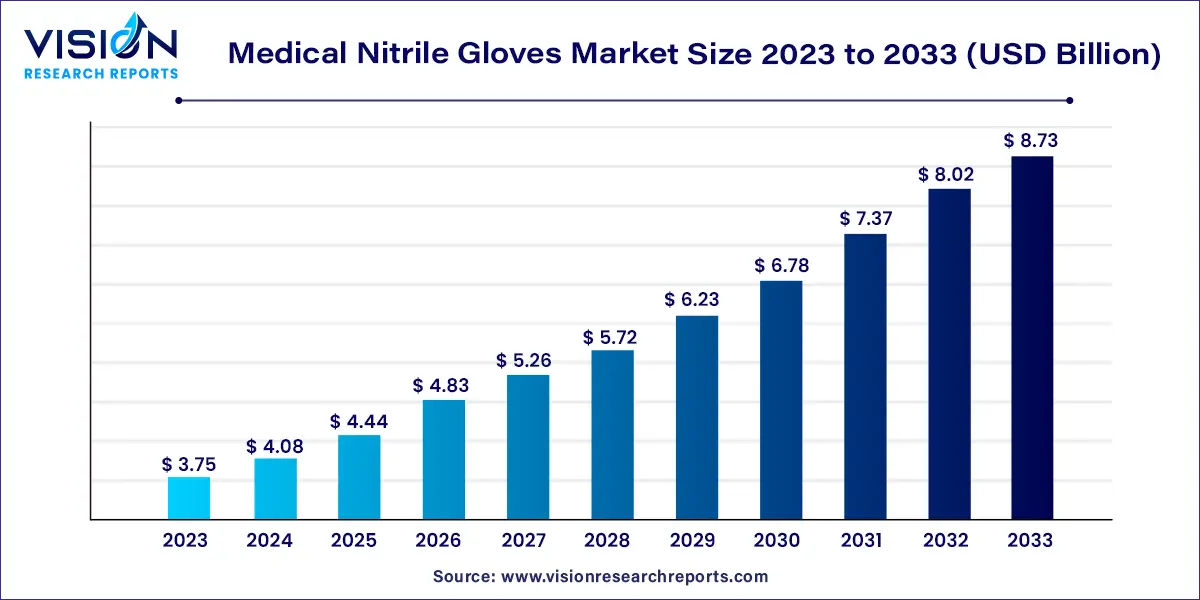

The global medical nitrile gloves market size was estimated at around USD 3.75 billion in 2023 and it is projected to hit around USD 8.73 billion by 2033, growing at a CAGR of 8.82% from 2024 to 2033. The medical nitrile gloves market is driven by the increasing emphasis on hygiene and safety in the healthcare sector. Nitrile gloves have gained prominence as a preferred choice due to their durability, puncture resistance, and superior protection against various contaminants.

The growth of the medical nitrile gloves market is propelled by several key factors. Firstly, the heightened awareness of hygiene and safety measures within the healthcare sector, particularly in response to global health challenges, has significantly increased the demand for nitrile gloves. Moreover, stringent regulations governing personal protective equipment (PPE) have compelled healthcare facilities to prioritize the adoption of nitrile gloves, given their compliance with quality and safety standards. The continuous rise in global healthcare expenditure, especially in emerging economies, further contributes to the market's expansion, as healthcare institutions prioritize infection control measures.

