The global microbial identification market size was surpassed at USD 3.68 billion in 2023 and is expected to hit around USD 11.25 billion by 2033, growing at a CAGR of 11.82% from 2024 to 2033.

The microbial identification market stands as a vital segment within the broader of life sciences. With the ever-evolving understanding of microbial diversity and its implications across industries ranging from healthcare to agriculture, the need for accurate and efficient microbial identification methodologies has become paramount.

The growth of the microbial identification market is propelled by an increasing prevalence of infectious diseases globally underscores the critical need for accurate and timely microbial identification in clinical settings. Additionally, the expanding adoption of microbial identification techniques in pharmaceutical and biotechnological research, driven by the pursuit of novel drug discovery and development, further fuels market growth. Technological advancements, particularly the emergence of rapid and high-throughput identification methods like MALDI-TOF MS and NGS, have revolutionized microbial identification, offering unparalleled speed and accuracy. Furthermore, the integration of AI and ML algorithms enhances the efficiency of identification platforms, facilitating real-time decision-making.

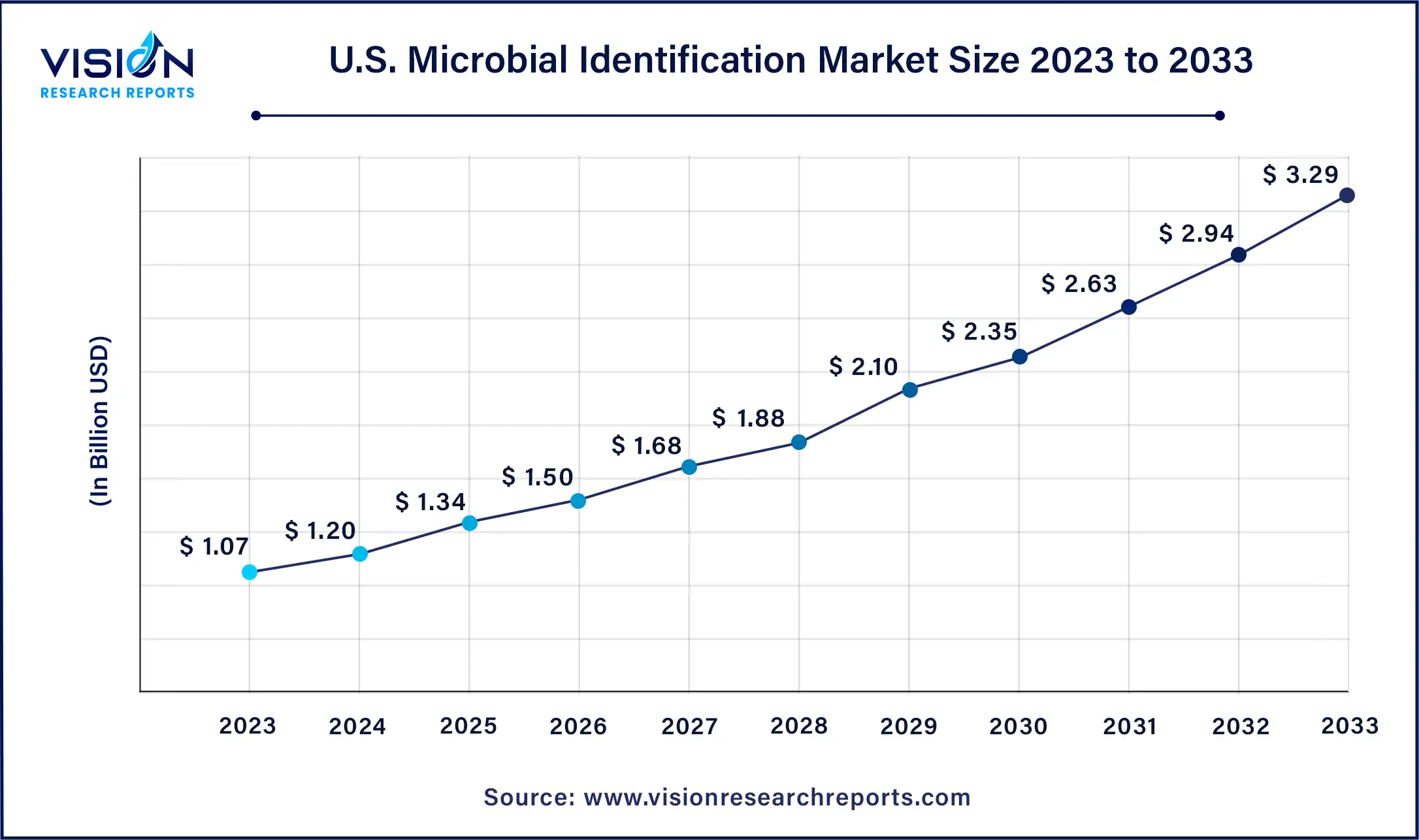

The U.S. microbial identification market size was estimated at around USD 1.07 billion in 2023 and is projected to hit around USD 3.29 billion by 2033, growing at a CAGR of 11.88% from 2024 to 2033.

