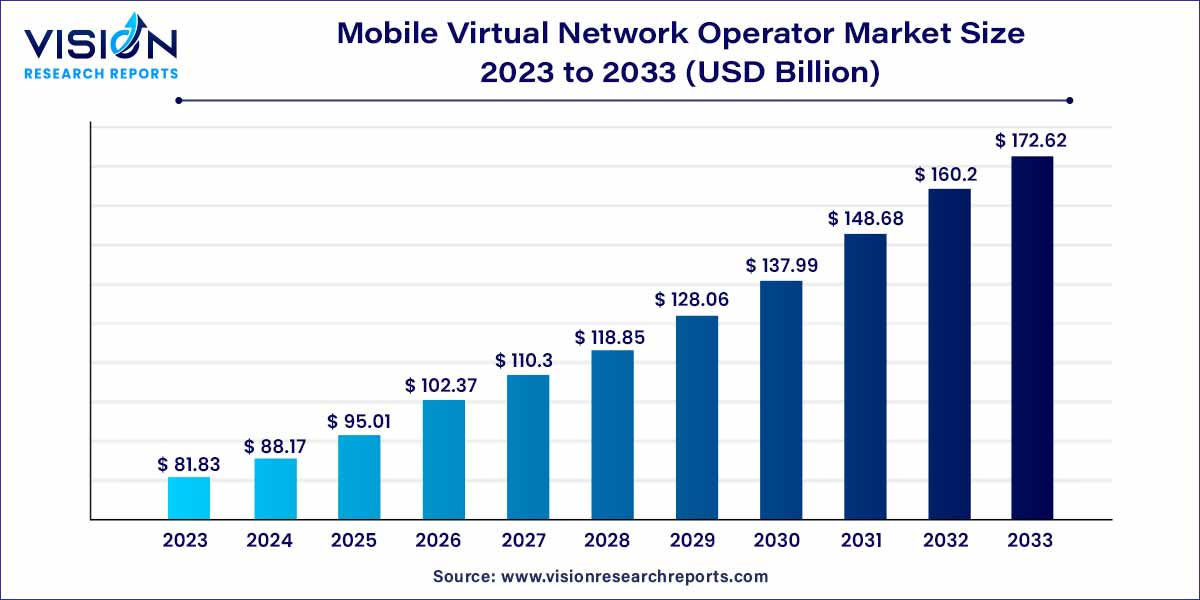

The global mobile virtual network operator market was estimated at USD 81.83 billion in 2023 and it is expected to surpass around USD 172.62 billion by 2033, poised to grow at a CAGR of 7.75% from 2024 to 2033.

The mobile virtual network operator (MVNO) market has emerged as a dynamic and evolving sector within the telecommunications industry. As a distinctive player in the mobile ecosystem, MVNOs have garnered significant attention due to their unique business model and ability to offer innovative solutions to diverse consumer needs. This overview delves into the key aspects of the MVNO market, examining its growth drivers, market dynamics, and potential future trends.

The mobile virtual network operator (MVNO) market is witnessing robust growth driven by several key factors. One significant contributor to this expansion is the cost efficiency inherent in the MVNO business model. By leasing network access from established mobile network operators (MNOs) rather than investing in costly infrastructure, MVNOs can operate with reduced capital expenditures, directing resources towards service innovation. Additionally, the market benefits from the strategic utilization of market segmentation by MVNOs. This approach allows these operators to cater to niche markets or underserved segments, tailoring their services to meet specific consumer needs and preferences. The ability of MVNOs to introduce innovative service offerings, including unique service plans, pricing models, and value-added services, further stimulates market growth, challenging traditional norms and fostering broader industry innovation.

The discount segment held the largest revenue share of 25% in 2023. The mobile virtual network operator (MVNO) market is poised for substantial growth in the Machine-to-Machine (M2M) segment, driven by the increasing adoption of cellular connectivity in various devices, ranging from vehicles to vending machines. Factors such as technological advancements in the 3G M2M segment, initiatives by Mobile Network Operators (MNOs) to diversify their service offerings, and the expansion of mobile network coverage are pivotal in supporting the upward trajectory of MVNOs in the M2M market.

The M2M segment is expected to exhibit the highest CAGR from 2024 to 2032. MNOs often provide diverse service plans and products tailored for markets with fewer users, leading to operational and business support systems that are both expensive and inefficient. The challenges of high costs associated with customer retention and acquisition, particularly for fixed-term contracts, can be mitigated by MVNOs.

In 2023, the full MVNO segment had the largest market share of 61%. Continuing its dominance, the full MVNO segment led the market in revenue throughout 2023. The implementation of a full MVNO network infrastructure requires minimal capital investment and affords comprehensive call control, enabling customers to make international calls at highly discounted rates.

The reseller MVNO segment is anticipated to register the highest CAGR during forecast period. While MNOs possess mobile licenses, infrastructure, and direct customer relationships, they often collaborate with MVNOs to expand their customer base and operations, particularly targeting niche segments. Despite having roaming agreements with foreign counterparts, MNOs opt for partnerships with MVNOs to avoid direct competition.

