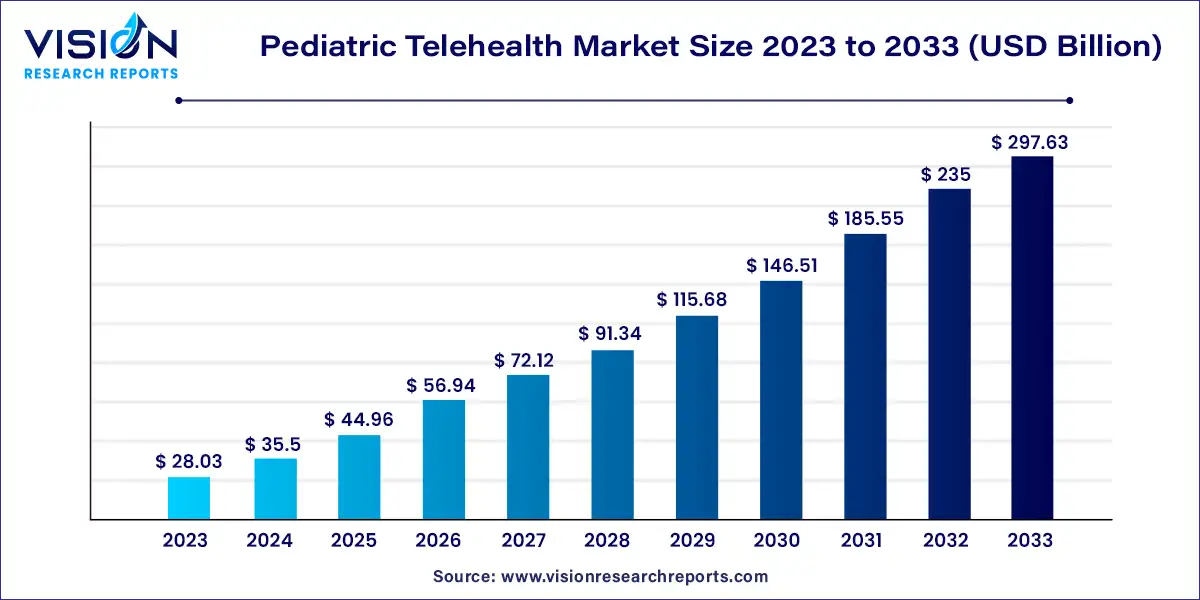

The global pediatric telehealth market size was estimated at around USD 28.03 billion in 2023 and it is projected to hit around USD 297.63 billion by 2033, growing at a CAGR of 26.65% from 2024 to 2033.

Telehealth, particularly in the realm of pediatric care, has emerged as a transformative force in healthcare delivery. With advancements in technology and a growing need for accessible healthcare services, the pediatric telehealth market is experiencing significant growth and evolution.

The growth of the pediatric telehealth market is propelled by an advancements in technology, particularly in telecommunication and digital health platforms, have significantly enhanced the feasibility and effectiveness of remote pediatric consultations. Secondly, the increasing demand for accessible healthcare services, coupled with the challenges of geographical barriers and limited healthcare infrastructure, has led to a surge in adoption of telehealth solutions among pediatric populations. Thirdly, regulatory reforms and changes in reimbursement policies have facilitated greater acceptance and integration of telehealth into mainstream healthcare systems, fostering a conducive environment for market expansion. Moreover, the COVID-19 pandemic has accelerated the adoption of telehealth across all age groups, including children, as a means to ensure continuity of care while minimizing exposure risks.

