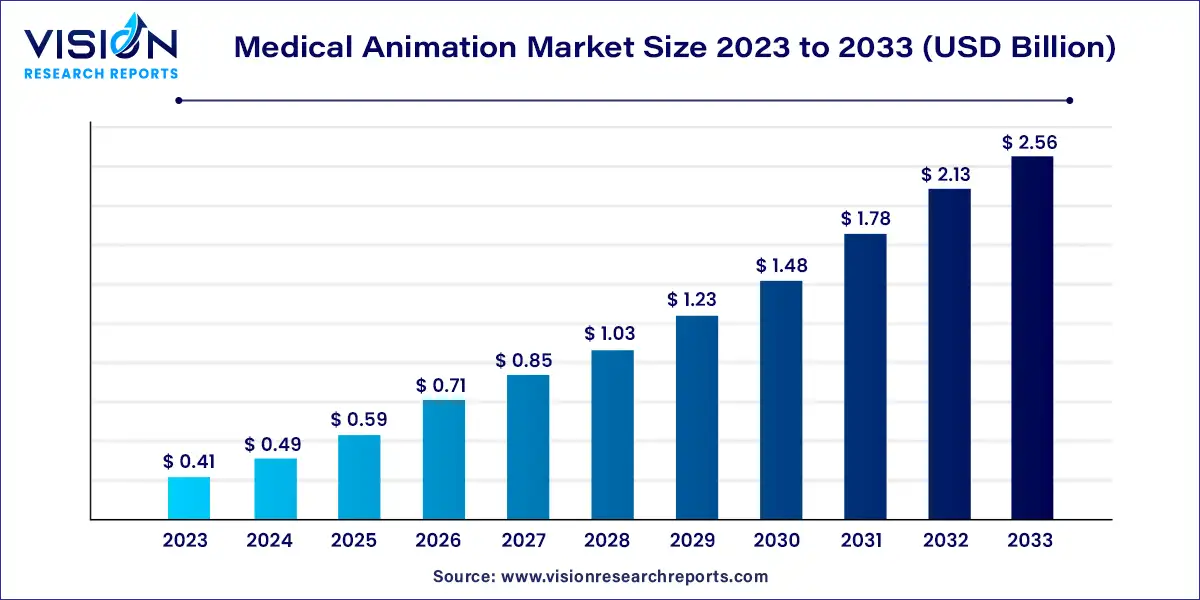

The global medical animation market size was estimated at USD 0.41 billion in 2023 and it is expected to surpass around USD 2.56 billion by 2033, poised to grow at a CAGR of 20.12% from 2024 to 2033. The medical animation market is a rapidly growing segment within the broader healthcare industry, driven by advancements in technology and increasing demand for educational and promotional tools. Medical animations are used for various purposes, including patient education, medical training, and marketing of pharmaceutical products.

The growth of the medical animation market is fueled by the technological advancements play a crucial role, as innovations in animation software and 3D modeling enable the creation of highly detailed and engaging visual content. This technological progress enhances the effectiveness of medical animations in conveying complex medical information, making it easier for both healthcare professionals and patients to understand. Additionally, the increasing emphasis on patient education and the need for effective communication tools drive demand for medical animations. These animations simplify intricate medical concepts and procedures, improving patient comprehension and engagement. The expansion of the pharmaceutical and biotechnology sectors also contributes to market growth, as companies leverage medical animations for marketing purposes and to demonstrate drug mechanisms and treatment benefits.

