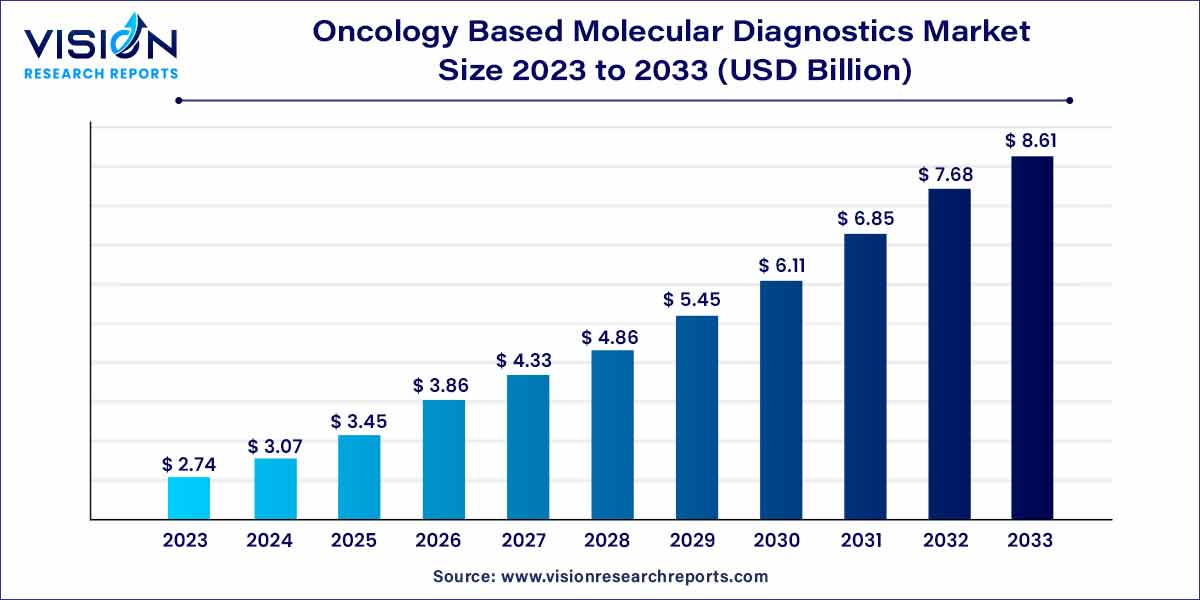

The global oncology based molecular diagnostics market size was estimated at around USD 2.47 billion in 2023 and it is projected to hit around USD 8.61 billion by 2033, growing at a CAGR of 12.13% from 2024 to 2033. The major factors expected to propel growth in the global market for molecular oncology diagnostics are the rising incidence of various cancers, including breast, colorectal, and non-small cell lung cancer (NSCLC), as well as significant developments in biomarker identification, the growing need for point-of-care testing, and technological advancements in diagnostic testing.

The oncology-based molecular diagnostics market is witnessing a paradigm shift in cancer diagnostics and treatment strategies, propelled by advancements in molecular technologies. This sector focuses on analyzing molecular and genetic markers, presenting a more precise understanding of tumors and revolutionizing personalized cancer care.

The growth of the oncology-based molecular diagnostics market is underpinned by several key factors. Firstly, the increasing incidence of cancer worldwide has elevated the demand for advanced diagnostic tools, propelling the market forward. Additionally, the rising awareness and adoption of personalized medicine have augmented the significance of molecular diagnostics in tailoring treatment approaches. Ongoing research endeavors focused on biomarker discovery and genetic profiling contribute to the expansion of the market, enabling more accurate and targeted cancer diagnoses. The integration of innovative technologies, such as next-generation sequencing and liquid biopsy techniques, further amplifies the market's growth trajectory by enhancing the speed and precision of molecular testing. As the market continues to evolve, these growth factors collectively position oncology-based molecular diagnostics as pivotal in reshaping the landscape of cancer care.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.13% |

