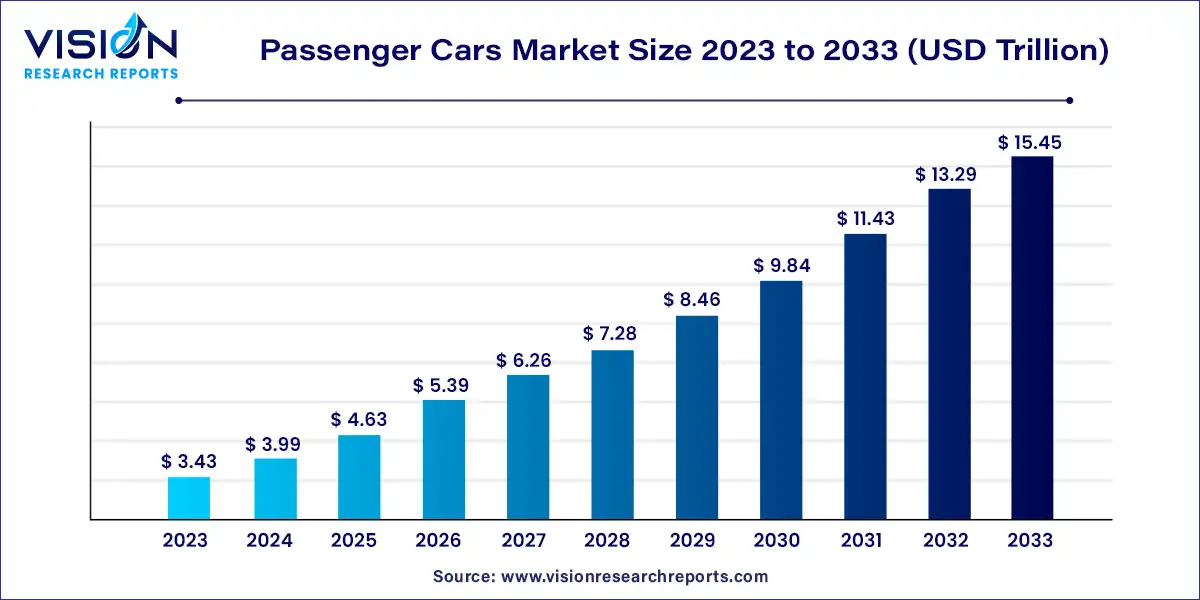

The global passenger cars market size was estimated at USD 3.43 trillion in 2023 and it is expected to surpass around USD 15.45 trillion by 2033, poised to grow at a CAGR of 16.24% from 2024 to 2033.

The passenger cars market is a dynamic segment of the global automotive industry, characterized by rapid technological advancements, shifting consumer preferences, and evolving regulatory landscapes. As one of the largest sectors within the automotive industry, it encompasses various vehicle types, including sedans, hatchbacks, SUVs, and electric vehicles (EVs).

The growth of the passenger cars market is significantly influenced by several key factors. Economic expansion and rising disposable incomes across the globe are crucial drivers, as they enhance consumers' purchasing power, enabling them to invest in personal vehicles. Technological advancements also play a pivotal role, with innovations such as electric vehicles (EVs), advanced driver-assistance systems (ADAS), and improved battery technologies addressing previous limitations and increasing their appeal. Stringent environmental regulations are pushing the automotive industry towards greener solutions, promoting the development and adoption of fuel-efficient and electric vehicles. Urbanization and infrastructure development further support market growth by increasing the demand for personal transportation and improving the practicality of vehicle ownership.

