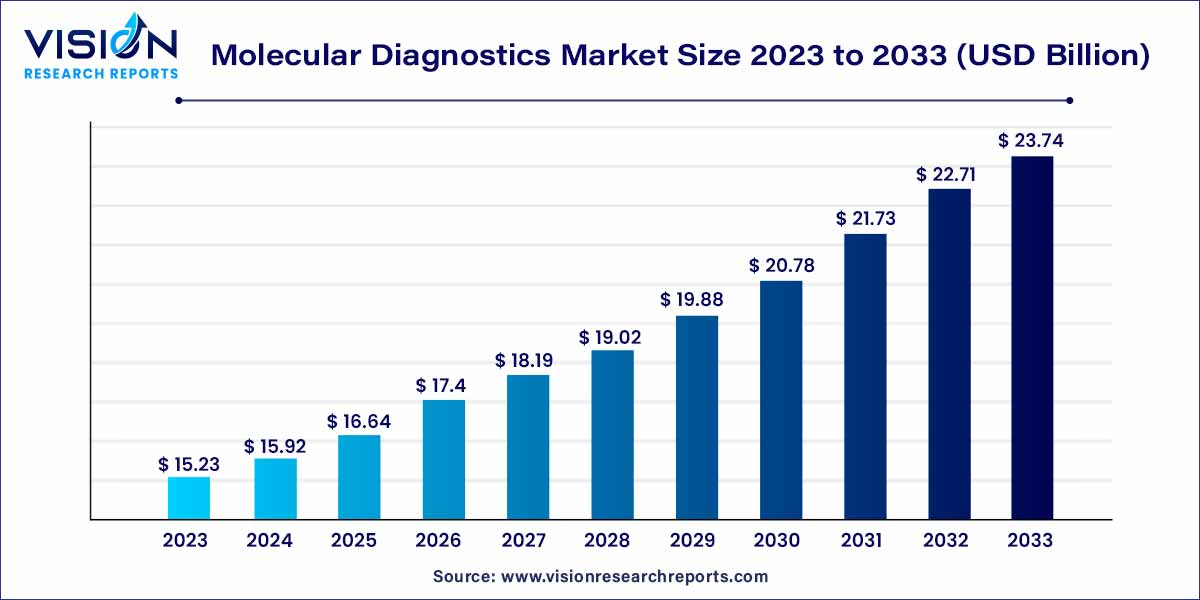

The global molecular diagnostics market size was estimated at around USD 15.23 billion in 2023 and it is projected to hit around USD 23.74 billion by 2033, growing at a CAGR of 4.54% from 2024 to 2033. The molecular diagnostics market is driven by the growing trend towards personalized medicine, point-of-care testing (POCT) demand, and rising incidence of infectious diseases.

Molecular diagnostics is a rapidly evolving field within the healthcare industry that focuses on the detection and analysis of genetic material at the molecular level. This innovative approach has transformed the diagnosis and management of various diseases, offering enhanced precision and personalized treatment strategies.

The molecular diagnostics market is witnessing robust growth driven by several key factors. Technological advancements, particularly in high-throughput sequencing and polymerase chain reaction (PCR) techniques, have significantly enhanced the precision and efficiency of diagnostic tests. The rising incidence of infectious diseases globally has heightened the demand for accurate and rapid diagnostic solutions, positioning molecular diagnostics as a critical tool for timely pathogen identification. Furthermore, the industry's response to the increasing trend of personalized medicine, where treatment plans are tailored based on individual genetic makeup, has fueled market expansion. The demand for point-of-care testing (POCT) is on the rise, especially in emergency settings, contributing to the market's overall growth.

The reagents segment was the leading force in the market, capturing a substantial 63% share of global revenue in 2023. This dominance is expected to persist throughout the forecast period, driven by the extensive application scope of reagents in both research and clinical settings, coupled with the increasing adoption of innovative tests. An illustrative example is the announcement made by Cepheid, a subsidiary of Danaher, in April 2023, outlining plans to introduce novel tests targeting various infectious diseases, such as respiratory diseases and tuberculosis. Collaborating with researchers at Rutgers University, the company developed a groundbreaking technology capable of detecting 10 independent targets in a single reaction. The anticipation of standardized results, heightened efficiency, and cost-effectiveness is poised to further fuel the growth of this segment.

