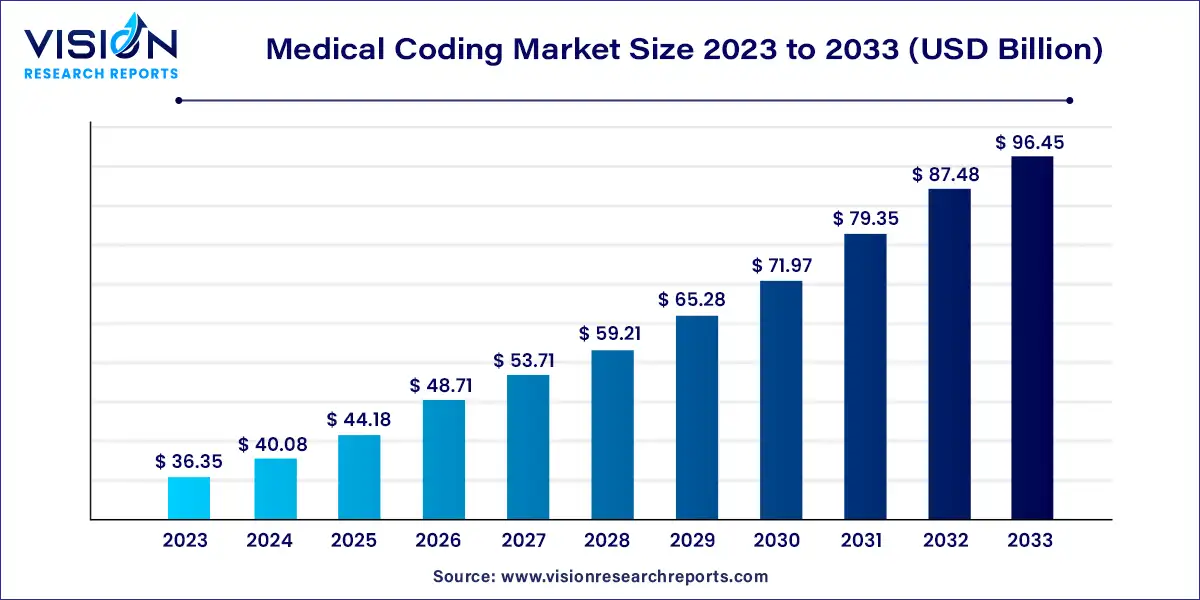

The global medical coding market size was estimated at around USD 36.35 billion in 2023 and it is projected to hit around USD 96.45 billion by 2033, growing at a CAGR of 10.25% from 2024 to 2033. The medical coding market plays a pivotal role in the healthcare industry by translating medical diagnoses, procedures, and services into standardized codes used for billing, reimbursement, and data analysis. This process is essential for maintaining accurate patient records, ensuring compliance with regulatory requirements, and facilitating efficient healthcare administration. With the increasing complexity of healthcare systems and the need for precise documentation, the medical coding market has seen significant growth and transformation in recent years.

The growth of the medical coding market is driven by the surge in global healthcare expenditures has amplified the need for accurate coding to ensure proper reimbursement and effective financial management. As healthcare costs rise, precise coding becomes crucial for maintaining financial stability within healthcare systems. Secondly, the transition to more advanced coding systems, such as ICD-10, has spurred the demand for updated coding practices and technology. This shift requires healthcare providers to adapt and invest in new systems to meet regulatory standards. Additionally, advancements in technology, particularly the integration of artificial intelligence and machine learning, have significantly enhanced the efficiency and accuracy of coding processes. These innovations streamline coding tasks, reduce errors, and accelerate processing times. Finally, the aging population, which requires extensive medical care, has led to an increased volume of coding tasks related to various diagnoses and treatments, further fueling market growth.

