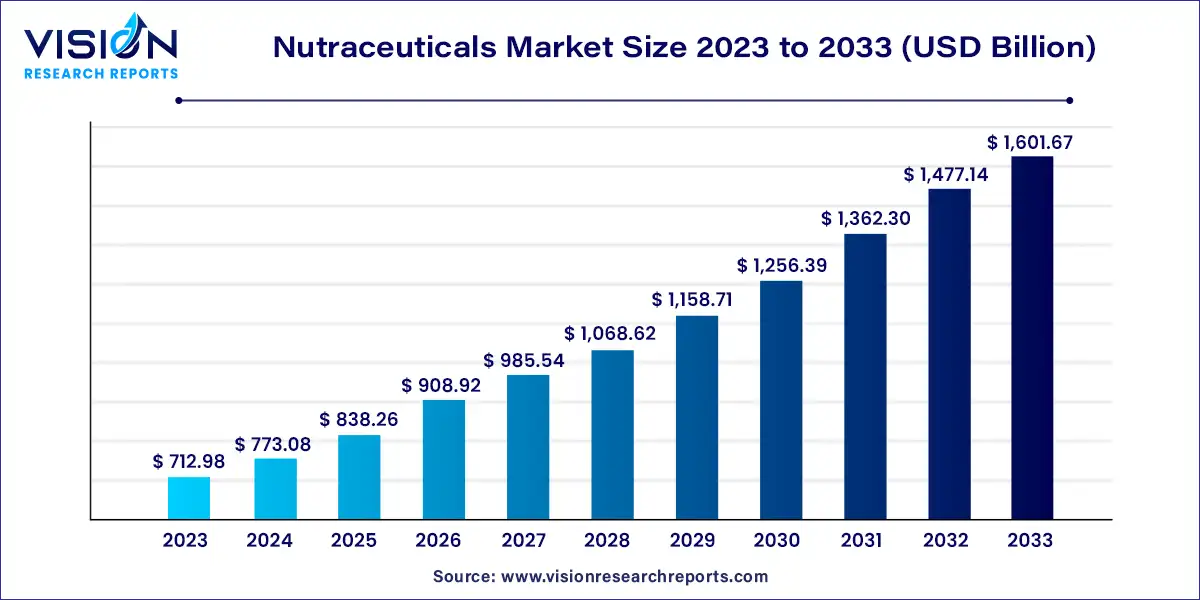

The global nutraceuticals market size was valued at USD 712.98 billion in 2023 and is anticipated to reach around USD 1,601.67 billion by 2033, growing at a CAGR of 8.43% from 2024 to 2033. The nutraceuticals market, a vibrant segment within the global health and wellness industry, is gaining significant traction. Nutraceuticals, derived from "nutrition" and "pharmaceuticals," are products that offer health benefits beyond basic nutrition. They encompass a wide range of products, including dietary supplements, functional foods, and medicinal foods.

The growth of the nutraceuticals market is propelled by the heightened health awareness among consumers is leading to a greater demand for products that support wellness and prevent disease. This shift towards preventive health measures is significantly boosting the market. Secondly, the aging population is a major driver, as older adults seek products that can help manage health conditions and enhance their quality of life. Additionally, increasing disposable incomes and a rising focus on personal health and nutrition are encouraging consumers to invest in high-quality nutraceuticals. Technological advancements in product formulation and delivery methods are also contributing to market growth by improving the efficacy and appeal of these products. Collectively, these factors are fueling a robust expansion in the nutraceuticals sector.

