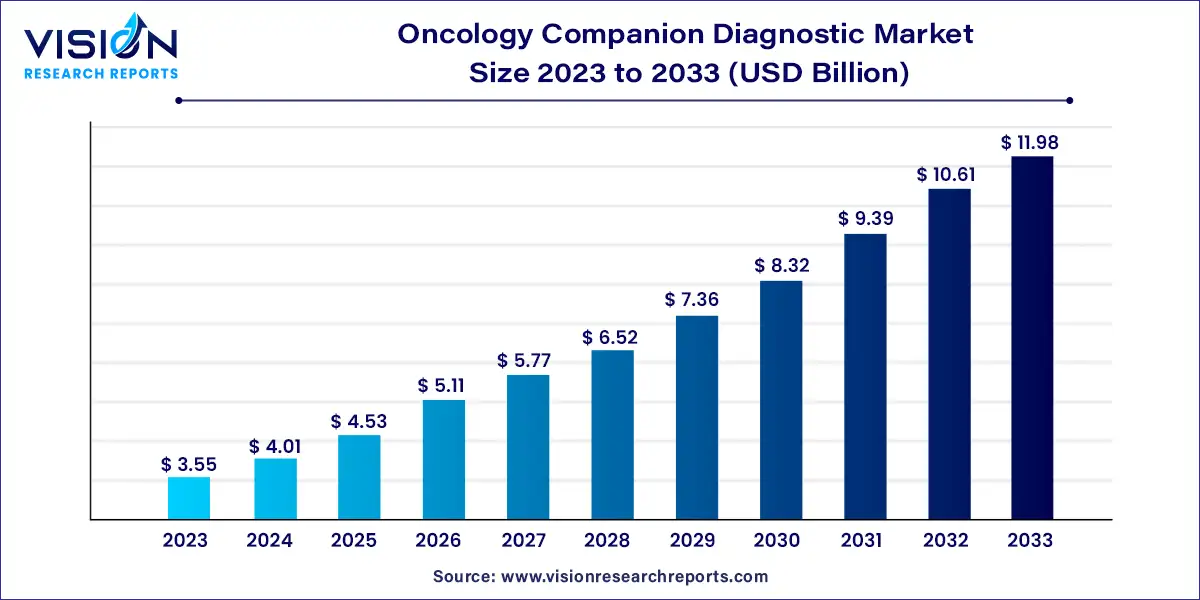

The global oncology companion diagnostic market size was estimated at USD 3.55 billion in 2023 and it is expected to surpass around USD 11.98 billion by 2033, poised to grow at a CAGR of 12.93% from 2024 to 2033. The oncology companion diagnostic market is witnessing robust growth propelled by advancements in genomic technologies, personalized medicine initiatives, and a growing demand for targeted therapies. With cancer incidence rates soaring globally, there is an escalating need for precise diagnostic tools to guide treatment decisions and optimize patient outcomes.

The growth of the oncology companion diagnostic market is driven by multifaceted factors. Technological advancements, particularly in genomic technologies such as next-generation sequencing (NGS), have enabled a deeper understanding of cancer biology and the identification of specific biomarkers. This enhanced molecular profiling capability empowers clinicians to tailor treatment strategies to individual patients, thereby driving demand for companion diagnostics. Additionally, the paradigm shifts towards personalized medicine, fueled by the recognition of cancer's inherent heterogeneity, underscores the importance of precise diagnostic tools in optimizing therapeutic outcomes. Regulatory agencies' increasing emphasis on the integration of companion diagnostics into drug development and clinical practice further accelerates market growth by providing a conducive regulatory environment.

