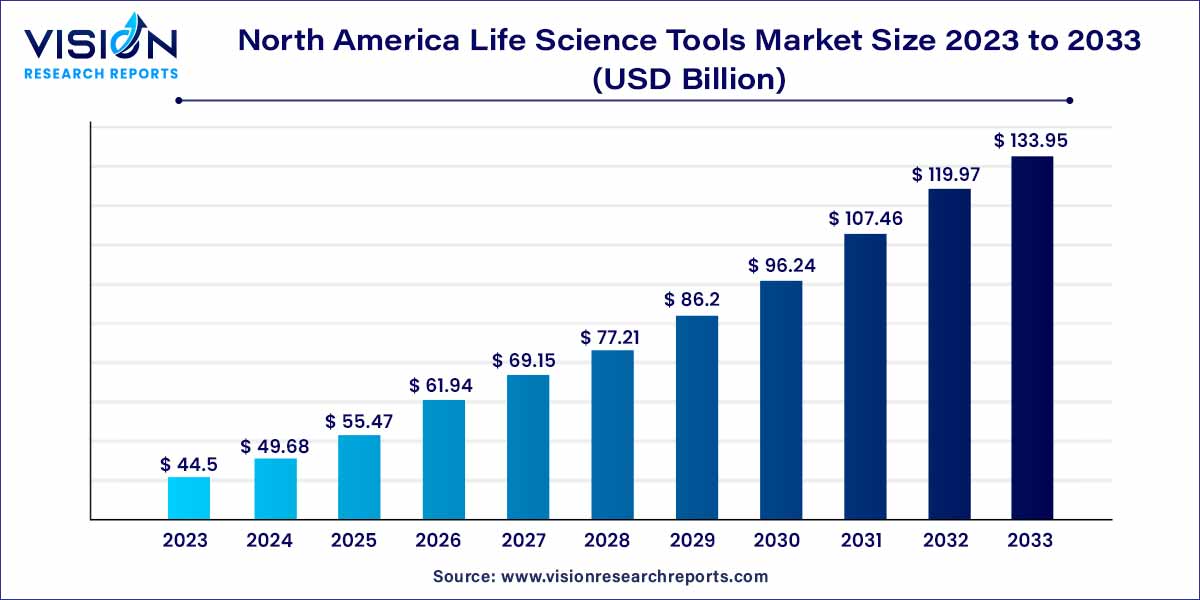

The North America life science tools market size was valued at USD 44.5 billion in 2023 and is projected to surpass around USD 133.95 billion by 2033 and is expected to grow at a compound annual growth rate (CAGR) of 11.65% from 2024 to 2033.

Increased government funding for life science technologies is expected to drive the market at a significant rate. Organizations, such as The National Human Genome Research Institute (NHGRI) and the National Institutes of Health (NIH), are actively funding multiple life science projects. The NHGRI collaborates with researchers and scientists to provide funds for genomic research, such as identification of the genomic basis of human diseases, and health; and understand the complexities associated with the human genome. NHGRI is working toward the application of genomic technologies to enhance patient care and benefit society.

The Glycoscience Program, 4D Nucleome Program, and Gabriella Miller Kids First Pediatric Research Program are the NIH common fund awards for biomedical research. During the Covid-19 pandemic, the U.S. FDA granted Emergency Use Authorizations (EUAs) to several diagnostic tests to make them rapidly and easily available for use. The FDA has issued EUAs to various types of Covid-19 tests, such as PCR-based molecular tests and serological & antigen tests. Thermo Fisher announced in March 2020 to develop up to 5 million Covid-19 test kits.

Moreover, in May 2020, the company stated that the FDA expanded the EUA for the company’s real-time PCR test, which detects nucleic acid from SARS‑CoV‑2. This approval expanded the application of the TaqPath Covid-19 Combo Kit developed by Thermo Fisher along with Applied Biosystems’ 7500 Real-time PCR series system. Likewise, in June 2020, Biocept, Inc. stated the availability of 10,000 nasopharyngeal specimen collection kits that provide RT-PCR-based testing for Covid-19.

In addition to PCR, several other nucleic acid assays, such as isothermal amplification assays, amplicon-based metagenomics sequencing, hybridization microarray assays, and CRISPR-related technologies, are also gaining momentum in the marketplace. The number of FDA EUA-approved tests is constantly increasing with a number of tests under development.

For instance, in August 2020, Oxford Nanopore introduced LamPORE, a portable test designed for the detection of Covid-19 and other seasonal flu viruses from saliva or swab samples within an hour. This test is based on the Loop-Mediated Isothermal Amplification (LAMP), a DNA amplification technology that only requires one incubation temperature, simple machinery, and provides faster results than PCR. Such initiatives are expected to drive market growth.

The North America Life Science Tools market is a dynamic and rapidly evolving sector that plays a pivotal role in advancing scientific research and technological innovations. This overview delves into the key aspects of this market, providing insights into its current landscape, trends, and future prospects.