| Market Revenue by 2033 | USD 8.61 billion |

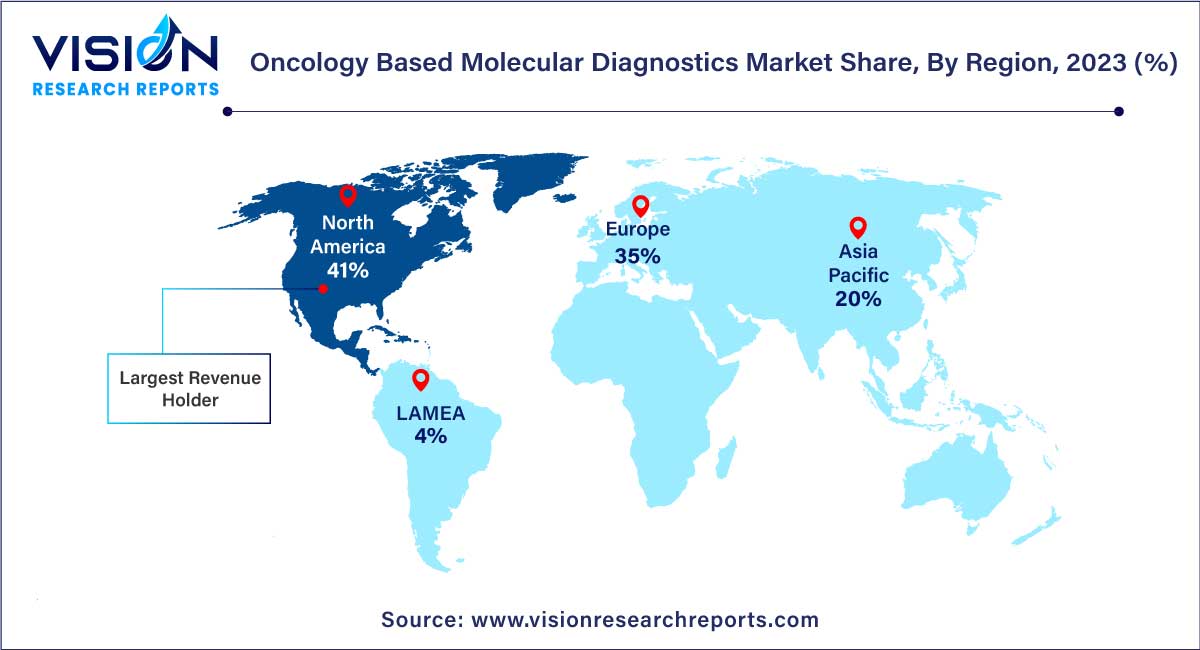

| Revenue Share of North America in 2023 | 41% |

| CAGR of Asia Pacific from 2024 to 2033 | 15.84% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The main types of cancer studied under this segment include breast cancer, prostate cancer, colorectal cancer, cervical cancer, liver cancer, lung cancer, blood cancer, and kidney cancer, among others. Of these, breast cancer dominated the overall market in 2023 in terms of revenue share due to large test volumes and an extensive portfolio of commercialized products.

On the other hand, liver cancer and prostate cancer diagnostics markets are also estimated to witness significant growth, in addition to colorectal cancer, due to rising prevalence and increasing awareness levels among consumers. Broad avenues mark oncology-based molecular diagnostics for the development of diagnostic technology at molecular levels in personalized medicine for medication and new drug discovery.

The polymerase chain reaction (PCR) technology segment held the highest revenue share of 32% in 2023. This can be attributed to its growing utilization in research labs and the increased need for enhanced diagnostics. The industry is segmented on the basis of technology into seven major types, which include polymerase chain reaction (PCR), In Situ Hybridization, Isothermal Nucleic Acid Amplification Technology (INAAT), Chips & Microarrays, Mass Spectrometry, Sequencing, and Transcription Mediated Amplification.

