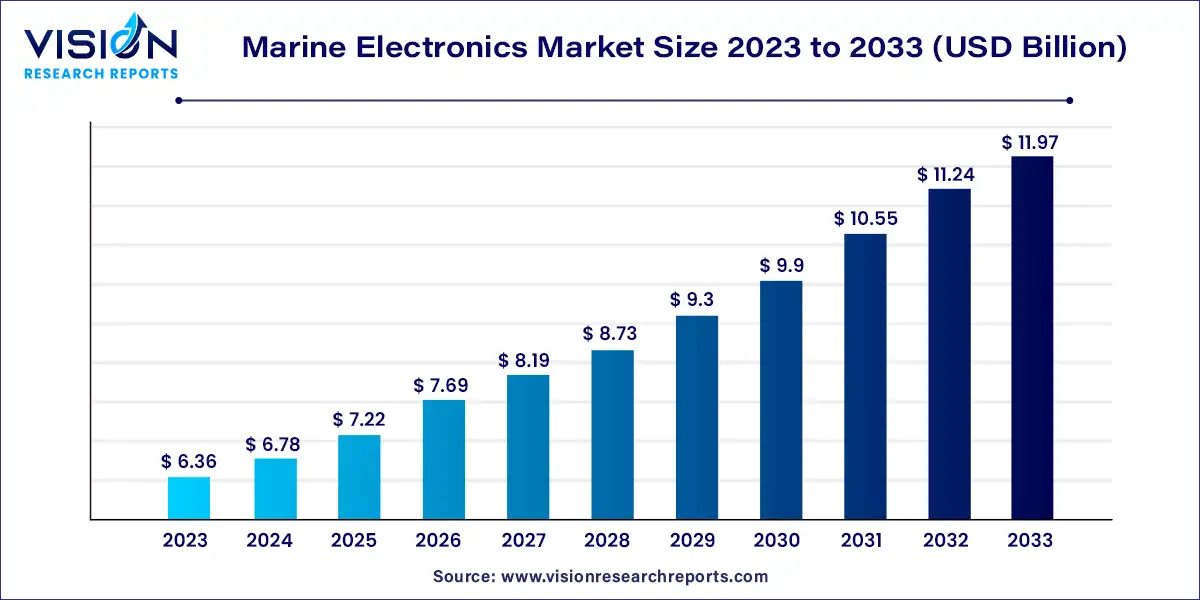

The global marine electronics market size was estimated at around USD 6.36 billion in 2023 and it is projected to hit around USD 11.97 billion by 2033, growing at a CAGR of 6.53% from 2024 to 2033. The marine electronics market encompasses a broad range of devices and systems designed for navigation, communication, and safety in maritime environments. These technologies are critical for enhancing operational efficiency, safety, and performance across various marine applications, including commercial shipping, leisure boating, and defense.

The marine electronics market is experiencing robust growth driven by the rise in global maritime trade has significantly increased the demand for advanced navigation and communication systems. As international shipping continues to expand, the need for precise and reliable marine electronics to ensure safe and efficient voyages becomes more critical. Additionally, ongoing technological advancements are a major growth driver. Innovations such as high-resolution radar, sophisticated sonar systems, and real-time satellite communications are enhancing the functionality and appeal of marine electronics. Moreover, stringent regulatory standards and safety mandates imposed by international maritime organizations are compelling operators to adopt the latest technologies to comply with safety and environmental regulations.

