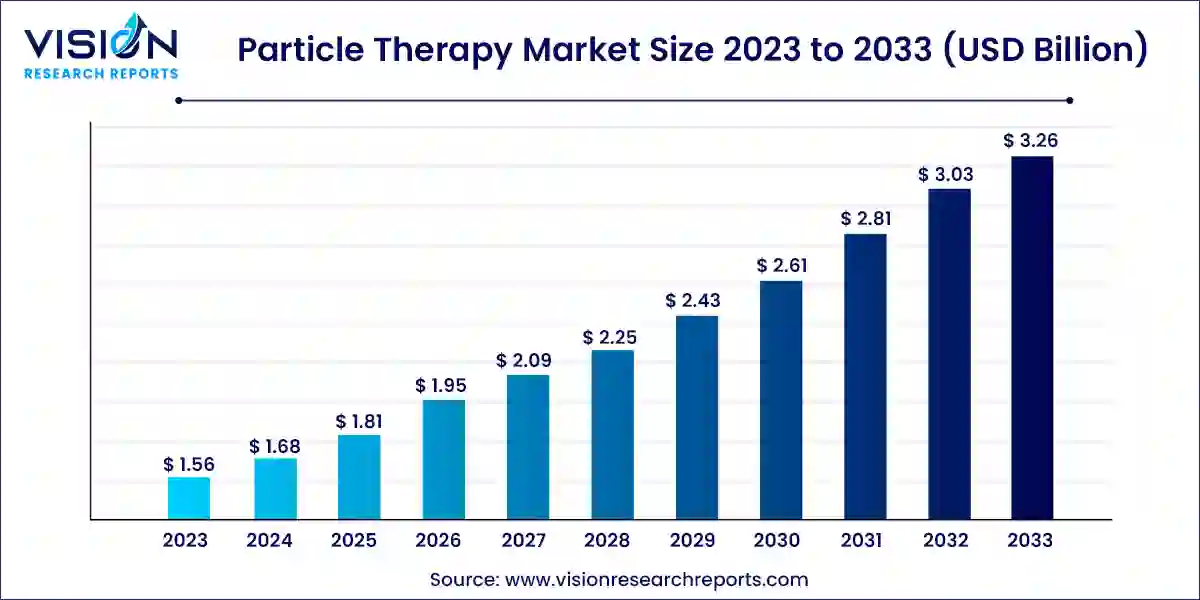

The global particle therapy market size was estimated at around USD 1.56 billion in 2023 and it is projected to hit around USD 3.26 billion by 2033, growing at a CAGR of 7.64% from 2024 to 2033.

Particle therapy, also known as proton therapy or particle beam therapy, is an advanced form of radiation therapy used in the treatment of various types of cancers. Unlike traditional radiation therapy, which uses X-rays, particle therapy utilizes charged particles such as protons or carbon ions to precisely target tumors while minimizing damage to surrounding healthy tissues. The global particle therapy market has witnessed significant growth in recent years, driven by technological advancements, increasing prevalence of cancer, and growing awareness about the benefits of this innovative treatment approach.

The growth of the particle therapy market is propelled by the technological advancements have revolutionized treatment precision and efficacy, with innovations like pencil beam scanning and intensity-modulated proton therapy (IMPT) enhancing therapeutic outcomes. Secondly, the increasing prevalence of cancer worldwide has bolstered the demand for advanced treatment options, with particle therapy offering a targeted approach with minimal damage to healthy tissues. Thirdly, favorable reimbursement policies and government initiatives in certain regions have facilitated patient access to particle therapy, encouraging healthcare providers to invest in state-of-the-art facilities.

