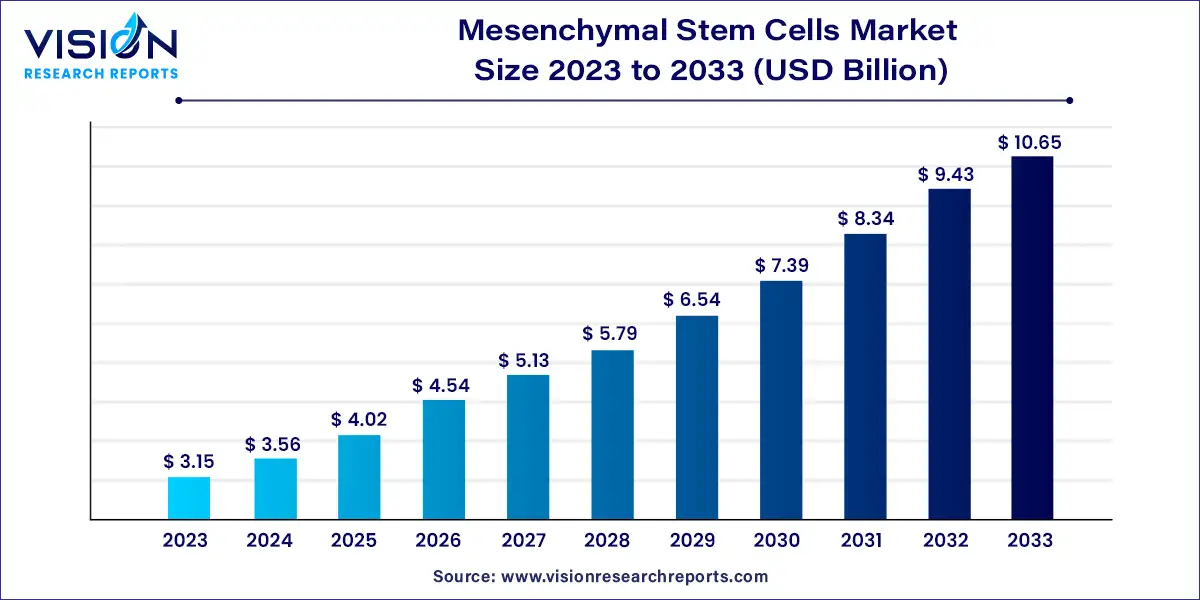

The global mesenchymal stem cells market was estimated at USD 3.15 billion in 2023 and it is expected to surpass around USD 10.65 billion by 2033, poised to grow at a CAGR of 12.95% from 2024 to 2033.

Mesenchymal stem cells, often abbreviated as MSCs, are multipotent stromal cells that can differentiate into a variety of cell types, including osteoblasts (bone cells), chondrocytes (cartilage cells), adipocytes (fat cells), and others. They are found in various tissues throughout the body, such as bone marrow, adipose tissue, and umbilical cord tissue.

The market for mesenchymal stem cells has witnessed significant growth in recent years due to their potential therapeutic applications in regenerative medicine, tissue engineering, and immunomodulation. Key drivers of this growth include increasing research and development activities, rising prevalence of chronic diseases, and growing demand for effective regenerative treatments.

The growth of the mesenchymal stem cells (MSCs) market is propelled by an increasing awareness and understanding of the therapeutic potential of MSCs in regenerative medicine and tissue engineering drive demand. Secondly, the rising prevalence of chronic diseases such as cardiovascular disorders, orthopedic injuries, and autoimmune conditions creates a pressing need for innovative treatment options, where MSC-based therapies show promise. Additionally, advancements in biotechnology and cell culture techniques enhance the scalability and efficiency of MSC production, facilitating commercialization. Moreover, supportive regulatory frameworks and favorable reimbursement policies further stimulate market growth by providing a conducive environment for research and development activities. Furthermore, strategic collaborations between academic institutions, biotechnology companies, and healthcare providers foster innovation and accelerate the translation of scientific discoveries into clinical applications.

