The global pancreatic cancer diagnostic market size was estimated at around USD 2.39 billion in 2022 and it is projected to hit around USD 4.51 billion by 2032, growing at a CAGR of 6.56% from 2023 to 2032. The pancreatic cancer diagnostic market in the United States was accounted for USD 906.4 million in 2022.

Key Pointers

Report Scope of the Pancreatic Cancer Diagnostic Market

| Report Coverage | Details |

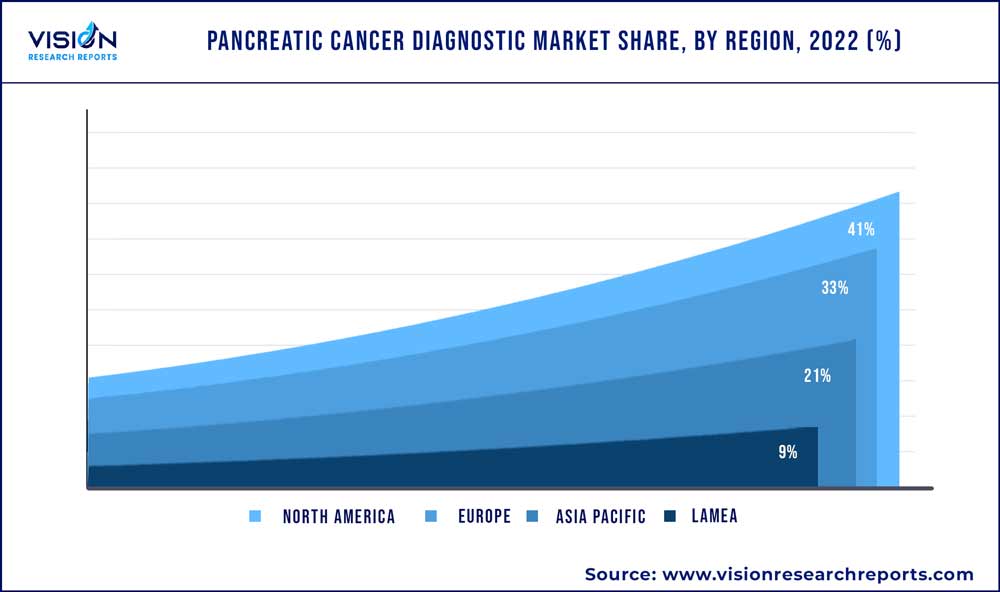

| Revenue Share of North America in 2022 | 41% |

| Revenue Forecast by 2032 | USD 4.51 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.56% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific, Inc.; QIAGEN; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Agilent Technologies, Inc.; Abbott; BD; Myriad Genetics, Inc; Koninklijke Philips N.V.; Hitachi, Ltd; Danaher; Prestige Biopharma Ltd; BioMarker Strategies; ASURAGEN, INC |

The increasing prevalence of pancreatic cancer and the rise in awareness regarding early disease diagnosis is the leading factor driving the global market. In addition, technological advancements in terms of accuracy & sensitivity of diagnostic tests, evolution in molecular diagnostics, and biomarker tests used for malignancy detection are other factors propelling the market demand forward.

Pancreatic cancer is one of the leading causes of cancer-related deaths globally and the burden of disease is escalating at a significant pace. According to the American Cancer Society, the 5-year relative survival rate of patients having localized pancreatic cancer is around 44%, whereas, in the case of regional and distant stages, the 5-year relative survival rate is 15% and 3% respectively. Therefore, medical professionals and healthcare authorities are emphasizing developing & commercializing precise screening methods to monitor the prevalence levels.

Moreover, early disease diagnosis is very crucial for positive treatment outcomes. As a result, market players and healthcare organizations are raising funds, awareness programs, and research initiatives to promote routine checkups and screenings. For instance, in August 2022, the Pancreatic Cancer Action Network (PanCAN) awarded USD 10.5 million for 16 new grants that would support R&D activities for early detection and better treatment options in cases of pancreatic cancer.

The significant rise in the number of pancreatic malignancy cases is fueling the adoption of screening tests and creating a demand for novel screening tests. According to the National Cancer Institute, in 2022, the number of estimated new cases was 62,210, with 49,830 deaths in the U.S. Currently, diagnostic tests like biomarker tests, liver function tests, biopsies, imaging tests, and others are used in disease diagnosis.

