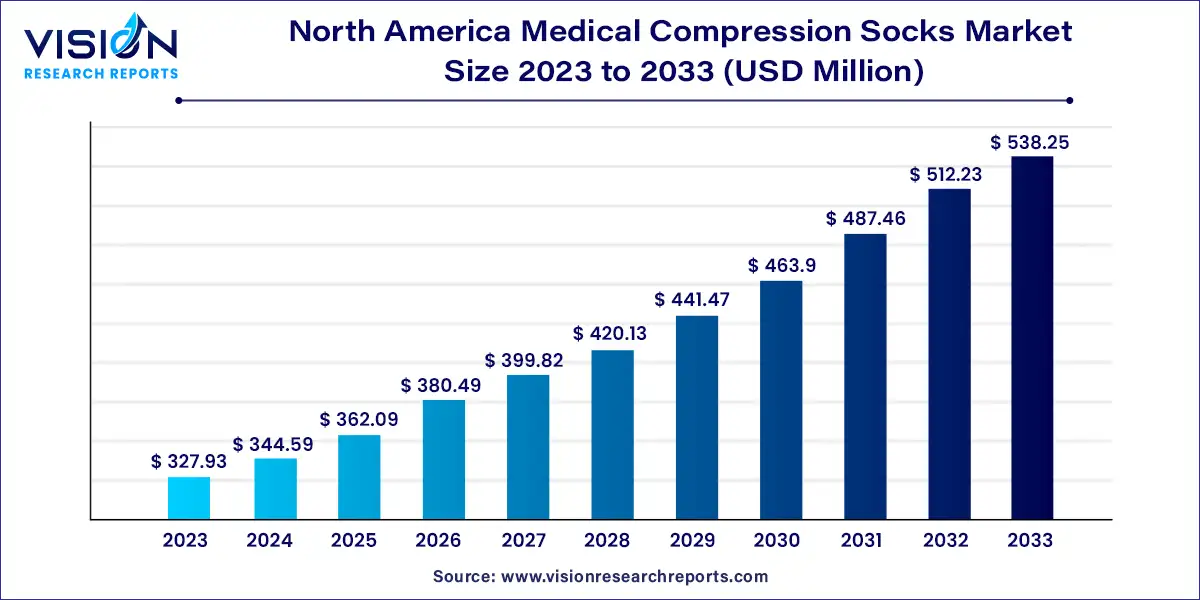

The North America medical compression socks market size was valued at USD 327.93 million in 2023 and it is predicted to surpass around USD 538.25 million by 2033 with a CAGR of 5.08% from 2024 to 2033. The North America medical compression market encompasses a diverse range of products designed to apply pressure to specific areas of the body for therapeutic purposes. These products are commonly used in the management of venous disorders, edema, and other health conditions.

The North American medical compression market is experiencing robust growth driven by an increasing prevalence of chronic venous insufficiency (CVI) and other venous disorders is significantly boosting demand for compression products. As the aging population in North America expands, the need for effective management of chronic conditions such as varicose veins and edema is rising. Additionally, advancements in compression technology, including the development of more comfortable and efficient materials, are enhancing product appeal and functionality. The growing awareness among healthcare professionals and patients about the benefits of compression therapy further supports market growth, as does the rising focus on preventive care and health management.

In 2023, athletes and sports enthusiasts were the leading segment in the market, capturing 34% of the share. Brands like CEP and 2XU dominate this space, offering compression socks tailored for athletic performance. These socks are engineered to enhance blood circulation, minimize muscle fatigue, and accelerate post-exercise recovery. Utilizing graduated compression technology, these brands provide a range of styles to meet varying preferences and needs. The effectiveness of these products in reducing muscle soreness and inflammation has led to their increasing popularity among athletes, who seek improved performance and faster recovery.

The traveler segment is anticipated to see significant growth over the forecast period. Extended periods of sitting during travel by plane, train, car, or bus elevate the risk of swelling, discomfort, and Deep Vein Thrombosis (DVT), according to vascular vein centers. Travelers are seeking compression socks that mitigate these risks while remaining durable through frequent use and washing. Additionally, ease of use—ensuring the socks are simple to put on and take off—is essential for accommodating the practical needs of those on the move.

The North American market for medical compression socks is influenced by stringent regulations, high rates of diabetes and cardiovascular diseases, and a cultural shift toward proactive health management. An aging population and a focus on innovation, as demonstrated by events like Exintex in Mexico, further drive market growth and highlight unique challenges. Economic factors also play a role, with consumers willing to invest in health-related products. Advances in fabric technology and design have made compression socks more comfortable and appealing, expanding their user base beyond medical needs to include athletes and individuals in professions requiring prolonged standing. A 2024 clinical study involving 85 lymphedema patients compared JOBST Confidence with previously used garments, revealing superior ratings in range of motion, moisture management, wearing comfort, and overall patient satisfaction.

U.S. Medical Compression Socks Market Trends

In 2023, the U.S. held the largest share of the North American medical compression socks market and is projected to experience rapid growth. This expansion is driven by an aging population and increasing rates of chronic conditions such as diabetes and obesity. The growing awareness of compression therapy's health benefits, along with advancements in materials and design, fuels this growth. The rise of telemedicine and e-commerce platforms also enhances access to these products. Notably, a clinical study indicated that nearly 80% of patients using knee-high compression socks experienced reduced leg swelling, and over 70% reported decreased pain and discomfort over six months, underscoring the effectiveness and rising demand for these products.

Canada Medical Compression Socks Market Trends

The Canadian market for medical compression socks is steadily expanding, largely due to the country’s aging demographic and high prevalence of venous diseases. Chronic venous insufficiency affects over 17% of Canadians, creating a substantial demand for compression socks. Additionally, increased government funding for healthcare and initiatives promoting preventive care have positively impacted market growth. The popularity of compression therapy for performance enhancement and recovery among athletes is also contributing to the market's expansion.

Mexico Medical Compression Socks Market Trends

In Mexico, the growth of the medical compression socks market is fueled by an aging population and rising rates of obesity and diabetes. The International Diabetes Federation reported that in 2021, approximately 14.1 million individuals aged 20-79 in Mexico were living with diabetes, leading to complications such as venous ulcers that require compression therapy. The expanding e-commerce sector and growing awareness of health and wellness further support market growth in the region.

By Target Group

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Medical Compression Socks Market

5.1. COVID-19 Landscape: North America Medical Compression Socks Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Medical Compression Socks Market, By Target Group

8.1. North America Medical Compression Socks Market, by Target Group Type, 2024-2033

8.1.1. Athletes/Sports People

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Travelers

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Expecting/Young Moms

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Sedentary Professionals

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Medical Compression Socks Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Target Group (2021-2033)

Chapter 10. Company Profiles

10.1. Julius Zorn, Inc.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Essity

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. SIGVARIS GROUP

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Medi

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Goodhew, LLC

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Cardinal Health

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Medline

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Mölnlycke Health Care AB

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. CHARMKING

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Thuasne

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others