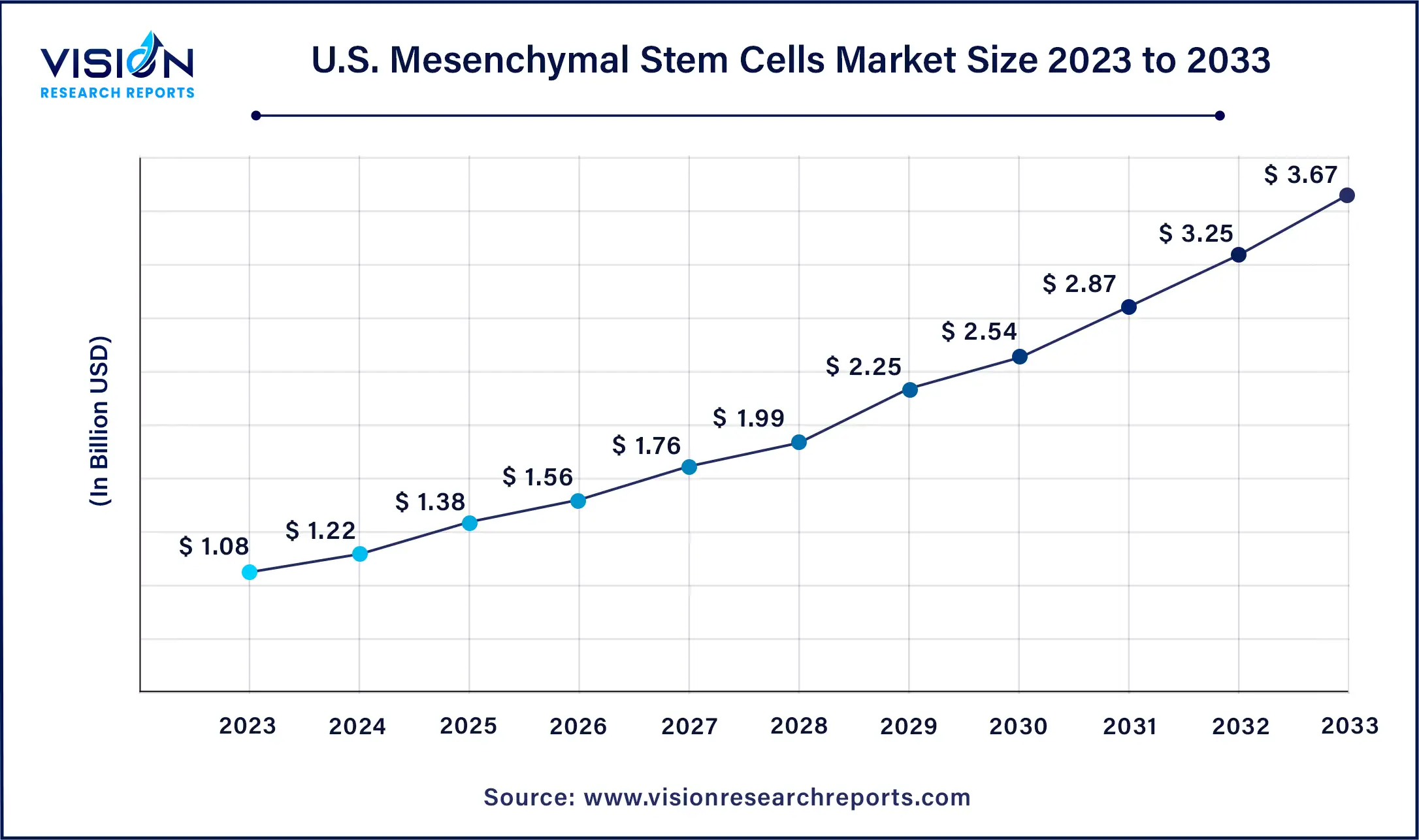

The U.S. mesenchymal stem cells market was valued at USD 1.08 billion in 2023 and it is expected to surpass around USD 3.67 billion by 2033, poised to grow at a CAGR of 13.90% from 2024 to 2033.