The sequencing segment is anticipated to witness a significant growth rate of 14.35% during the forecast period. The growth in demand for sequencing technology is augmented by an increase in research and development expenditure and the widespread use of sequencing technologies in clinical diagnosis, which is anticipated to provide a favorable environment for market expansion during the forecast period, due to its benefits such as quick turnaround times and speedier processing.

For instance, in 2021, BD introduced a brand-new, completely automated, high throughput molecular diagnostic platform for American laboratories called the "BD COR PX/GX" system. The method uses robotics and sample management software programs to set a new benchmark for automation in infectious disease molecular testing. High-throughput laboratories, which handle most cervical cancer screening specimens in the U.S., can access the BD Onclarity HPV test with enhanced genotyping for the BD COR system due to this development.

The reagents segment held the largest revenue share of 59% in 2023. This can be attributed to the high-volume usage of reagents for conducting tests and diagnostics in cancer research. The expansion in the field of molecular biology technology, progress in biotechnology advancements, rising demand for synthetic biology, and increasing investment in research and development by biotechnology companies are the main factors fueling the rapid growth of this industry segment.

The reagents segment is also anticipated to expand at a significant CAGR of 13.37% over the forecast period. The CE-IVD marked PD-L1 IHC 22C3 pharmDx assay from Agilent Technologies, Inc. was made available for esophageal cancer patients in August 2021. Using a cumulative positive score, this assay was employed to help identify individuals with esophageal cancer who would benefit from KEYTRUDA therapies.

North America dominated the market with a revenue share of over 41% in 2023. The strong market growth in this region can be attributed to a well-established healthcare infrastructure, the constantly rising health-conscious population base, and high healthcare expenditure.

The Asia Pacific region is estimated to expand the fastest CAGR of 15.84% during the projection period. There has been an increasing incidence rate of tumors in low- and middle-income countries of the Asia-Pacific region, which can be attributed to the aging population and lifestyle changes associated with economic development and epidemiologic transitions. India, China, and Australia are expected to offer immense potential for this industry in the coming years, mainly due to improving economic conditions and high unmet needs.

By Type

By Technology

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Oncology Based Molecular Diagnostics Market

5.1. COVID-19 Landscape: Oncology Based Molecular Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Oncology Based Molecular Diagnostics Market, By Type

8.1. Oncology Based Molecular Diagnostics Market, by Type, 2024-2033

8.1.1 Breast Cancer

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Prostate Cancer

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Colorectal Cancer

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Cervical Cancer

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Liver Cancer

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Lung Cancer

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Blood Cancer

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Kidney Cancer

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Other Cancer

8.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Oncology Based Molecular Diagnostics Market, By Technology

9.1. Oncology Based Molecular Diagnostics Market, by Technology, 2024-2033

9.1.1. PCR

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. In Situ Hybridization

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. INAAT

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Chips and Microarrays

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Mass Spectrometry

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Sequencing

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. TMA

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Oncology Based Molecular Diagnostics Market, By Product

10.1. Oncology Based Molecular Diagnostics Market, by Product, 2024-2033

10.1.1. Instruments

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Reagents

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Oncology Based Molecular Diagnostics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.3. Market Revenue and Forecast, by Product (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Product (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Product (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.3. Market Revenue and Forecast, by Product (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Product (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Product (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Product (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Product (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.3. Market Revenue and Forecast, by Product (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Product (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Product (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Product (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Product (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.3. Market Revenue and Forecast, by Product (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Product (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Product (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Product (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Product (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.3. Market Revenue and Forecast, by Product (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Product (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Product (2021-2033)

Chapter 12. Company Profiles

12.1. Abbott.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bayer AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BD.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Cepheid.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Agilent Technologies, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Danaher

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hologic, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Qiagen

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. F. Hoffmann-La Roche Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Siemens

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others