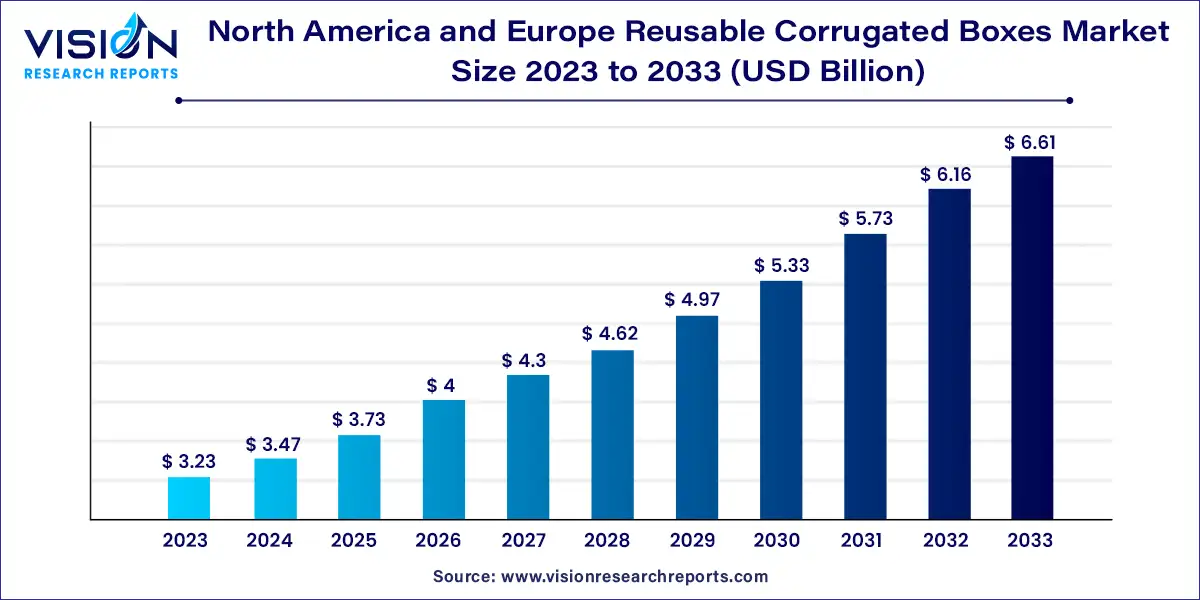

The North America and Europe reusable corrugated boxes market size was valued at USD 3.23 billion in 2023 and it is predicted to hit around USD 6.61 billion by 2033 with a CAGR of 7.43% from 2024 to 2033.

The North America and Europe reusable corrugated boxes market is experiencing robust growth driven by an increasing environmental regulations and consumer demand for sustainable packaging solutions. The shift towards a circular economy, where materials are reused and recycled, is pushing businesses to adopt eco-friendly practices. Advances in packaging technology, such as improved durability and customization options, enhance the appeal of reusable corrugated boxes. Additionally, the expanding e-commerce sector fuels demand for reliable and cost-effective packaging solutions that align with sustainability goals. Regulatory incentives and corporate sustainability commitments further accelerate market adoption, making reusable corrugated boxes a preferred choice for a wide range of industries.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.23 billion |

| Revenue Forecast by 2033 | USD 6.61 billion |

| Growth rate from 2024 to 2033 | CAGR of 7.43% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Mondi Group; Rengo Co., Ltd.; DS Smith; International Paper; sappi; Stora Enso; Trident Paper Box Industries; Packaging Corporation of America; WestRock Company; Packman Packaging; Smurfit Kappa; Cascades Inc.; Georgia-Pacific, LLC.; Nine Dragons Worldwide (China) Investment Group Co., Ltd; Kapco Packaging |

Based on type, the North America & Europe reusable corrugated boxes market is segmented into slotted boxes, telescope boxes, corrugated boxes, and folder boxes. Among these, the telescope boxes dominated the segment with a market share of over 46% in 2023 in terms of revenue. This growth is attributed to the boxes being extra thick and providing additional stacking ability and support for flat, long slender items, heavy items, and fragile products such as pipes, poles, water heaters, and kitchen crockery items.