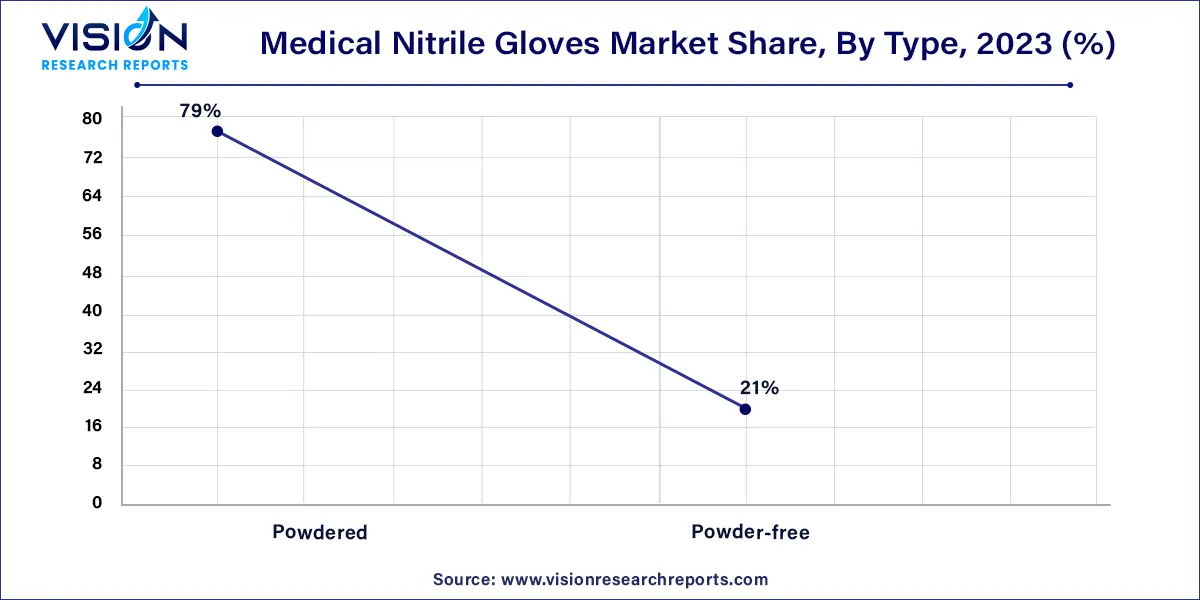

The powdered variety emerged as the dominant segment, capturing a substantial 79% market share in 2023. This form facilitates the convenient donning and doffing of gloves, a crucial factor for professionals frequently changing gloves during their tasks. Notably, the healthcare sector stands out as a major consumer of this product, driven by the imperative need for PPE in hospitals, clinics, and various healthcare facilities.

Nevertheless, the chlorination process presents certain drawbacks, such as the potential for powder-free gloves to become more challenging to swiftly remove and a potential decrease in overall glove grip. In response to these challenges, manufacturers employ polymer coatings like acrylics, silicones, and hydrogels. These coatings introduce a lower surface friction than the glove material itself, facilitating an easier process for users to don and doff the gloves.

Disposable nitrile gloves are typically thinner than durable gloves, providing greater sensitivity. These gloves offer protection against mild chemicals and irritants, though they are not suitable for use with harsh chemicals or in demanding environments such as metal & manufacturing or oil & gas industries. Durable nitrile gloves, in contrast, boast higher chemical resistance compared to other disposable options. Designed for single-use and disposal after each use, disposable nitrile gloves provide safety assurance and cost-effectiveness, driving their demand in the foreseeable future.

Durable nitrile gloves are specifically engineered for challenging environments and are intended for multiple uses. They come with several advantages, including enhanced durability, strength, minimal waste generation, and other environmental benefits. Characterized by their thickness, which surpasses that of disposable nitrile gloves, they ensure prolonged use without tearing easily, providing heightened hand protection in demanding work settings. Despite their durability, these gloves are less sensitive than their disposable counterparts, potentially causing discomfort during intricate tasks. Additionally, they require more frequent cleaning after use, introducing an inconvenience compared to disposable gloves that can be easily discarded post-use.

Examination nitrile gloves find widespread use among healthcare professionals during routine physical examinations of patients. These gloves are instrumental in various activities, including checking vital signs, palpating specific areas, and conducting comprehensive health assessments. Their thin and tactile nature allows for detailed examinations without compromising sensitivity. In diagnostic settings, healthcare providers commonly utilize examination gloves when collecting samples or performing procedures that do not involve surgery, such as obtaining blood samples, conducting swab tests, or performing dermatological examinations.

