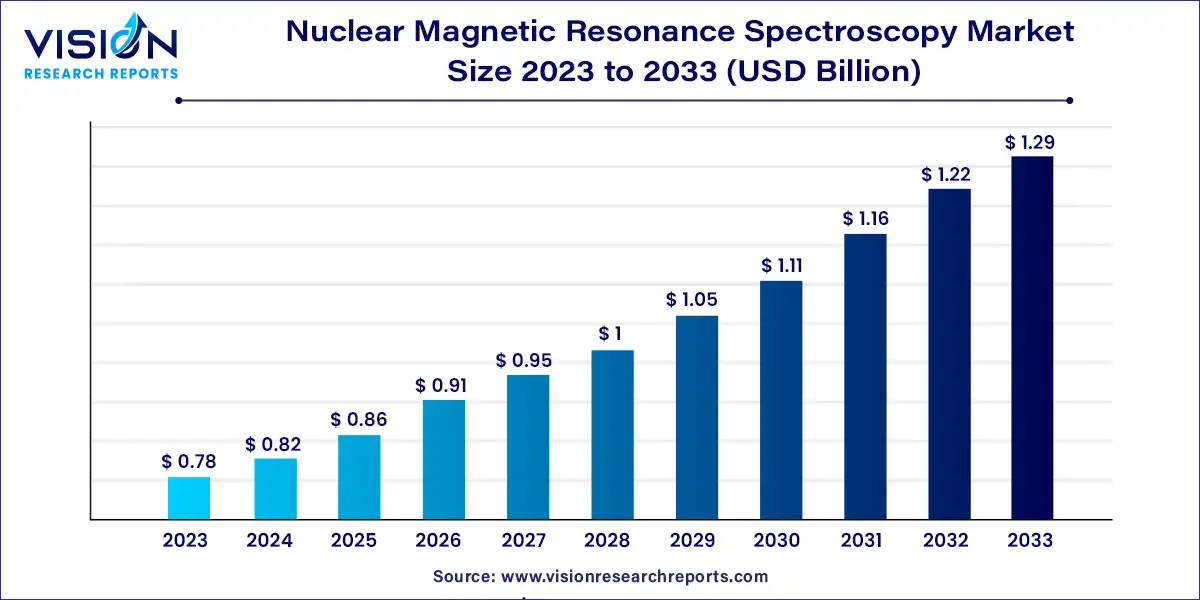

The global nuclear magnetic resonance spectroscopy market size was estimated at around USD 0.78 billion in 2023 and it is projected to hit around USD 1.29 billion by 2033, growing at a CAGR of 5.12% from 2024 to 2033.

Nuclear magnetic resonance (NMR) spectroscopy has emerged as a pivotal analytical technique in various scientific disciplines, including chemistry, biochemistry, and medicine. This non-destructive method provides detailed insights into the structure, dynamics, and interactions of molecules by exploiting the magnetic properties of atomic nuclei. The global market for NMR spectroscopy is witnessing steady growth, driven by increasing applications across research institutions, pharmaceutical companies, and clinical diagnostics.

The growth of the nuclear magnetic resonance (NMR) spectroscopy market is driven by an advancements in technology, particularly in magnet technology and software algorithms that enhance instrument sensitivity and resolution. This has expanded the application of NMR spectroscopy in complex molecular analysis across various sectors such as pharmaceuticals, biotechnology, and materials science. Additionally, the increasing research activities in drug discovery and biomolecular research, coupled with its non-invasive clinical applications in disease diagnostics, contribute significantly to market expansion.

Instruments maintained market dominance with an 81% share in 2023, driven by increased adoption in research. Notably, Numares' FDA approval of the AXINON System in July 2023 for cardiovascular lipoprotein analysis marked a significant milestone. Advancements in spectrometer technology, including enhanced detector integration, optical designs, and advanced software, are expected to further propel instrument adoption by 2033. Additionally, the introduction of innovative technologies through new product launches is set to positively impact segment growth.

The Consumables segment is poised to register the fastest CAGR during the forecast period. This growth is fueled by rising demand for advanced analytical techniques across pharmaceuticals, materials science, and biotechnology. NMR consumables such as specialized sample tubes and solvents are critical for ensuring precise and reproducible experimental outcomes. For instance, JEOL Ltd.'s introduction of the Cryogen Reclamation System in April 2023, aimed at reducing cryogenic material evaporation in NMR instruments, illustrates ongoing product innovations driving segment expansion.

Academic institutions led the nuclear magnetic resonance spectroscopy market with a 47% share in 2023. Increased investments in advanced analytical instrumentation within academia are expected to accelerate segment growth. For example, the University of Warwick's USD 20.7 million funding in December 2022 for a 1.2 GHz NMR instrument underscores this trend. Moreover, academic institutions play a pivotal role in knowledge transfer through seminars and meetings, further boosting segment growth.