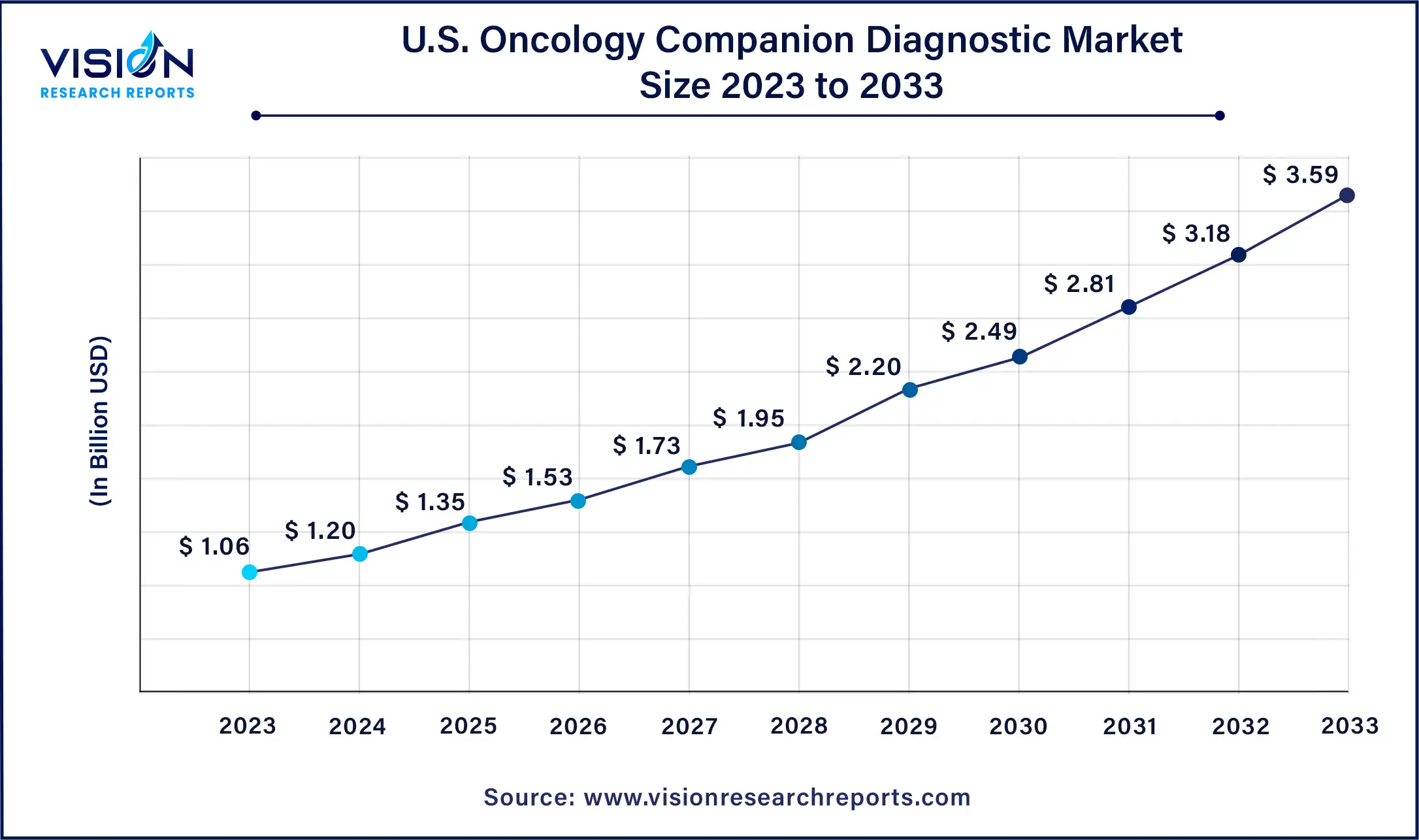

The U.S. oncology companion diagnostic market size was estimated at USD 1.06 billion in 2023 and is expected to be worth around USD 3.59 billion by 2033, at a CAGR of 12.97% from 2024 to 2033.

