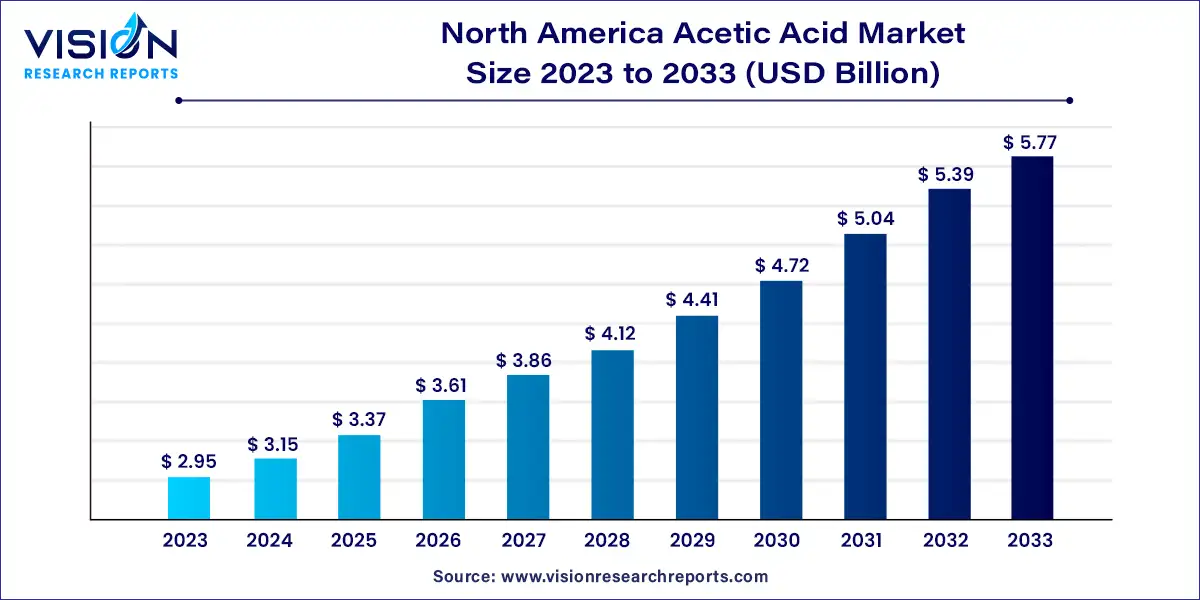

The North America acetic acid market size was estimated at USD 2.95 billion in 2023 and is expected to surpass around USD 5.77 billion by 2033, poised to grow at a CAGR of 6.93% from 2024 to 2033. The North America acetic acid market stands as a vital segment within the region's chemical industry, playing a crucial role in various sectors such as manufacturing, healthcare, and agriculture.

The growth of the North America acetic acid market is propelled by an increasing industrialization across the region drives demand for acetic acid in manufacturing processes, particularly in the production of chemicals, plastics, and textiles. Additionally, the expanding healthcare sector fuels demand for acetic acid in pharmaceutical formulations and medical devices. Moreover, the growing adoption of acetic acid in the food and beverage industry as a preservative and flavor enhancer contributes to market growth. Furthermore, advancements in production technologies and the shift towards bio-based alternatives offer opportunities for market expansion.

In 2023, vinyl acetate monomer (VAM) held the market dominantly, accounting for over 42% of the revenue share. It is projected to exhibit the fastest compound annual growth rate (CAGR) of 7.33% throughout the forecast period. The surge in demand for paints and coatings, driven by an enhanced consumer lifestyle and an uptick in house renovation and redecoration activities, particularly in the U.S., fuels the demand for VAM. Consequently, this upward trend is expected to bolster the demand for acetic acid.

Acetic acid serves as a crucial component in the production of vinyl acetate monomers (VAM), a colorless, slightly sweet liquid. VAM finds application in manufacturing polyvinyl alcohol (PVA) and polyvinyl acetate (PVA). Polyvinyl acetate is utilized in paints, coatings, adhesives, and textile treatments, while polyvinyl alcohol is employed in the production of water-soluble packaging, adhesives, textile wraps, and coatings. Additionally, VAM contributes to the production of polyvinyl butyral and ethylene-vinyl acetate, which are integral in the manufacturing of various end-use products such as car safety glass, packaging films, heavy-duty bags, wire and cable jackets, and coatings.

In 2023, the U.S. dominated the market with a revenue share exceeding 69%. It is also anticipated to exhibit the fastest compound annual growth rate (CAGR) of 7.0% during the forecast period. Acetic acid finds extensive use in the food and beverage industry for food processing purposes. Given that meat constitutes a substantial portion of the food processing sector in the U.S., the product enjoys wide consumption within the country. The steady rise of the U.S. market over the forecast period is expected, influenced by changing consumer lifestyles and increased urbanization, which impact consumption patterns.

The Canadian market for acetic acid is experiencing growth at a comparable CAGR to that of the U.S. With high living standards, Canada has positioned itself as a global leader in per capita coatings consumption rates, matching those of the U.S. The construction industry, a significant end-user of paints and coatings, holds prominence in Canada, constituting 6% of the country's GDP and employing over 1.26 million individuals. This robust industry is poised to drive growth in the coatings segment, subsequently boosting the utilization of VAM in paints and coatings.

In Mexico, the acetic acid market is expanding at a moderate pace, driven primarily by meat processing activities, as meat features prominently in traditional Mexican cuisine. The rapid expansion of slaughterhouses and processing facilities has enhanced product accessibility in Mexico. Strengthening distribution networks within the industry and substantial growth in the food and beverage segment are anticipated to positively impact the acetic acid market in the foreseeable future.

By Application

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others