On the other hand, surgical nitrile gloves play a crucial role in the operating room, where they are worn by surgeons and other members of the surgical team. Serving as a sterile barrier, these gloves prevent contamination during surgical interventions. The textured surface of surgical nitrile gloves enhances the surgeon's grip on delicate instruments, enabling precise movements during surgery—a critical aspect for maintaining control and minimizing the risk of errors. Furthermore, surgical gloves are indispensable for preserving a sterile environment in the operating room.

Medical nitrile gloves play a vital role in various diagnostic procedures, including drawing blood for laboratory tests, collecting samples for cultures, and conducting swab tests. Their usage serves to prevent direct contact between healthcare workers' hands and bodily fluids, effectively reducing the risk of infection transmission. Healthcare professionals, including doctors, nurses, and medical assistants, rely on medical nitrile gloves during routine patient examinations. These gloves establish a protective barrier, allowing healthcare workers to conduct physical examinations while minimizing the potential for cross-contamination. The increasing utilization of these gloves in home healthcare is fueled by a growing emphasis on personal protective measures and infection control within domestic settings.

With the rising demand for home healthcare services, driven by factors such as an aging population, the prevalence of chronic conditions, and a focus on patient comfort, the need for protective gear becomes paramount. Medical nitrile gloves offer a convenient and effective solution, enabling caregivers and individuals receiving care at home to maintain a barrier against potential infections. Whether during routine health monitoring, administering medications, or providing wound care, these gloves facilitate safe interactions, contributing to the overall well-being of patients and caregivers in the home healthcare environment.

In 2023, North America emerged as the dominant force in the global medical nitrile gloves market. The region exhibited a strong market presence, driven by heightened awareness of infection control, especially in the aftermath of the COVID-19 pandemic. This increased awareness has led to a greater emphasis on personal protective equipment (PPE), with medical nitrile gloves playing a pivotal role in the overall strategy. Factors contributing to this market dominance include the expansion of healthcare infrastructure, augmented healthcare spending, and the imperative for robust safety measures in medical facilities. Additionally, the prevalence of chronic diseases, an aging population, and an upswing in healthcare services have propelled the widespread adoption of nitrile gloves across various medical applications. The versatility, durability, and hypoallergenic properties of nitrile gloves position them as the preferred choice for healthcare professionals.

Simultaneously, the medical nitrile gloves market in the Asia Pacific region is poised for significant growth in the coming years. This growth is underpinned by factors such as the increasing demand for eco-friendly products, a rising consumption of medical gloves in Asian countries, and adherence to high safety standards. The demand for examination gloves is on the rise in Asia, finding applications in medical examinations, surgeries, chemotherapy, and other medical procedures. Notably, major market players are investing in sustainable and biodegradable glove production methods, aligning with environmental considerations and meeting evolving customer expectations.

By Type

By Product

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Nitrile Gloves Market

5.1. COVID-19 Landscape: Medical Nitrile Gloves Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Nitrile Gloves Market, By Type

8.1. Medical Nitrile Gloves Market, by Type, 2024-2033

8.1.1. Powdered

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Powder-free

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Medical Nitrile Gloves Market, By Product

9.1. Medical Nitrile Gloves Market, by Product, 2024-2033

9.1.1. Disposable

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Durable

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Medical Nitrile Gloves Market, By Application

10.1. Medical Nitrile Gloves Market, by Application, 2024-2033

10.1.1. Examination

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Surgical

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Medical Nitrile Gloves Market, By End-use

11.1. Medical Nitrile Gloves Market, by End-use, 2024-2033

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Home Healthcare

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Outpatient/Primary Care Facilities

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Medical Nitrile Gloves Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Ansell Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Honeywell International, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Top Glove Corporation Bhd

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Hartalega Holdings Berhad

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Kimberly-Clark

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Kossan Rubber Industries Bhd

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Superior Gloves

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. MCR Safety

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Supermax Corporation Berhad

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Ammex Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others