Moreover, the increasing demand for advanced diagnostic solutions has compelled manufacturers to develop novel & precise testing solutions. For instance, in January 2023, Biological Dynamics announced that its lab-on-a-chip plasma test developed for the early-stage detection of pancreatic cancer had entered human trials. This test can detect malignancy at an early stage with accurate biomarkers detection.

Moreover, the increasing number of programs to create awareness about malignant tumor screening is facilitating the demand for diagnostic products worldwide. Partnerships and collaborations undertaken by government & non-government bodies such as WHO, CDC, and Pancreatic Cancer Action Network to promote pancreatic cancer diagnosis are anticipated to fuel market growth.

In addition, various countries have undertaken certain measures to promote the early screening of malignancies. For instance, in October 2018, the UK government announced several measures to diagnose oncology diseases at their early stages, and such initiatives are anticipated to increase the demand for pancreatic cancer testing products.

Advancements in molecular diagnostics are also creating opportunities in the market. Molecular diagnostic tests can detect specific genetic mutations and biomarkers associated with pancreatic cancer, enabling earlier diagnosis and more precise treatment. For example, liquid biopsy tests that detect circulating tumor DNA are being developed that could help diagnose pancreatic cancer at an earlier stage.

Moreover, the use of AI in imaging, pathology tests, and biomarkers tests for diagnosing pancreatic malignancy will boost the adoption of diagnostic tests at the early stages of the disease. According to a study about Artificial Intelligence in Gastroenterology published in April 2021, AI applications in endoscopic ultrasound and novel biomarkers tests to detect pancreatic lesions early showed impressive results, when compared to traditional methods.

Product Insights

The consumables segment held the largest revenue share of 49% in 2022 and is anticipated to grow at a steady rate during the projected period. Rising adoption of consumables in diagnostic procedures, an increase in R&D investments, and intensifying launches of technologically advanced diagnostic kits and reagents are factors anticipated to support segment expansion. For instance, in August 2021, Immunovia received approval to start patient testing for the ‘IMMray PanCan-d’ blood test used for the early detection of pancreatic cancer.

The services segment is expected to register a lucrative growth rate during the forecast period. The rising focus on research to develop advanced diagnostic methods, incorporation of modules such as AI, use of computer-aided detection tools in imaging modalities for precise detection, and ongoing efforts from organizations to boost survival rates of pancreatic cancer patients are factors fueling segment uptake. For instance, in September 2021, Lee Health and GenesisCare collaborated to improve the survival rates of pancreas malignancy patients, with the launch of a center of excellence.

Test Type Insights

The imaging test segment dominated the global market with a revenue share of 58% in 2022. The segment growth is attributed to its ability to allow healthcare professionals to detect and diagnose pancreatic cancer earlier and help to stage cancer, which can improve treatment outcomes and patient survival rates. Several imaging techniques are currently used in pancreatic cancer diagnosis, including computed tomography (CT) scans, magnetic resonance imaging (MRI), endoscopic ultrasound (EUS), and positron emission tomography (PET) scans.

Moreover, these techniques are much preferred by health professionals owing to their higher accuracy in malignancy detection and their non-invasive nature. Advancements in imaging technologies, such as the development of contrast agents and 3D imaging, and the use of AI in imaging, are further improving the accuracy & efficiency of pancreatic cancer diagnosis. Rising efforts from researchers to develop advanced imaging modalities for precise diagnosis is another factor supporting segment growth. For instance, a research team from Taiwan has been studying a CAD tool that uses artificial intelligence to detect pancreatic cancer.

The market for blood tests is projected to experience robust growth during the forecast period. The segment growth is owing to the rising demand for early diagnosis of malignancies and technological advancements. Pancreatic cancer can elevate the level of certain biomarkers, which act as tumor markers in disease diagnosis. For instance, CA 19-9 and carcinoembryonic antigen are the most common type of biomarkers for diagnosing cancers of the pancreas. Moreover, the rising emphasis on genetic tests and counseling has resulted in the deeper market penetration of blood tests such as Galleri and PanCan-d.

