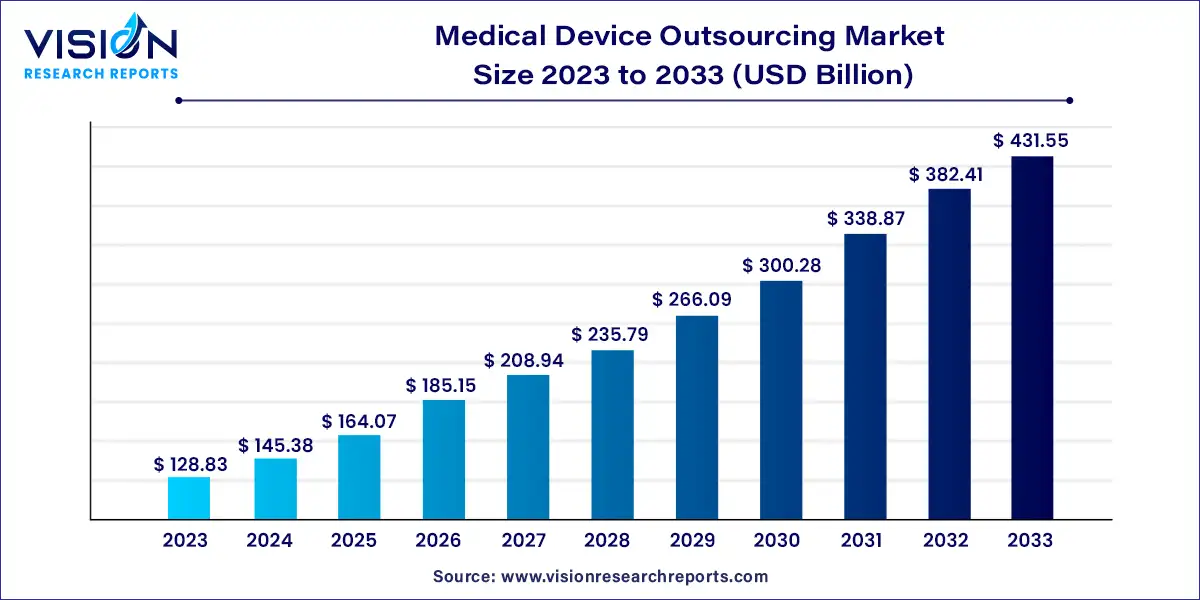

The global medical device outsourcing market was surpassed at USD 128.83 billion in 2023 and is expected to hit around USD 431.55 billion by 2033, growing at a CAGR of 12.85% from 2024 to 2033.

The medical device outsourcing market has witnessed significant growth driven by factors such as technological advancements, increasing demand for healthcare services, and cost-efficiency considerations among medical device manufacturers. This overview aims to provide insights into the key trends, drivers, challenges, and opportunities shaping the medical device outsourcing market landscape.

The growth of the medical device outsourcing market is driven by an increasing complexity of medical device development and regulatory requirements has prompted companies to seek specialized outsourcing partners with expertise in areas such as design, manufacturing, and regulatory compliance. Additionally, the globalization of healthcare markets has created opportunities for outsourcing providers to offer localized solutions and expand their global footprint. Moreover, rapid technological advancements, including the adoption of digital health solutions and advanced manufacturing techniques, have fueled innovation in the industry, driving demand for outsourcing services. Furthermore, cost-efficiency considerations and the need to streamline operations have led medical device manufacturers to leverage outsourcing as a means to reduce production costs and improve operational efficiency.

The global market size of medical device contract manufacturing was estimated to be around USD 70 billion in 2023, with this segment leading the market and accounting for more than 55% of the global revenue. The market is segmented based on services into quality assurance services, regulatory affairs services, product design & development services, product testing & sterilization services, product implementation services, product upgrade services, product maintenance services, and contract manufacturing services.

The growth of this segment is being fueled by an increasing focus on reducing production costs and the growing complexity in manufacturing processes. Ensuring the production of high-quality and safe devices for patient care is a significant concern for medical device manufacturers. Factors such as the expanding patient pool, advancements in product technology, and investments by market players are expected to positively influence market growth. Consequently, the global medical device manufacturing outsourcing market size is projected to witness significant growth in the coming years.

Moreover, the quality assurance services segment is expected to achieve the fastest compound annual growth rate (CAGR) of 15.03% during the forecast period. Maintaining an effective quality management system is crucial for the production of every medical device. One such system is ISO 13485, which encompasses the development, implementation, and maintenance of products intended for use by medical device manufacturers and suppliers.

The cardiology segment held the largest share, accounting for over 22% of the market in 2023, and is projected to maintain its dominance throughout the forecast period. The market is segmented based on application into cardiology, diagnostic imaging, orthopedic, IVD (in vitro diagnostics), ophthalmic, general & plastic surgery, drug delivery, dental, endoscopy, diabetes care, and others.

The high number of deaths due to cardiovascular diseases is driving positive growth in this industry, as both medical practitioners and patients increasingly recognize the importance of early diagnosis and treatment of these disorders. Cardiovascular devices are inherently complex and require technical expertise, making outsourcing an advantageous option. Additionally, to meet the growing demand for cardiovascular devices, market players are turning to contract manufacturers for their production, warehousing, and distribution capabilities, ultimately helping them save costs and sustain in the face of rising competition.

