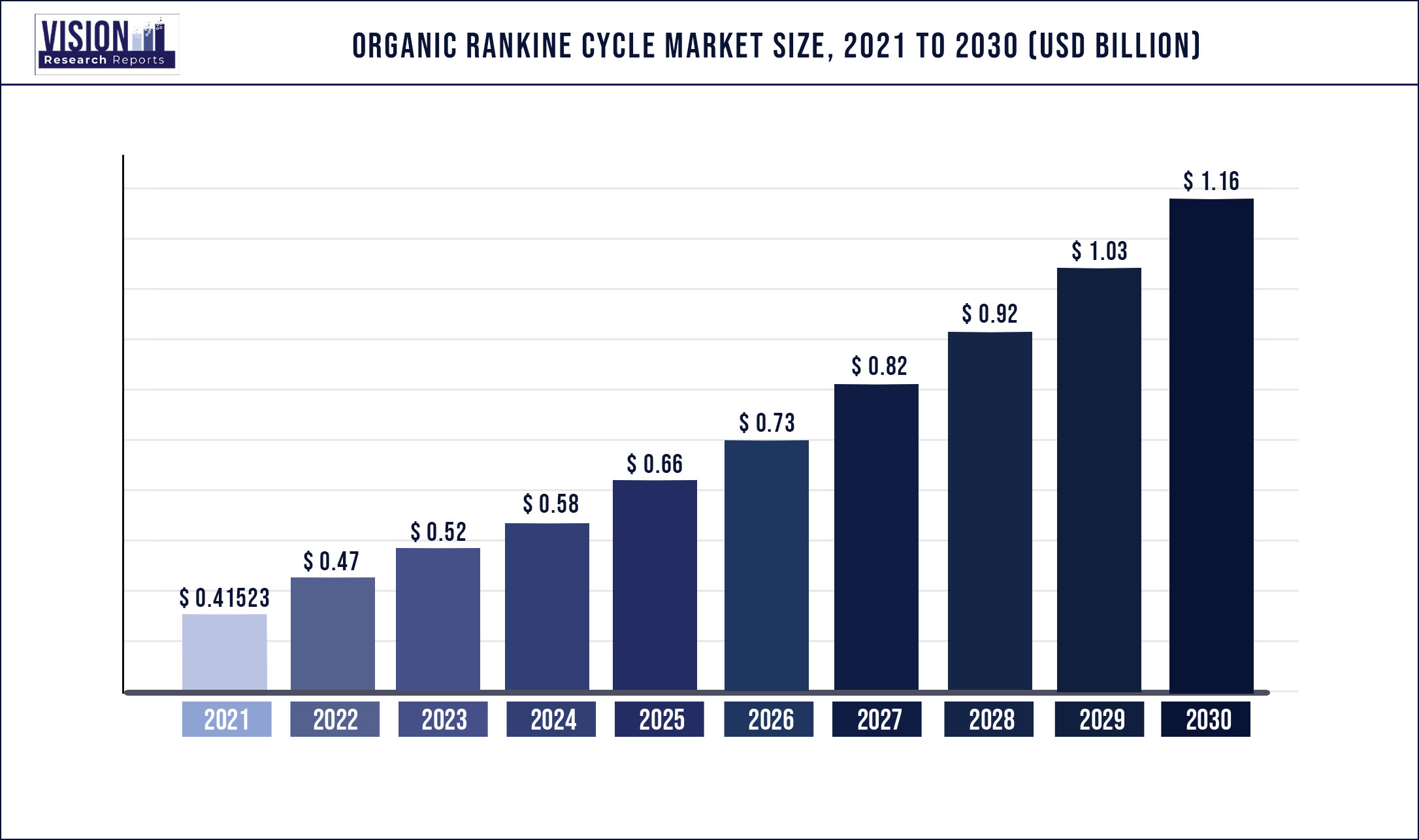

The global organic rankine cycle market was estimated at USD 415.23 million in 2021 and it is expected to surpass around USD 1.16 billion by 2030, poised to grow at a CAGR of 12.09% from 2022 to 2030

A rise in the adoption of renewable energy in countries such as the U.S., China, Germany, and Canada is making supporting regulations and providing financial incentives for the deployment of renewable energy. Financial incentives such as feed-in-tariff, subsidies, and tax benefits are some of the major tools utilized by countries around the world to attract investment in the renewable energy sector. These factors propel the growth of the organic rankine cycle (ORC) market in the near future.

The supply chains of spare parts for ORC systems are majorly affected due to the shutdown of production facilities of the manufacturers. The manufacturing of most components in the energy & power sector is slowing down considerably. In addition, local and international travel restrictions, quarantine requirements, and lockdowns have caused delays in shipments of already manufactured parts to be supplied to the distributors and end-users. ORC manufacturers usually have access to an adequate supply of critical parts, devices, components, and materials for emergencies. But, these companies are facing bottlenecks due to the limited production of supplies in countries severely affected by COVID-19.

The geothermal segment led the market and accounted for the largest revenue share in 2021. The major reason for the dominance of the geothermal segment is due to the large-scale megawatt capacity of these geothermal projects as compared to other application segments such as biomass, waste heat recovery, and solar thermal. Since every geothermal project is usually of more than 10 MW capacity whereas ORC-based projects in other application segments are not always of capacities equivalent to 10 MW and are generally less than 1 to 2 MW.

