Mental Health Screening Market Size and Trends

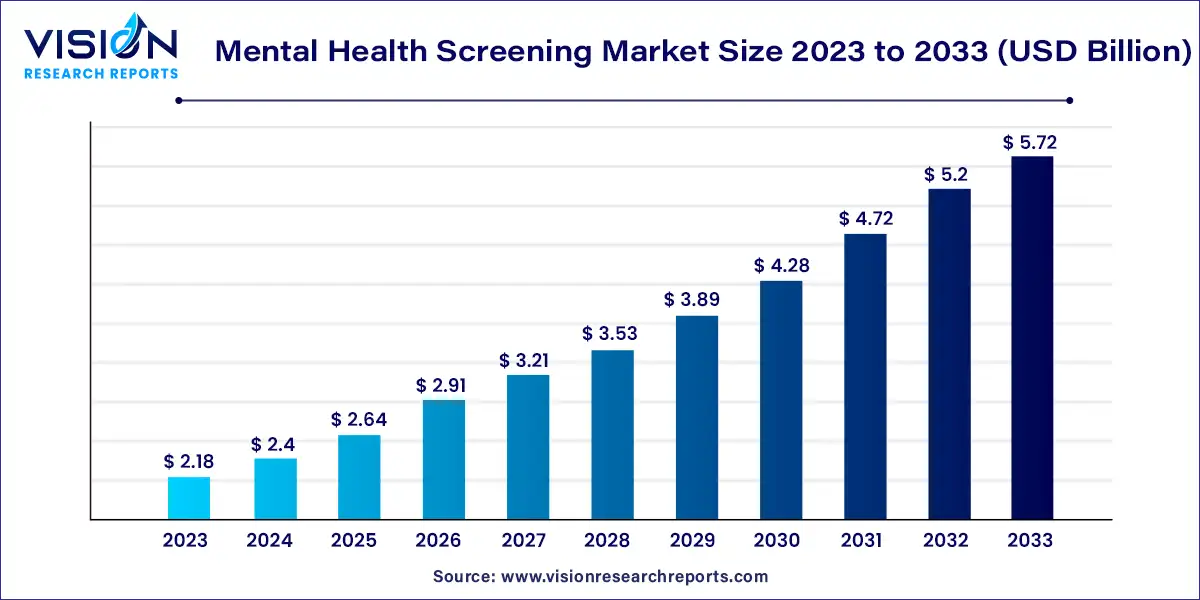

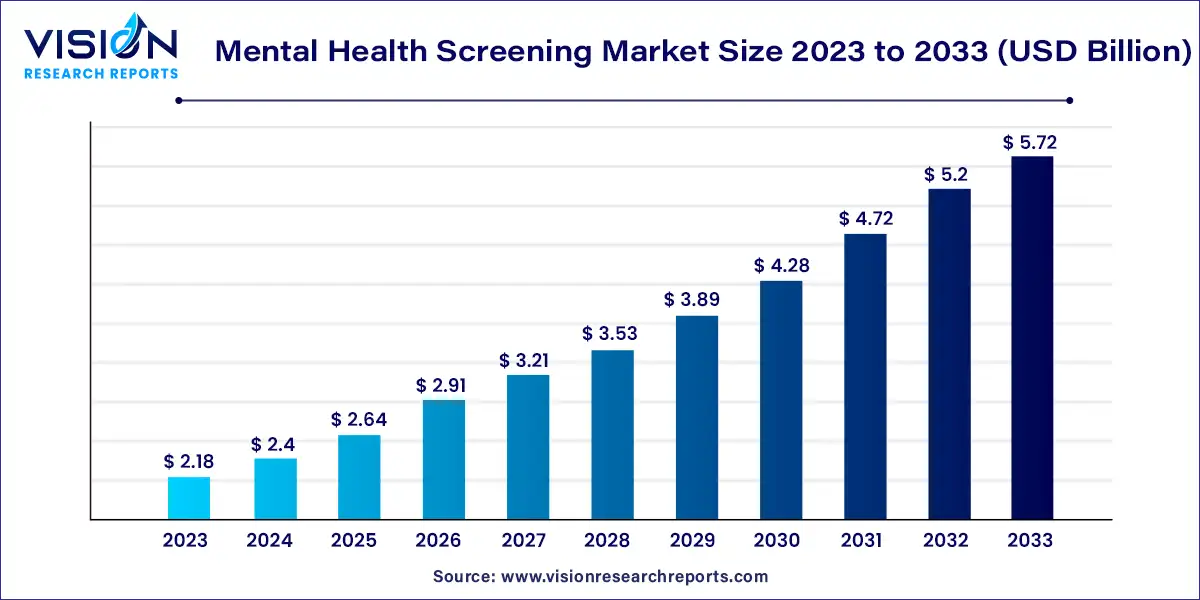

The global mental health screening market size was estimated at around USD 2.18 billion in 2023 and it is projected to hit around USD 5.72 billion by 2033, growing at a CAGR of 10.13% from 2024 to 2033.