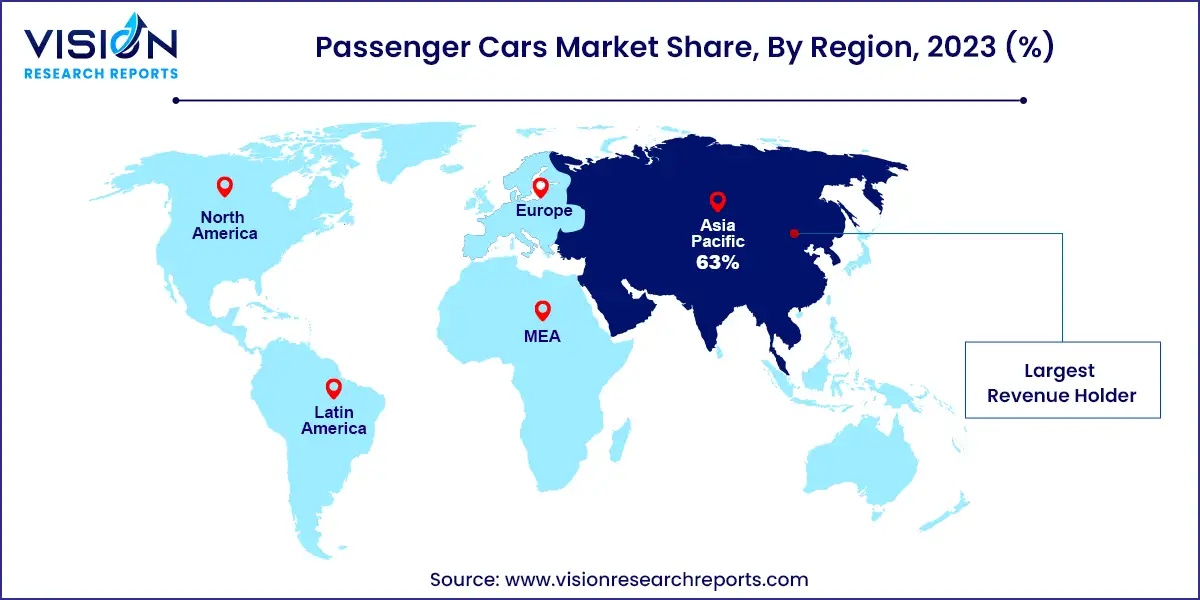

The Asia Pacific market accounted for over 63% of global revenue in 2023, driven by rapid economic growth in China, India, and Southeast Asia. This growth has expanded the middle class and increased disposable incomes.

| Attribute | Asia Pacific |

| Market Value | USD 2.16 Trillion |

| Growth Rate | 16.24% CAGR |

| Projected Value | USD 9.73 Trillion |

In China, the passenger cars market held a share exceeding 33.4% in 2023, with urbanization driving demand for personal vehicles. In Japan, the market is projected to grow at a CAGR of 10.1% from 2023 to 2033, influenced by the cultural emphasis on personal mobility. India's market is expected to grow due to improved infrastructure facilitating car adoption.

North America Market Trends

The North American passenger cars market is expected to grow at a CAGR of 19.53% from 2024 to 2033. A strong economy, rising disposable incomes, and higher employment rates are driving consumer demand for personal vehicles in the region.

Europe Passenger Cars Market Trends

The European passenger cars market was valued at USD 772.97 billion in 2023 and is projected to register the fastest CAGR from 2024 to 2033. Stringent EU regulations are accelerating the shift toward electric and hybrid vehicles, driving demand.

In the UK, the market is expected to grow at a CAGR of 22.4% from 2024 to 2033, supported by incentives and subsidies for electric vehicles. Germany's market is anticipated to grow at a CAGR of 21.8% due to the rise of smart mobility solutions and shared transportation options. The overall shift from conventional vehicles to EVs in France and other European nations reflects growing environmental concerns and industry adaptation.

The internal combustion engine (ICE) segment dominated the market with a share of nearly 77% in 2023. The persistent demand for personal transportation, particularly in developing regions, has solidified ICE vehicles as a primary choice. Their affordability compared to electric vehicles (EVs) and the well-established infrastructure for gasoline and diesel fuel have sustained their global presence. Additionally, ICE vehicles' ability to perform well in various weather conditions and terrains has further enhanced their popularity.

The electric vehicle (EV) segment is projected to experience the fastest compound annual growth rate (CAGR) from 2024 to 2033. This growth is driven by stringent environmental regulations and ambitious carbon reduction targets set by numerous countries. For example, in January 2021, Honda Motor Co., Ltd. and Komatsu Ltd. formed a partnership to develop a battery-sharing system utilizing Honda's Mobile Power Pack (MPP) batteries. Such initiatives are aimed at improving the feasibility and appeal of EVs. Moreover, advancements in battery technology, which enhance driving ranges and reduce charging times, are addressing range anxiety and fostering broader EV adoption.

The economy segment held the largest market share of approximately 88% in 2023. The expanding middle class globally has increased individuals' purchasing power, making economy cars an attractive option due to their affordability and cost-efficiency. These vehicles are designed for fuel efficiency, offering savings both at the time of purchase and during daily use. As fuel prices fluctuate, the emphasis on fuel efficiency becomes crucial for consumers seeking economical transportation solutions, driving growth in this segment.

The luxury segment is expected to see substantial growth from 2024 to 2033. Rising disposable incomes and an expanding affluent demographic are driving demand for high-end vehicles. Economic growth, particularly in emerging markets, has enabled more consumers to afford luxury cars. The prestige associated with luxury vehicles and the integration of advanced driver-assistance systems and connectivity features contribute to their appeal. Luxury cars are increasingly seen as symbols of modernity and sophistication, fueling sustained demand in this segment.

The SUV segment led the market with a share exceeding 49% in 2023. SUVs are popular due to their versatility, spaciousness, and off-road capabilities, appealing to a wide range of consumers. Their advanced safety features and modern infotainment systems also enhance their attractiveness. For instance, in August 2022, Mercedes-Benz Group AG introduced the EQS SUV, the brand's first all-electric luxury SUV, showcasing innovation in both comfort and technology. This trend has significantly driven global demand for SUVs.

The sedan segment is anticipated to grow at the fastest CAGR from 2024 to 2033. Sedans offer a blend of comfort, versatility, and efficiency, catering to a diverse consumer base. For example, in December 2023, BYD Co. Ltd. launched the BYD SEAL, a pure electric sports sedan, adding to its Ocean series. The SEAL features innovative technologies, including BYD's Blade battery known for its safety and durability, highlighting the segment's evolution and growing appeal.

By Propulsion Type

By Vehicle Class

By Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others