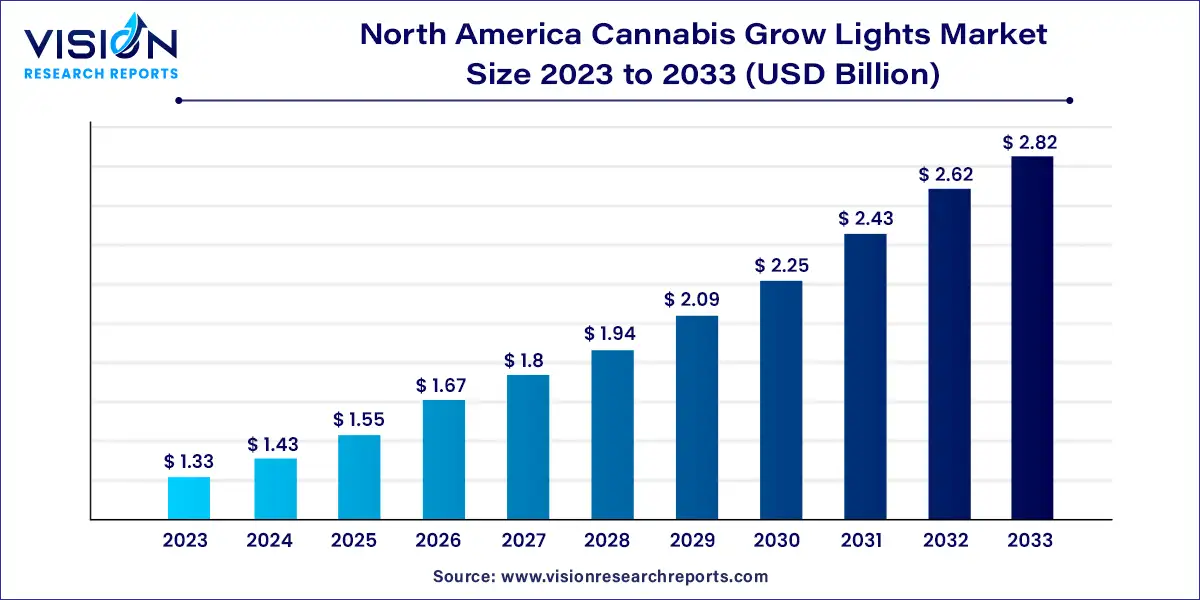

The North America cannabis grow lights market size was valued at USD 1.33 billion in 2023 and it is predicted to surpass around USD 2.82 billion by 2033 with a CAGR of 7.82% from 2024 to 2033.

North America has experienced significant growth, driven by regulatory changes and increasing consumer demand. A crucial component of successful cannabis cultivation is the use of specialized grow lights, which play a pivotal role in optimizing plant growth, quality, and yield indoors.

The growth of the North America cannabis grow lights market is driven by an increasing legalization of cannabis across various states and provinces has spurred demand for indoor cultivation technologies, including advanced grow lights. Technological advancements in lighting, such as LED and HPS systems, offer energy-efficient solutions tailored to enhance plant growth and maximize yields. Moreover, there is a rising emphasis on producing high-quality cannabis products, prompting cultivators to invest in premium lighting systems to achieve consistent quality and cannabinoid profiles. Additionally, the industry's shift towards sustainable practices has led to the adoption of environmentally friendly lighting solutions that minimize operational costs and carbon footprints.

The LED segment emerged as the market leader in 2023, capturing the largest revenue share at approximately 44%. The increasing demand for efficient and effective LED grow lights mirrors the rapid expansion of the cannabis industry in North America. This growth is largely fueled by the ongoing legalization of cannabis, which enables more cultivators to legally produce cannabis for both medical and recreational purposes.

The adoption of LED technology has significantly contributed to the surge in demand. Historically, LED grow lights faced challenges in providing adequate light intensity for plant growth. However, advancements in LED technology have overcome these limitations, resulting in brighter and more efficient lighting solutions. Modern LED grow lights now offer full-spectrum illumination necessary for robust plant growth and photosynthesis, thereby promoting healthier and higher-quality cannabis plants.