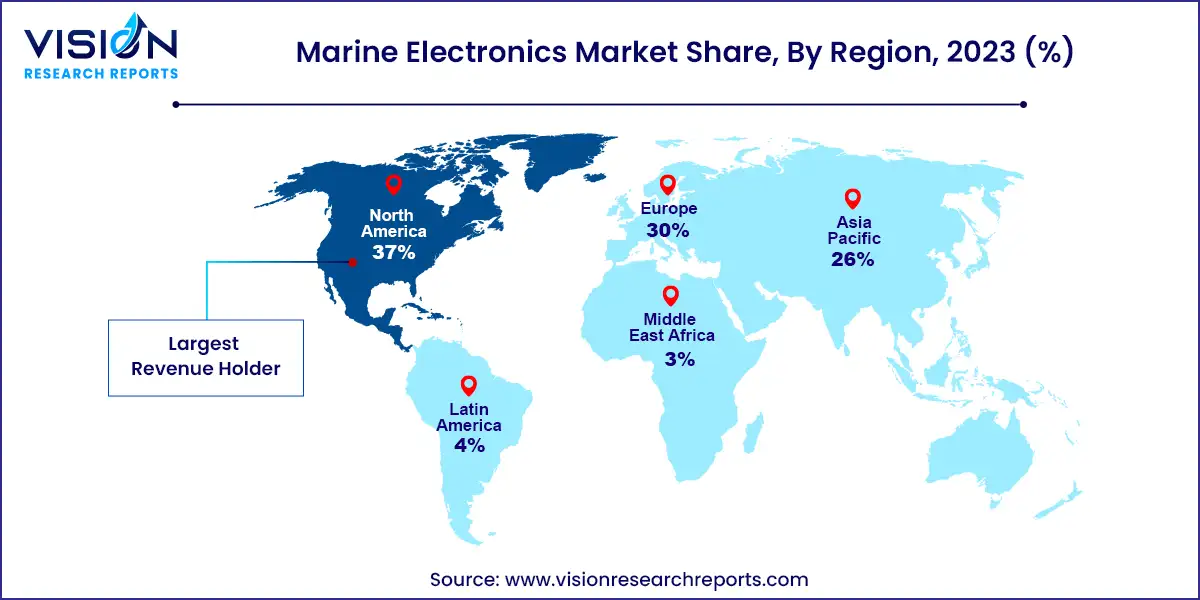

North America commanded the largest market share of 37% in 2023, owing to its advanced maritime infrastructure, high adoption of cutting-edge technologies, and substantial investments in both commercial and recreational boating. The presence of leading marine electronics manufacturers and a strong focus on maritime safety and regulations contribute to the region's market dominance. Additionally, the thriving recreational boating industry in the U.S. drives the demand for sophisticated marine electronics.

