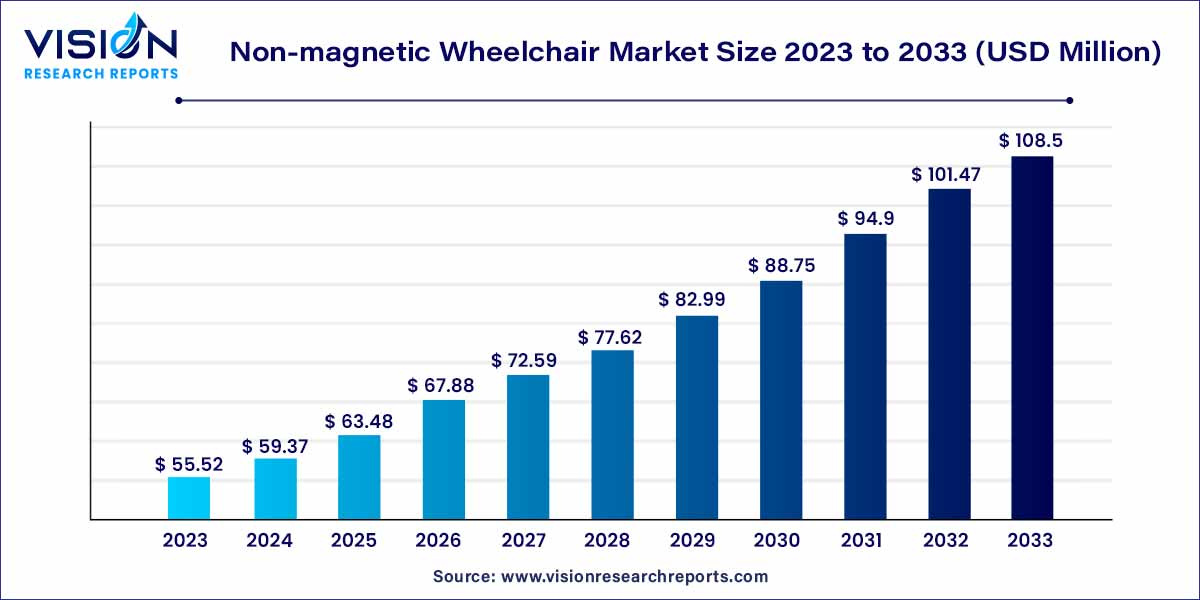

The global non-magnetic wheelchair market size was estimated at USD 55.52 million in 2023 and it is expected to surpass around USD 108.5 million by 2033, poised to grow at a CAGR of 6.93% from 2024 to 2033. The non-magnetic wheelchair market is experiencing notable growth, driven by advancements in medical technology and the increasing need for specialized equipment in healthcare settings. This market caters specifically to individuals requiring mobility assistance during magnetic resonance imaging (MRI) procedures, offering a solution that ensures both patient safety and diagnostic accuracy.

The robust growth of the non-magnetic wheelchair market can be attributed to several key factors. Firstly, the escalating demand for magnetic resonance imaging (MRI) procedures, driven by the increasing prevalence of diagnostic applications, has created a substantial need for specialized mobility solutions. As awareness grows regarding the potential risks associated with traditional wheelchairs during MRI scans, there is a heightened emphasis on adopting non-magnetic alternatives to ensure patient safety. Furthermore, continuous advancements in material technology play a pivotal role, enabling the development of lightweight, durable, and MRI-compatible wheelchairs. The market's focus on enhancing the overall patient experience during diagnostic imaging procedures has contributed to the rising adoption of non-magnetic wheelchairs, which prioritize both comfort and safety. As healthcare professionals increasingly recognize the importance of such specialized equipment, coupled with a surge in technological innovation, the non-magnetic wheelchair market is positioned for sustained and substantial growth.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 108.5 million |

| Growth Rate from 2024 to 2033 | CAGR of 6.93% |

| Revenue Share of North America in 2023 | 35% |

| CAGR of Asia Pacific from 2024 to 2033 | 7.98% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The 100 kg to 150 kg segment dominated with a revenue share of 48% in 2023. In addressing the segment of patients weighing between 100 kg to 150 kg, manufacturers are prioritizing the development of non-magnetic wheelchairs that combine robust structural integrity with ergonomic design. These wheelchairs are meticulously engineered to ensure optimal support and comfort for individuals within this weight range, aligning with the industry's dedication to providing effective and safe mobility solutions.