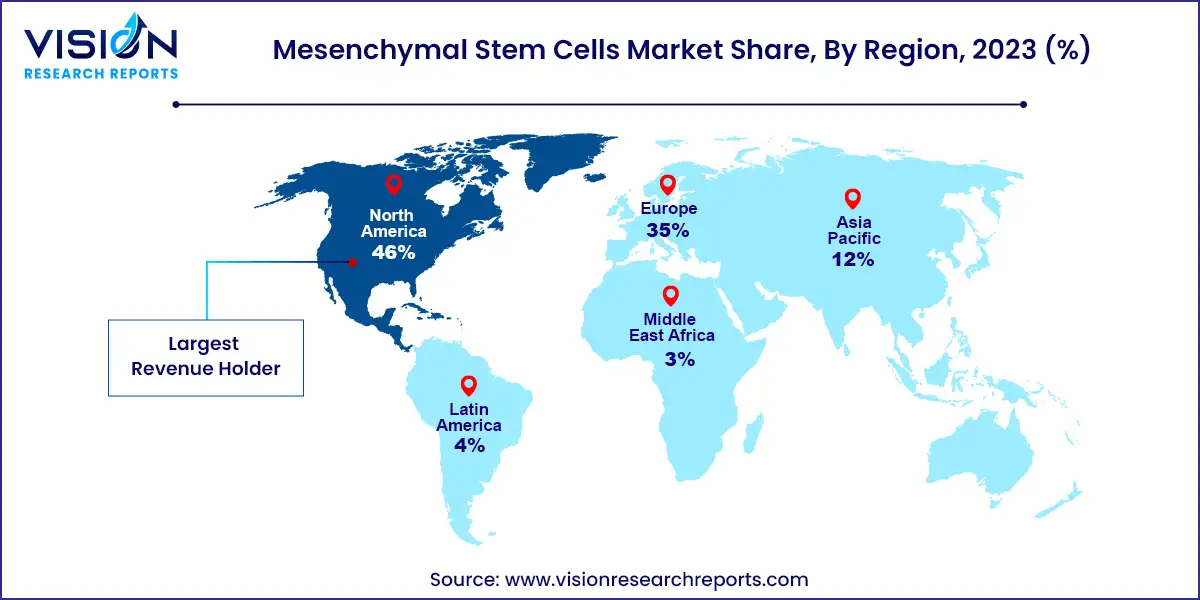

In 2023, North America emerged as the dominant force in the market, capturing the largest revenue share at 46%. The region boasts a significant number of ongoing clinical trials evaluating the efficacy and safety of Mesenchymal Stem Cells (MSCs) as potential treatments for various life-threatening diseases. Additionally, many major companies involved in the supply and commercialization of MSCs are headquartered in North America. Moreover, increased funding from both government and private organizations is anticipated to further drive market demand. For example, in January 2022, Cellino Biotech announced a successful Series A financing round, raising approximately USD 80 million from investors such as 8VC and Felicis Ventures.

Meanwhile, the Asia Pacific mesenchymal stem cells market is poised to experience the fastest compound annual growth rate (CAGR) from 2024 to 2033. This rapid growth is attributed to various strategic initiatives between local players and international companies. Additionally, the pandemic has spurred the development of stem cell therapies for treating conditions such as COVID-19. For instance, in August 2022, Panacell Biotech utilized Natural Killer (NK) cells, brown Adipose-Derived Stem Cells (ADSC), and exosomes to treat COVID-19 infections, with clinical trials expected to commence shortly.

The products segment held the market's largest revenue share at 79% in 2023. Within this category, the cells and cell lines segment played a significant role in contributing to the overall revenue. Many market players are exploring new opportunities within this market by initiating new product development and expanding their business initiatives. These players provide mesenchymal stem cells and cell lines to support research endeavors. For example, in June 2021, Essent Biologics introduced human MSCs (hMSCs) tailored for regenerative medicine, biopharmaceuticals, and cell therapy research.

On the other hand, the services segment is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period. Companies providing services for MSC research are expected to witness significant growth due to the increasing number of studies and clinical applications exploring MSCs as potential treatments for severe diseases. While large-scale laboratories often have in-house facilities covering various stages of the research workflow, medium- and small-scale research institutions and academic centers often prefer outsourcing to Contract Research Organizations (CROs) or specialized service providers.

