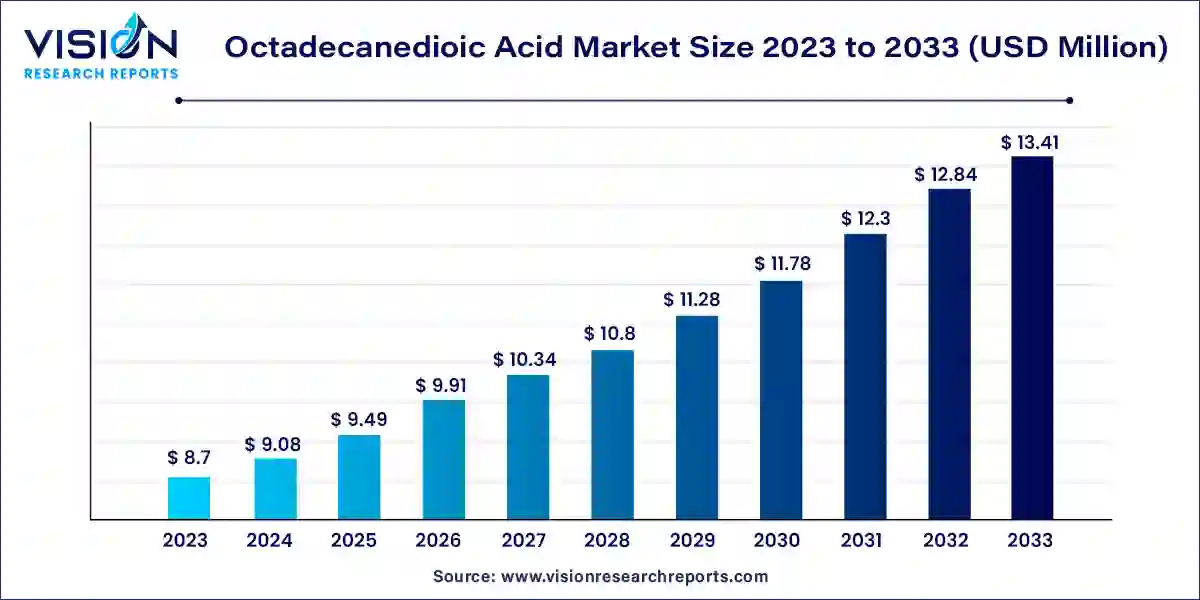

The global octadecanedioic acid market size was estimated at around USD 8.7 billion in 2023 and it is projected to hit around USD 13.41 billion by 2033, growing at a CAGR of 4.42% from 2024 to 2033. Octadecanedioic acid, also known as behenic acid, is a dicarboxylic acid with the chemical formula C18H36O4. It is a white crystalline substance that is primarily used in various industrial applications, including the production of surfactants, lubricants, and polymers. Its unique chemical properties make it a valuable ingredient in the formulation of cosmetics, personal care products, and food additives.

The growth of the octadecanedioic acid market is significantly driven by an increasing consumer demand for natural and eco-friendly ingredients in personal care products is propelling the adoption of octadecanedioic acid due to its safe and effective properties as an emollient and emulsifier. Additionally, the expanding applications of octadecanedioic acid in various industrial sectors, including the production of biodegradable lubricants, surfactants, and polymers, are enhancing its market potential. The rising awareness of environmental sustainability and the shift towards greener alternatives further boost the demand for this versatile compound. Moreover, advancements in manufacturing processes have improved the production efficiency and cost-effectiveness of octadecanedioic acid, making it more accessible to a broader range of industries.

