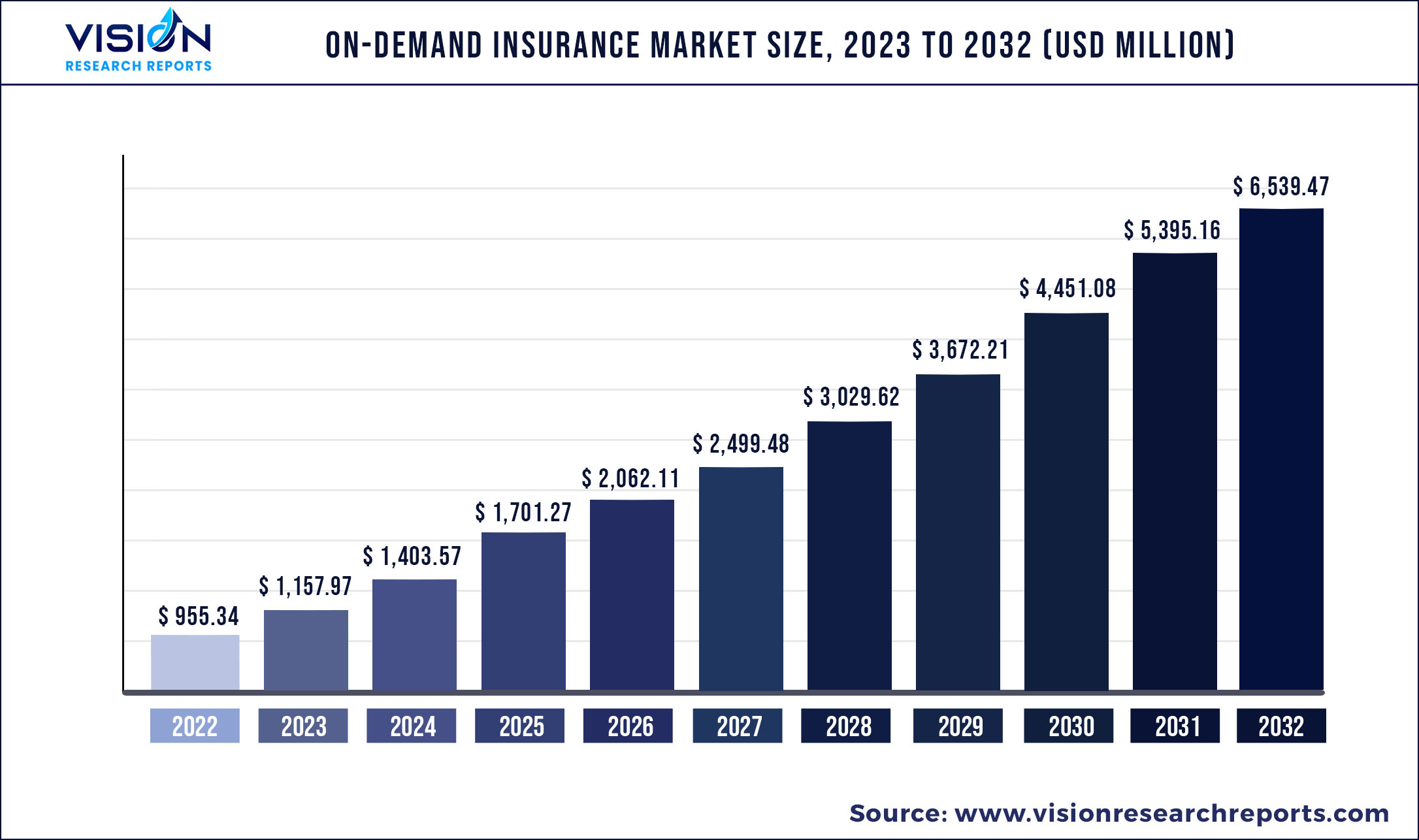

The global on-demand insurance market was surpassed at USD 955.34 million in 2022 and is expected to hit around USD 6,539.47 million by 2032, growing at a CAGR of 21.21% from 2023 to 2032.

