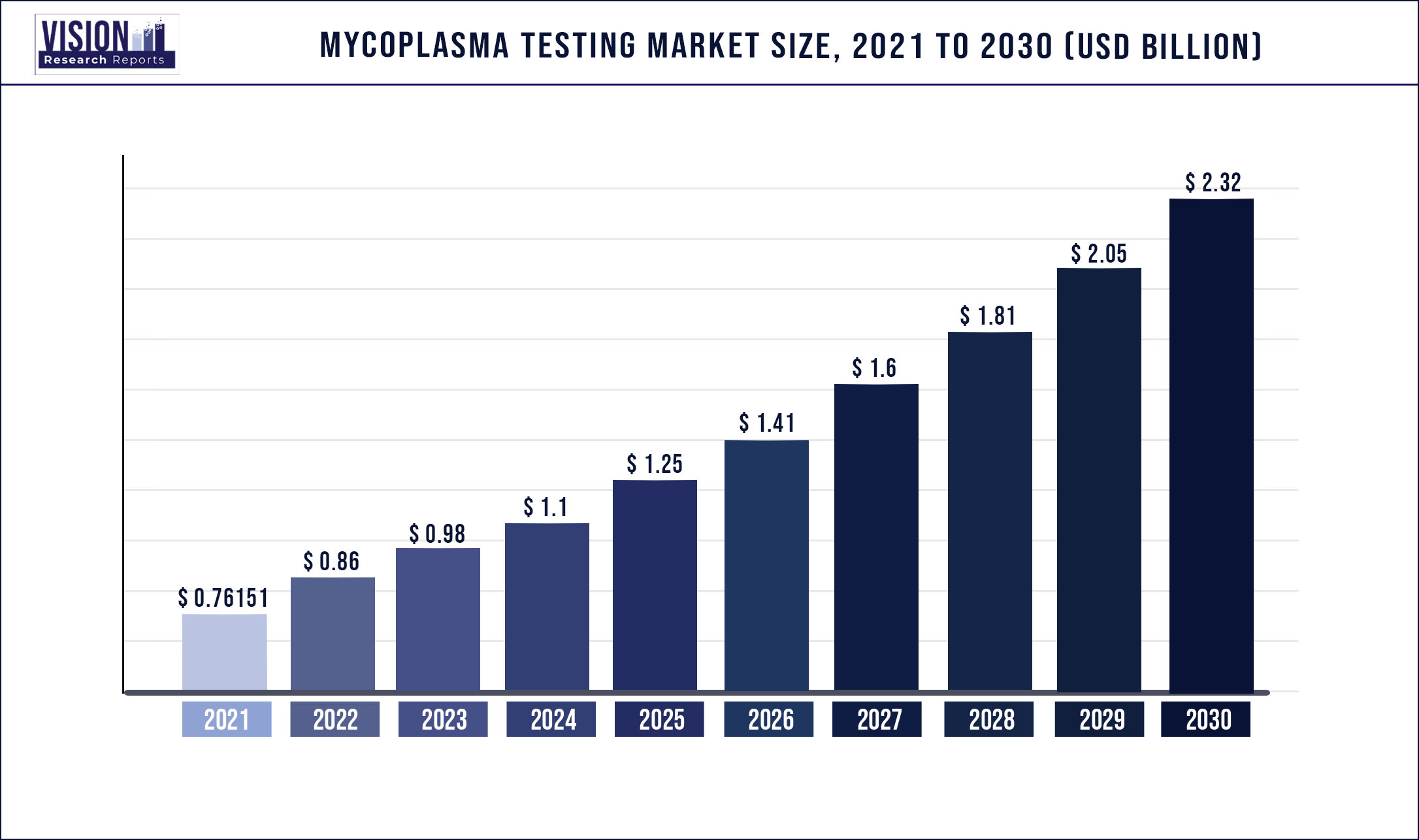

The global mycoplasma testing market was valued at USD 761.51 million in 2021 and it is predicted to surpass around USD 2.32 billion by 2030 with a CAGR of 13.18% from 2022 to 2030.