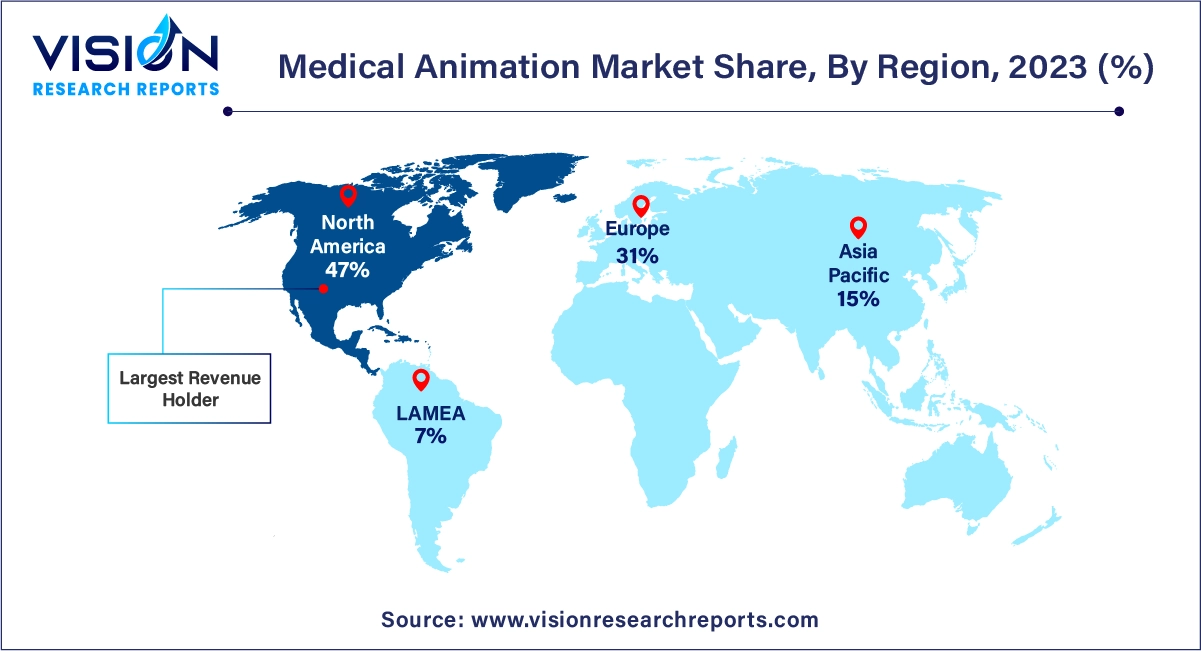

The medical animation market in North America led in 2023, supported by favorable government initiatives promoting the adoption of medical animations. The increasing use of 3D animations in various studies fuels this growth. Notably, in September 2020, Sketchy Group LLC secured a $30 million investment from TCG CAPITAL MANAGEMENT, LP., highlighting the region’s market strength.

Europe is identified as a significant market due to the introduction of innovative medical animations that clarify complex cellular and molecular studies. For example, in March 2021, Disney and Koninklijke Philips N.V. collaborated to test custom Disney animations within Philips Ambient Experience, enhancing patient and staff environments through personalized lighting and visuals.

The Asia Pacific market is expected to grow at the fastest rate during the forecast period. The region is seeing increased use of 3D animations in disease management and awareness programs. For instance, Fresenius Medical Care expanded its "The Kidney Kid Superhero" initiative globally in March 2020, aiming to promote kidney health awareness among children.

The market in Latin America is set to experience significant growth, driven by the use of medical animations in rehabilitation programs. These animations are essential for informing patients about disease recovery, contributing to the anticipated market expansion.

The 3D animation segment led the market with a 32% share in 2023. Its prominence is due to its effectiveness in illustrating complex medical procedures and concepts, making it a preferred choice for healthcare communication. The growth of 3D animation is driven by increasing digitalization and its applications in medical device manufacturing and forensic science. For example, in November 2022, ANIMA RES GmbH partnered with GigXR to provide hyper-realistic 3D anatomy learning through the Insight Series. This global initiative offers advanced holographic training for healthcare providers, medical and nursing schools, and defense agencies.

The 4D animation segment is anticipated to experience the fastest growth rate during the forecast period. This is attributed to the increasing use of 4D animations in medical simulations, which help illustrate intricate surgical procedures and physiological processes, thus enhancing medical education and understanding.

In 2023, the oncology segment held the largest market share at 25%. The high demand for animated studies of drug mechanisms is fueled by the rising incidence of cancer and ongoing research for novel treatments. Increased awareness and advancements in surgical training methods also contribute to the market's growth. For instance, in October 2023, Apollo Proton Cancer Centre and the Social Welfare & Women Empowerment Department introduced a self-breast examination chart and an animated video to raise awareness about early breast cancer detection and treatment.

The plastic surgery segment is projected to grow at the highest CAGR of 20.43% during the forecast period. This growth is driven by the increasing number of minimally invasive procedures and an aging population. Medical animations in this segment assist plastic surgeons in explaining complex procedures and enhance patient education and confidence by providing clear treatment information.

The drug mechanism of action (MoA) segment was the largest in 2023, holding a 31% market share. The widespread use of medical animation to depict drug interactions and mechanisms drives this segment's growth. For example, Microverse Studios specializes in creating high-quality animations that explain complex scientific concepts such as AI-driven drug discovery and drug MoA.

