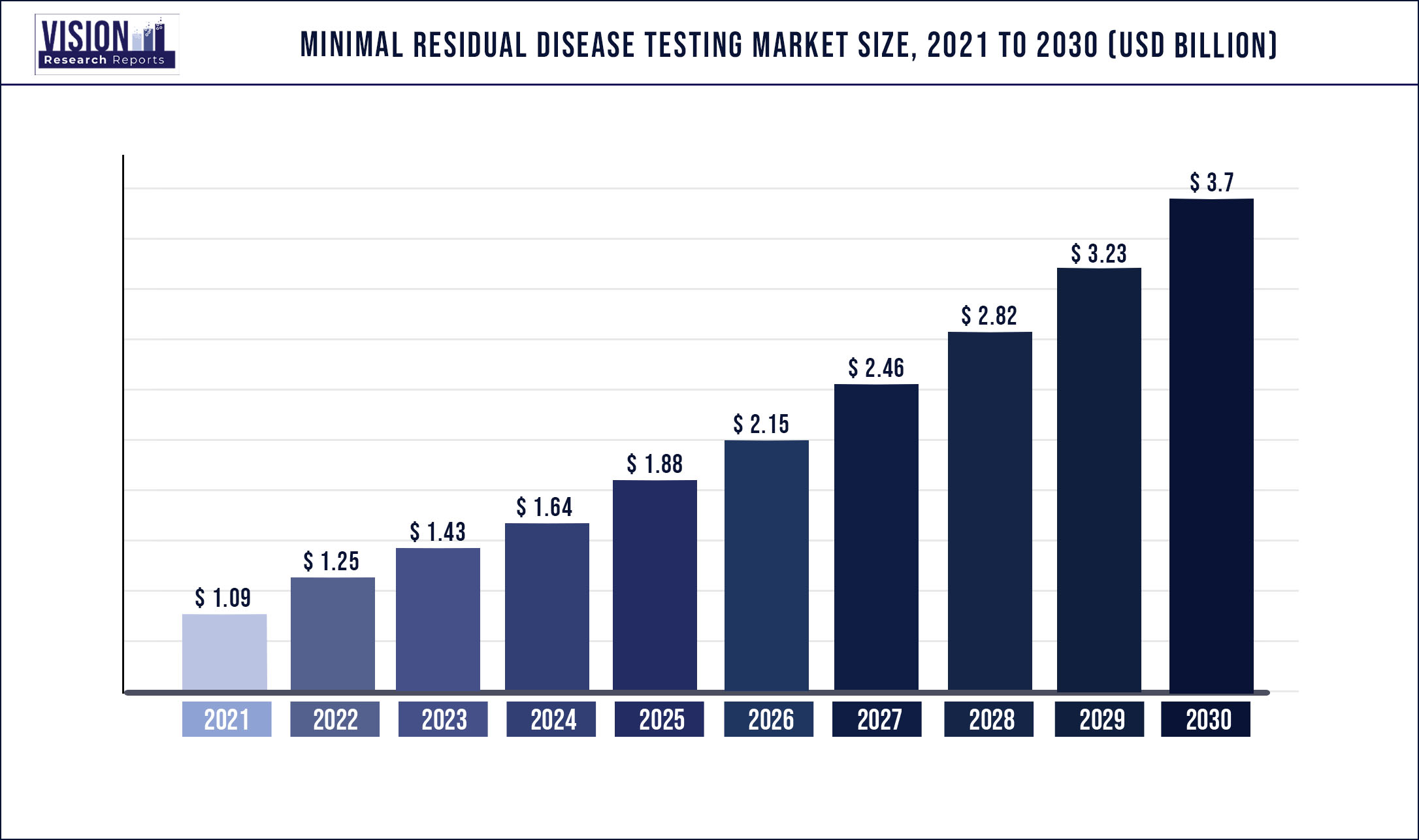

The global minimal residual disease testing market was valued at USD 1.09 billion in 2021 and it is predicted to surpass around USD 3.70 billion by 2030 with a CAGR of 14.53% from 2022 to 2030.

MRD testing is essentially used in clinical and research applications for the detection of a residual disease condition. These tests are used for the detection of either hematological malignancies or solid tumors. Continuous monitoring of residual cancer cells throughout the core treatment and during the remission stage fetches the oncologists with personalized insights on the efficacy of the used therapy. It also precisely predicts the risk of a possible relapse of the condition. MRD testing influences treatment choices to yield better therapeutic outcomes.

