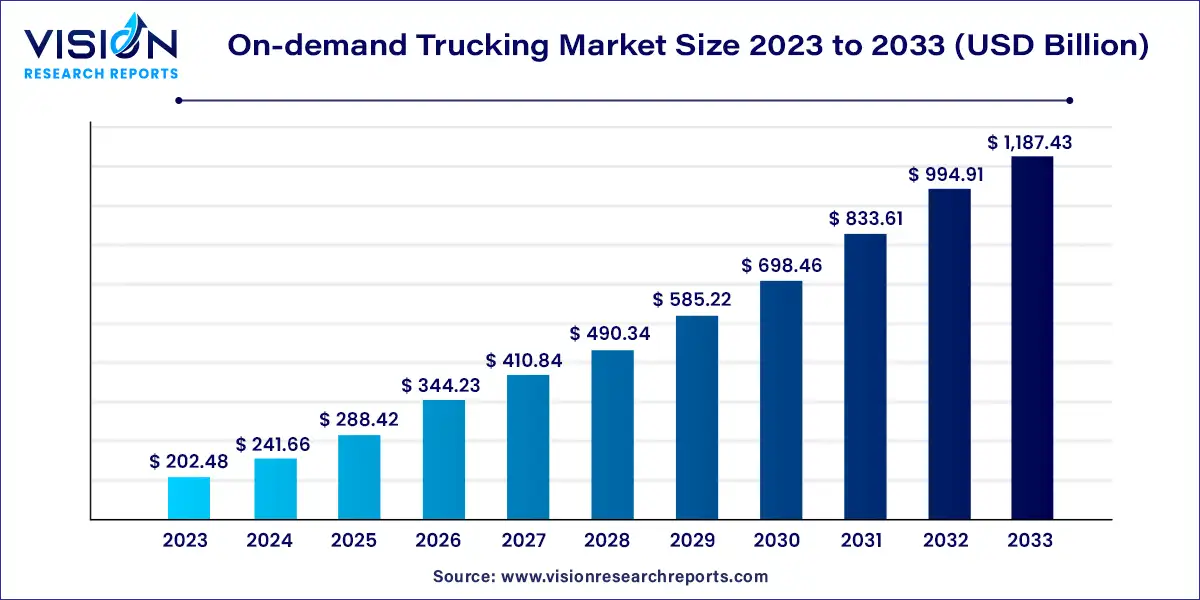

The global on-demand trucking market size was estimated at around USD 202.48 billion in 2023 and it is projected to hit around USD 1,187.43 billion by 2033, growing at a CAGR of 19.35% from 2024 to 2033. The on-demand trucking market is rapidly emerging as a key segment within the logistics and transportation industry, driven by the increasing need for flexible, efficient, and scalable transportation solutions. This market leverages digital platforms to connect shippers with truck drivers, enabling real-time bookings and route optimization.

The growth of the on-demand trucking market is propelled by an increasing adoption of digital platforms and mobile applications has revolutionized how freight is managed, allowing for real-time tracking, efficient route planning, and seamless communication between shippers and drivers. Second, the surge in e-commerce has heightened the demand for flexible and rapid delivery solutions, making on-demand trucking an attractive option for businesses seeking to meet customer expectations for quick and reliable shipping. Additionally, the emphasis on cost reduction and operational efficiency has driven companies to favor on-demand trucking, which eliminates the need for maintaining large, fixed fleets and allows for scalability based on fluctuating demand. These factors, combined with the growing preference for just-in-time delivery models, are contributing to the robust expansion of the on-demand trucking market.

Asia Pacific region dominated the on-demand trucking market in 2023, accounting for 42% of global revenue. This dominance is attributed to rapid economic growth, increasing industrialization, and a burgeoning e-commerce sector. As businesses in Asia Pacific expand their operations and logistics needs, the demand for on-demand trucking services is significantly rising.

| Attribute | Asia Pacific |

| Market Value | USD 85.04 Billion |

| Growth Rate | 19.37% CAGR |

| Projected Value | USD 498.72 Billion |

North America market is expected to grow steadily from 2024 to 2033, driven by rising e-commerce activity, urbanization, and a focus on supply chain efficiency. North America's well-developed infrastructure and technology ecosystem support the growth of on-demand trucking, while an emphasis on sustainability and reduced carbon emissions fuels demand for more efficient transportation solutions.