Key Pointers

Report Scope of the On-demand Insurance Market

| Report Coverage | Details |

| Market Size in 2022 | USD 955.34 million |

| Revenue Forecast by 2032 | USD 6,539.47 million |

| Growth rate from 2023 to 2032 | CAGR of 21.21% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Slice Insurance Technologies Inc.; VSure.life; Xceedance, Inc.; SkyWatch Insurance Services, Inc.; JaSure; Thimble; JAUTIN; Cuvva; Snap-it Cover |

Growing internet penetration and smartphone users have increased access to on-demand insurance products for a large population. Today, insurers can reach potential customers through online channels and mobile apps, making it easier for customers to purchase insurance policies. Additionally, the growth of smartphone users has led to the development of mobile apps that enable customers to purchase on-demand insurance policies on the go. Insurers provide mobile apps allowing customers to browse policies, get quotes, and purchase policies through mobile devices.

Digital transformation is another major factor driving the growth of the on-demand insurance industry. The use of digital technologies has enabled insurers to collect additional data on customer behavior and usage patterns, allowing them to offer more personalized insurance policies. For instance, insurers can use data analytics to offer personalized pricing based on individual risk profiles. Moreover, digital technologies have also made it easier for insurers to interact with customers and offer them a seamless experience. Customers can access insurance products and services through digital channels such as mobile apps and websites, making managing their policies more convenient.

Fintech has positively impacted the on-demand insurance industry by making it easier for on-demand insurance providers to offer their products and for consumers to purchase and manage their policies. Fintech has enabled insurance companies to use data analytics to understand their customers better and offer personalized products. By analyzing data, on-demand insurance providers can gain insights into customer behavior and preferences that can help them to create personalized products that better meet their customers' needs. For instance, they could analyze data on the frequency and severity of customer claims during specific times of the year or in specific geographic locations. This information can help on-demand insurance providers anticipate customer needs and develop products that are tailored to the specific needs of the customers.

Regulatory compliance significantly affects the on-demand insurance industry, as on-demand insurance companies need to comply with various regulations and laws in the countries where they offer their products. Insurance companies offering on-demand insurance products may be required to obtain licenses in the countries where they operate. For instance, in the U.S., insurance companies must obtain licenses from individual states to offer insurance products in those states. Additionally, insurance companies offering on-demand insurance products may collect personal data from their customers. They must comply with data privacy laws, such as the European Union's General Data Protection Regulation (GDPR). According to the GDPR, companies must obtain explicit consent from individuals before collecting and processing their data, as required.

One major restraint of the on-demand insurance industry is the potential fraudulent claims. Fraudulent claims can lead to increased costs for insurers, which may result in higher customer premiums. Insurers would have to allocate more resources to investigate claims and may also need to increase their reserves to cover potential losses. Additionally, fraudulent claims can damage the reputation of insurance providers, leading to a loss of trust and confidence in the market. This can deter potential customers from buying insurance and cause existing customers to switch to other providers.

On-demand Insurance Market Segmentations:

| By Coverage | By End-user |

|

Car Insurance Home Appliances Insurance Entertainment Insurance Contractor Insurance Electronic Equipment Insurance Others |

Individuals Businesses |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on On-demand Insurance Market

5.1. COVID-19 Landscape: On-demand Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global On-demand Insurance Market, By Coverage

8.1. On-demand Insurance Market, by Coverage, 2023-2032

8.1.1. Car Insurance

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Home Appliances Insurance

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Entertainment Insurance

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Contractor Insurance

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Electronic Equipment Insurance

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global On-demand Insurance Market, By End-user

9.1. On-demand Insurance Market, by End-user, 2023-2032

9.1.1. Individuals

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Businesses

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global On-demand Insurance Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.1.2. Market Revenue and Forecast, by End-user (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.2.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-user (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Coverage (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 11. Company Profiles

11.1. Slice Insurance Technologies Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. VSure.life

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Xceedance, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. SkyWatch Insurance Services, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. JaSure

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Thimble

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. JAUTIN

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Cuvva

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Snap-it Cover

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others