The instruments segment secured the second-largest share of revenue in 2023, primarily due to the widespread utilization of instruments in various healthcare facilities for diagnosing life-threatening diseases. Additionally, the introduction of technologically advanced instruments has significantly contributed to the growth of this segment. For instance, Thermo Fisher Scientific, Inc. announced the release of the QuantStudio, Applied Biosystems, Absolute Q AutoRun dPCR Suite, a cutting-edge digital PCR research tool in February 2023. Furthermore, Sansure Biotech showcased its extensive range of In Vitro Diagnostic (IVD) products, including the iPonatic III portable molecular workstation, at EuroMedLab Rome 2023 in May 2023.

In 2023, the polymerase chain reaction (PCR) technology segment claimed the largest share of revenue, driven significantly by its widespread use in detecting COVID-19 and other infectious diseases. The adoption of high-throughput PCR technology for identifying infectious diseases and genetic conditions is anticipated to fuel market growth. A noteworthy example is Molbio Diagnostics' launch of Truenat H3N2/H1N1 in April 2023, representing the initial Point-of-Care (PoC) Real-Time Polymerase Chain Reaction (PCR) test that facilitates the reliable identification of influenza infections.

Conversely, the sequencing technology segment is poised to exhibit the fastest CAGR from 2024 to 2033. This growth can be attributed to the increasing integration of technology in diagnostic applications, the introduction of innovative Next-Generation Sequencing (NGS) tests, and supportive initiatives by key industry players. Alercell's launch of the LENA Molecular Dx Leukemia Platform in April 2023, featuring 12 molecular diagnostic tests based on next-gen DNA sequencing technology, exemplifies this trend.

In 2023, the infectious diseases segment emerged as the leader in revenue, largely driven by the heightened usage of molecular diagnostic tests, particularly Polymerase Chain Reaction (PCR) tests, for diagnosing COVID-19. This increased application significantly contributed to the segment's expanded market share. Additionally, the rising global prevalence of infectious diseases is further amplifying the demand for innovative molecular diagnostic tests. An example of this trend is evident in the U.S. FDA's approval of 510(k) clearance for Hologic's Panther Fusion SARS-CoV-2/Flu A/B/RSV assay in May 2023. This molecular diagnostic test distinguishes between the four most common respiratory viruses. Furthermore, a strategic partnership between Oxford Nanopore and bioMérieux in April 2023, focusing on nanopore technology, aims to develop novel treatments for infectious diseases.

Conversely, the oncology segment is anticipated to experience a high CAGR from 2024 to 2033. In 2023, the American Cancer Society estimated approximately 288,300 new cases of prostate cancer and around 59,610 new cases of leukemia in the U.S. The increasing collaboration between research institutes and industry players to devise new diagnostic solutions for cancer is a key factor supporting the growth of this segment. Notably, in October 2023, QIAGEN and Myriad Genetics joined forces to develop companion diagnostic tests utilizing Polymerase Chain Reaction (PCR), digital PCR (dPCR), and Next-Generation Sequencing (NGS) technologies for cancer diagnostics.

In 2023, the central laboratories segment emerged as the dominant force in the industry, primarily due to the high volumes of procedures conducted for COVID testing and other healthcare indications within central laboratories. ELITechGroup's announcement in April 2023 regarding the introduction of a high throughput sample-to-result molecular diagnostics equipment further underlines the significance of central laboratories in meeting global testing demands. Additionally, the surge in government initiatives aimed at providing various services, including reimbursement for diagnostic tests, is expected to be a key driving factor for market growth.

A notable trend in the industry is the growing interest in the development of molecular diagnostic platforms that can be utilized over-the-counter (OTC) or in at-home settings. Consequently, several companies are designing assays and molecular diagnostic platforms that empower patients to perform tests without the assistance of healthcare professionals. For example, in March 2023, Lucira Health launched the first and only at-home COVID-19 and flu tests in the U.S. This COVID-19 & Flu Home Test received the first and only Emergency Use Authorization (EUA) from the U.S. FDA for OTC usage at home and other non-laboratory locations.

