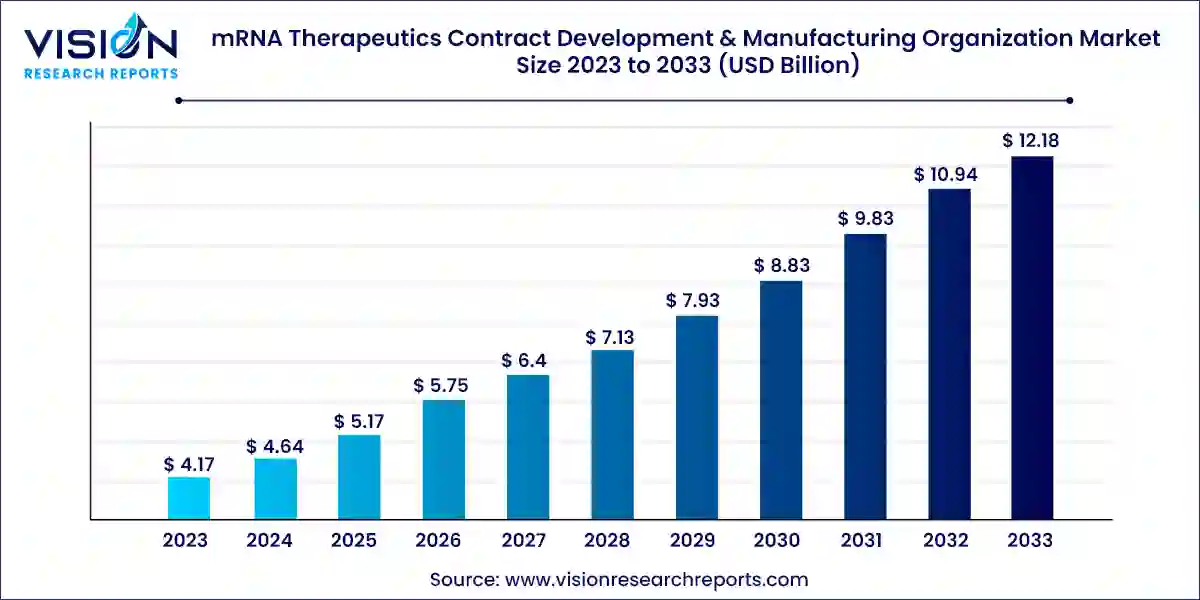

The global mRNA therapeutics contract development & manufacturing organization market size was valued at USD 4.17 billion in 2023 and is anticipated to reach around USD 12.18 billion by 2033, growing at a CAGR of 11.31% from 2024 to 2033.

The field of mRNA therapeutics has witnessed a surge in interest and investment due to its potential to revolutionize the treatment of various diseases, including cancer, infectious diseases, and genetic disorders. As a result, the market for mRNA therapeutics Contract Development & Manufacturing Organizations (CDMOs) has experienced significant growth and evolution.

The mRNA therapeutics CDMO market comprises companies that specialize in providing contract services for the development, manufacturing, and production of mRNA-based therapeutics. These CDMOs offer a range of services, including mRNA synthesis, formulation development, process optimization, analytical testing, and regulatory support.

The growth of the mRNA therapeutics contract development & manufacturing organization (CDMO) market is propelled by several key factors. Firstly, the burgeoning interest and investment in mRNA therapeutics due to their potential to revolutionize disease treatment drive demand for CDMO services. Additionally, the increasing outsourcing trend among pharmaceutical and biotechnology companies seeking specialized expertise and infrastructure for mRNA therapeutic development and production contributes significantly to market expansion. Moreover, the expanding pipeline of mRNA-based drugs in clinical development stages necessitates reliable CDMO partners for scaling up production and ensuring regulatory compliance.