Key Pointers

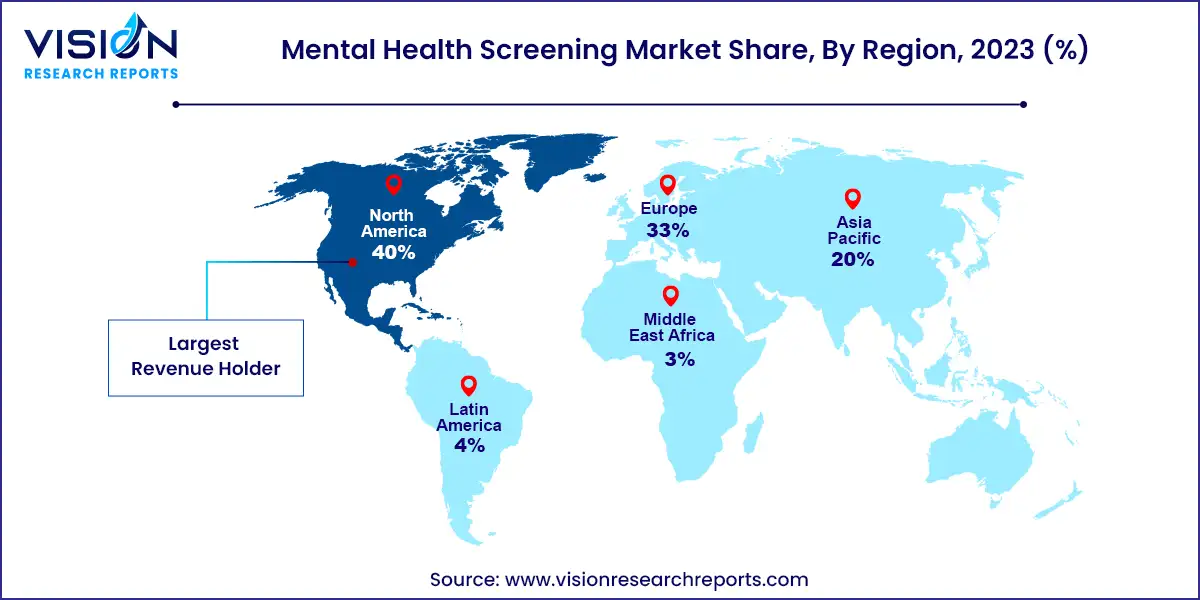

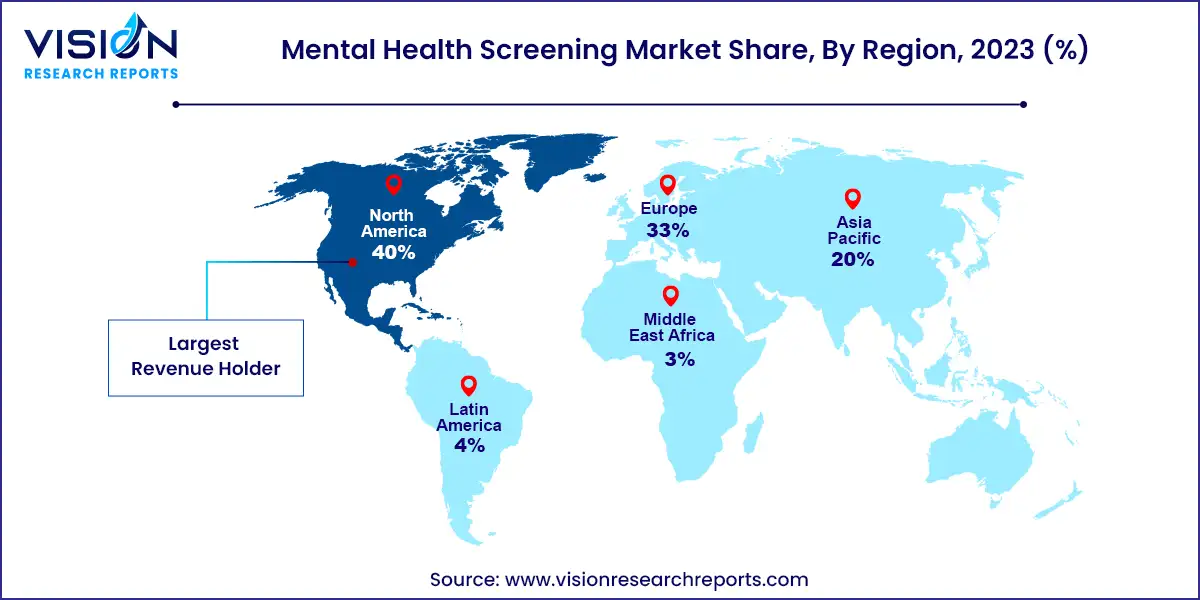

- North America led the market with the largest market share 40% in 2023.

- By Component, the software segment held the largest revenue share of 89% in 2023.

- By Solution Type, the online platforms generated the maximum market share 60% in 2023.

- By Demography, the adults aged 19-64 captured the maximum market share of 42% in 2023.

- By Application, the physiological disorders generated the maximum market share of 46% in 2023.

Mental Health Screening Market Overview

The Mental Health Screening Market is experiencing significant growth and is poised to expand even further in the coming years. This market encompasses a wide range of products and services aimed at assessing and diagnosing mental health conditions in individuals across various age groups and demographics.

Mental Health Screening Market Growth Factors

The growth of the Mental Health Screening Market is propelled by several key factors. Firstly, increasing awareness and destigmatization surrounding mental health issues are fostering greater acceptance of screening practices. Moreover, technological advancements, particularly in AI and telepsychiatry, are revolutionizing the accessibility and efficiency of screening tools. Additionally, the rising prevalence of mental health disorders worldwide is driving the demand for early detection and intervention. Furthermore, the integration of mental health screening into various healthcare settings, including primary care and workplace wellness programs, is expanding market opportunities. Lastly, supportive government initiatives and growing investment in mental health infrastructure are further fueling market growth.