Report Highlights

The major factors driving the expansion of market includes growing demand for mycoplasma testing in biomanufacturing, emerging economies, and growing pharmaceutical outsourcing. Additionally, the market's overall growth is driven by rising cell-line contamination and innovation & research in biological sciences.

Growing number of government initiatives to support pharmaceutical and biotechnology companies is also driving the market growth. The U.S. FDA proposed to remove a test for detecting mycoplasma within in vitro living cell cultures, as it can help identify only a single test method. These changes in biologics regulations are anticipated to improve specificity and sensitivity in mycoplasma detection tests, leading to introduction of new technologies in the industry. This is expected to create immense opportunities for key players in new product development.

The rates of M. pneumoniae positivity sharply decreased during the COVID-19 pandemic outbreak at the end of 2019. This was a result of the COVID-19 pandemic's stringent regulations, which successfully stopped the spread of M. pneumonia. However, it is anticipated that M. pneumonia will expand even more throughout the research period following the relaxation of COVID-19 limits, which will have a positive impact on the mycoplasma testing market's growth.

Increasing investments in R&D have contributed significantly to the market’s revenue growth. With rising healthcare expenditure, research activities in the life sciences industry are increasing significantly. The adoption of new technologies for drug discovery & development and innovations in cell culture technologies are driving the demand for mycoplasma tests. The high risk of cell culture contamination remains the primary factor expected to drive the mycoplasma testing market over the forecast period

Mycoplasma is estimated to contaminate around 15%-35% of all continuous cell cultures around the world. Out of over 190 known species of mycoplasma, only eight species are responsible for more than 95% of cell culture contamination. Poor cultural practices, aerosols, dust, and cross-contamination as a result of faulty or broken laminar flow are some of the factors responsible for an increase in the number of cell culture contamination events. Such factors are likely to drive the market demand for mycoplasma testing solutions.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 761.51 million |

| Revenue Forecast by 2030 | USD 2.32 billion |

| Growth rate from 2022 to 2030 | CAGR of 13.18% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, Technology, Application, End-use, Region |

| Companies Covered |

Thermo Fisher Scientific, Inc.; Merck KGaA; Lonza Group AG; Charles River Laboratories International, Inc.; PromoCell GmbH; American Type Culture Collection; Asahi Kasei Medical Co. Ltd.; Sartorius AG; InvivoGen; Eurofins Scientific. |

Product Insights

The kits and reagents segment captured the highest revenue share of 50.75% in 2021, due to the high demand for these products in mycoplasma detection, as well as their high cost. Various market players have developed mycoplasma detection kits catering specifically to the needs of researchers and biologic manufacturers, which is fueling segment growth. Due to the growing availability of automated equipment for the detection of mycoplasma, instruments are predicted to experience substantial growth during the projected period.

A better method that enables quick detection and produces results quickly is provided by PCR systems. For instance, the CFX96 Touch Real-Time PCR Detection System from Bio-Rad Laboratories is based on PCR. It is a versatile and accurate PCR detection system with six channels that combines cutting-edge optical technique with exact temperature control. As a result, both multiplex as well as singleplex reactions can be detected using a method that is trustworthy and sensitive. Thus, propelling the mycoplasma testing market growth.

Technology Insights

The PCR segment dominated the mycoplasma testing market with a revenue share of 32.3% in 2021 and exhibits the fastest growth rate during the projected period. This approach allows the separation of other contaminating DNA while allowing the detection of various mycoplasma species. It offers test findings that are highly efficient and specific. Some of the key benefits provided by this technology includes ease of use and quick detection. For instance, the Merck KGaA-developed LookOut Mycoplasma PCR Detection Kit that makes it easier to detect contamination with Ureaplasma, Mycoplasma, and Acholeplasma in cell-derived biologicals and cell culture lines.