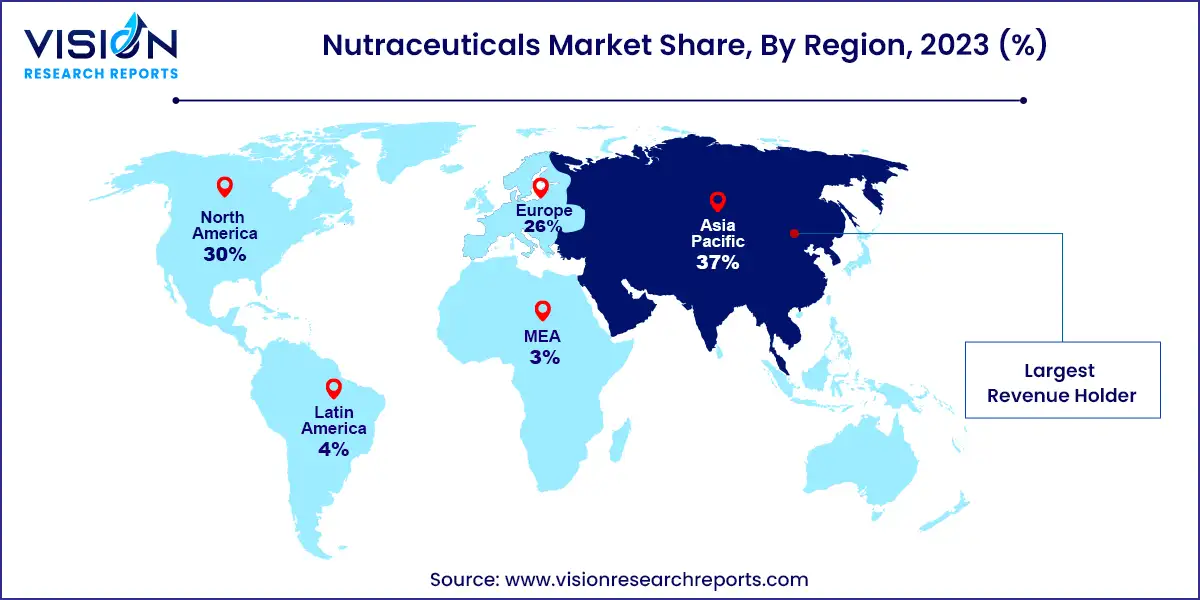

In 2023, the Asia Pacific nutraceuticals market accounted for the largest revenue share of over 37% and is expected to grow at a CAGR of 9.83% from 2024 to 2033. This market, one of the fastest-growing globally, benefits from rising disposable incomes, increasing health awareness, and a growing aging population. Key markets, including China, Japan, and India, are major contributors to this growth. The sector encompasses a diverse range of products, such as dietary supplements, functional foods and beverages, and traditional herbal products.

| Attribute | Asia Pacific |

| Market Value | USD 263.80 Billion |

| Growth Rate | 8.43% CAGR |

| Projected Value | USD 592.61 Billion |

In 2023, North America’s nutraceuticals market held a revenue share of over 30%. This growth is driven by increasing health concerns, heightened awareness of nutraceuticals, and a rising aging population. Additionally, changing lifestyles and healthcare spending contribute to the sector's expansion. While a diverse product portfolio and regulatory challenges may pose constraints, the trend of fortifying foods with nutraceuticals presents a significant growth opportunity.

Europe Nutraceuticals Market Trends

The European nutraceuticals market is projected to grow at a CAGR of 7.63% from 2024 to 2033. Countries like Germany, France, and the UK lead the market, which is also benefiting from the rise of online sales channels. Despite varying market dynamics across different European nations due to cultural, regulatory, and consumer preference differences, the region shows strong overall performance.

In 2023, the functional foods segment led the market with a revenue share of 47% and is anticipated to maintain its leading position throughout the forecast period. This growth is attributed to technological advancements and ongoing product development in the sector. Sports drinks, in particular, are gaining traction among athletes and active individuals. The millennial demographic significantly drives this trend, thanks to their strong purchasing power, commitment to health, enthusiasm for sports, and increasing interest in fitness.

Technological innovations, such as microencapsulation, are advancing the functional foods industry. This technology improves the taste of functional foods by masking unpleasant flavors, such as those of omega-3 fatty acids, making products more palatable and attractive to consumers. These advancements, aligned with evolving consumer preferences, are expected to bolster the functional foods market.

The weight management and satiety segment led the market with a revenue share of 20% in 2023, driven by heightened focus on fitness and nutrition. As consumers increasingly seek to enhance their dietary habits in response to changing work environments and socioeconomic factors, the demand for sports nutrition products is rising. This trend is anticipated to boost the need for nutraceuticals designed for weight management, including energy drink-mix powders.

Weight management remains a critical application area due to the growing prevalence of obesity linked to lifestyle changes. According to the 19th annual report by Trust for America's Health (TFAH), 19 states in the U.S. had obesity rates exceeding 35% in 2022, up from 16 states in 2021.

By Product

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others