The European on-demand trucking market is projected to grow at a notable CAGR from 2024 to 2033. Factors such as increasing urbanization, e-commerce growth, and sustainability concerns are driving this expansion. The region's advanced transportation infrastructure and regulatory framework provide a conducive environment for the growth of on-demand trucking services.

In 2023, the one-time service segment led the market, capturing 65% of global revenue. Its dominance stems from its flexibility and suitability for ad-hoc shipping needs, making it a preferred choice for businesses with irregular or unpredictable transportation requirements. However, the contractual service segment is rapidly growing as businesses increasingly seek long-term partnerships and guaranteed capacity. Contractual arrangements offer stability and cost certainty, appealing to companies with consistent shipping needs as they look to optimize supply chains and reduce transportation costs.

The contractual segment is expected to experience the highest growth rate from 2024 to 2033. This segment is especially attractive to large enterprises that need reliable and consistent transportation services. Contractual agreements help shippers secure capacity, negotiate favorable rates, and build stable partnerships with carriers, leading to enhanced supply chain visibility, reduced transportation costs, and improved customer satisfaction.

The first mile and last mile delivery segment was the market leader in 2023, driven by the growing need for efficient and reliable transportation for the final leg of deliveries, especially in urban areas. With the expansion of e-commerce and increasing consumer expectations for fast and convenient delivery options, this segment is experiencing significant growth.

Looking ahead, the same-day delivery segment is set to grow rapidly from 2024 to 2033. This growth is fueled by rising demand for quick and efficient delivery services, particularly in urban settings. Same-day delivery is becoming increasingly popular among businesses that need to provide rapid delivery, such as retailers, e-commerce platforms, and restaurants.

In 2023, the full truck load (FTL) segment dominated the market, thanks to its efficiency and cost-effectiveness for transporting large quantities of goods. FTL shipments, which allow direct transportation from origin to destination, minimize handling and shorten transit times. Nonetheless, the less-than-truckload (LTL) segment is also growing swiftly, driven by the need for smaller shipments and flexible transportation solutions.

From 2024 to 2033, the intermodal segment is projected to grow the fastest. Intermodal transportation provides flexibility for smaller shipments and allows sharing truck capacity with other shippers, which can reduce costs. LTL carriers consolidate shipments to optimize truck usage and offer efficient solutions for a diverse range of businesses.

The medium-duty trucks segment led the market in 2023, offering a balance between payload capacity and maneuverability. These trucks are commonly used for deliveries within urban areas as well as regional and intercity transport.

The light-duty trucks segment is expected to see the fastest growth from 2024 to 2033, driven by increased demand for agile and smaller vehicles for last-mile delivery and urban transportation. Light-duty trucks, such as vans and pickups, are more maneuverable and fuel-efficient, making them ideal for navigating congested urban areas and handling smaller packages. With the rising demand for last-mile services, light-duty trucks will play a crucial role in the market.

In 2023, the domestic segment was the market leader, reflecting the concentration of businesses and industries within national borders. However, the international segment is growing rapidly, driven by globalization and expanding international trade.

From 2024 to 2033, the international segment is expected to see the fastest growth due to increased global economic interconnectedness. As businesses enter new markets and engage in international trade, the demand for cross-border transportation services is rising. International shipments often involve complex logistics, customs clearance, and regulatory compliance, making efficient on-demand trucking a valuable solution for businesses needing reliable cross-border transport.

In 2023, the manufacturing sector dominated the market, relying heavily on efficient transportation for raw materials, components, and finished products. Manufacturing operations often involve large-scale shipments and require timely transportation solutions to support production and meet customer demands.

However, the retail and e-commerce segment is experiencing rapid growth, driven by the surge in online shopping and the need for fast delivery. This segment is expected to grow the fastest during the forecast period, as e-commerce continues to expand and retailers and e-commerce companies seek transportation solutions that can handle various shipment sizes, ensure timely delivery, and provide tracking capabilities.

By Service

By Delivery Type

By Freight Type

By Vehicle Type

By Location

By Industry Vertical

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others