The market for ORC is concentrated where major companies such as Ormat, Turboden, and Exergy account for more than 75% market share in 2020. These companies apart from equipment supply are also focusing on providing EPC and long-term maintenance services to enhance their market share further. This factor is expected to make these companies hold their dominance in the ORC market during the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 415.23 million |

| Revenue Forecast by 2030 | USD 1.16 billion |

| Growth rate from 2022 to 2030 | CAGR of 12.09% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, region |

| Companies Covered | Turboden S.p.A.; Exergy S.p.A.; Zhejiang Kaishan Compressor Co., Ltd.; Ormat; TAS; Elvosolar, a.s. ; General Electric; INTEC GMK Enogia SAS Triogen; Calnetix Technologies, LLC; ABB; SUMEC GeoPower AG; Atlas Copco AB; ORCAN ENERGY AG |

Application Insights

The geothermal segment led the market and accounted for the largest revenue share of 61.8% in 2021. The major reason for the dominance of the geothermal segment is due to the large-scale megawatt capacity of these geothermal projects as compared to other application segments such as biomass, waste heat recovery, and solar thermal. Since each geothermal project is usually of the capacity of more than 10 MW where ORC-based projects in other application segments are not always of capacities equivalent to 10 MW and are generally less than 1 to 2 MW.

Countries with high geothermal potential such as the U.S., Turkey, Kenya, New Zealand, and Indonesia have taken significant steps to utilize the available geothermal potential available in their respective countries. For instance, from 2017 to 2018 Indonesia started the commercial operation of geothermal power plants with a cumulative capacity of 330 MW.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 50.04% in 2021. The U.S. dominated the regional market owing to the high geothermal potential in the country. Furthermore, the country has taken active steps to enhance the deployment of geothermal potential for power generation applications in the past. ORMAT has been the major company working in the U.S. to tap geothermal potential in the country by use of its ORC technology. This factor is expected to make the U.S. dominant in North America during the forecast period.

Turkey led the market in 2021, in terms of revenue in the global market. The availability of large geothermal potential in the country serves as the major driver for the ORC market in the country. The European market for the organic rankine cycle is primarily driven by implementing favorable policies and support mechanisms for the growth of renewable energy and energy efficiency projects across the globe. This has resulted in the dominance of Europe in the global ORC market.

Further, new ORC-based geothermal power projects are under construction and are expected to commission in the forecast period in countries such as Turkey and France. For instance, Turboden is constructing an 11 MW ORC-based geothermal power project in France for Fonroche Geothermie which is expected to commence operation in the forecast period. These developments will lead the geothermal application segment to grow in the forecast period in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Organic Rankine Cycle Market

5.1. COVID-19 Landscape: Organic Rankine Cycle Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Organic Rankine Cycle Market, By Application

8.1.Organic Rankine Cycle Market, by Application Type, 2020-2027

8.1.1. Waste Heat Recovery

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2. Biomass

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3. Geothermal

8.1.3.1.Market Revenue and Forecast (2016-2027)

8.1.4. Solar Thermal

8.1.4.1.Market Revenue and Forecast (2016-2027)

8.1.5. Oil & Gas (Gas pipeline pressure stations)

8.1.5.1.Market Revenue and Forecast (2016-2027)

8.1.6. Waste to Energy

8.1.6.1.Market Revenue and Forecast (2016-2027)

Chapter 9. Global Organic Rankine Cycle Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Source (2017-2030)

9.1.2. Market Revenue and Forecast, by Application (2017-2030)

9.1.3. U.S.

9.1.3.1. Market Revenue and Forecast, by Source (2017-2030)

9.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.1.4. Rest of North America

9.1.4.1. Market Revenue and Forecast, by Source (2017-2030)

9.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Source (2017-2030)

9.2.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.3. UK

9.2.3.1. Market Revenue and Forecast, by Source (2017-2030)

9.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.4. Germany

9.2.4.1. Market Revenue and Forecast, by Source (2017-2030)

9.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.5. France

9.2.5.1. Market Revenue and Forecast, by Source (2017-2030)

9.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.2.6. Rest of Europe

9.2.6.1. Market Revenue and Forecast, by Source (2017-2030)

9.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Source (2017-2030)

9.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.3. India

9.3.3.1. Market Revenue and Forecast, by Source (2017-2030)

9.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.4. China

9.3.4.1. Market Revenue and Forecast, by Source (2017-2030)

9.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.5. Japan

9.3.5.1. Market Revenue and Forecast, by Source (2017-2030)

9.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.3.6. Rest of APAC

9.3.6.1. Market Revenue and Forecast, by Source (2017-2030)

9.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Source (2017-2030)

9.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.3. GCC

9.4.3.1. Market Revenue and Forecast, by Source (2017-2030)

9.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.4. North Africa

9.4.4.1. Market Revenue and Forecast, by Source (2017-2030)

9.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.5. South Africa

9.4.5.1. Market Revenue and Forecast, by Source (2017-2030)

9.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.4.6. Rest of MEA

9.4.6.1. Market Revenue and Forecast, by Source (2017-2030)

9.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Source (2017-2030)

9.5.2. Market Revenue and Forecast, by Application (2017-2030)

9.5.3. Brazil

9.5.3.1. Market Revenue and Forecast, by Source (2017-2030)

9.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

9.5.4. Rest of LATAM

9.5.4.1. Market Revenue and Forecast, by Source (2017-2030)

9.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 10.Company Profiles

10.1.Elvosolar, a.s

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Enogia SAS

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Exergy S.p.A.

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.General Electric

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.INTEC GMK

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.Ormat

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.TAS

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Triogen

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.Turboden S.p.A.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.Zhejiang Kaishan Compressor Co., Ltd.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others