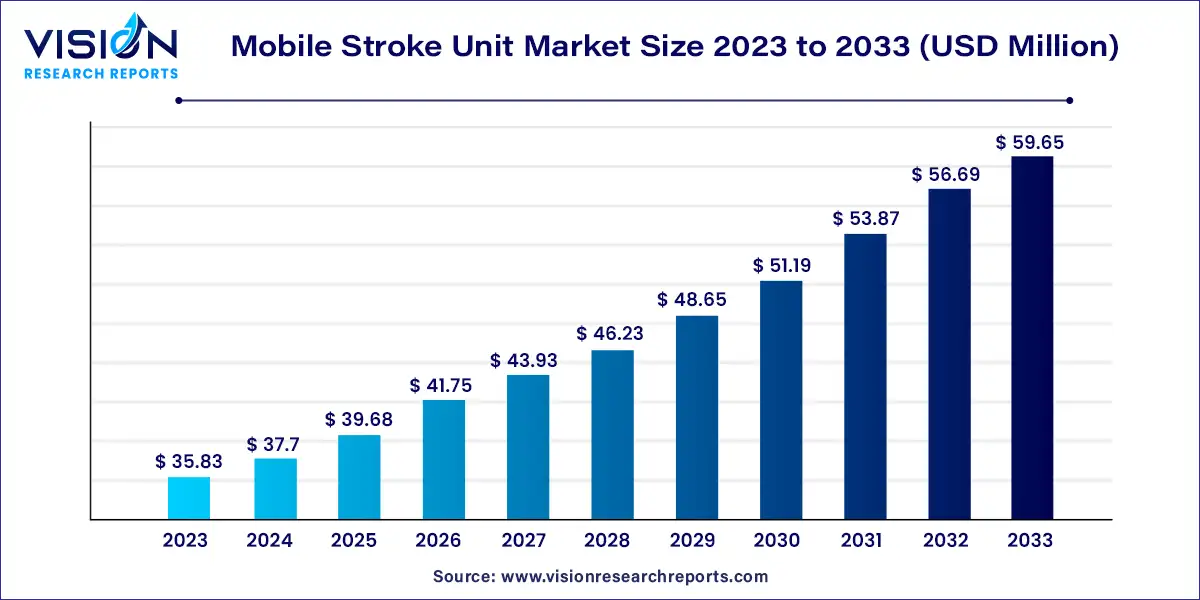

The global mobile stroke unit market size was surpassed at USD 35.83 million in 2023 and is expected to hit around USD 59.65 million by 2033, growing at a CAGR of 5.23% from 2024 to 2033. The Mobile Stroke Unit (MSU) market has emerged as a significant sector within the healthcare industry, driven by the increasing demand for rapid stroke diagnosis and treatment. Mobile Stroke Units are specialized ambulances equipped with advanced imaging technology and staffed with stroke specialists, enabling them to provide immediate care to stroke patients directly at the scene. This innovative approach aims to minimize treatment delays and improve patient outcomes in stroke care.

The mobile stroke unit (MSU) market is experiencing significant growth driven by the rising incidence of stroke globally is creating a pressing need for swift and effective treatment solutions. As stroke rates increase due to aging populations and prevalent risk factors such as hypertension and diabetes, the demand for Mobile Stroke Units is escalating. Additionally, advancements in imaging technology, including portable CT scanners and telemedicine capabilities, have significantly enhanced the functionality of MSUs, allowing for rapid diagnosis and intervention. Government initiatives and funding aimed at improving stroke care are also contributing to market expansion by supporting the deployment and operation of these specialized units. Furthermore, the demonstrated improvement in patient outcomes, including reduced treatment times and enhanced recovery rates, is encouraging healthcare providers to adopt Mobile Stroke Units more widely. Together, these factors are driving robust growth in the Mobile Stroke Unit market, highlighting its critical role in modern stroke care.

In 2023, the computed tomography (CT) scanner segment led the market with a 39% share, owing to its capability for immediate, on-site imaging. This rapid diagnostic capability significantly accelerates the initiation of treatment. CT scanners deliver detailed brain images, allowing healthcare professionals to swiftly identify the type of stroke and determine the most suitable treatment approach. Recent advancements in CT technology have introduced portable and more efficient devices, which can be seamlessly integrated into mobile units, thereby enhancing their effectiveness in emergency situations.

The telemedicine system segment is anticipated to experience the highest growth rate, with a projected compound annual growth rate (CAGR) of 7.03% during the forecast period. Telemedicine facilitates real-time communication between on-site medical teams and stroke specialists, which is crucial for prompt decision-making and treatment planning, especially in remote areas. The integration of telemedicine systems into mobile stroke units improves their overall efficiency and ensures that patients receive high-quality care regardless of their location.

In 2023, the U.S. led the mobile stroke unit market due to the high incidence of strokes, which drives the need for rapid and effective stroke care solutions. Each year, over 795,000 individuals in the U.S. suffer a stroke, with approximately 610,000 of these being first-time strokes.

In India, the mobile stroke unit market also holds a significant share, driven by factors such as a rising stroke burden, an aging population, and a high prevalence of risk factors like hypertension and diabetes. Stroke is the second leading cause of death in India, with approximately 185,000 strokes occurring annually. This equates to a stroke every 40 seconds and a stroke-related death every 4 minutes in the country.

By Product

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Stroke Unit Market

5.1. COVID-19 Landscape: Mobile Stroke Unit Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Stroke Unit Market, By Product

8.1.Mobile Stroke Unit Market, by Product Type

8.1.1. Computed Tomography Scanner

8.1.1.1. Market Revenue and Forecast

8.1.2. Conventional Emergency Equipment

8.1.2.1. Market Revenue and Forecast

8.1.3. Telemedicine System

8.1.3.1. Market Revenue and Forecast

8.1.4. Automated Image Analysis

8.1.4.1. Market Revenue and Forecast

8.1.5. Others (POC Laboratory System, etc.)

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Mobile Stroke Unit Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product

Chapter 10. Company Profiles

10.1. MEYTEC GmbH

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Frazer, Ltd.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. NeuroLogica Corp.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Tri-Star Industries Limited

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. RMA Group

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Schiller

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others