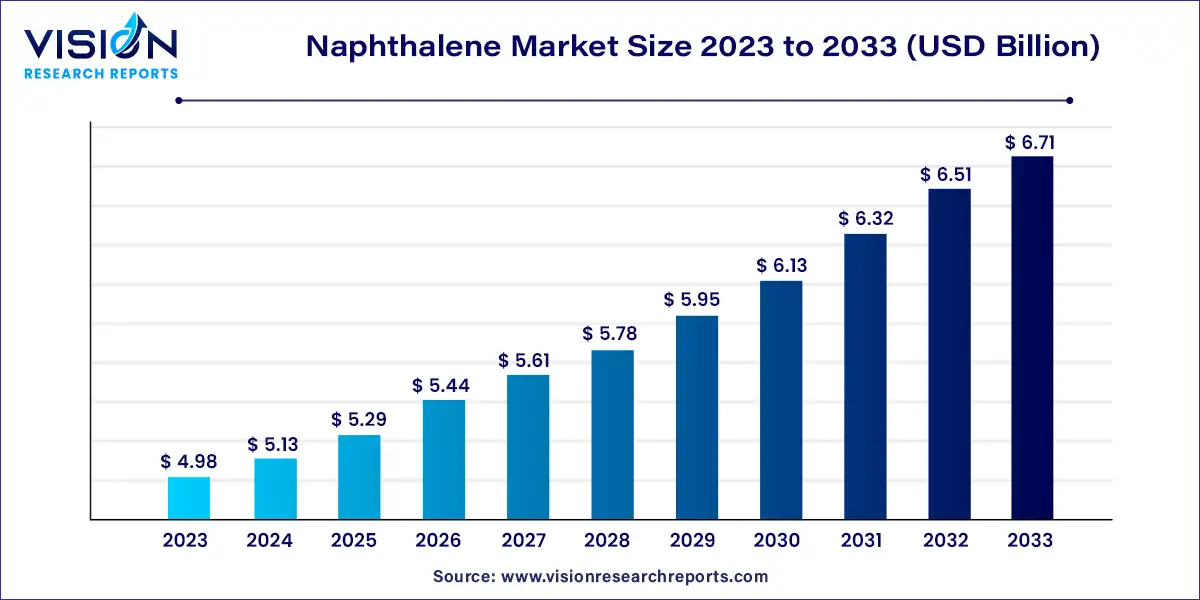

The global naphthalene market size was estimated at around USD 4.98 billion in 2023 and it is projected to hit around USD 6.71 billion by 2033, growing at a CAGR of 3.02% from 2024 to 2033.

Naphthalene, a versatile aromatic hydrocarbon compound, holds a pivotal position in several industrial processes and applications. Its distinct chemical properties and wide-ranging applications across sectors such as chemicals, construction, textiles, and agriculture contribute to its robust market demand.

The growth of the naphthalene market is propelled by an increasing demand from the chemical industry serves as a significant growth driver, with naphthalene being a crucial raw material for various intermediates and specialty chemicals. This demand is particularly pronounced in the production of derivatives like phthalic anhydride, naphthalene sulfonates, and insecticides, driving market growth. Secondly, infrastructure development projects worldwide are stimulating market growth, especially in construction chemicals where naphthalene is extensively used as a plasticizer and concrete admixture. The surge in construction activities, particularly in emerging economies, further fuels the demand for naphthalene. Lastly, the expansion of the textile industry plays a pivotal role, particularly in dye manufacturing and textile processing applications. With a resurgence in the textile sector and escalating demand for high-performance dyes and pigments, the naphthalene market is poised for continued growth. These growth factors collectively contribute to the dynamic expansion of the naphthalene market, shaping its trajectory in the foreseeable future.

In 2023, the coal tar segment emerged as the market leader, commanding a substantial revenue share of 63%. The escalating requirement for coal tar naphthalene in the textile sector, particularly in dye and pigment production, is anticipated to propel market expansion. Additionally, the burgeoning demand for coal tar naphthalene as a solvent across diverse industrial applications and its rising utilization in the manufacture of asphalt additives contribute significantly to its market dominance.