The high-intensity discharge (HID) lamps/lights segment is projected to grow at a compound annual growth rate (CAGR) exceeding 8.03% during the forecast period. This segment includes high-pressure sodium (HPS) bulbs and metal-halide (MH) lights. HPS lights are favored for their ability to support cannabis growth from seedling to harvest, with many growers initially using MH bulbs to control plant height before transitioning to HPS during the flowering stage. HPS lights are renowned for their capacity to yield large, dense buds, driving segment growth in the coming years.

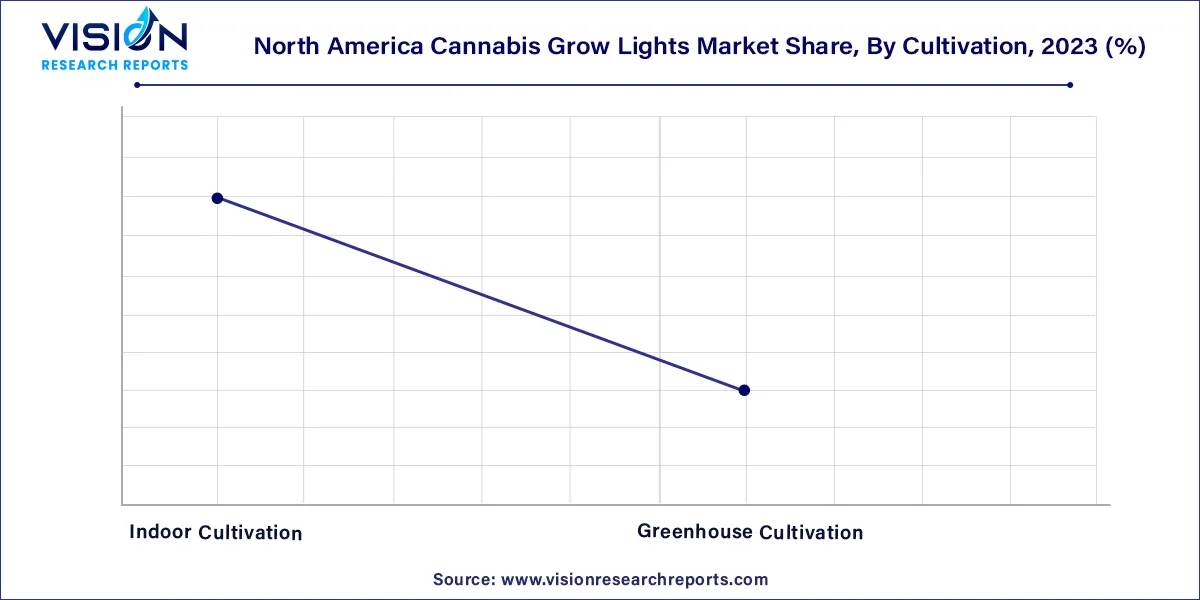

In 2023, indoor cultivation led the market in revenue share and is anticipated to exhibit the highest CAGR throughout the forecast period. The dominance of indoor cultivation is attributed to the expanding legalization of cannabis for indoor growing and the increasing demand for cannabis-derived products in North America. According to the "State of the Cannabis Lighting Market" report by Cannabis Business Times and Fluence, 88% of surveyed participants in the U.S. cultivated cannabis indoors under artificial lighting in 2022.

The greenhouse cultivation segment is also poised for significant growth. In response to environmental challenges, there is a growing trend towards greenhouse cultivation, which provides controlled environments conducive to cannabis cultivation. Similarly, the same report indicated that 28% of respondents in the U.S. engaged in greenhouse cultivation using supplemental and natural lighting in 2022.

The United States dominated the cannabis grow lights market in 2023, holding the largest revenue share. The widespread use of cannabis across pharmaceutical, cosmetic, and food & beverage industries is a key driver of market growth. The increasing legalization of cannabis for medical purposes and growing acceptance of its therapeutic benefits are further propelling market expansion. Additionally, heightened research into cannabis applications and medicinal properties is bolstering demand, supported by the introduction of technologically advanced products. For instance, Mammoth Lighting launched a new LED grow light in October 2023, featuring the Samsung EVO chip and a green photon boost, resulting in improved yields and plant quality during trials.

By Product

By Cultivation

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others