| Attribute | North America |

| Market Value | USD 2.35 Billion |

| Growth Rate | 6.57% CAGR |

| Projected Value | USD 4.42 Billion |

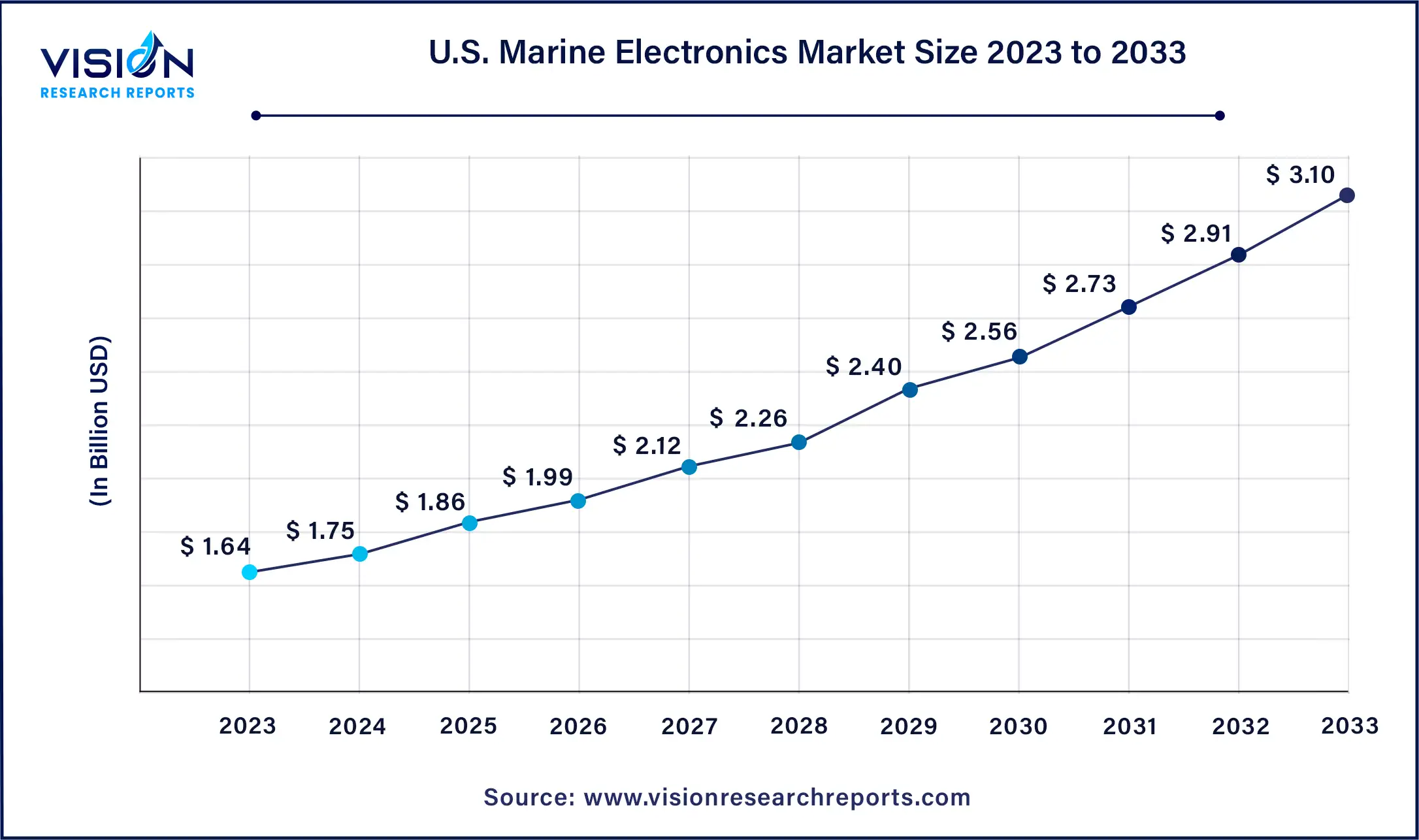

The U.S. marine electronics market size was valued at USD 1.64 billion in 2023 and it is predicted to surpass around USD 3.10 billion by 2033 with a CAGR of 6.57% from 2024 to 2033.

The presence of major marine electronics manufacturers and high adoption rates of advanced maritime technologies further bolster the country's market position. Stringent maritime safety regulations also drive the demand for sophisticated marine electronics.

Asia Pacific Marine Electronics Market Trends

Asia Pacific is anticipated to record the fastest CAGR of 7.43% from 2024 to 2033, fueled by the rapid expansion of the maritime industry, increasing trade activities, and significant investments in port infrastructure. The region's burgeoning shipbuilding industry and rising adoption of advanced technologies in both commercial and recreational vessels contribute to this growth. Supportive government initiatives and policies aimed at enhancing maritime safety and efficiency also drive accelerated market expansion in Asia Pacific.

Europe Marine Electronics Market Trends

The marine electronics market in Europe is experiencing steady growth, driven by a focus on sustainable maritime practices and environmental regulations. European countries are emphasizing eco-friendly technologies and solutions, such as energy-efficient navigation systems and emissions-reducing technologies for vessels. This commitment to sustainability not only fosters innovation but also supports the market's resilience and long-term growth prospects in the region.

In 2023, the hardware segment dominated the market with a share of 64%, driven by the high demand for sophisticated navigation systems, communication devices, and sonar equipment crucial for maritime operations. Essential components such as radar systems, GPS units, and fish finders play a vital role in ensuring safety and operational efficiency at sea. Additionally, the modernization of naval fleets and the rising adoption of automated and smart technologies in both commercial and recreational vessels are fueling significant investments in marine hardware.

Conversely, the software segment experienced the highest growth rate, registering a CAGR of 7.43% from 2024 to 2033. This surge is attributed to the increasing need for advanced maritime analytics, real-time data processing, and predictive maintenance solutions. The growing implementation of IoT and AI technologies in maritime operations enhances efficiency and safety, driving demand for sophisticated software solutions. Furthermore, the shift towards digitalization and automation in the marine industry, along with the adoption of integrated maritime management systems, supports the rapid expansion of the software segment.

The merchant vessel segment led the market with a 48% share in 2023, owing to the extensive utilization of advanced navigation, communication, and safety systems essential for commercial shipping. The significant volume of global trade conducted via merchant vessels necessitates reliable and efficient electronic equipment to ensure the safe and timely delivery of goods. Moreover, stringent maritime safety regulations and the increasing adoption of automation and digitalization in the shipping industry further drive the demand for marine electronics in this segment.

The recreational boats segment recorded the fastest growth, with a CAGR of 7.13% from 2024 to 2033, reflecting the rising popularity of boating and water sports. The growing consumer interest in advanced navigation, entertainment, and safety systems for leisure vessels fuels demand for sophisticated marine electronics. Technological advancements and increasing disposable incomes also contribute to the segment's rapid expansion.

In 2023, the navigation system segment held the largest market share of 44%, driven by the critical need for accurate and reliable navigation to ensure maritime safety and efficiency. Advanced navigation systems, including GPS, radar, and electronic chart display and information systems (ECDIS), are crucial for precise route planning and hazard avoidance. The rising volume of global maritime trade and the growing number of recreational boaters boost the demand for advanced navigation solutions. Additionally, stringent international regulations and standards for maritime safety further support the widespread adoption of these systems.

The entertainment system segment achieved the fastest CAGR of 7.14% from 2024 to 2033, driven by the growing demand for enhanced onboard experiences among recreational boaters and luxury yacht owners. Increasing consumer expectations for high-quality audio, video, and connectivity solutions on vessels are fueling the adoption of advanced entertainment systems.

By Component

By Vessel Type

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others