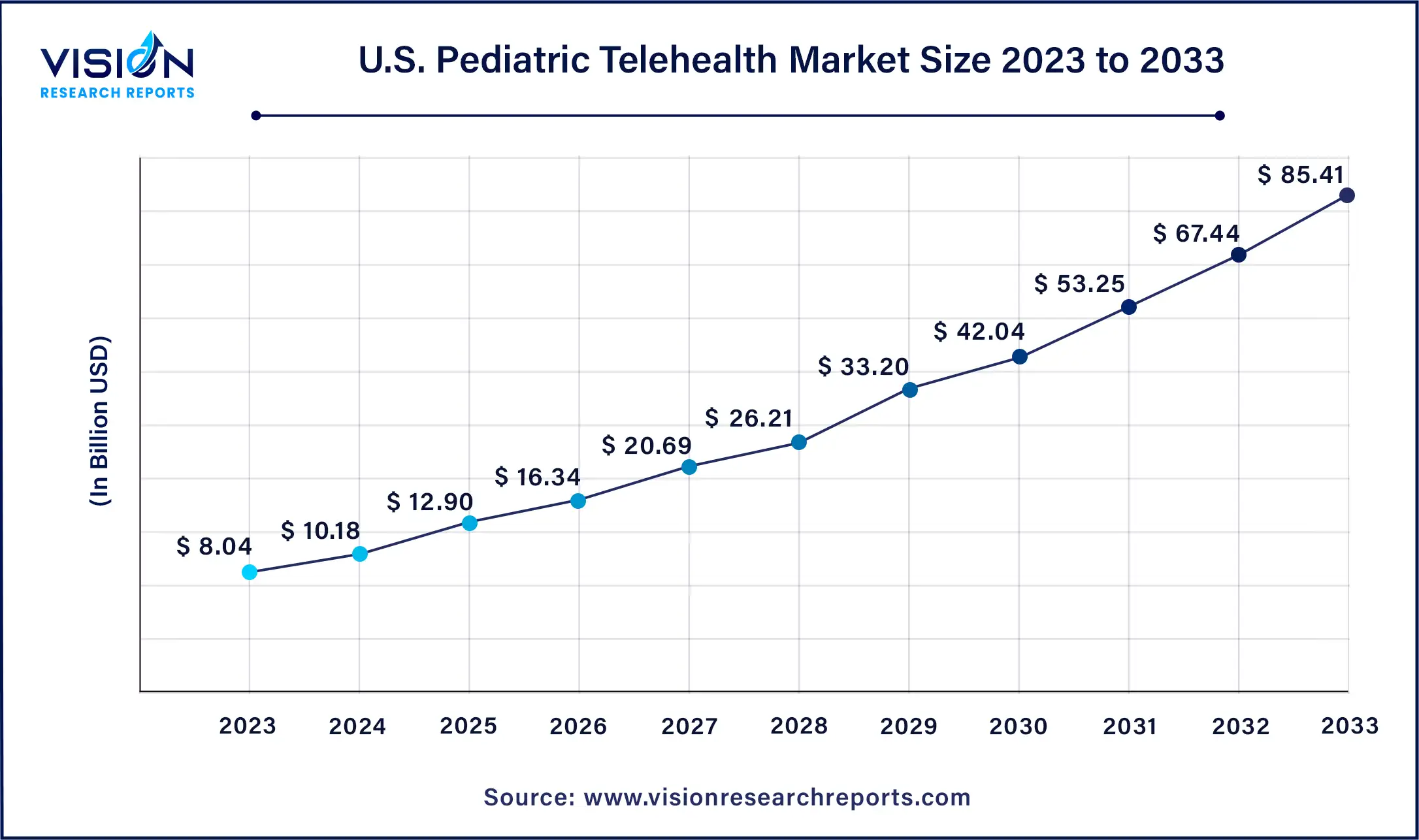

The U.S. pediatric telehealth market was estimated at USD 8.04 billion in 2023 and it is expected to surpass around USD 85.41 billion by 2033, poised to grow at a CAGR of 26.65% from 2024 to 2033.

Within North America, the United States dominated the pediatric telehealth market with a share exceeding 70% in 2023. This growth is attributed to ongoing technological advancements, increasing initiatives by market players, and rising demand for remote patient monitoring and real-time monitoring solutions.