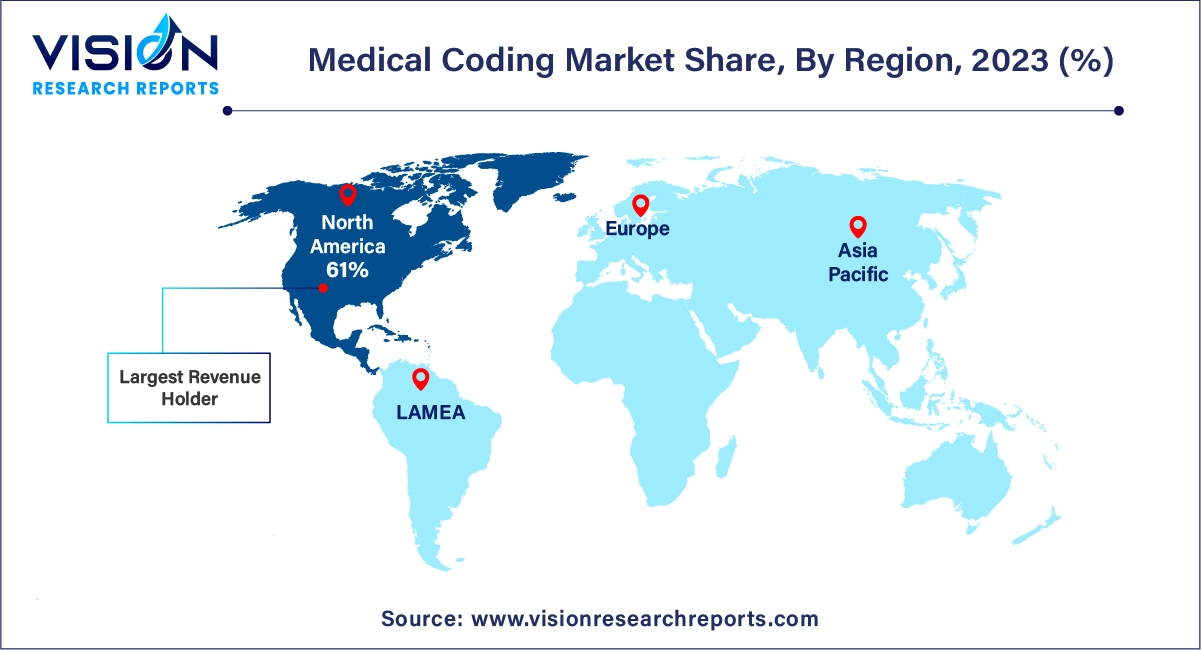

In 2023, North America held the largest share of the medical coding market, accounting for 61%. This dominance is due to the need for a universal coding language to reduce errors and inconsistencies in healthcare documentation. Medical coding addresses this need by converting healthcare diagnoses, procedures, services, and equipment into standardized alphanumeric codes, essential for accurate billing and efficient healthcare management. Additionally, the integration of AI and Machine Learning (ML) into medical coding processes is expected to drive further market growth.

| Attribute | North America |

| Market Value | USD 22.17 Billion |

| Growth Rate | 10.27% CAGR |

| Projected Value | USD 58.83 Billion |

The medical coding market in Europe is set to grow due to the increasing need for standardized coding in medical records. Standardized coding helps reduce the risk of insurance fraud and misinterpretation of claims, streamlining hospital billing processes. Technological advancements, such as computer-aided coding systems and improvements in healthcare infrastructure across several European countries, are expected to contribute to this growth.

The Asia Pacific medical coding market is anticipated to grow the fastest over the forecast period. This growth is driven by the rising prevalence of chronic diseases, which prompts healthcare providers to enhance their infrastructure and services. Efficient medical coding practices are crucial for accurate billing and insurance claims. Additionally, increased healthcare expenditure and government initiatives to improve healthcare services are expected to further boost market growth in the region.

The medical coding market in Latin America is projected to grow due to recent healthcare reforms, supportive regulatory initiatives, expanded health insurance coverage, and the increasing adoption of healthcare IT systems. Countries like Argentina are experiencing a higher demand for medical coding services as both private and public health insurance schemes expand, necessitating accurate coding for effective insurance claims processing and reimbursement. The growth in insurance coverage is driving the need for complex and extensive claims management, thus fueling the adoption of advanced coding technologies.

In 2023, the outsourced segment dominated the medical coding market, accounting for 66% of revenue and is expected to experience the highest growth rate during the forecast period. This segment’s expansion is driven by the growing volume of patient data and healthcare information, the need for cost reduction and operational efficiency within healthcare organizations, and the necessity to comply with international coding standards and regulations. Outsourcing enables healthcare providers to leverage skilled coding professionals without the overhead costs associated with in-house teams. It also allows healthcare professionals to concentrate on primary care services by delegating the complex and time-consuming task of medical coding to external experts. This model benefits from advancements in technology and communication, which facilitate secure and effective international collaboration.

Conversely, the in-house segment is projected to experience substantial growth over the forecast period. This increase is driven by the rising demand for accurate billing procedures, the growing need for standardized patient data, and healthcare providers' focus on cost-cutting measures. The adoption of electronic health records and the rising requirement for specialized medical coders to manage complex coding standards contribute to this trend. Organizations are recognizing the advantages of having a dedicated, well-trained in-house team to ensure compliance, maximize reimbursement, and minimize billing errors.

By Component

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others