The use of MRD testing as a novel prognostic and diagnostic assay facilitates robust moderation of treatment regimes to treat all kinds of hematological malignancies. It generates important molecular information to better understand the cancer conditions and ultimately work towards leveraging treatment outcomes. For instance, in February 2022, the Foundation for National Institutes of Health’s Biomarkers Consortium launched a project for the validation of novel detection and quantification methods to effectively detect the trace amounts of carcinogenic cells left out in the body after a full-fledged anti-cancer therapy, and in cases of acute myeloid leukemia.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.09 billion |

| Revenue Forecast by 2030 | USD 3.70 billion |

| Growth rate from 2022 to 2030 | CAGR of 14.53% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, Cancer Type, End use, Region |

| Companies Covered |

Adaptive Biotechnologies Corporation, Bio-Rad Laboratories, Inc., Arup Laboratories, F. Hoffmann- La Roche Ltd, Cergentis B.V., Guardant Health, ICON plc, Laboratory Corporation of America Holdings, Invivoscribe, Inc., Mission Bio, Inc., Opko Health, Natera, Inc., NeoGenomics Laboratories, Inc., Sysmex Corporation, Quest Diagnostics Incorporated |

Measurement of therapeutic outcomes are critical for the successful adoption of a given cancer therapeutic regime. Therefore, MRD testing is increasingly used as an end-point analysis step in numerous clinical trial studies for oncology-based research and also effectively records the variations in outcomes due to individual genetic characteristics. For instance, in November 2020, Adaptive Biotechnologies Corporation, entered into a collaboration with GlaxoSmithKline plc., to use its clonoSEQ assay for the assessment of residual cancer cells after treatment with GSK’s hematology therapeutics.

Surgical removal of a tumor with other associative therapies does not essentially mean, that the cancerous cells are removed completely. Traces of cancer can still remain in the body parts and bloodstream. The diagnosis of such residual cells are crucial for deciding upon the need for further rounds of chemotherapy and radiation. Researchers are devising non-invasive tests to effectively detect MRD. For instance, in February 2022, a blood test from C2i Genomics quantified the residual cancer cells after surgical oncology procedures. The C2inform test also achieved the CE mark clearance and is offered as a ‘software-as-a-medical-device’ MRD test in Europe.

Potential MRD diagnostics play a crucial role to make effective individual and long-term clinical decisions after the core cancer therapy. Moreover, MRD diagnostics efficiency is also important for healthcare insurance companies to effectively offer financial assistance to cancer survivors across the globe. For instance, in November 2021, Palmetto GBA's Molecular Diagnostics Program (MolDX) determined a medical expense cover that supported patients with multiple myeloma (MM), chronic lymphocytic leukemia (CLL), and B-cell acute lymphoblastic leukemia (ALL) for effectively monitoring the presence of residual cancer cells using the clonoSEQ platform.

Numerous MRD tests for the detection of residual solid tumors require tissue biopsy samples and deployment of patient-specific assays, which consumes longer turn-around time. Therefore, blood sample-based MRD detection assays are preferred. For instance, in January 2021 GRAIL, Inc., signed into a collaboration with Amgen, AstraZeneca, and Bristol Myers Squibb for evaluation of its MRD detection technology that is based on methylation.

Cancer therapeutics are effectively moderated to avoid leaving a residue of tumorous cells using the most relevant clinical evidence and are also personalized based on specific progression profiles in an individual. Numerous research studies are rising the need for consideration of individual genetic characteristics for effective treatment. For instance, in February 2021, Natera Inc., collaborated with Personalis Inc., to understand the outcomes of personalized cancer care by integrating the NeXT tumor profiling (by Personalis) and the personalized ctDNA platform Signatera’s diagnostic products (by Natera, Inc.,) for effectively designing the treatment monitoring regime and assessment of MRD.

Key Players

Market Segmentation

By Technology

By Cancer Type

By End use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Minimal Residual Disease Testing Market

5.1. COVID-19 Landscape: Minimal Residual Disease Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Minimal Residual Disease Testing Market, By Technology

8.1. Minimal Residual Disease Testing Market, by Technology, 2022-2030

8.1.1 Next Generation Sequencing (NGS)

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Polymerase Chain Reaction (PCR)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Flow Cytometry

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Minimal Residual Disease Testing Market, By Cancer Type

9.1. Minimal Residual Disease Testing Market, by Cancer Type, 2022-2030

9.1.1. Haematological Malignancy

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Haematological Malignancy

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Minimal Residual Disease Testing Market, By End use

10.1. Minimal Residual Disease Testing Market, by End use, 2022-2030

10.1.1. Hospitals & Diagnostic Laboratories

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Academic & Research Institutes

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Minimal Residual Disease Testing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.1.3. Market Revenue and Forecast, by End use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.2.3. Market Revenue and Forecast, by End use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.3.3. Market Revenue and Forecast, by End use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.4.3. Market Revenue and Forecast, by End use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.5.3. Market Revenue and Forecast, by End use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Cancer Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End use (2017-2030)

Chapter 12. Company Profiles

12.1. Adaptive Biotechnologies Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bio-Rad Laboratories, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Arup Laboratories

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. F. Hoffmann- La Roche Ltd

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cergentis B.V.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Guardant Health

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ICON plc

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Laboratory Corporation of America Holdings

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Invivoscribe, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Mission Bio, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others