The Agriculture and Food segment is forecasted to experience rapid growth during the forecast period. In the food industry, NMR supports quality assessment and authenticity verification, crucial for detecting contaminants in products like olive oil and fruit juices. Additionally, in agriculture, NMR aids in soil analysis to optimize fertilization strategies and enhance crop productivity while minimizing environmental impact.

High-field NMR spectroscopy dominated with an 89% market share in 2023, driven by technological advancements and increasing demand across various sectors. Advancements such as cryogen-free spectrometers and enhanced data analysis software have made high-field NMR more accessible, efficient, and cost-effective. Its extensive applications in organic chemistry, biochemistry, and pharmaceuticals for detailed molecular structure analysis are expected to sustain steady market growth.

Low-field NMR spectroscopy is projected to record the fastest CAGR, driven by its affordability and versatile applications across industries. Operating at fields below 100 MHz, low-field NMR systems offer cost-effective solutions suitable for academic, research, and industrial settings. The affordability and efficiency of benchtop spectrometers, demonstrated in research at Aston University in September 2023, highlight their potential in expanding NMR applications.

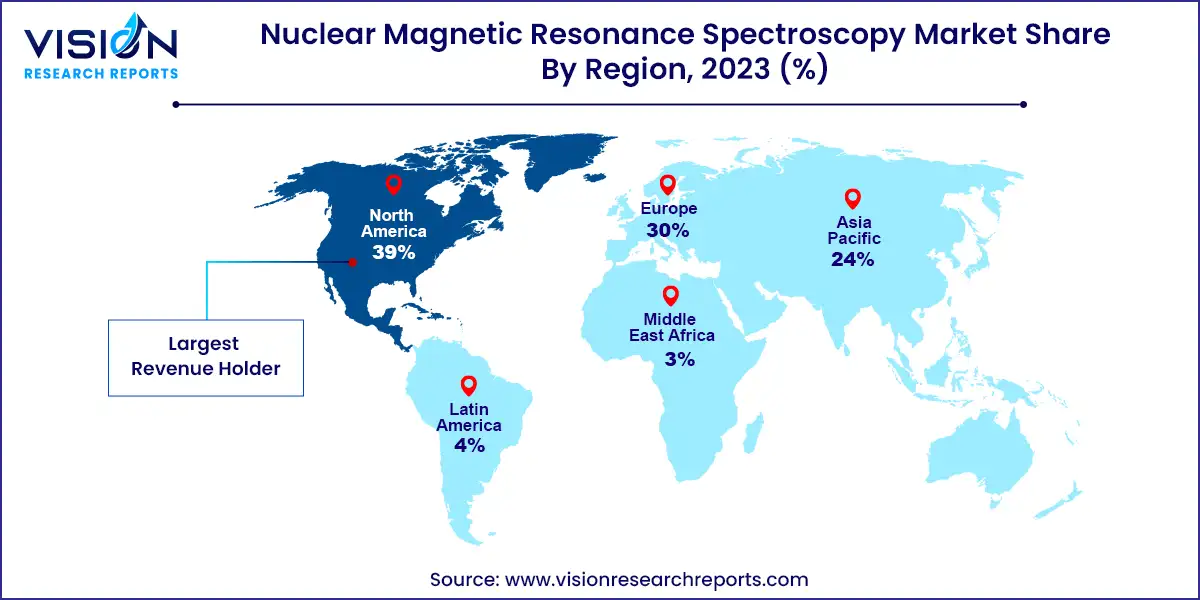

North America held a significant share of 39% in the global NMR spectroscopy market, driven by a robust pharmaceutical industry and healthcare infrastructure in the U.S. Demand for NMR spectroscopy in clinical diagnostics and research further supports market growth in the region.

The Asia Pacific region is poised to witness the fastest CAGR, fueled by expanding pharmaceutical and biotechnology industries in countries like China and India. Government initiatives supporting healthcare advancements and ongoing innovations in disease research are anticipated to drive market expansion in this dynamic region.

By Product

By Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Nuclear Magnetic Resonance Spectroscopy Market

5.1. COVID-19 Landscape: Nuclear Magnetic Resonance Spectroscopy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Nuclear Magnetic Resonance Spectroscopy Market, By Product

8.1. Nuclear Magnetic Resonance Spectroscopy Market, by Product, 2024-2033

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Nuclear Magnetic Resonance Spectroscopy Market, By Type

9.1. Nuclear Magnetic Resonance Spectroscopy Market, by Type, 2024-2033

9.1.1. Low-field NMR Spectroscopy

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. High-field NMR Spectroscopy

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Nuclear Magnetic Resonance Spectroscopy Market, By End-use

10.1. Nuclear Magnetic Resonance Spectroscopy Market, by End-use, 2024-2033

10.1.1. Academic

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pharmaceutical & Biotech Companies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Agriculture & Food

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Chemical Industry

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Nuclear Magnetic Resonance Spectroscopy Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. JEOL Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Thermo Fisher Scientific Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bruker

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Magritek

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Oxford Instruments

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Nanalysis Corp.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Anasazi Instruments, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. QOneTec

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Advanced Magnetic Resonance Limited

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others