Petroleum-based naphthalene, a widely used chemical compound, finds its primary applications in mothball production and the manufacturing of specific resins and dyes. The market's expansion is primarily fueled by the growing demand for mothballs, essential for safeguarding clothing and fabrics against moth and insect damage. Moreover, naphthalene serves as a key ingredient in resin and dye production, catering to various sectors such as textiles and plastics.

In 2023, the phthalic anhydride segment emerged as the dominant player in the global market, capturing a significant revenue share. This growth is attributed to the escalating demand for phthalic anhydride, a major derivative of naphthalene, widely utilized in diverse industrial applications. The global demand for phthalic anhydride reaches millions of tons annually, primarily employed as an intermediate in dye, resin, insect repellent, and plasticizer production. It holds a pivotal role in the extensive manufacturing of plastic plasticizers and has witnessed heightened demand in polyester resin production, thereby driving the demand for naphthalene.

Naphthalene sulfonates, another essential chemical compound, find widespread usage across various industrial and personal care product segments. One of its prominent applications involves the production of naphthalene sulphonate formaldehyde (NSF), utilized in polymer-concrete admixtures to enhance concrete properties. NSF aids in neutralizing the surface charge on cement particles, facilitating easier mixing and handling. Additionally, naphthalene sulfonates are instrumental in the production of surfactants utilized in personal care items such as shampoos, automatic dishwashing detergents, and industrial cleansers, further underscoring their versatility.

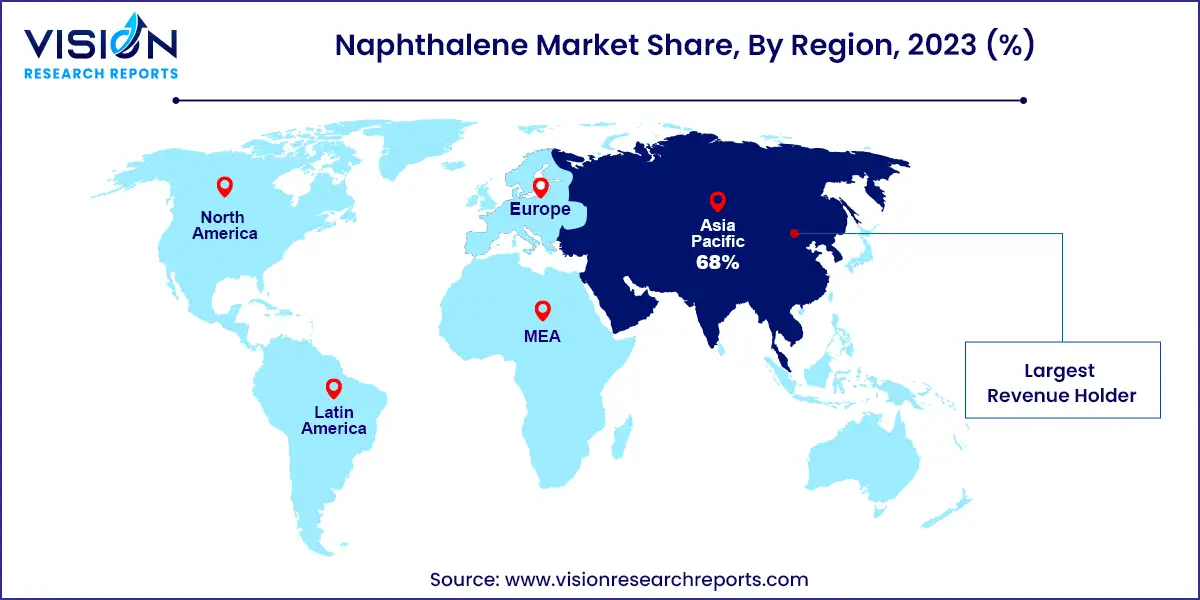

In 2023, Asia Pacific emerged as the dominant force in the market, commanding a substantial revenue share of 68% and maintaining its stronghold in the global market landscape. This growth is fueled by several factors, including robust infrastructure development initiatives and the burgeoning consumer demand across diverse sectors. Moreover, Asia Pacific stands as the epicenter of the global textile industry, further driving the demand for naphthalene. Its utilization in textiles as dyes and surfactants has witnessed a significant upsurge, contributing to the region's market dominance.

In 2023, the North American naphthalene market secured a notable revenue share, propelled by its increased usage in the construction sector and rising demand for pesticides. These factors have collectively contributed to market expansion in the region.

By Source

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others