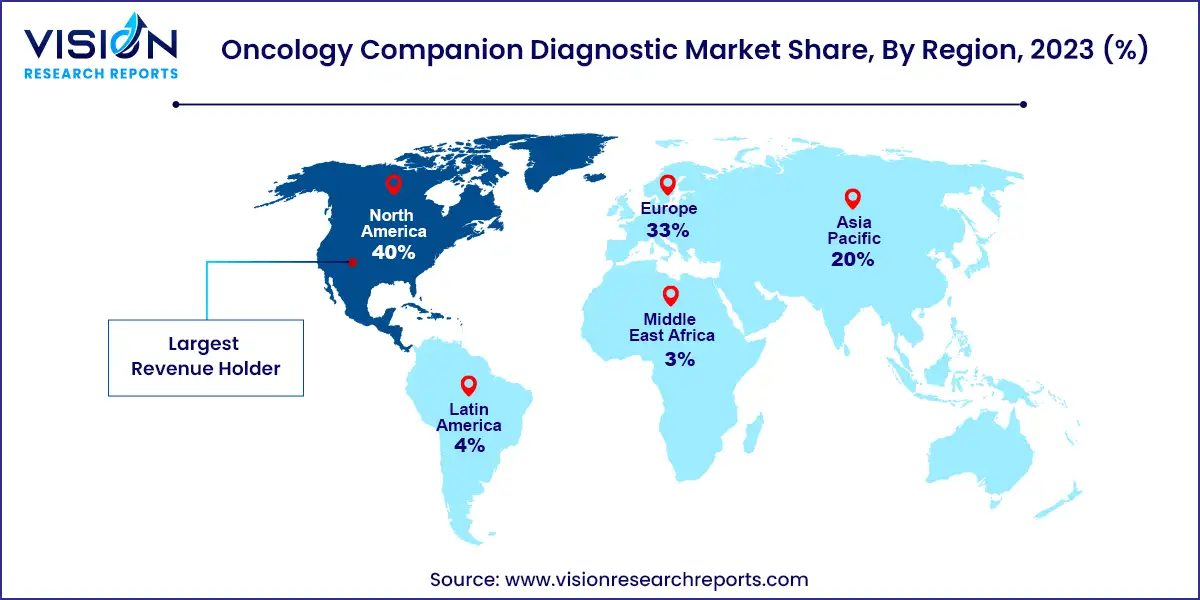

The North American market held a significant position in the oncology companion diagnostics sector, capturing 40% of the revenue share in 2023. The support from organizations like the National Cancer Institute (NCI) through funding and grants has played a crucial role in accelerating the development of precision therapies, thereby positively impacting the regional market. Initiatives such as the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs by the NCI aim to foster the advancement of cutting-edge technologies and products for cancer prevention, detection, and treatment. Additionally, Canada hosts various conferences aimed at enhancing awareness about emerging trends and innovations in companion diagnostics (CDx), further bolstering market growth.

The Asia Pacific region is projected to exhibit the highest compound annual growth rate (CAGR) of 14.04% during the forecast period from 2024 to 2033. The market's momentum will be driven by robust regulations governing the approval of oncology companion diagnostic tests, along with accelerated research and development efforts for integrated and personalized medicine, particularly in the United States.

The product segment dominated the revenue share, accounting for over 66% in 2023, mainly attributed to the emergence of highly sensitive technologies like NGS for cancer diagnosis. Leading companies such as Illumina, Roche, and ThermoFisher Scientific are poised for significant growth opportunities in the upcoming years, driven by the increasing utilization of cancer companion diagnostic equipment and the growing global disease burden. Notably, in October 2023, Roche received FDA approval for its first companion diagnostic to aid in determining eligibility for Enhertu treatment in patients with HER2 low metastatic breast cancer. Enhertu, an antibody-drug conjugate (ADC), is jointly developed and commercialized by AstraZeneca and Daiichi Sankyo.

