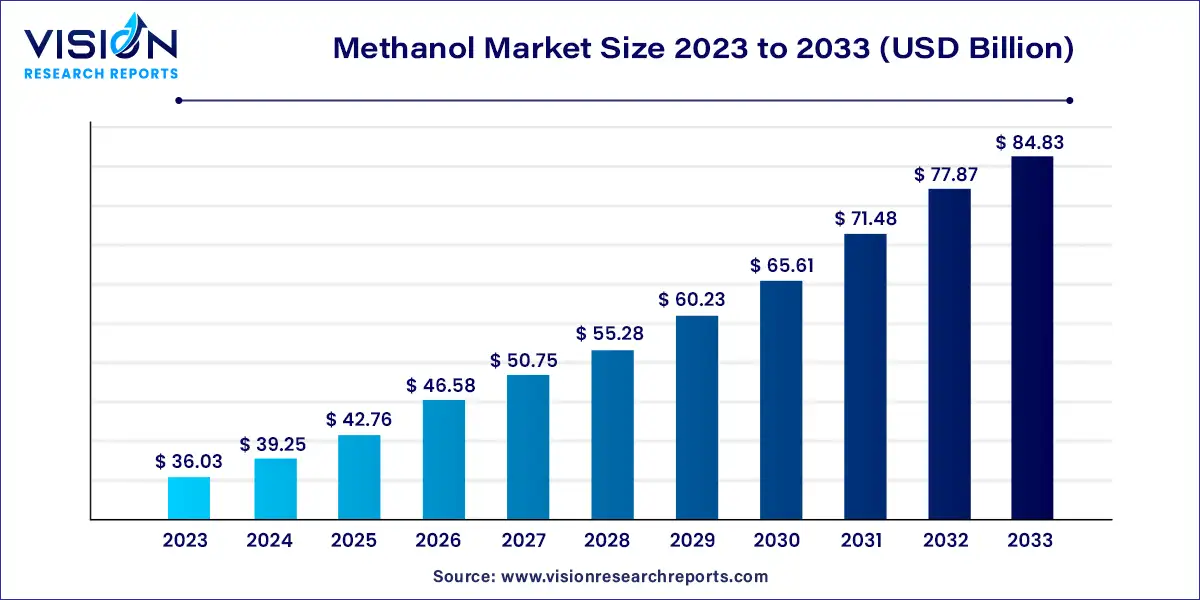

The global methanol market size was valued at USD 36.03 billion in 2023 and is anticipated to reach around USD 84.83 billion by 2033, growing at a CAGR of 8.94% from 2024 to 2033.

The global methanol market is a dynamic sector characterized by its significant role as a versatile chemical building block. Methanol, also known as methyl alcohol or wood alcohol, is a vital component in various industries, including automotive, construction, energy, and chemicals.

The growth of the methanol market is propelled by an increasing demand for methanol as a feedstock in the production of chemicals such as formaldehyde, acetic acid, and olefins drives market expansion. Additionally, the growing adoption of methanol as a clean-burning fuel additive and alternative fuel source in transportation fuels contributes to market growth. Moreover, technological advancements in methanol production processes, such as the development of more efficient catalysts and conversion technologies, enhance production efficiency and drive market expansion. Furthermore, supportive regulatory policies promoting the use of methanol as a low-carbon alternative to conventional fossil fuels stimulate market growth by incentivizing investment in methanol production capacity. Overall, these factors combined create a conducive environment for the growth of the methanol market, with promising opportunities for industry stakeholders.