The growth of the North America Life Science Tools market is fueled by several key factors. Firstly, the region's robust investment in research and development activities serves as a significant catalyst, driving continuous innovation in life science tools. The emphasis on precision medicine and the increasing understanding of biological processes further contribute to the expanding market. Additionally, the well-established infrastructure and supportive regulatory environment in North America create a conducive landscape for the development and commercialization of advanced life science tools. The ongoing technological advancements, particularly in genomics, proteomics, and imaging technologies, play a pivotal role in shaping the market dynamics. Furthermore, collaborations and partnerships among industry players foster a collaborative ecosystem, promoting knowledge exchange and accelerating the pace of discoveries. Overall, these growth factors collectively propel the North America Life Science Tools market, positioning it as a dynamic and evolving sector with considerable potential for future advancements.

Cell biology technology dominated the market in 2023 and accounted for the largest revenue share of over 36%. The relevance of cell biology technology in drug discovery and the rise in NIH/NSF funding for cell biology can be attributed to the segment’s steady growth.

In addition, advancements in liquid handling and flow cytometry have led to a dramatic rise in the applications of cell-based assays for drug discovery. Moreover, late-stage failure of pre-clinical animal models during drug discovery further increases the adoption of cell-based assays as they offer a practical alternative by predicting in vivo activities of novel drug candidates. Mass spectrometry is a key technique employed throughout the proteomic workflows.

Thus, technological advancements in mass spectrometry drive proteomic discovery capabilities. Development of high-mass accuracy, high-resolution mass spectrometers, such as Orbitrap and time-of-flight (TOF) mass analyzers have improved the identification of posttranslational modifications, and peptides. Enhancement of mass resolution has led to an increase in the overall mass range, thereby leading toward efficient analysis.

The cell biology product segment led the global market in 2023 with a revenue share of over 25%. Researchers in the life science industry are keen on adopting modern instruments, which is expected to drive the segment growth. This trend has encouraged several manufacturers to expand their cell biology instrument portfolios. For instance, Cytiva, Horizon Discovery, BioTek Instruments, and Seahorse Bioscience, are focusing on developing instruments pertaining to cell biology, analysis, and imaging.

Each of the cell biology applications demands specific sets of protocols, techniques, and lab instruments. Early developments in this segment have offered scientists with significant insights, further encouraging the development of confocal scanning microscopy and electron microscopy, making them mainstream instruments. Recent trends in the life science tools industry have propelled technological interventions aimed at advancing drug research.

The integration of smart technology has enhanced the efficiency of patient assessment, fueling the demand for separation technologies, Next-Generation Sequencing (NGS), and PCR. In addition, the development of integrated devices, such as MRI scans, in-patient monitoring & management tools, and laboratory equipment, is aiding in improved assessment & management of patients, which is expected to propel the market.

Through these integrated devices, healthcare professionals can process the data required to prescribe the right medications to patients. Collaborations between several industry stakeholders have significantly driven innovations in this field, encouraging emerging entities to invest in the development of modern life science tools. In addition, the advent of modern tools, such as bi-specific antibodies, nanosensors, and computational biology, has prompted further collaborations between manufacturing entities across a range of disciplines, including flow cytometry, mass spectrometry, and nucleic acid microarray.

Healthcare dominated the end-use segment in 2023 with a revenue share of over 37% as several hospitals and clinics are currently offering sequencing services to patients and are determining the use of this technology in the daily practice of medicine. Stanford Medicine is one such hospital that offers sequencing service to individuals who have a rare or undiagnosed condition that is believed to be genetic. Partners HealthCare in the U.S. is one of the first hospital systems to provide genomic sequencing, analysis, and interpretation services to the public. It has enrolled over 200 patients and physicians in a study funded by NIH to study the integration of whole-genome sequencing in clinical medicine. The industrial sector includes applied applications of life science tools within the bioengineering and applied biosciences fields.

The market is marked by multi-disciplinary research within the biological engineering, and novel biosciences domains. The segment is inclusive of biochemical engineering, pharmaceutical engineering, and other applied sciences. Proteomics technology has been used in drug discovery, development, neuroscience, apoptosis, and toxicology analysis. The knowledge of proteomics science has been applied in the food industry to characterize and map changes in the protein components present in foods during production.

The U.S. dominated the market in North America in 2023 with a revenue share of over 88%. The application of life sciences tools in disease diagnosis is anticipated to propel the U.S. market. For instance, in June 2020, the FDA issued an emergency use authorization for COVIDSeq Test; an NGS-based Covid-19 diagnostic test developed by Illumina. Owing to the use of NGS, the viral genomic sequence obtained from samples can be used for research to understand the mutation patterns of the virus.

The U.S. has been a host to several conferences and seminars pertaining to life science research. These events keep the researchers updated with the latest technologies and, thereby, increase the adoption of life science tools. The American Society for Mass Spectrometry has planned to organize the 69th ASMS Conference on Mass Spectrometry and Allied Topics in June 2021 in Philadelphia. Such initiatives are anticipated to increase revenue generation in the U.S. life science tools market.

An increase in R&D in biotechnology due to growing funding by the Canadian government has led to increased demand for life science tools, thus boosting the market growth in the country. In October 2020, the Canadian government announced to invest USD 6.5 million for Toronto Innovation Acceleration Partners (TIAP). TIAP is a membership-based organization of research hospitals, institutions, and top universities in Canada that work to improve and advance various health science technologies.

By Technology

By Product

By End-use

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others