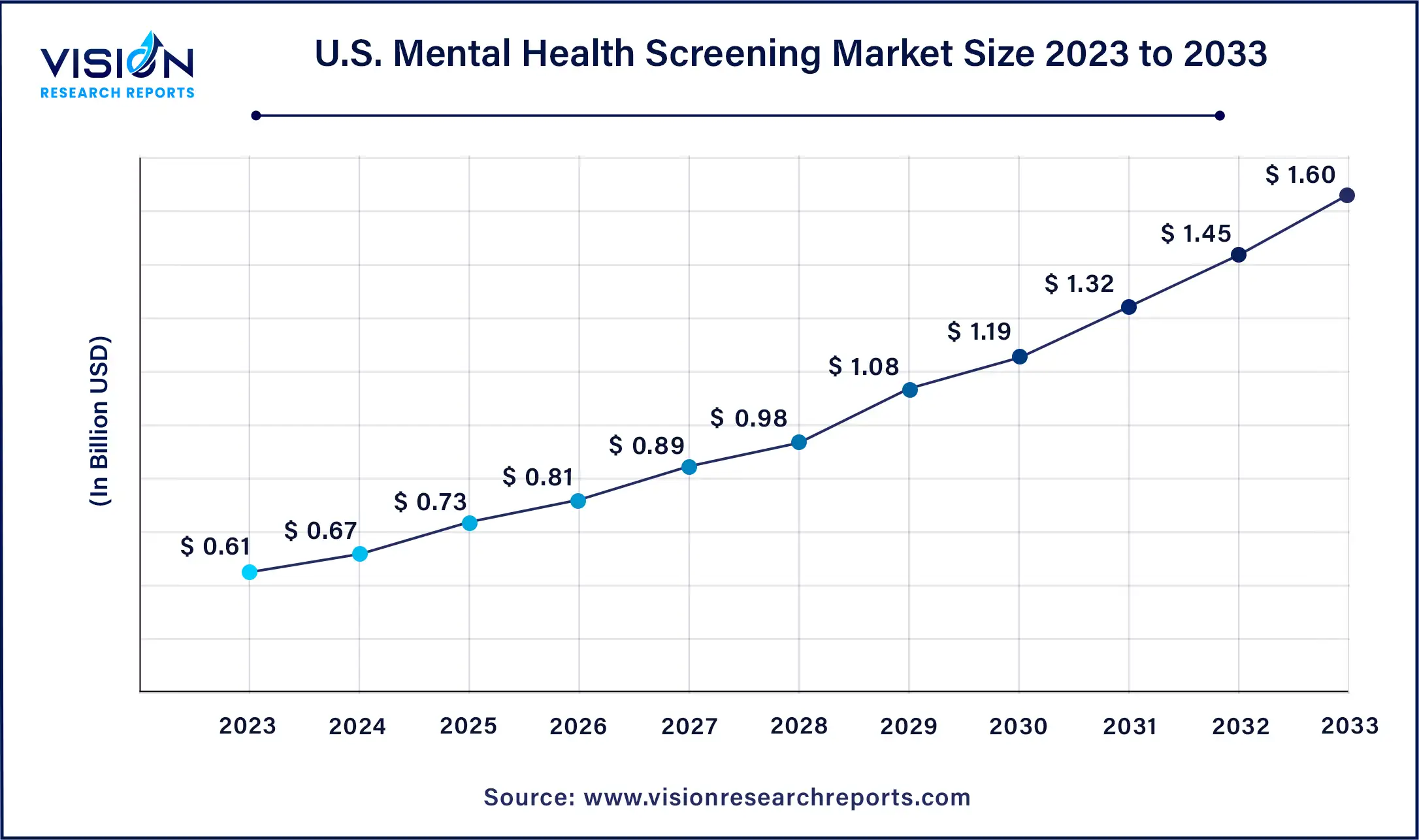

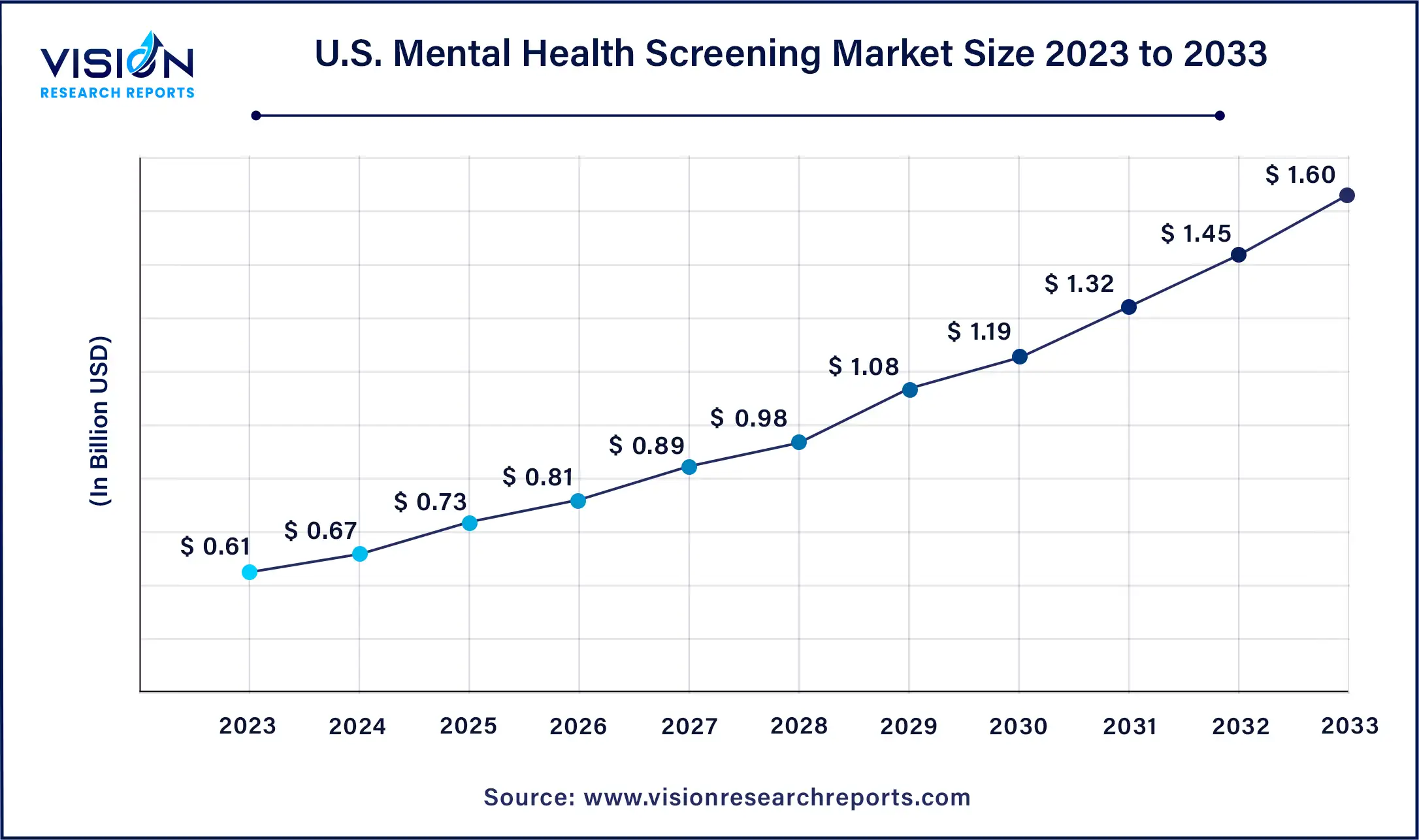

U.S Mental Health Screening Market Size 2024 to 2033

The U.S. mental health screening market size was valued at around USD 0.61 billion in 2023 and is projected to hit around USD 1.60 billion by 2033, growing at a CAGR of 10.12% from 2024 to 2033.

North America accounted for over 40% of global revenue in the mental health screening market in 2023. Favorable government initiatives and increased societal awareness contribute to growth.

The Asia Pacific mental health screening market is expected to experience the fastest growth worldwide. This growth is attributed to the rapid development of healthcare infrastructure in major countries within the region, coupled with a growing awareness of mental health issues. Additionally, the increasing prevalence of mental disorders and government initiatives aimed at enhancing mental health services are expected to further fuel market growth.

Mental Health Screening Market Trends:

- Digital Transformation: The integration of digital technologies such as artificial intelligence (AI), machine learning, and telepsychiatry is transforming mental health screening. Digital platforms and mobile applications offer convenient and accessible means of conducting screenings and monitoring mental health symptoms remotely.

- Remote Screening and Telepsychiatry: The COVID-19 pandemic has accelerated the adoption of remote mental health screening and telepsychiatry services. Virtual consultations and screenings have become increasingly popular, allowing individuals to access mental health support from the comfort of their homes.