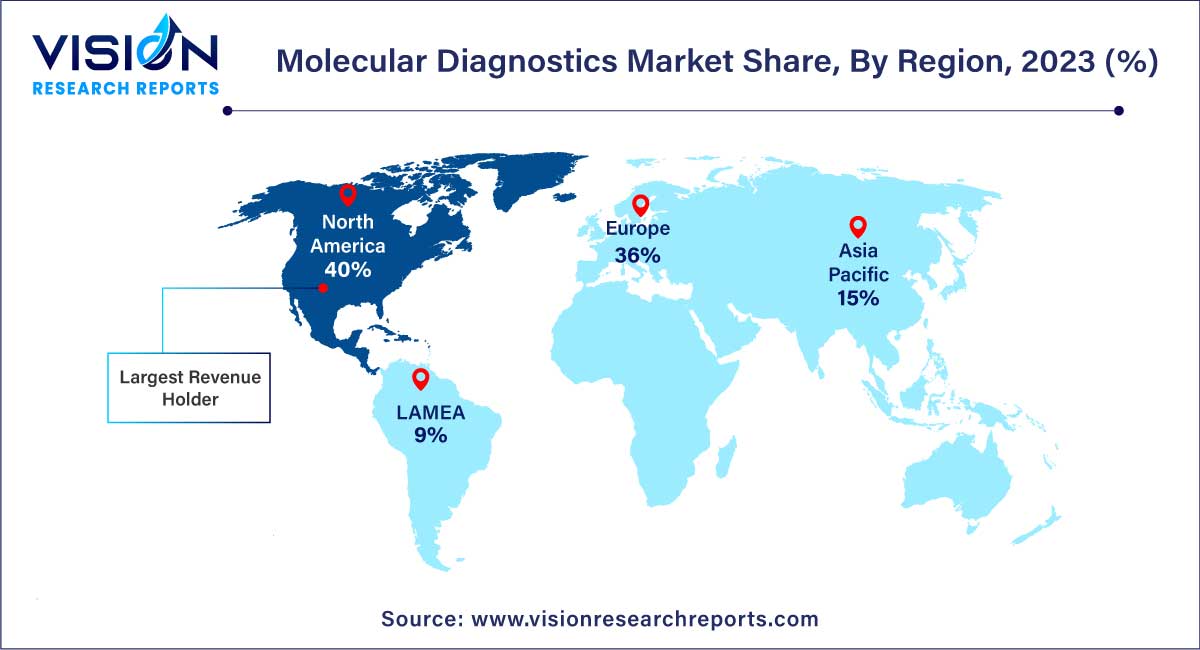

In 2023, North America asserted its dominance in the market, capturing a substantial 40% share. This stronghold is attributed to the escalating prevalence of infectious and chronic diseases, prompting companies to introduce innovative molecular diagnostic tests and thereby fueling overall market growth. Notable instances include QIAGEN's U.S. FDA approval for the therascreen PDGFRA RGQ PCR kit in August 2023, aiding physicians in identifying patients with gastrointestinal stromal tumors (GIST). Furthermore, in January 2023, the U.S. FDA granted Emergency Use Authorization (EUA) for the VIASURE Monkeypox Virus Real-Time PCR Reagents, developed by BD and CerTest Biotec, for Mpox virus detection. The region's high standards of living, consumer awareness regarding early diagnosis, and a well-established healthcare system collectively act as pivotal drivers for market expansion.

Moving forward, Asia Pacific is poised for substantial growth from 2024 to 2033. This anticipated growth is attributed to increased market penetration, local market players' initiatives to promote the adoption of novel diagnostic technologies, and high unmet market needs. For instance, in August 2023, Indian companies CrisprBits and MolBio Diagnostics formed a strategic collaboration to revolutionize Point-of-Care (POC) diagnostics by integrating CRISPR technology into POC tests for detecting pathogens and genetic markers.

By Product

By Technology

By Application

By Test Location

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Molecular Diagnostics Market

5.1. COVID-19 Landscape: Molecular Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Molecular Diagnostics Market, By Product

8.1. Molecular Diagnostics Market, by Product, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Molecular Diagnostics Market, By Technology

9.1. Molecular Diagnostics Market, by Technology, 2024-2033

9.1.1. Polymerase chain reaction (PCR)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. In Situ Hybridization (ISH)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Isothermal Nucleic Acid Amplification Technology (INAAT)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Chips and Microarrays

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Mass Spectrometry

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Sequencing

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Transcription Mediated Amplification (TMA)

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Molecular Diagnostics Market, By Application

10.1. Molecular Diagnostics Market, by Application, 2024-2033

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pharmacogenomics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Infectious Diseases

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Methicillin-resistant Staphylococcus Aureus (MRSA)

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Neurological Disease

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Cardiovascular Disease

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Microbiology

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Molecular Diagnostics Market, By Test Location

11.1. Molecular Diagnostics Market, by Test Location, 2024-2033

11.1.1. Point of Care

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Self-test or OTC

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Central Laboratories

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Molecular Diagnostics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Test Location (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Test Location (2021-2033)

Chapter 13. Company Profiles

13.1. BD

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. bioMérieux SA

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Bio-Rad Laboratories, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Abbott

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Agilent Technologies, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Danaher

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Hologic Inc. (Gen Probe)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Illumina, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Grifols, S.A.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. QIAGEN

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others