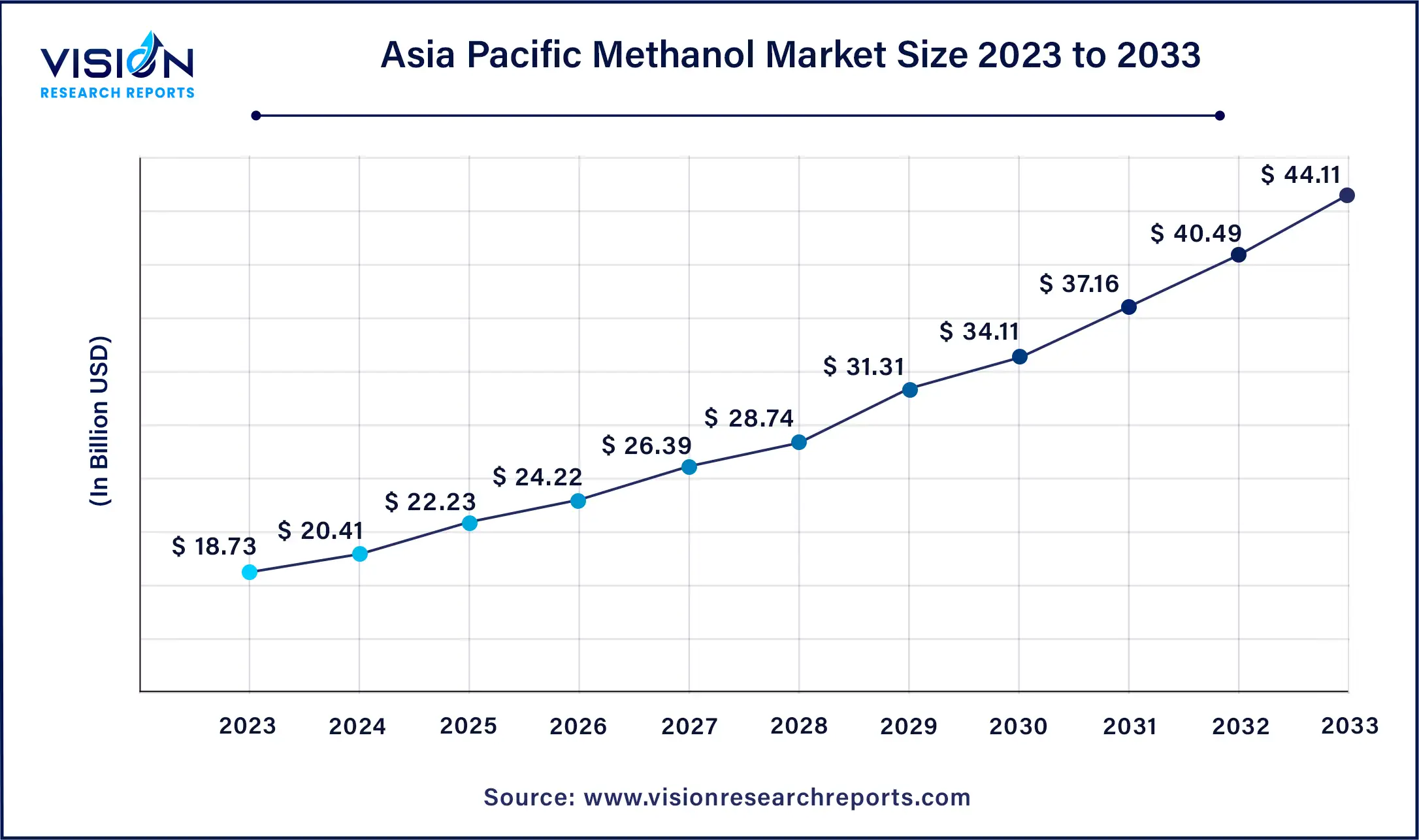

The Asia Pacific methanol market size was estimated at around USD 18.73 billion in 2023 and it is projected to hit around USD 44.11 billion by 2033, growing at a CAGR of 8.94% from 2024 to 2033.

In 2023, the Asia Pacific region emerged as the dominant market, capturing the largest revenue market share at 52%. The escalating demand for acetic acid, formaldehyde, and DME serves as the primary industry drivers across the Asia Pacific region. Moreover, the adoption of methanol for fuel applications is expected to open up new growth opportunities for the industry throughout the forecast period.

The methanol market in North America is poised for significant growth in the forecast period. This growth is primarily driven by a robust product supply, leading to increased demand for methanol in the region to meet the rising needs of industries such as MTBE, acetic acid, and formaldehyde production. However, the recession experienced between 2008 and 2010 resulted in reduced construction activities, subsequently lowering the demand for MTBE and formaldehyde. Presently, the industry remains stable, largely due to the consistent supply of natural gas at low costs, a key factor propelling growth in North America. Additionally, the region is witnessing a surge in demand for methanol due to the increasing number of biodiesel projects scheduled until 2022.

Formaldehyde stands as a crucial application of methanol, typically derived from a vapor oxidation reaction involving oxygen and methanol. However, beyond this method, formaldehyde can also be produced using the metal oxide catalyst process. In this process, methanol combines with air in a heat exchanger reactor containing tubes filled with metal oxide catalysts. Methanol production encompasses various feedstocks, including natural gas, coal, and biomass. This involves synthesizing carbon monoxide and hydrogen, which are subsequently reacted through a catalytic process.

Methanol presents itself as a viable alternative to fossil fuels due to its cleanliness and cost-effectiveness. These attributes have fueled heightened demand, particularly in emerging economies like those in the Asia Pacific and the Middle East. Notably, countries in the Asia Pacific, such as India, import substantial quantities of methanol from Saudi Arabia. The consumption trajectory of methanol is anticipated to steadily ascend, particularly in the transportation sector of these nations. Positioned as a cleaner fuel for transportation and cooking, methanol is poised to reduce reliance on fossil fuels and associated imports, potentially slashing import bills by 20% or more over the next five years.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Methanol Market

5.1. COVID-19 Landscape: Methanol Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Methanol Market, By Application

8.1. Methanol Market, by Application Type, 2024-2033

8.1.1. Formaldehyde

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Gasoline

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Acetic Acid

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. MTBE

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Dimethyl Ether

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. MTO/MTP

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Biodiesel

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Methanol Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. BASF SE

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Zagros Petrochemical Company

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Mitsui & Co. Ltd.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Celanese Corporation

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Petroliam Nasional Berhad (PETRONAS)

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. SABIC

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Methanex Corporation

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Mitsubishi Gas Chemical Co., Inc.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. QAFAC (Qatar Fuel Additives Company Limited)

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others