Consumables and reagents are pivotal in ensuring the reliability of cancer testing across various technologies. Key players are actively involved in developing consumables for oncology CDx. For instance, in February 2020, Biocare Medical introduced seven novel IVD IHC antibody markers, expected to bolster growth in the consumables segment of the oncology companion diagnostics market. Major companies like Fujifilm Wako Diagnostics, Thermo Fisher Scientific, Sysmex Corporation, Abbott Diagnostics, and Roche Diagnostics offer a wide array of reagents for cancer diagnosis and various cancer research products.

The service segment is anticipated to witness the fastest growth, with a projected CAGR of 13.35% during the forecast period. The presence of service providers such as Covance, Q2 Solutions, and LabCorp offering CDx development services is expected to drive the growth of the services segment in the oncology companion diagnostics market. In June 2023, the FDA initiated a pilot program aimed at mitigating the risks associated with using laboratory tests for cancer biomarker identification, ultimately assisting clinicians in selecting appropriate cancer treatments for patients.

The market is categorized by technology, including PCR, NGS, IHC, ISH/FISH, and other technologies. Immunohistochemistry (IHC) led with a substantial revenue share, surpassing 61% in 2023. This dominance is attributed to the widespread availability of IHC-based CDx solutions within the oncology companion diagnostics market.

IHC-based CDx plays a pivotal role in expediting the drug development process and enhancing the likelihood of successful approvals. Adoption of IHC-based oncology companion diagnostic assays proves beneficial across all stages of development. Various antibody therapies, such as Antibody-Dependent Cell-Mediated Cytotoxicity (ADCC), Antibody Drug Conjugates (ADC), immune checkpoint blockade, and signal transduction blockade, leverage the advantageous features of IHC technology as a CDx.

The next-generation sequencing (NGS) sector is projected to experience the most rapid growth rate of 18.54% throughout the forecast period in the oncology companion diagnostics market. This surge is attributed to the precision and comprehensive biomarker insights offered by NGS-based tools. Moreover, NGS-based CDx tests are extensively employed in Non-small cell lung cancer (NSCLC) diagnosis, revealing a wide array of actionable driver mutations and associated therapeutic avenues.

Segmented by disease type, the market encompasses leukemia, non-small cell lung cancer, breast cancer, colorectal cancer, melanoma, prostate cancer, and others. The "others" category emerged as the market leader in terms of revenue share. Within this framework, the non-small cell lung cancer (NSCLC) segment held the largest revenue share of 26% in 2023. This dominance stems from the rising prevalence of NSCLC and the proliferation of oncology companion diagnostic tests tailored for this disease.

The breast cancer segment is poised to exhibit the swiftest compound annual growth rate (CAGR) of 13.64% during the forecast period. Breast cancer, among the most prevalent cancers with a notable mortality rate, is propelling the demand for oncology companion diagnostics. According to the World Health Organization (WHO), in 2020 alone, 2.3 million women globally received a breast cancer diagnosis, with 685,000 reported deaths. Similarly, data from the Centers for Disease Control and Prevention (CDC) indicates approximately 264,000 women and 2,400 men are diagnosed with breast cancer annually in the U.S.

The hospital segment accounted for the largest share of 54% in 2023 and is expected to grow at the fastest CAGR of 13.24% during the forecast period. Well-equipped facilities and a substantial number of skilled healthcare professionals are anticipated to drive this segment's growth. In addition, improving healthcare coverage and favorable reimbursement policies for early diagnosis & cancer prevention provided in the U.S. hospitals are expected to contribute to the market share of this segment.

The penetration of oncology companion diagnostics is relatively low in academic medical centers due to lower clinical oncology testing volume. However, the segment is expected to witness a considerable CAGR throughout the forecast period in the market for oncology companion diagnostics. This is owing to increased partnerships of academic centers with diagnostic developers. For instance, QIAGEN has a global co-exclusive license with Johns Hopkins University for PCR-based oncology companion diagnostics to detect mutations of the PIK3CA gene. This development led to the CE approval of the therascreen PIK3CA RGQ PCR kit in February 2020.

By Product & Service

By Technology

By Disease Type

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others