ELISA technology is expected to gain considerable market share during the forecast period as it facilitates easy detection with the use of labeled probes or antibodies for mycoplasma detection. In some instances, PCR and ELISA tests are combined to form PCR-ELISA, a photometric enzyme-based immunoassay that facilitates the detection of PCR-amplified mycoplasma DNA in samples. Functional advantages, cost-effectiveness, and ability to detect a wide range of strains are few factors propelling segment growth during the forecast period.

Application Insights

The cell line testing segment accounted for the largest share of 41.34% in 2021, as well as the fastest growth rate throughout the forecast period, owing to the increase in research projects being done in the field of cell culture. For instance, the federal funding agency in Canada for health research, Canadian Institutes of Health Research (CIHR), has supported many health researchers in Canada with around USD 981 million in investments. The National Research Council’s Industrial Research and Assistance Program (NRC-IRAP) is also offering technical support to several Canadian life science companies including small and medium-scale involved in product development and innovation.

A surge in mycoplasma contamination in cell culture is also anticipated to cause it to see the largest growth during the projection period. Toxin development and changes in metabolite production in cell culture can be caused by mycoplasma contamination. As a result, cell line testing and authentication are given the utmost significance in the biopharmaceutical and pharmaceutical industries.

End-use Insights

The pharmaceutical and biotechnology companies segment received highest revenue shares of 35.24% in 2021, as well as the fastest CAGR throughout the forecast period. Because these firms have made significant investments in R&D efforts, which have fostered advancements in the field of drug development research. These businesses carry out quality tests on raw materials to manage biological safety. Furthermore, the prevalence of disorders like rheumatoid arthritis and psoriasis is rising, which is contributing to the growth of the biopharmaceutical industry.

Due to the expanding research services offered by these firms, contract research organizations (CROs) are predicted to grow profitably over the projected period. In order to ensure the sterility of cultures used in preclinical research and biopharmaceutical development, they mandate the use of mycoplasma tests, ensuring the caliber of the outsourced testing services.

Regional Insights

North America dominated the market and accounted for revenue share of 39.08% in 2021. Due to its established healthcare sector and the increased incidence of respiratory disorders, this area is predicted to enhance its market share. The existence of multinational pharmaceutical and biotech companies as well as increased investment in R&D activities in the region are additional factors promoting the expansion of this region.

Asia Pacific is estimated to witness an exponential CAGR during the projected timeframe, which can be attributed to increase in healthcare spending and rise in the demand for better infrastructure in laboratory & clinical research. Furthermore, regulatory policies imposed by healthcare organizations favoring improvements in biosafety quality are likely to surge growth opportunities in the future.

In addition, emerging markets such as India are also witnessing lucrative opportunities in this sector. the Indian government is implementing a variety of strategic efforts to encourage more Research and innovation for the development of new medication, propels the market growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mycoplasma Testing Market

5.1. COVID-19 Landscape: Mycoplasma Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mycoplasma Testing Market, By Product

8.1. Mycoplasma Testing Market, by Product, 2022-2030

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Kits & Reagents

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Mycoplasma Testing Market, By Technology

9.1. Mycoplasma Testing Market, by Technology, 2022-2030

9.1.1. PCR

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. ELISA

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Direct Assay

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Indirect Assay

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Microbial Culture Techniques

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Enzymatic Methods

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Mycoplasma Testing Market, By Application

10.1. Mycoplasma Testing Market, by Application, 2022-2030

10.1.1. Cell Line Testing

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Virus Testing

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. End of Production Cells Testing

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Mycoplasma Testing Market, By End-use

11.1. Mycoplasma Testing Market, by End-use, 2022-2030

11.1.1. Academic Research Institutes

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Cell Banks

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Contract Research Organizations

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Pharmaceutical & Biotechnology Companies

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Mycoplasma Testing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Merck KGaA

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Lonza Group AG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Charles River Laboratories International, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. PromoCell GmbH

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. American Type Culture Collection

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Asahi Kasei Medical Co., Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Sartorius AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. InvivoGen

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Eurofins Scientific

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others