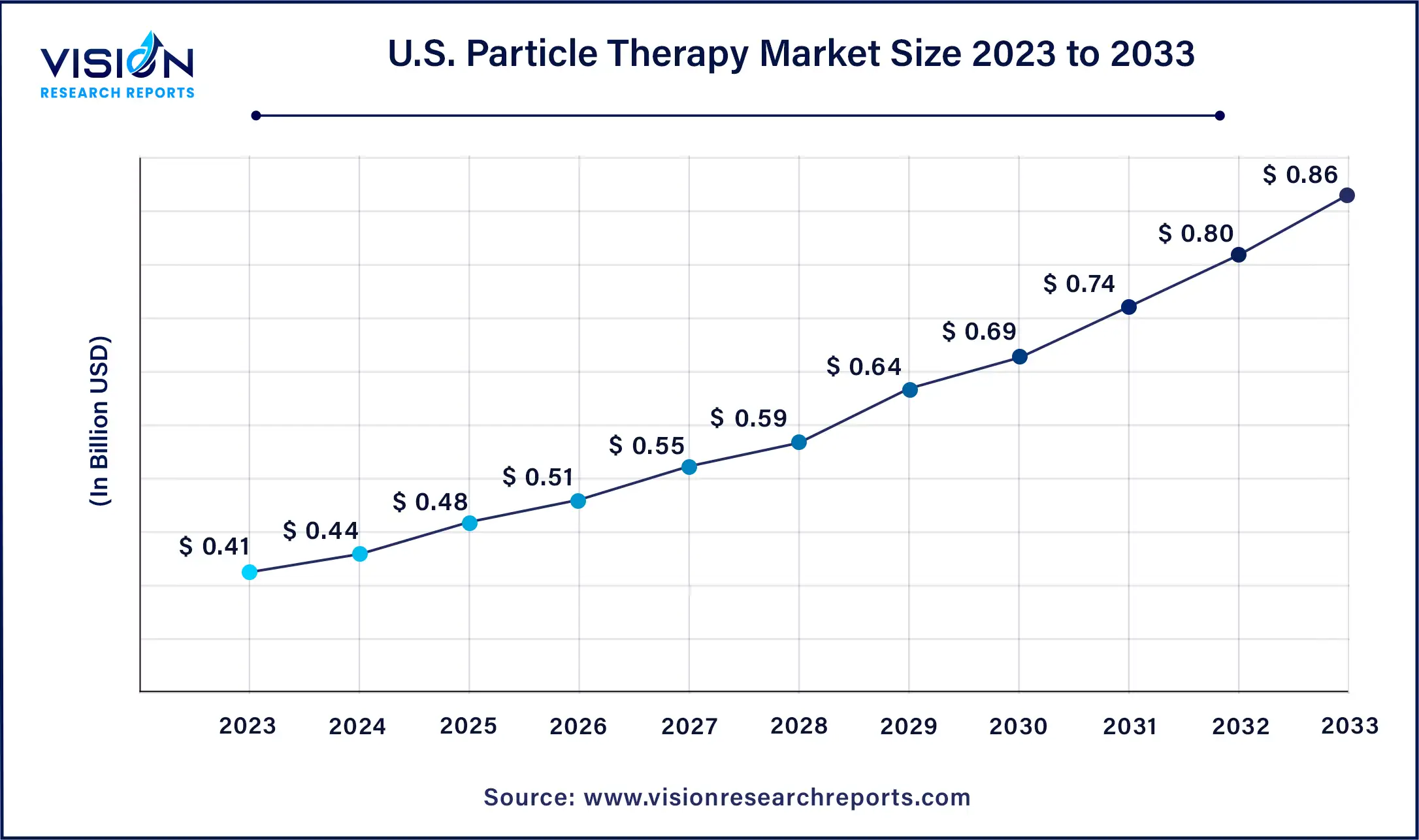

The U.S. particle therapy market was valued at USD 0.41 billion in 2023 and is predicted to surpass around USD 0.86 billion by 2033 with a CAGR of 7.68% from 2024 to 2033.

The particle therapy market in the United States is anticipated to experience rapid expansion over the forecast period, propelled by factors such as heightened awareness among healthcare professionals regarding available radiation therapies for cancer treatment and the escalating disease prevalence. According to the American Cancer Society, an estimated 1.9 million new cancer cases were diagnosed in the U.S., with over 609,000 cancer-related deaths recorded in 2022.

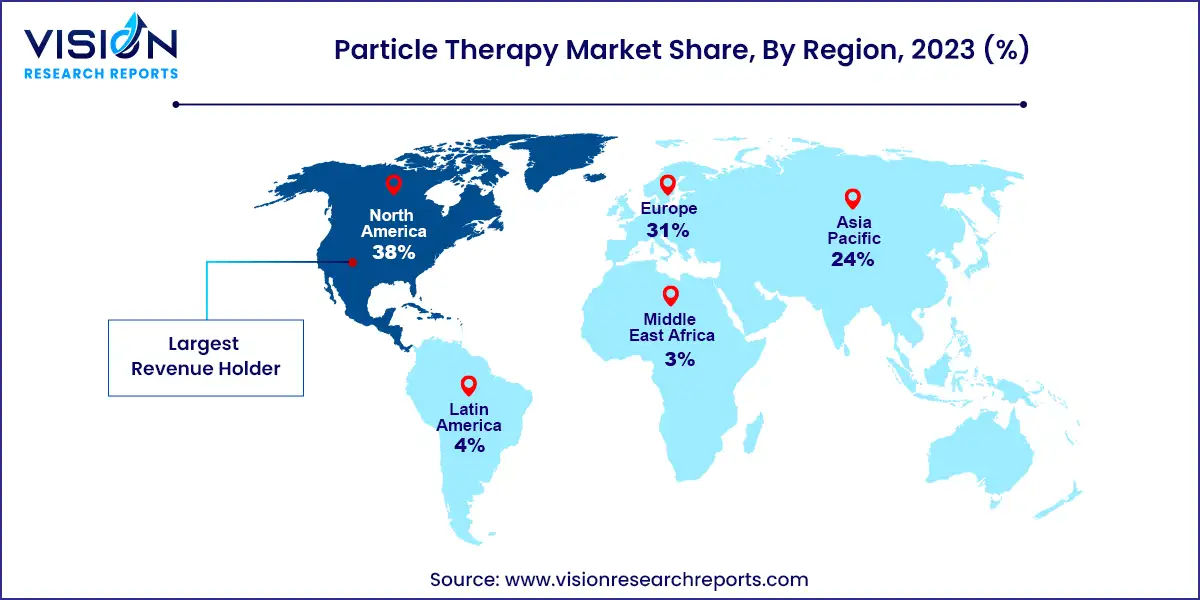

In 2023, the North America particle therapy market commanded a share of 38%, owing to its robust healthcare infrastructure, substantial healthcare expenditures, increasing prevalence of cancer, rising number of radiation treatment procedures, and heightened awareness regarding preventive healthcare treatments. The presence of skilled radiotherapy practitioners further contributes to the market's growth trajectory.