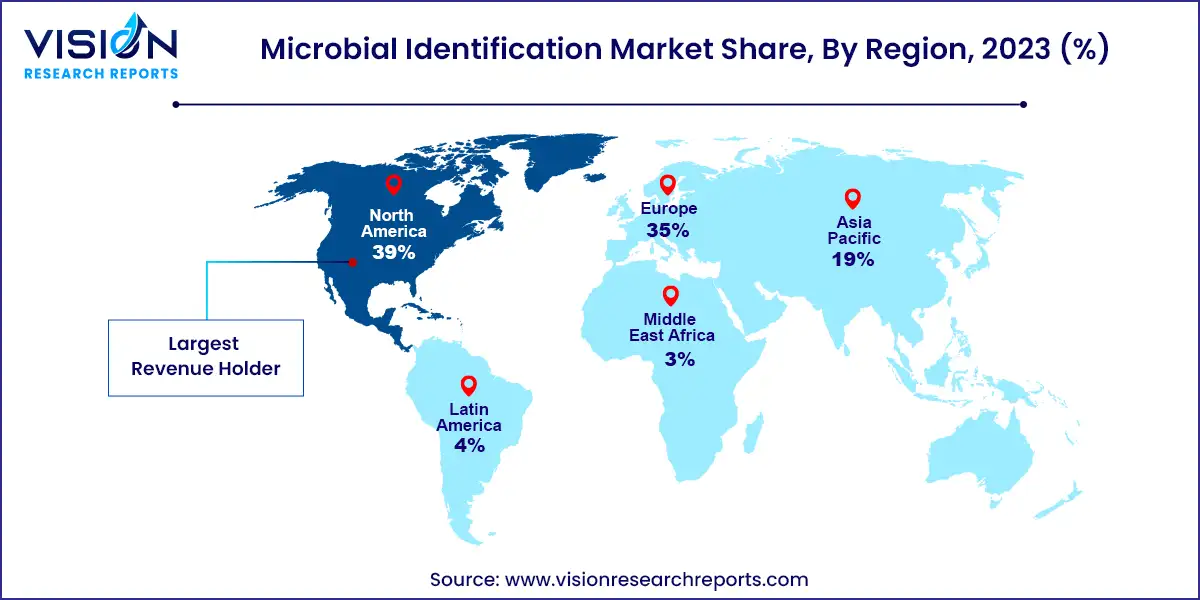

In 2023, the North America microbial identification market held the largest market share at 39%. This significant share can be attributed to several factors, including the increasing prevalence of infectious diseases, the presence of key market players, and a well-established healthcare infrastructure. Notably, in January 2022, BD obtained FDA 510(k) clearance for the BD Kiestra IdentifA system, an automated platform designed to streamline the microbiology bacterial identification testing sample preparation process.

Additionally, there is a growing emphasis on food safety by government and regional authorities, prompting the use of microbial identification techniques to identify and trace microbes in food products. For instance, as reported in a June 2022 article in PubMed, various organizations at the federal, state, and local levels play distinct roles in formulating, executing, and upholding food safety regulations in the U.S. Therefore, ensuring effective collaboration among these entities is crucial for maintaining food safety standards. These factors are anticipated to further drive the growth of the microbial identification market in the North American region

The consumables segment captured the largest market share of 37% in 2023. Consumables within the microbial identification industry encompass essential items such as culture media, reagents, and test kits, necessitating frequent replenishment. Laboratories and research facilities rely on a consistent supply of these consumables to conduct microbial identification tests. This perpetual demand for replacement fosters a stable revenue stream for manufacturers and suppliers. For example, in August 2023, Lovibond introduced test kits tailored for industrial applications. With increasing emphasis on water resource management and corresponding legal mandates, Lovibond aims to provide comprehensive solutions addressing specific needs and facilitating precise water analyses. These product launches are expected to propel the growth of the segment.