- Personalized Screening Solutions: There is a growing demand for personalized mental health screening solutions that cater to individual needs and preferences. Tailored assessments and algorithms are being developed to provide more accurate and relevant results, enhancing the effectiveness of screening processes.

- Integration into Primary Care Settings: Mental health screening is being integrated into primary care settings to improve early detection and intervention. Screening tools are being incorporated into routine healthcare practices, enabling healthcare professionals to identify and address mental health concerns during routine check-ups.

- Focus on Workplace Wellness: Employers are recognizing the importance of mental health in the workplace and are implementing screening programs as part of their wellness initiatives. Workplace screenings aim to identify and support employees experiencing mental health challenges, ultimately improving productivity and employee well-being.

- Increasing Adoption in Educational Institutions: Educational institutions are prioritizing student mental health and are implementing screening programs to identify students at risk of mental health issues. Screening initiatives in schools and universities aim to provide early intervention and support to students, promoting academic success and well-being.

Mental Health Screening Market Restraints:

- Stigma and Perception: Despite efforts to destigmatize mental health, there remains a significant social stigma surrounding mental illness, which can deter individuals from seeking or participating in screenings. Fear of judgment or discrimination may prevent people from accessing screening services, particularly in certain cultural or demographic groups.

- Limited Access to Healthcare Services: Inadequate access to mental healthcare services, particularly in underserved communities or rural areas, poses a significant barrier to mental health screening. Limited availability of mental health professionals and resources can hinder the implementation and uptake of screening programs.

- Cost and Affordability: The cost of mental health screening tools and services can be prohibitive for individuals, especially those without insurance coverage or financial resources. High costs may limit access to screenings and prevent widespread adoption, particularly among vulnerable populations with limited financial means.

- Privacy and Confidentiality Concerns: Privacy and confidentiality concerns may deter individuals from participating in mental health screenings, especially in settings where personal information may be at risk of being disclosed or accessed by unauthorized parties. Maintaining confidentiality and safeguarding sensitive data are critical considerations in mental health screening initiatives.

Component Insights

The software segment accounted for the majority of revenue 89% in 2023, comprising AI-based screening tools, self-screening mHealth apps, remote mental health platforms, and telehealth solutions. These tools offer personalized screening recommendations, driving segment growth. The proliferation of smartphones and increased mental health awareness have boosted the adoption of software services like self-screening mHealth apps. For example, Fortis Healthcare launched an AI-powered app in April 2024, featuring a self-assessment tool for personalized assessments.