The general and plastic surgery device outsourcing segment is expected to witness the fastest compound annual growth rate (CAGR) of 14.35% from 2024 to 2033. The availability of competent outsourcing firms that comply with regulatory requirements, coupled with the rising demand for cosmetic surgeries, are key factors expected to drive growth in this segment. There has been a significant increase in awareness and consciousness about physical appearance in recent years, leading to a surge in demand for cosmetic surgeries globally.

Surgical devices such as fixation devices, extremity splints, and epilators require specialized molding and machining processes, thus increasing the demand for outsourcing these devices. The introduction of minimally invasive and noninvasive surgeries has also led to a rise in the number of surgeries performed each year, necessitating innovative and procedure-specific devices.

In 2023, Class II type medical devices held the largest market share, accounting for 82% of the market, and this segment is expected to register the fastest compound annual growth rate (CAGR) of 14.0% over the forecast period. This growth can be attributed to the high cost of medical devices, with nearly 43.0% of medical devices falling under this category. The medical device outsourcing market is segmented based on class type into Class I, Class II, and Class III.

Class II devices include catheters, syringes, surgical gloves, blood pressure cuffs, pregnancy test kits, contact lenses, and blood transfusion kits. These devices entail a higher risk compared to Class I devices as they are in continuous contact with patients.

Class I type medical devices are also expected to witness significant growth during the forecast period. These devices are noninvasive, with 47.0% of devices falling under this category. Moreover, 95.0% of Class I devices are exempt from regulatory procedures due to their low-risk levels. Class I devices are readily available on the market due to their low risk to patients and typically do not provide critical life-sustaining care. The majority of Class I devices are exempt from the FDA's premarket notification (510k) and Premarket Approval Requirements (PMA).

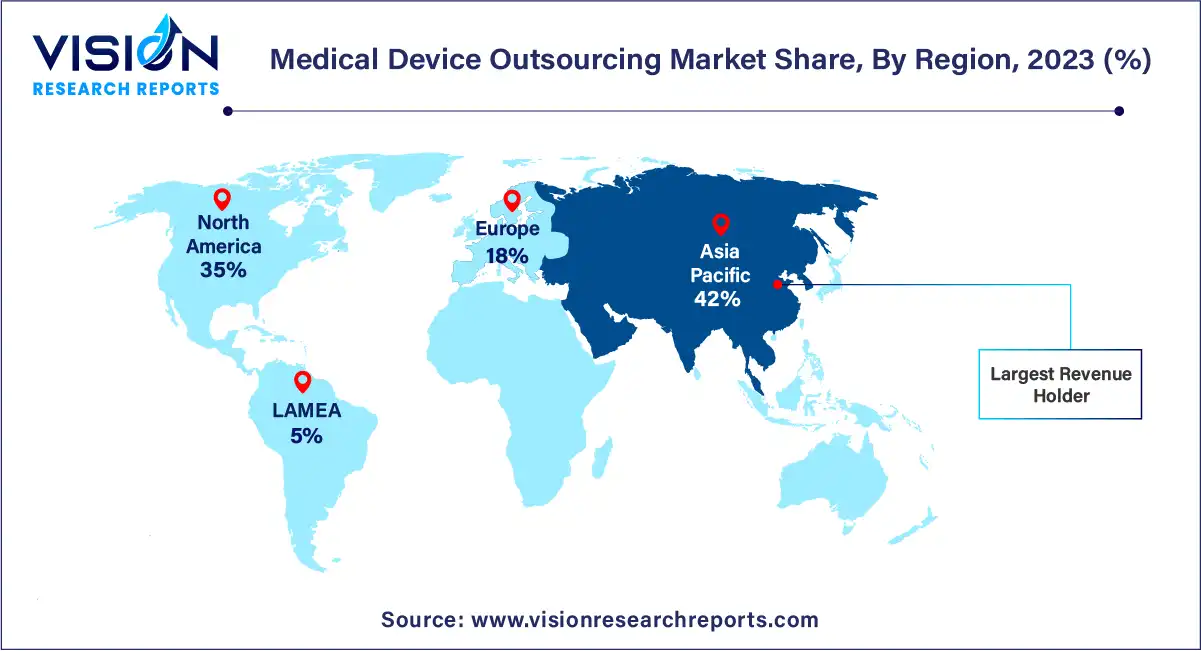

In 2023, Asia Pacific emerged as the dominant force in the global market, boasting the largest revenue share at 42%. This regional dominance is bolstered by factors such as the presence of key market players and competitive pricing strategies. Moreover, the escalating demand for medical devices in response to a burgeoning population afflicted with chronic and infectious diseases is propelling market expansion across Asia Pacific. For instance, during the initial wave of the COVID-19 pandemic, India witnessed a surge in demand for CT scanners to aid in pneumonia detection.

Meanwhile, North America is poised for significant growth in the medical device outsourcing market from 2024 to 2033. This projection is attributed to the region's abundance of medical device companies, many of which are outsourcing portions of their regulatory and consulting functions to specialized service providers. Notably, the high cost associated with research and development poses a major challenge for medical device firms in North America. Consequently, an increasing number of companies are opting to outsource these functions to third-party vendors renowned for their expertise in the field.

By Service

By Application

By Class

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others