The software and services segment are projected to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033. Software solutions have gained prominence in microbial identification, with advanced data analytics, including machine learning and artificial intelligence, utilized to analyze and interpret data generated during identification processes. This advancement promises more accurate and efficient results crucial for applications such as clinical diagnostics, food safety, and environmental monitoring. Consequently, the segment is poised to experience significant growth within the microbial identification industry throughout the forecast period.

In 2023, the PCR segment dominated the market, holding the largest share. This can be attributed to PCR's remarkable precision, speed, and versatility in detecting and identifying microorganisms. PCR facilitates the amplification of specific DNA sequences, rendering it highly sensitive and capable of detecting even minute amounts of microbial DNA. Its widespread adoption in clinical diagnostics, research laboratories, and various industries stems from its ability to swiftly and accurately identify pathogens. PCR plays a crucial role in disease diagnosis, food safety, and environmental monitoring. In August 2022, Bruker Corporation unveiled advancements to its MALDI Biotyper (MBT) platform, introducing novel multiplex PCR infectious disease assays that leverage its exclusive LiquidArray technology. This innovation significantly propelled the growth of the PCR segment.

The next-generation sequencing (NGS) segment is poised to exhibit the highest compound annual growth rate (CAGR) of 14.75% from 2024 to 2033. NGS technologies enable the sequencing of entire genomes, facilitating highly accurate species identification, even at the strain level. This granular level of analysis is critical in various fields, including clinical diagnostics, epidemiology, and research. In January 2023, Charles River introduced Accugenix Next-Gen Sequencing for Bacterial and Fungal Identification, a pioneering sequencing solution integrated into the Accugenix portfolio of microbial testing services.

In 2023, the genotypic segment commanded the largest market share, accounting for 42%. This segment is projected to experience the highest compound annual growth rate (CAGR) from 2024 to 2033. Genotypic methods, which include DNA sequencing and DNA fingerprinting techniques, offer exceptional accuracy and specificity in microbial identification. By identifying microorganisms at the genetic level, these methods often yield more precise results compared to phenotypic approaches. Additionally, genotypic methods find applications across various sectors, including clinical diagnostics, epidemiological studies, environmental assessments, and microbial diversity research. The extensive utility of genotypic methods across diverse applications has been a significant driver behind the segment's growth in the market.

Furthermore, the increasing adoption of precision medicine, which customizes medical treatments based on individual patient characteristics, has bolstered the demand for genotypic identification. A comprehensive understanding of the genetic composition of microorganisms is essential for devising personalized treatment strategies. Consequently, this trend is expected to further propel the growth of the genotypic segment in the microbial identification market throughout the forecast period.

In 2023, the clinical diagnostics segment emerged as the leader in market share. The increasing prevalence of infectious diseases is expected to be a primary driver propelling the growth of this segment. Furthermore, advancements in molecular biology techniques, such as PCR and next-generation sequencing, are projected to significantly enhance the speed and accuracy of microbial identification in clinical settings. These technological advancements, coupled with the escalating incidence of infectious diseases, are poised to drive growth within the clinical diagnostics segment, ultimately leading to more efficient and accessible healthcare solutions. Consequently, the market is anticipated to experience growth from 2024 to 2033.

The pharmaceuticals segment is forecasted to exhibit the highest compound annual growth rate (CAGR) of 14.85% from 2024 to 2033. The pharmaceutical industry plays a crucial role in developing treatments and vaccines for emerging infectious diseases. Accurate and rapid microbial identification is imperative during epidemic outbreaks, making it a significant driver for the pharmaceutical sector. With the prevalence of infectious diseases on the rise, the pharmaceutical segment is expected to witness substantial growth within the microbial identification market over the forecast period.

In 2023, the hospitals and diagnostic laboratories segment commanded the largest market share at 36%. This dominance can be attributed to the high patient volume and the diverse range of clinical scenarios encountered, which consistently drive the demand for microbial identification services. The necessity for rapid and accurate identification of pathogens further solidifies the market share of hospitals and diagnostic laboratories in the microbial identification industry.

On the other hand, the pharmaceutical and biotechnology companies’ segment is projected to exhibit the highest compound annual growth rate (CAGR) over the forecast period. These sectors play pivotal roles in developing treatments and vaccines for emerging infectious diseases. Rapid and precise microbial identification is indispensable for early detection and containment of outbreaks, as demonstrated during events like the COVID-19 pandemic. Therefore, this anticipated need is expected to significantly propel the growth of the pharmaceutical and biotechnology companies’ segment from 2024 to 2033.

By Product & Services

By Technology

By Method

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others