Cancer Type Insights

The exocrine cancer segment dominated the market with a revenue share of 94% in 2022. Factors such as the high prevalence of exocrine malignancies, the development of new & more effective diagnostic technologies, and a growing awareness regarding the importance of early detection and treatment of pancreatic cancers are factors responsible for the higher market share of the exocrine segment.

According to Johns Hopkins University, all types of exocrine cancer account for more than 95% of cancers of the pancreas. Out of these, adenocarcinoma is the most common form, accounting for 90% of the diagnostic cases. Thus, the higher incidence of adenocarcinoma propels the disease diagnosis rate, thereby driving segment growth.

On the other hand, the endocrine segment is expanding at a steady rate. Endocrine malignancies are not as common as exocrine ones and account for less than 5% of all pancreas tumors. However, significant lifestyle changes, inherited gene mutations, and the presence of comorbidities are expected to increase the disease prevalence and drive segment growth in the coming years.

End-use Insights

The hospitals segment dominated the pancreatic cancer diagnostics market with a revenue share of 57% in 2022. Factors such as rising awareness regarding personalized medicines, improvements in affordable healthcare services, an increasing number of patient visits at hospitals, and a growing focus on strategic activities are supporting the hospital segment growth.

For instance, in December 2021, the City of Hope cancer center announced that it had agreed to acquire Cancer Treatment Centers of America to build a national, integrated research and treatment system for cancer. The joint entity will be one of the major cancer treatment and research organizations in the U.S. with a strong geographic footprint, serving nearly 115,000 patients each year.

The laboratories segment is likely to be the fastest-growing segment during the forecast period. The high disease burden is fueling the demand for lab tests for accurate disease diagnosis. In addition, the large volume of tests performed in labs, advanced healthcare infrastructure acquired by laboratories, and favorable reimbursement policies are supporting the segment expansion. For instance, according to the American Society of Clinical Oncology, the cost for most of the genetic testing are covered by health insurance plans.

Regional Insights

North America held a market share of 41% in 2022. The growth of the North American region is fueled by the increasing incidence of the target disease and rising initiatives from profit and non-profit organizations to promote early disease diagnosis. For instance, the Pancreatic Cancer Action Network is a leading organization that promotes research activities and creates awareness about the condition.

Moreover, the presence of leading market players and various strategic initiatives undertaken by them is another factor supporting the regional market growth. For instance, Abbott, Agilent Technologies, Inc, and Laboratory Corporation of America Holdings have a well-established position in the regional market. Furthermore, the increasing demand for novel diagnostic tests and favorable reimbursement policies are also expected to support market growth in North America.

The heavy burden of pancreatic cancer, high unmet needs, and increasing investments by market players in the Asia Pacific region are factors driving the APAC market. For instance, in December 2022, Hirotsu Bio Science, a biotechnology company in Japan, developed the first early screening tests for pancreas malignancies. Additionally, the increasing demand for minimally invasive tests and supportive government legislations are further escalating the regional market advancement.

Pancreatic Cancer Diagnostic Market Segmentations:

By Product

By Test Type

By Cancer Type

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pancreatic Cancer Diagnostic Market

5.1. COVID-19 Landscape: Pancreatic Cancer Diagnostic Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pancreatic Cancer Diagnostic Market, By Product

8.1. Pancreatic Cancer Diagnostic Market, by Product, 2023-2032

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Pancreatic Cancer Diagnostic Market, By Test Type

9.1. Pancreatic Cancer Diagnostic Market, by Test Type, 2023-2032

9.1.1. Imaging Test

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Biopsy

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Blood Test

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Pancreatic Cancer Diagnostic Market, By Cancer Type

10.1. Pancreatic Cancer Diagnostic Market, by Cancer Type, 2023-2032

10.1.1. Exocrine

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Endocrine

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Pancreatic Cancer Diagnostic Market, By End-use

11.1. Pancreatic Cancer Diagnostic Market, by End-use, 2023-2032

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Clinics

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Laboratories

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Pancreatic Cancer Diagnostic Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.2.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.3.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.4.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.5.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Test Type (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Cancer Type (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. QIAGEN

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Illumina, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. F. Hoffmann-La Roche Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Agilent Technologies, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Abbott

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. BD

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Myriad Genetics, Inc

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Koninklijke Philips N.V.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Hitachi, Ltd

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others