The services segment is projected to witness the fastest CAGR, driven by healthcare providers, mental health clinics, and specialized screening centers offering professional screening and assessment services. These services employ trained professionals who administer standardized tools, interpret results, and provide recommendations. Partnerships between healthcare providers and technology companies, such as the APA and NBCC expanding training programs, also contribute to segment growth. Additionally, NAMI's partnership program with manufacturers offers online therapy services.

Solution Type Insights

Online platforms held the largest revenue share of 60% in 2023, offering user-friendly assessment tools and fostering mental health awareness. Government efforts to promote mental health awareness facilitate early intervention and access to support services. For instance, California's DHCS unveiled the Behavioral Health Virtual Services Platform in January 2024, aiding families with children and young adults. Nationwide platforms drive market growth.

Corporate programs are expected to see the fastest CAGR, as companies recognize the impact of mental health on productivity and implement screening programs. Partnerships with mental health service providers offer screening, counseling, and support services to employees.

Demography Insights

Adults aged 19-64 held the largest market share of 42% in 2023 due to the rising prevalence of mental illness in this group. Anxiety disorders are most common among adults, according to Forbes. Among adults with serious mental illness, usage of mental health services is higher.

Children & Adolescents (Age 0-18 Years) are expected to witness the fastest CAGR, with over 20% experiencing debilitating mental illness. Government programs like AAP's universal mental health screening recommendations drive market growth.

Application Insights

Physiological disorders held the largest revenue share of 46% in 2023 due to high prevalence globally. Companies leverage smartphone data and wearable devices to monitor mental health indicators, driving market growth.

Cognitive disorders are projected to see the fastest CAGR, fueled by the growing geriatric population and increased neurodegenerative diseases.

Mental Health Screening Market Key Companies

- Sondermind

- Riverside Community Care

- Proem Behavioral Health

- Headspace Inc.

- Quartet

- Clarigent Corporation

- Ellipsis Health, Inc.

- Adaptive Testing Technologies

- Aiberry

- Kintsugi Mindful Wellness, Inc

- Thymia Limited

- Canary Speech, Inc.

- Modern Life, Inc.

- Sonde Health, Inc.

- FuturesThrive

- Fitbit

- Apple Inc

- Cognitive Health Solutions

Recent Developments

- In November 2023, SonderMind, a mental wellness company based in the US, announced its acquisition of Total Brain to expand its services. The acquisition aims to provide personalized mental health services to individuals, improve care methods for therapists, equip enterprises with population mental health tools, and offer comprehensive solutions to health plans.

- In October 2023, Ellipsis Health Inc. and Augmedix collaborated to introduce AI-generated vocal biomarker technology for automated mental health screenings during patient visits. The technology helps to identify and monitor mental health conditions.

- In January 2023, Metta Media, an Indian startup, announced the launch of the country’s first MyndStories platform for guidance and insights on mental health.

Mental Health Screening Market Segmentation:

By Component

- Hardware

- Software

- AI-Based Screening Tools

- Self-screening mHealth Apps

- Remote Mental Health Platforms & Virtual Care Solutions

- Telehealth

- Services

By Demography

- Seniors (Age 65 and above)

- Adults (Age 19-64)

- Children & Adolescents (Age 0-18 Years)

By Application

- Cognitive Disorders

- Alzheimer’s Disease

- Cognitive Impairment

- Dementia

- Other Cognitive Disorders

- Behavioral Disorders

- Sleep Disorder

- Social Withdrawal

- Dissociative Disorder

- Hyperactivity

- Self-Harm

- Aggression

- Other Behavioral Disorders

- Physiological Disorders

- Bipolar Disorder

- Eating Disorder

- Substance Abuse

- Depression

- Anxiety

- Post-Traumatic Stress Disorder (PTSD)

- Other Physiological Disorders

- Psychiatric Disorders

- Psychotic Disorder

- Dissociative Disorder

- Obsessive Compulsive Disorder

- Schizophrenia

- Dissociative Disorder

- Attention Deficit Hyperactivity Disorder (ADHD)

- Other Psychiatric Disorders

By Solution Type

- Online Platforms

- Corporate Programs

- Clinical Settings

- Educational Institutions

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

The global mental health screening market size was reached at USD 2.18 billion in 2023 and it is projected to hit around USD 5.72 billion by 2033.

The global mental health screening market is growing at a compound annual growth rate (CAGR) of 10.13% from 2024 to 2033.

The North America region has accounted for the largest mental health screening market share in 2023.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others