The patient education segment is expected to grow at the fastest CAGR of 20.93%. This is due to the increasing need for animations that simplify disease information for patients, improving their understanding of their health conditions. An example is the animated video series launched by the National Kidney Foundation in December 2023, aimed at educating patients about the connection between systemic lupus erythematosus (SLE) and lupus nephritis (LN), ultimately seeking to improve patient awareness and reduce mortality risks.

Hospitals dominated the market in 2023 with a 26% share. Medical animations are increasingly utilized in hospitals to simplify complex patient information, enhancing understanding and treatment compliance. These animations bridge the communication gap between healthcare professionals and patients with varying levels of health literacy.

The life science companies segment is expected to grow at the fastest CAGR of 20.73% during the forecast period. The rise of biological illustrations and 3D graphics in healthcare marketing, coupled with increased research activities, is driving this growth. For instance, Random42 Scientific Communication introduced a VR experience in May 2022, aiming to educate users about the human body through immersive storytelling.

By Type

By Therapeutic Area

By Application

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Animation Market

5.1. COVID-19 Landscape: Medical Animation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Animation Market, By Type

8.1. Medical Animation Market, by Type

8.1.1. 3D Animation

8.1.1.1. Market Revenue and Forecast

8.1.2. 2D Animation

8.1.2.1. Market Revenue and Forecast

8.1.3. 4D Animation

8.1.3.1. Market Revenue and Forecast

8.1.4. Flash Animation

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Medical Animation Market, By Therapeutic Area

9.1. Medical Animation Market, by Therapeutic Area

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast

9.1.2. Cardiology

9.1.2.1. Market Revenue and Forecast

9.1.3. Plastic Surgery

9.1.3.1. Market Revenue and Forecast

9.1.4. Dental

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Medical Animation Market, By Application

10.1. Medical Animation Market, by Application

10.1.1. Drug MoA

10.1.1.1. Market Revenue and Forecast

10.1.2. Patient Education

10.1.2.1. Market Revenue and Forecast

10.1.3. Surgical Training & Planning

10.1.3.1. Market Revenue and Forecast

10.1.4. Cellular & Molecular Studies

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Medical Animation Market, By End Use

11.1. Medical Animation Market, by End Use

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast

11.1.2. Life Science Companies

11.1.2.1. Market Revenue and Forecast

11.1.3. Academic Institutes

11.1.3.1. Market Revenue and Forecast

11.1.4. Medical Device Manufacturers

11.1.4.1. Market Revenue and Forecast

11.1.5. Others

11.1.5.1. Market Revenue and Forecast

Chapter 12. Global Medical Animation Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type

12.1.2. Market Revenue and Forecast, by Therapeutic Area

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type

12.1.5.2. Market Revenue and Forecast, by Therapeutic Area

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type

12.1.6.2. Market Revenue and Forecast, by Therapeutic Area

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type

12.2.2. Market Revenue and Forecast, by Therapeutic Area

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type

12.2.5.2. Market Revenue and Forecast, by Therapeutic Area

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type

12.2.6.2. Market Revenue and Forecast, by Therapeutic Area

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type

12.2.7.2. Market Revenue and Forecast, by Therapeutic Area

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type

12.2.8.2. Market Revenue and Forecast, by Therapeutic Area

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type

12.3.2. Market Revenue and Forecast, by Therapeutic Area

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type

12.3.5.2. Market Revenue and Forecast, by Therapeutic Area

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type

12.3.6.2. Market Revenue and Forecast, by Therapeutic Area

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type

12.3.7.2. Market Revenue and Forecast, by Therapeutic Area

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type

12.3.8.2. Market Revenue and Forecast, by Therapeutic Area

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type

12.4.2. Market Revenue and Forecast, by Therapeutic Area

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type

12.4.5.2. Market Revenue and Forecast, by Therapeutic Area

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type

12.4.6.2. Market Revenue and Forecast, by Therapeutic Area

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type

12.4.7.2. Market Revenue and Forecast, by Therapeutic Area

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type

12.4.8.2. Market Revenue and Forecast, by Therapeutic Area

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type

12.5.2. Market Revenue and Forecast, by Therapeutic Area

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type

12.5.5.2. Market Revenue and Forecast, by Therapeutic Area

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type

12.5.6.2. Market Revenue and Forecast, by Therapeutic Area

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. INFUSE MEDIA GROUP, LLC.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Medmovie.com

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Nucleus Medical Media

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Radius Digital Science

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Scientific Animations

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Trinsic Animation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Viscira

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Epic Systems Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. XVIVO

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Ghost Productions, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others