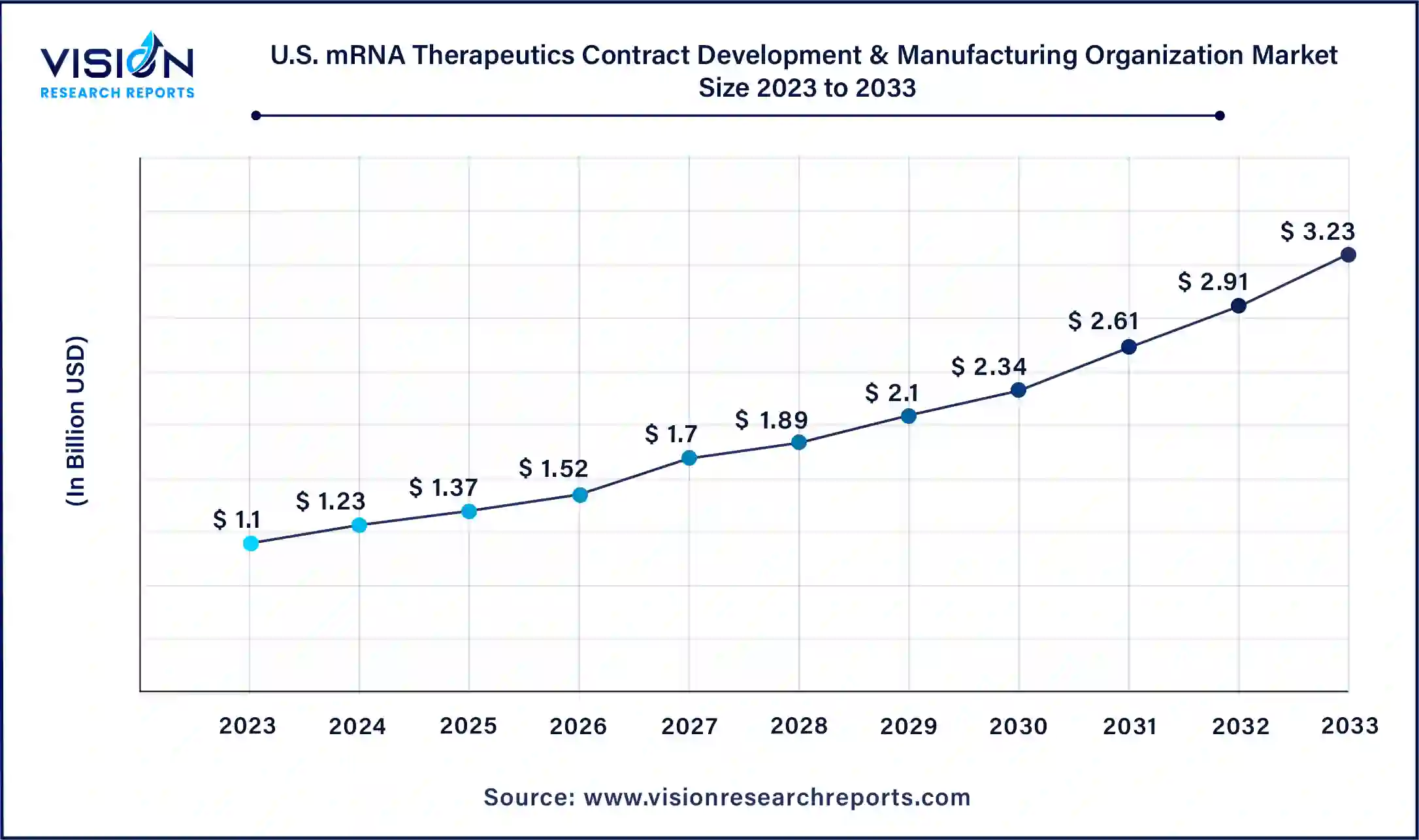

The U.S. mRNA therapeutics contract development & manufacturing organization market size was surpassed at USD 1.1 billion in 2023 and is expected to hit around USD 3.23 billion by 2033, growing at a CAGR of 11.37% from 2024 to 2033.

The U.S. held the largest share of the mRNA therapeutics contract development & manufacturing organization market in 2023. With numerous pharmaceutical and life sciences companies based in the country, the U.S. accounts for the highest share of the North American regional market.