The 4G MVNO segment contributed the largest market share of 71% in 2023. This growth is fueled by the escalating demand for high-speed mobile data and enhanced connectivity. The adoption of 4G technology, facilitating seamless video streaming, improved browsing experiences, and efficient app downloads, has significantly contributed to the prominence of the 4G MVNO segment throughout the forecast period. Additionally, the 4G MVNOs have strategically capitalized on the surging demand for smartphones, data-savvy devices, and catering to a diverse user base, businesses, and Internet of Things (IoT) devices.

Conversely, the 5G MVNO segment is expected to expand at the highest CAGR of 10.05% from 2024 to 2033. Riding on the global rollout of 5G technology, 5G MVNOs leverage the capabilities of this advanced technology, offering high data speeds, low latency, and increased network capacity to enhance the overall user experience.

The prepaid MVNO segment is expected to command the largest market share, surpassing 71% in 2023. The surge in prepaid MVNO growth is attributable to the customer-centric advantages it provides, offering flexible and cost-effective alternatives compared to traditional postpaid plans. Additionally, companies within the mobile virtual network operator market have undertaken various initiatives, including new product launches, mergers, and acquisitions, fostering the expansion of the prepaid MVNO segment. This strategic move aims to compete with Chinese national carriers and is expected to bolster the adoption of prepaid MVNOs, contributing significantly to market growth.

On the other hand, the postpaid MVNO segment is projected to experience a substantial growth rate of approximately 7% from 2024 to 2033. Catering predominantly to customers who prefer monthly billing and opt for long-term contracts, postpaid MVNOs provide additional benefits. These benefits include competitive pricing, unlimited data, and truly international calling, among others, shaping the growth trajectory of the postpaid MVNO segment in the mobile virtual network operator market over the forecast period.

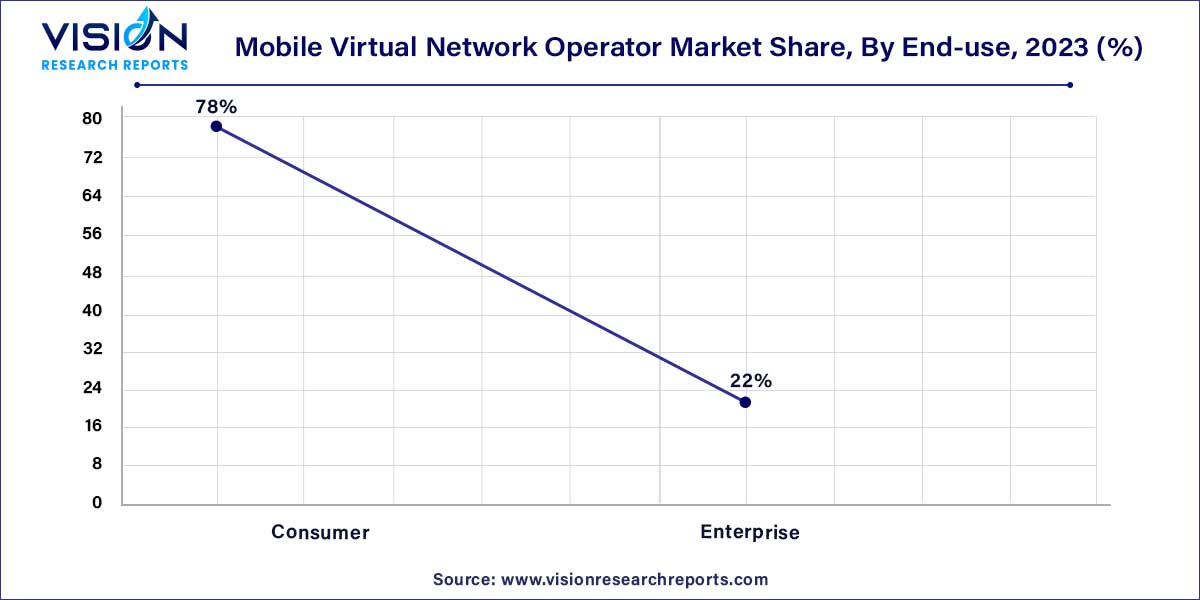

The consumer segment held the largest revenue share of 78% in 2023. The proliferation of advanced devices and the augmentation of network speed have fueled the growth of data-centric applications, including internet browsing and video streaming. Substantial investments directed towards enhancing network coverage and the expansion of Mobile Broadband (MBB) connections further contribute to the consumer segment's growth.

Conversely, the enterprise segment is poised to exhibit the highest CAGR from 2024 to 2033. This growth is propelled by the management of connected living, personal data, and the increasing prevalence of e-commerce activities, offering significant opportunities for key market players. The rising benefits to consumers, coupled with intelligent networks connecting a diverse array of devices, contribute to enhanced productivity for enterprises.