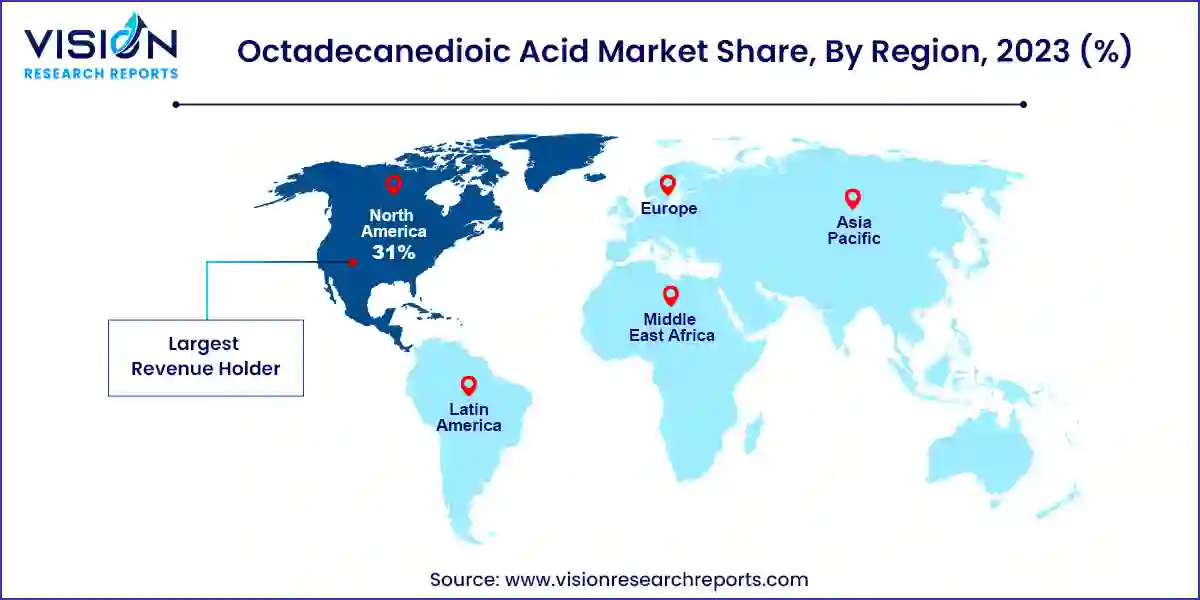

In 2023, North America led the global octadecanedioic acid market with a market share of 31%. The region benefits from a well-established industrial base that supports the production and utilization of compounds like ODDA. Numerous chemical manufacturing facilities in North America have intensified their R&D efforts to enhance production processes and product quality. This robust industrial infrastructure provides a favorable environment for the large-scale production and distribution of ODDA.

The octadecanedioic acid market in the U.S. dominated the North American segment with a market share of 78.05% in 2023. The U.S. features a mature chemical manufacturing sector characterized by advanced technologies, skilled labor, and complex supply chains, which facilitate the synthesis of ODDA. Additionally, the U.S. government actively promotes the use of bio-based chemicals like ODDA to foster environmental sustainability.

The Asia Pacific region is expected to experience the highest CAGR of 5.65% during the forecast period. The market for ODDA is growing rapidly in this region due to industrialization, urbanization, and infrastructure development. Significant investments in sectors such as automotive, construction, and electronics are driving this growth, particularly in countries like China, India, and Japan. The cosmetics market also shows considerable potential for expansion, driven by rising per capita incomes and a shift toward high-quality skincare products.

India is set to witness growth in the octadecanedioic acid market throughout the forecast period. As the largest producer of ODDA, India has made substantial investments in its chemical manufacturing industry, resulting in several large-scale production facilities employing modern technologies. This capacity enables India to meet both domestic and international demand effectively.

In 2023, Europe held a significant share of the octadecanedioic acid market. The region benefits from a reliable industrial foundation and a strong emphasis on environmental sustainability. Regulations from the EPA that restrict chemical usage in regional industries encourage the adoption of ODDA in sustainable products like powder coatings and bio-based lubricants. Moreover, the European cosmetics sector recognizes ODDA as a natural ingredient beneficial for skin health, aligning with the growing trend towards organic and environmentally friendly cosmetics.

Germany, in particular, captured a substantial market share in 2023. With one of the largest chemical industries in Europe, Germany is home to several prominent chemical companies that focus on R&D for specialty chemicals, including ODDA. This robust industrial base supports effective manufacturing processes and continuous product innovation.

In 2023, polyester polyols accounted for the largest segment of the market, commanding a revenue share of 51%. The remarkable flexibility and elongation properties of octadecanedioic acid (ODDA) make it an excellent choice for applications that demand enhanced strength and durability. Its resistance to chemicals further improves material performance in challenging environments. Industries such as automotive and construction leverage polyester polyols to create high-performance coatings known for their superior adhesion and weather resistance.

The cosmetics sector is projected to exhibit the fastest compound annual growth rate (CAGR) of 5.14% during the forecast period. The increasing consumer focus on skin health has led to a surge in demand for anti-aging skincare products. The properties of ODDA, which support skin elasticity and hydration, make it particularly effective in anti-aging formulations. As safety and efficacy continue to be priorities in the cosmetics industry, the demand for products containing ODDA is anticipated to rise.

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others