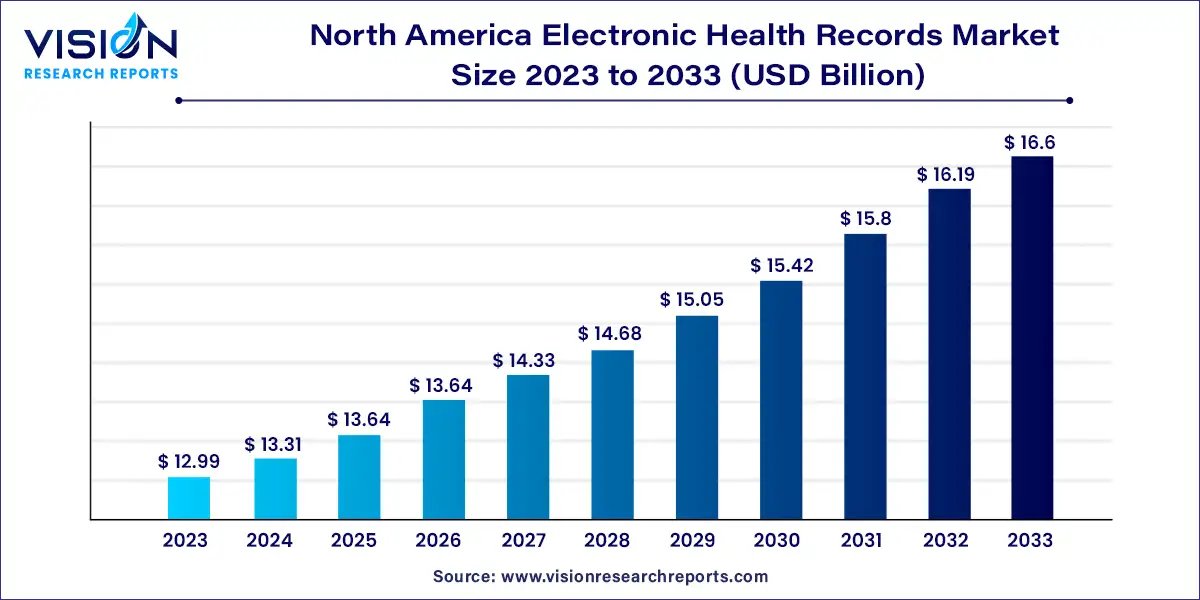

The North America electronic health records market size was estimated at around USD 12.99 billion in 2023 and it is projected to hit around USD 16.6 billion by 2033, growing at a CAGR of 2.48% from 2024 to 2033.

The North America electronic health records (EHR) market showcases a dynamic landscape driven by technological advancements and regulatory initiatives aimed at enhancing healthcare delivery. As of the latest assessments, the market is characterized by robust adoption across various healthcare facilities, including hospitals, clinics, and specialty centers. Key factors influencing market growth include the increasing need for interoperability, patient data security measures, and the integration of artificial intelligence to streamline healthcare workflows.

The growth of the North America electronic health records (EHR) market is driven by an increasing emphasis on interoperability and data exchange within the healthcare sector. This demand is fueled by efforts to enhance care coordination and patient outcomes across diverse healthcare settings. Additionally, stringent regulations like HIPAA (Health Insurance Portability and Accountability Act) drive the adoption of EHR systems, ensuring compliance with data security and privacy standards. The integration of advanced technologies such as artificial intelligence (AI) and machine learning further accelerates market growth, enabling healthcare providers to optimize workflows and decision-making processes. Moreover, the shift towards cloud-based EHR solutions offers scalability and cost-efficiency advantages, appealing to healthcare organizations looking to modernize their operations.

In 2023, the web-based EHR segment dominated the market with a commanding 56% market share and is poised to exhibit the highest growth rate during the forecast period. This segment's popularity among smaller-scale healthcare providers and physicians stems from its ability to be implemented without in-house servers and its flexibility in customization to meet specific customer needs. Major EHR vendors are launching new web-based solutions and expanding their service offerings to meet escalating demand, further driving segment growth. For example, in March 2022, MEDITECH extended its Expanse Ambulatory system to independent and physician-owned practices, independent of requiring an Expanse EHR in a hospital setting.

Additionally, the client-server-based EHR segment is expected to experience significant growth. This system type provides secure, in-house data storage, which appeals to multi-physician facilities seeking tailored solutions. Unlike web-based EHRs, these systems operate independently of constant internet connectivity, a key driver for their adoption.

The acute care segment commanded a 47% market share in 2023, driven by widespread adoption in hospitals to enhance patient care, streamline workflows, and meet regulatory standards. For instance, according to ONC, by 2021, 86% of non-Federal general acute care hospitals had adopted a 2015 Edition certified EHR.

The post-acute care segment is projected to grow most rapidly during the forecast period. Market players are pursuing merger and acquisition strategies to expand their service portfolios, improve care coordination, and strengthen their market position. For example, in January 2024, PointClickCare Technologies acquired American HealthTech, a CPSI subsidiary specializing in EHR solutions for post-acute care. This acquisition enhances PointClickCare's presence in this sector, facilitating greater provider connectivity and improving care collaboration and value-based care delivery.

In 2023, the professional services segment led the market with a 33% share and is expected to grow most rapidly during the forecast period. These services enable healthcare organizations to design and implement EHR systems effectively, enhancing patient outcomes, optimizing resource utilization, and facilitating data-driven decision-making. Continuous advancements in the professional services EHR business model in North America are driving this growth. For example, in January 2021, the U.S. Orthopedic Alliance (USOA) partnered with Veradigm LLC to accelerate the adoption of EHRs in orthopedic practices, offering evidence-based guidelines and value-based care analytics.

The EHR subscription model is gaining traction among small and medium-sized healthcare organizations due to its affordability compared to licensed software. It eliminates costs such as license fees, regular upgrades, and device maintenance, reducing the need for in-house IT staff. This model's popularity is expected to increase further, driven by its cost-effectiveness and user-friendly operation. Larger healthcare facilities may incur annual subscription fees up to USD 500,000 for leading EHR software like Epic EHR.

The cardiology segment is anticipated to grow rapidly, driven by rising hospitalizations due to cardiovascular diseases like coronary heart disease and stroke. According to the American Heart Association's 2024 Statistical Update, cardiovascular diseases remain leading causes of death in the U.S., underscoring the need for efficient EHR systems to monitor and prevent medication errors.

The oncology segment is also expected to capture a significant market share, fueled by increasing cancer incidence rates. The National Cancer Institute estimates over 2 million new cancer cases in 2024, highlighting the demand for effective EHR solutions to manage patient data and treatment protocols.

Hospitals dominated the EHR market in 2023 with a 61% share, driven by efforts to enhance clinical, financial, and administrative efficiency. The shift towards value-based care further boosts EHR adoption, with U.S. hospital adoption reaching 96% by 2021, according to ONC.

The ambulatory care segment is projected to grow fastest, supported by technological advancements and government initiatives promoting seamless healthcare information exchange. Adoption of enterprise-wide patient flow systems is high, especially in critical care areas, as reported by the College of Healthcare Information Management Executives.

The U.S. held the largest share of the EHR market in 2023, driven by robust regulatory frameworks, substantial R&D investments, and increasing interoperability needs. Key players like Oracle, GE Healthcare, and Epic Systems compete based on factors such as cost, functionality, and customer support, reflecting a competitive landscape focused on advancing healthcare IT solutions.

By Product

By Type

By Business Model

By Application

By End-use

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others