The Asia Pacific particle therapy market is poised to witness the swiftest growth over the forecast period. The region boasts a large target population, significant unmet clinical needs, and ongoing development of healthcare infrastructure, all contributing to its high growth potential. Major industry players are continuously focusing on the development of new particle therapy solutions, driven by factors like the aging population and the increasing prevalence of cancer diseases in the region.

The proton therapy segment asserted its dominance in the market, capturing an 87% share in 2023. This surge is primarily fueled by substantial investments in proton therapy facilities and the expanding application of proton therapy in cancer treatment. Proton therapy's superiority over conventional radiation therapy, demonstrated by its enhanced precision in targeting cancer cells and minimal impact on surrounding healthy tissue, has propelled its acceptance. Additionally, the growing awareness among patients and physicians regarding the benefits of proton therapy is expected to drive an increase in the number of proton radiation treatment centers. Japan leads Asia with the highest number of centers, while new facilities are under construction in Singapore, South Korea, Thailand, and China.

However, the high cost of treatment remains a significant obstacle to market expansion. Heavy ion therapy is projected to exhibit the fastest compound annual growth rate (CAGR) from 2024 to 2033. Utilizing radiation beams of accelerated charged particles heavier than protons, heavy ion therapy demonstrates high efficiency in targeting tumor tissue with minimal impact on healthy tissue. This growing prevalence signifies substantial market potential for companies within the dental industry. Key players offering heavy ion beam therapy products include Toshiba, Hitachi, and IBA. In May 2023, Hitachi, Ltd. expanded its presence in Taiwan by supplying its heavy-ion therapy system to the Taipei Veterans General Hospital.

The single-room systems segment is poised to witness the fastest CAGR of 7.98% during the forecast period. Single-room proton therapy systems offer compact treatment equipment, appealing to cancer patients due to its advantages over multi-room systems. These benefits include reduced adverse effects, as patients experience less discomfort during treatment, and lower risk of radiation damage to healthy tissue. Moreover, patients can maintain their quality of life by continuing their daily activities during therapy, driving significant growth in the global market for single-room proton treatment systems.

Conversely, the multi-room systems segment is expected to experience substantial growth. The rising costs of particle therapy treatments and infrastructure investments serve as primary growth drivers. Multi-room systems and particle therapy facilities equipped with numerous treatment rooms enable healthcare professionals to treat more patients and offer greater treatment options. Benefits such as increased patient throughput, shorter treatment wait times, and enhanced treatment planning flexibility further propel the adoption of multi-room systems over single-room alternatives. The increasing utilization of particle therapy as a preferred cancer treatment option also contributes to market growth.

The treatment segment dominated the market in 2023 and is anticipated to grow at a CAGR of 7.78% from 2024 to 2033. Hospitals and cancer centers play pivotal roles in patient care by providing diagnoses and treatments directly to patients within a hospital setting. As cancer diseases garner increasing recognition for their high mortality rates, hospitals are integrating comprehensive cancer care into their treatment protocols, including the utilization of particle therapies like proton beam therapy. Consequently, the demand for particle therapy treatments is expected to surge over the forecast period.

Clinical research held the second-largest share of the market in 2023. Particle therapy serves a significant role in clinical research endeavors aimed at developing and commercializing new radiation therapy treatments. For instance, in December 2023, Mevion Medical Systems and Kansas City Proton Institute (KCPI) reported the utilization of the MEVION S250i Proton Therapy System to treat the first four patients at KCPI. The growing adoption of particle therapy for research purposes is expected to further propel market growth.

The pediatric cancer segment accounted for the largest share of 45% in 2023. This can be attributed to the escalating number of pediatric cancer cases worldwide. According to the International Agency for Research on Cancer (IARC), approximately 400,000 children and adolescents aged 0 to 19 years are diagnosed with cancer annually. Brain cancers, leukemia, and lymphomas are the most prevalent types of cancer observed in children. Enhancing access to high-quality care and improving the capacity and accuracy of diagnostics and treatment are crucial for reducing childhood cancer-related mortality rates. Consequently, the development and introduction of new proton systems for pediatric disease treatment are driving market growth.

The breast cancer segment is poised for rapid growth throughout the forecast period. Breast cancer stands as the most prevalent form of cancer among women globally. According to Globocan, approximately 2.30 million new cases of breast cancer were diagnosed in 2022, with projections indicating a rise to around 2.70 million new cases by 2030. Proton therapy, utilizing protons to target and eliminate breast cancer cells, is expected to play a crucial role in driving market expansion as the number of breast cancer cases continues to grow.

By Therapy Type

By System

By Application

By Cancer Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others