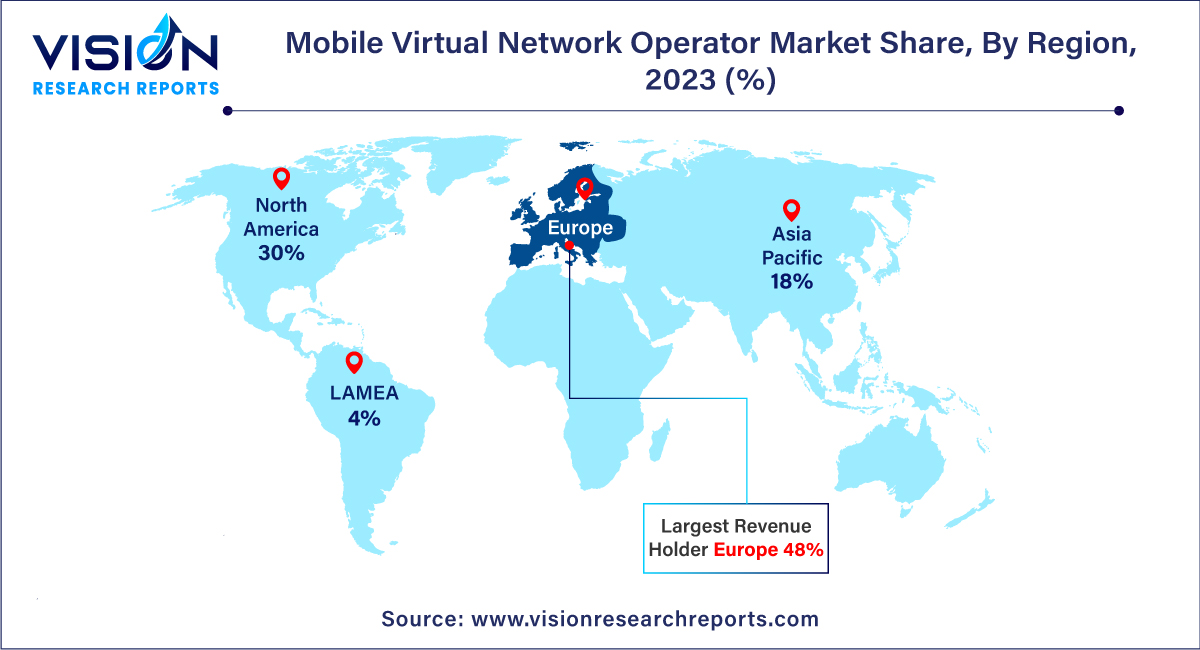

In 2023, the European region dominated the market with the largest market share 48%. The region's growth is attributed to a favorable regulatory framework, anticipated to play a pivotal role in the development of Mobile Virtual Network Operators (MVNOs). Countries like the U.K., Germany, and the Netherlands are poised to significantly contribute to regional growth throughout the forecast period. Data services are expected to be the primary driver of growth in this region over the foreseeable future.

Asia Pacific and the Middle East and Africa (MEA) are forecasted to witness substantial growth during the forecast period. This growth is propelled by the remarkable expansion of the telecom services industry, particularly in emerging economies like India, Vietnam, Myanmar, and China, which are actively working towards expanding and modernizing their telecommunication services. Southeast Asian nations such as Singapore, Thailand, and the Philippines are also expected to make substantial contributions to the regional market expansion.

By Type

By Operational Model

By Service Type

By Contract Type Model

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Virtual Network Operator Market

5.1. COVID-19 Landscape: Mobile Virtual Network Operator Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Virtual Network Operator Market, By Type

8.1. Mobile Virtual Network Operator Market, by Type, 2024-2033

8.1.1. Business

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Discount

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. M2M

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Media

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Migrant

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Retail

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Roaming

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Telecom

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Mobile Virtual Network Operator Market, By Operational Model

9.1. Mobile Virtual Network Operator Market, by Operational Model, 2024-2033

9.1.1. Full MVNO

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Reseller MVNO

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Service Operator MVNO

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Mobile Virtual Network Operator Market, By Service Type

10.1. Mobile Virtual Network Operator Market, by Service Type, 2024-2033

10.1.1. 4G MVNO

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. 5G MVNO

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Mobile Virtual Network Operator Market, By Contract Type Model

11.1. Mobile Virtual Network Operator Market, by Contract Type Model, 2024-2033

11.1.1. Prepaid MVNO

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Postpaid MVNO

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Mobile Virtual Network Operator Market, By End-use

12.1. Mobile Virtual Network Operator Market, by End-use, 2024-2033

12.1.1. Consumer

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Enterprise

12.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Mobile Virtual Network Operator Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.1.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.1.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.2.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.2.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.2.7. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.2.10. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.3.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.3.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.4.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.4.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.5.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.5.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Operational Model (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Service Type (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Contract Type Model (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Boost Mobile

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Consumer Cellular

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Cricket Wireless LLC.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. DISH Wireless L.L.C.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. FreedomPop

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Locus Telecommunications, LLC.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Lyca Mobile

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Mint Mobile, LLC.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Red Pocket Mobile

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Tello

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others