The above 150 kg segment anticipated to grow at the fastest CAGR of 7.25% during the forecast period. This significant shift responds to the increasing prevalence of individuals with higher weight requirements who also require mobility assistance during MRI procedures. Manufacturers are responding to this demand by incorporating advanced materials and reinforced structures in the design of these wheelchairs, ensuring both durability and safety for heavier patients.

Up to 3T segment led the market with a revenue share of 79% in 2023. As the demand for higher magnetic field strengths, such as those up to 3 Tesla (3T), continues to grow in diagnostic imaging, non-magnetic wheelchair manufacturers are strategically aligning their designs to ensure compatibility within these environments. Wheelchairs engineered for use in up to 3T magnetic fields prioritize materials and construction methods that mitigate interference, providing a safe and reliable solution for individuals requiring mobility assistance during MRI procedures.

The 7T segment is estimated to witness the fastest CAGR of 7.76% during the forecast period. In the evolving landscape of medical imaging technology, there is a discernible trend towards addressing the needs of facilities equipped with higher magnetic field strengths, including those up to 7 Tesla (7T). This reflects a commitment within the non-magnetic wheelchair market to adapt to the advancements in diagnostic capabilities. Wheelchair manufacturers are rising to the challenge by developing solutions that meet the stringent safety and performance requirements associated with environments featuring magnetic field strengths up to 7T. These specialized wheelchairs undergo meticulous design and testing processes to ensure their efficacy within these high-field MRI settings, thereby expanding the scope of non-magnetic mobility solutions in the healthcare landscape.

Hospitals segment held the largest revenue share of 52% in 2023. In hospitals, non-magnetic wheelchairs play a crucial role in facilitating the safe and efficient mobility of patients within the complex and often magnetically sensitive environments of diagnostic imaging facilities. The seamless integration of these wheelchairs ensures that individuals with mobility challenges can navigate hospital spaces comfortably while also providing a reliable solution for those undergoing magnetic resonance imaging (MRI) procedures.

The outpatient facilities segment is expected to grow at the fastest CAGR of 7.36% during the forecast period. Outpatient facilities, including diagnostic imaging centers and rehabilitation clinics, are increasingly recognizing the value of non-magnetic wheelchairs in optimizing patient care. These facilities cater to a diverse range of medical needs, and the adoption of non-magnetic wheelchairs aligns with the commitment to maintaining patient safety during MRI examinations. The versatility of these wheelchairs allows outpatient facilities to address the mobility requirements of individuals with varying medical conditions while also ensuring compliance with the stringent safety standards associated with high-field MRI environments.

North America dominated the market with the largest market share of 35% in 2023. In North America, a mature healthcare infrastructure and a high prevalence of advanced diagnostic facilities contribute to a robust demand for non-magnetic wheelchairs. The region's emphasis on patient safety and technological innovation aligns with the features of these wheelchairs, making them integral to healthcare practices in the United States and Canada.

Asia Pacific is expected to grow at the fastest CAGR of 7.98% over the forecast period. The Asia-Pacific region, with its rapidly evolving healthcare landscape, presents a burgeoning opportunity for non-magnetic wheelchair manufacturers. Countries such as China, Japan, and India are witnessing increased investments in healthcare infrastructure and a rising demand for advanced medical equipment. As awareness grows about the benefits of non-magnetic wheelchairs, the Asia-Pacific market is poised for substantial growth, driven by the expansion of diagnostic imaging facilities.

By Patient Weight

By Magnetic Field Strength

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others