The corrugated pallets segment is anticipated to grow at the fastest CAGR of 9.34% during the forecast period, owing to the corrugated pallets being considered a lightweight and cost-effective alternative to heavy wooden pallets in various end-use applications. Many landfills no longer accept wood pallets as they are difficult to dispose of. This has driven pallet manufacturers to develop reusable options as an alternative to wooden pallets, which can be further disposed of easily upon completing its service lifecycle. For instance, Green Label Packaging manufactures Ecodek Pallets, manufactured from 100% corrugated paper and assembled with "repulpable" F.D.A.-approved adhesive.

The rising demand for slotted-type corrugated boxes in packaging is driven by several box manufacturers developing slotted-type boxes complying with the edge crush test (ECT) and burst resistance strength test to increase the loading capacity of the slotted corrugated boxes. This further makes them suitable to be reused more than once. These boxes are mainly of four types: regular slotted cartons (RSC), half-slotted cartons (HSC), partial overlap (POL), complete overlap slotted cartons (FOL), and center slotted corrugated boxes. Out of these, regular slotted cartons account for a significant market share of slotted-type reusable corrugated boxes.

Based on end-use, the North America & Europe market for reusable corrugated boxes is categorized into food & beverages, electronics, home & personal care, chemicals, textile goods, glassware & ceramics, paper products, e-commerce, and others. Among these, food & beverage held the largest market share of over 21% in 2023 in terms of revenue. This market growth is due to its utilization in the food & beverage industry for cost savings, supply chain efficiency, and sustainability.

Food & beverage manufacturers mainly receive shipments of food ingredients and packaging materials in sturdy and durable reusable corrugated boxes. These boxes are reused by food & beverage manufacturers for packaging and transportation purposes instead of being disposed of. For instance, Liviri, a U.S.-based wine bottle packaging manufacturer, uses reusable corrugated boxes for wine bottles for a cost-effective supply chain by reducing overall packaging expenses for wine manufacturers.

The e-commerce industry is expected to grow at the fastest CAGR of 10.75% over the forecast period. This is owing to the reusable boxes being considered the backbone of the supply chain in the e-commerce industry. This industry utilizes these boxes to ship fragile, delicate, or heavy products requiring secure and protective packaging. Several e-commerce platforms have shifted from traditional plastic packaging to reusable corrugated boxes to reduce packaging waste and landfills. For instance, in July 2023, Amazon.com, Inc. adopted reusable corrugated boxes as a part of its sustainability goals.

The demand for reusable corrugated boxes in the electronics industry is driven by their utilization to provide cushioning and protection to electronic products such as smartphones. Moreover, electronic manufacturers, such as SAMSUNG, prefer these reusable corrugated boxes as a part of their sustainability initiatives. This allows electronic manufacturers to enhance customer engagement and showcase their sustainability commitment to their customers. For instance, in April 2020, SAMSUNG introduced a new ‘eco-packaging’ made from eco-friendly corrugated cardboard for the packaging of Samsung television models, such as The Frame, The Serif, and The Sero.

By Type

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America and Europe Reusable Corrugated Boxes Market

5.1. COVID-19 Landscape: North America and Europe Reusable Corrugated Boxes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America and Europe Reusable Corrugated Boxes Market, By Type

8.1. North America and Europe Reusable Corrugated Boxes Market, by Type, 2024-2033

8.1.1. Slotted Boxes

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Telescope Boxes

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Folder Boxes

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Corrugated Pallets

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America and Europe Reusable Corrugated Boxes Market, By End-use

9.1. North America and Europe Reusable Corrugated Boxes Market, by End-use, 2024-2033

9.1.1. Food & Beverage

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Electronics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Home & Personal Care

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Chemicals

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Textile Goods

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Glassware & Ceramics

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Paper Products

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. E-commerce

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Others

9.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America and Europe Reusable Corrugated Boxes Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Mondi Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Rengo Co., Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. DS Smith

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. International Paper

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. sappi

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Stora Enso

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Trident Paper Box Industries

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Packaging Corporation of America

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. WestRock Company

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Packman Packaging

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others