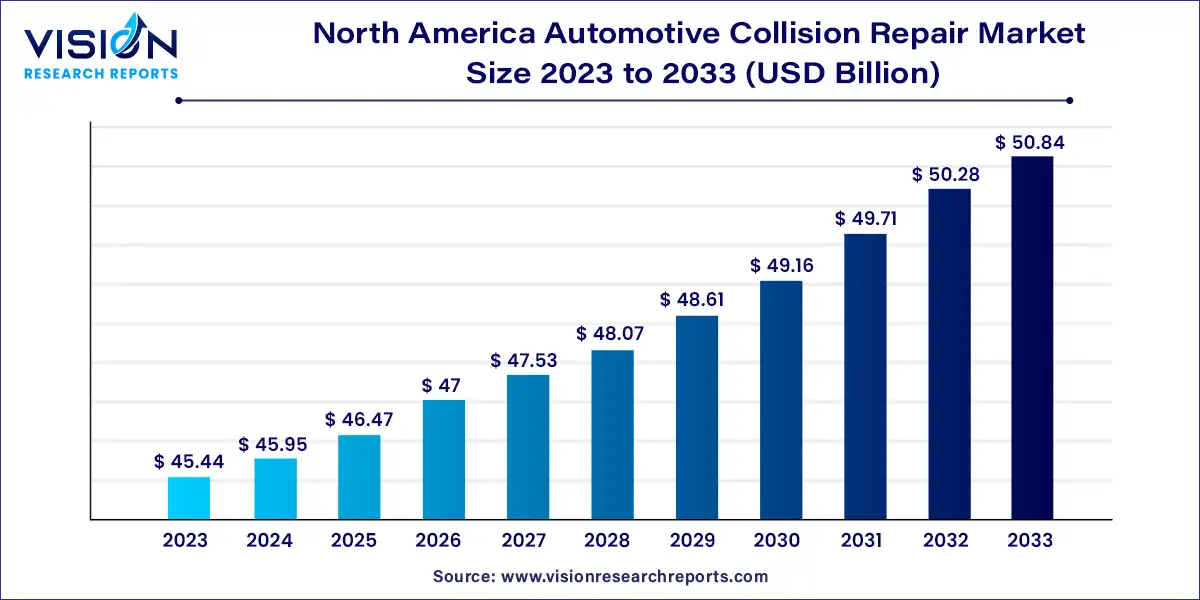

The North America automotive collision repair market size was estimated at around USD 45.44 billion in 2023 and it is projected to hit around USD 50.84 billion by 2033, growing at a CAGR of 1.13% from 2024 to 2033.

The automotive collision repair market in North America is a dynamic sector characterized by constant innovation and evolving consumer preferences. As one of the largest regions for automobile production and ownership, North America presents a lucrative landscape for collision repair service providers.

The growth of the North America automotive collision repair market is propelled by an increasing number of vehicles on the road, coupled with higher traffic congestion, contributes to a greater frequency of accidents, thus driving the demand for collision repair services. Additionally, advancements in automotive technology have led to more complex vehicles with sophisticated components, necessitating specialized repair expertise. Moreover, rising consumer awareness regarding vehicle safety standards has heightened the demand for high-quality repair services that ensure the structural integrity and performance of vehicles post-collision. Furthermore, the integration of innovative repair techniques and technologies, such as paintless dent repair and computerized diagnostic systems, has enhanced the efficiency and effectiveness of collision repair processes, driving market growth.

In 2023, the light-duty vehicle segment held a dominant position in the market, commanding a revenue share of 57%. Projections indicate that this segment will experience the most rapid Compound Annual Growth Rate (CAGR) throughout the forecast period. The surge in electric and hybrid vehicle adoption is a primary driver behind this growth. As electric vehicles (EVs) and hybrids gain traction, collision repair shops have an opportunity to diversify their services to meet the unique needs of these vehicle owners, such as offering battery diagnostics and repair services.

Meanwhile, the heavy-duty vehicle segment is poised to exhibit significant growth in the coming years. Technological advancements in the design and manufacturing of heavy-duty vehicles are reshaping collision repair practices and requirements. Features like telematics systems, vehicle-to-vehicle communication, and autonomous driving capabilities are increasingly prevalent in commercial trucks and buses. Consequently, collision repair shops must adapt by investing in specialized diagnostic equipment, training their technicians in new repair methodologies, and fostering partnerships with manufacturers to access repair data and original equipment manufacturer (OEM) parts.

In 2023, the OE segment, managed by Original Equipment Manufacturers (OEMs), dominated the market share. The increasing complexity of contemporary vehicles, characterized by advanced technology and materials, necessitates specialized expertise and tools for repairs. Consequently, repair shops frequently turn to OE parts to ensure the vehicle's structural integrity and safety post-repair. Moreover, the growing vehicle population on the roads amplifies the demand for collision repair services, underscoring the significance of the OE segment in delivering high-quality replacement components.

Conversely, the DIFM (Do it For Me) segment is projected to experience the fastest compound annual growth rate (CAGR) throughout the forecast period. The escalating sophistication of automotive paint systems drives the demand for professional collision repair services. Modern paint formulations demand precise application techniques and equipment to achieve flawless color matching and finish quality. Professional collision repair establishments boast cutting-edge paint booths and skilled technicians proficient in delivering impeccable paintwork results.

In 2023, the spare parts segment emerged as the dominant market player. Vehicle complexity and platform consolidation have notable impacts on this segment, especially concerning parts standardization and compatibility. Standardizing parts and components not only reduce manufacturing costs but also simplifies inventory management and repair processes for collision repair shops. Additionally, advancements in modular design and component sharing empower spare parts suppliers to offer cost-effective solutions that address the repair requirements of diverse vehicle models and brands, thereby augmenting efficiency and profitability in the collision repair market.

Conversely, the paints & coatings segment is poised to witness the fastest compound annual growth rate (CAGR) over the forecast period. Innovations in automotive paints and coatings, such as the integration of nanoparticles into paint formulations, are driving the segment's growth by significantly enhancing aesthetic appeal and performance.

In 2023, the automotive collision repair market in the U.S. held the leading share in the North America region, and it is anticipated to exhibit significant growth at a considerable Compound Annual Growth Rate (CAGR) throughout the forecast period. Market expansion is propelled by advancements in materials science, with vehicle manufacturers increasingly adopting advanced materials like high-strength steel, aluminum, and composites to enhance fuel efficiency, safety, and overall performance. While these materials offer advantages such as weight reduction and improved structural integrity, they also pose challenges for repair technicians. Working with such materials often requires specialized equipment, training, and techniques, thereby adding complexity and cost to collision repairs.

On the other hand, the Canadian automotive collision repair market is poised to register the fastest CAGR over the forecast period. Diverse weather patterns across various regions, including harsh winters characterized by snow and ice, contribute to a heightened frequency of accidents and collisions on Canadian roads. Consequently, there is a heightened demand for collision repair services, particularly during the winter months. This seasonal fluctuation in demand influences the operational planning and resource allocation strategies of collision repair shops

By Vehicle

By Product

By Service Channels

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others