In 2023, the culture and cryopreservation segment commanded the largest revenue share at 45%. The segment's growth is fueled by increasing demand for cryopreservation services, improved healthcare infrastructure, and escalating research activities focusing on enhancing the effectiveness of MSC culture techniques. For instance, researchers in Malaysia conducted a systematic review in June 2020, evaluating the use of microcarriers in MSC cultures. The study revealed that MSCs exhibited enhanced proliferation when cultured on microcarriers, leading to increased cell differentiation. Major players in this segment include Merck KGaA, R&D Systems, and STEMCELL Technologies.

Meanwhile, the differentiation segment is poised to demonstrate the fastest compound annual growth rate (CAGR) throughout the forecast period. Companies within this segment offer kits designed to facilitate the complete differentiation of human mesenchymal stem cells into various cell types, including osteoblasts, adipocytes, chondrocytes, or osteocytes. Key market players such as Thermo Fisher Scientific, Cyagen Biosciences, and ScienCell Research Laboratories provide a range of differentiation kits for MSCs. The introduction of serum-free and xeno-free hMSC differentiation kits represents a significant advancement in this segment, driving its anticipated growth.

In 2023, the allogeneic MSCs segment dominated with the largest revenue share of 56%. This growth is primarily driven by the favorable safety profile of allogeneic MSCs in clinical applications. Moreover, the implantation of allogeneic MSCs is emerging as a pioneering approach in cell-based therapy due to their low immunogenicity and immunosuppressive properties. These properties contribute to a reduced immune response, enhancing the success rate of allogeneic MSC implantations.

Conversely, the use of autologous mesenchymal stem cells has witnessed significant advancements in recent years. This segment is expected to register the fastest compound annual growth rate (CAGR) during the period from 2024 to 2033. Numerous studies are underway exploring the application of autologous MSCs in treating various diseases, which is projected to create exponential growth opportunities for the segment in the foreseeable future.

In 2023, the bone marrow segment emerged as the market leader with the largest revenue share of 25%, and it is expected to experience the fastest compound annual growth rate (CAGR) over the forecast period. Bone marrow serves as a primary source for isolating Mesenchymal Stem Cells (MSCs), which possess multilineage differentiation potential. These cells can differentiate into various cell types, including cartilage, bones, fibroblasts, adipocytes, cardiac muscle cells, tendons, and endothelial cells. The growing demand for MSCs, coupled with their increasing utilization in disease modeling and drug discovery efforts, is anticipated to propel the growth of this segment.

Meanwhile, the cord blood segment is projected to witness significant growth in CAGR throughout the forecast period. Umbilical cord blood stands as the second-most utilized source for isolating MSCs in clinical trials. MSCs derived from umbilical cord blood are of allogeneic origin and have demonstrated considerable potential as a source for MSCs applicable in articular cartilage repair. These factors are expected to drive substantial growth in this segment.

In 2023, the disease modeling application segment established itself as the market leader, commanding the largest revenue share at 36%. Leveraging cellular disease models featuring patient-specific Mesenchymal Stem Cells (MSCs) has emerged as an invaluable tool for pathological research. MSCs derived from patient-induced pluripotent stem cells serve as a promising tool for disease modeling. Numerous research studies have utilized MSC models to delve into the underlying mechanisms of chronic disorders. Furthermore, MSCs are utilized as models in the evaluation of non-hematological mesenchymal cancers like sarcomas, contributing significantly to the dominance of this segment.

Conversely, the tissue engineering application segment is poised to witness the fastest compound annual growth rate (CAGR) from 2024 to 2033. Mesenchymal stem cells have emerged as a promising therapeutic avenue in tissue engineering endeavors. Their extensive applications stem from their remarkable capacity for expansion, self-renewal, and reduced tumorigenic potential. Mesenchymal stem cell encapsulation techniques have garnered substantial demand in this market in recent years.

By Products & Services

By Workflow Type

By Type

By Source of Isolation

By Indication

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others