North America dominated the mRNA therapeutics contract development & manufacturing organization market, contributing 38% of global revenue in 2023. Market growth in North America is propelled by established CDMOs, expanding clinical trials, and the rising prevalence of infectious diseases, respiratory diseases, and cardiovascular & cerebrovascular diseases. For instance, in February 2024, Arcturus Therapeutics and CSL unveiled the results of a Phase 3 study follow-up on the ARCT-154 booster dose, marking the first sa-mRNA COVID-19 vaccine globally approved, offering administration at one-sixth the dose of Comirnaty (5 μg vs. 30 μg).

The mRNA therapeutics contract development & manufacturing organization market in the Asia Pacific region is projected to achieve a compound annual growth rate (CAGR) of 10.85% from 2024 to 2033. This growth is attributed to several key factors, including escalating investments in research and development (R&D), the surging prevalence of diseases amenable to mRNA therapies, and advancements in technology.

Within the application segment, the market divides into viral vaccines, protein replacement therapies, and cancer immunotherapies. Viral vaccines stand out as the leading segment, accounting for 100% of global revenue in 2023. This dominance stems from established technology, the broad applicability of viral vaccines, and the introduction of various mRNA-based vaccines to combat the spread of the COVID-19 virus. Notably, Moderna unveiled mRNA-1345, an investigational respiratory syncytial virus vaccine, in January 2023. Moreover, ongoing Phase 3 trials investigating the coadministration of flu vaccine and COVID-19 (mRNA-1083) for older adults are fully enrolled, with data expected in 2024.

Concurrently, the cancer immunotherapies segment is poised to register the fastest CAGR over the forecast period, fueled by increasing cancer prevalence and investments in novel therapies to counter this trend. mRNA-based approaches in cancer immunotherapies exhibit substantial promise and garner significant attention in oncology circles. mRNA cancer vaccines, particularly, offer potent and adaptable immunotherapeutic potential, owing to their robust immunogenicity that elicits strong cell-mediated and humoral immune responses.

The market's indication segment comprises infectious diseases, metabolic & genetic diseases, and cardiovascular & cerebrovascular diseases. Infectious diseases dominate, commanding a revenue share of 100% in 2023. The ascendancy of this segment is propelled by rising adoption of mRNA-based vaccines, a multitude of candidates entering clinical trials for various infectious diseases, and the advent of the COVID-19 pandemic. Given the longstanding global health challenge posed by infectious diseases, mRNA therapies emerge as promising solutions. The market for mRNA therapeutics in infectious diseases represents a dynamic and rapidly expanding segment with distinctive advantages and growth prospects. The burgeoning incidence of respiratory ailments underscores the imperative for swift and adaptable vaccine development.

Meanwhile, the metabolic & genetic segment is poised to exhibit a rapid CAGR of 11.66% over the forecast period, driven by the increasing number of products under development for these applications. Notably, in February 2023, Moderna forged an agreement with Life Edit Therapeutics to address genetic diseases using mRNA-based gene editing, combining Moderna’s mRNA platform with Life Edit’s specialized gene editing capabilities, including the precise technique of base editing.

End-uses segment the market into biotech companies, pharmaceutical companies, and government & academic research institutes. Biotech companies emerge as the dominant segment in 2023, propelled by the urgent need for therapeutics amidst the COVID-19 pandemic and the growing trend of outsourcing end-to-end services. This trend is particularly notable among small- and mid-sized biotechnology firms lacking mRNA development expertise. Strategic collaborations with CDMOs have enabled biotech companies to generate lucrative revenues. For instance, PackGene Biotech Inc. and Kudo Biotechnology forged a strategic partnership in September 2023 to offer high-quality mRNA manufacturing services for drug and vaccine development.

The government & research institutes segment is projected to witness the fastest CAGR of 11.55% from 2024 to 2033. This growth is fueled by increased government investment in novel therapies for chronic diseases and heightened healthcare interest following the pandemic's challenges. For example, in March 2023, the U.S. government allocated USD 31.9 billion for mRNA vaccine research and procurement. This investment aims to bolster mRNA COVID-19 vaccine development, production, and procurement from the National Institutes of Health to the Department of Defense, enhancing overall support for mRNA vaccine production.

By Application

By Indication

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others