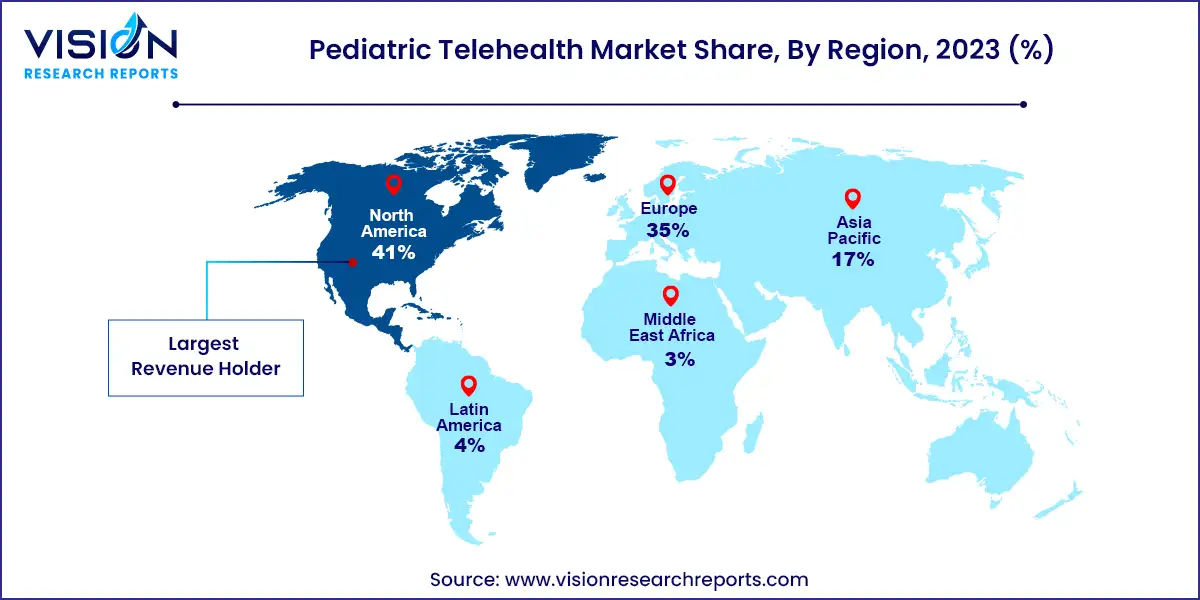

In 2023, North America secured the largest market share, exceeding 41% of the global pediatric telehealth market. The region's robust expansion in pediatric telehealth services is propelled by substantial investments in healthcare IT infrastructure and the widespread adoption of internet and smartphone technologies. As an early adopter of innovative healthcare solutions, North America has seamlessly integrated technologies such as eHealth services, smart wearables, and mobile health applications. These advancements facilitate remote management and access to information for severe and chronic conditions. Moreover, the presence of key market players like Teladoc Health, Inc., American Well, and Oracle further bolsters the growth of pediatric telehealth in North America.

The pediatric telehealth market in the Asia Pacific region is poised to witness the fastest growth during the forecast period. This growth can be attributed to several factors, including the increasing birth rates in countries like China and India, technological advancements in digital healthcare, and active participation from both market players and governments. For example, in June 2023, the government of South Australia announced a funding of approximately USD 21.0 million for the Child and Adolescent Virtual Urgent Care Service (CAVUCS) over the next four year

In 2023, the services segment emerged as the dominant player in the global pediatric telehealth market, commanding a significant revenue share of 48%. This supremacy is attributed to the rising demand for specialized healthcare services tailored to children, particularly in remote or underserved regions. The allure of virtual consultations, coupled with a growing emphasis on preventive and continuous pediatric care, fuels the expansion of telehealth services for this demographic. Furthermore, companies are increasingly investing in the development, introduction, and enhancement of telehealth services aimed at children. For example, in December 2022, OSF Healthcare launched a Real Patient Monitoring (RPM) program designed for toddlers and infants afflicted with Respiratory Syncytial Virus (RSV) infection. This initiative not only reduced the strain on hospital beds occupied by RSV patients but also facilitated remote care for toddlers and infants.

Meanwhile, the software segment is poised to witness the most rapid growth rate during the forecast period. This surge can be attributed to technological advancements, including the integration of Artificial Intelligence (AI) and Machine Learning (ML), as well as the increasing utilization of Electronic Health Record (EHR) and Electronic Medical Record (EMR) software. For instance, in February 2024, Vital partnered with Children’s Hospital Los Angeles (CHLA) to unveil an AI-powered application. This application provides real-time updates on discharge progress, laboratory and imaging results, wait times, and patient education for families and patients in the emergency department, showcasing the transformative potential of software innovations in pediatric telehealth.

In 2023, the web-based segment emerged as the dominant force in the pediatric telehealth market, capturing the largest revenue share. Web-based telehealth solutions are delivered to users via web servers utilizing the internet protocol. These solutions encompass four key elements: a web server, data administrator, internet connection, and software coding system. Web-based and internet services offer access to remote areas through a single monitoring device or computer. Additionally, data from these solutions can be analyzed and accessed in real time, leading to a significant reduction in decision-making time. For example, HyperSend, a web-based delivery system, adheres to the Health Insurance Portability and Accountability Act (HIPAA) and is utilized by numerous healthcare companies.

Meanwhile, the cloud-based segment is projected to experience the fastest compound annual growth rate (CAGR) of 26.23% during the forecast period. This technology facilitates the remote hosting of software, systems, applications, and services, which can be accessed or utilized via the internet. The adoption of cloud-based delivery modes or cloud computing in the healthcare industry has surged due to various security breaches associated with on-premises and web-based deployments. Furthermore, virtualization in cloud computing reduces operational costs for healthcare facilities while enabling them to deliver personalized, high-quality care. Moreover, cloud solutions for healthcare allow professionals to outsource data storage to cloud service providers such as Azure and AWS, facilitating compliance with privacy and security standards like the General Data Protection Regulation (GDPR) and HIPAA

In 2023, the psychiatry segment within the disease area emerged as the leader in the pediatric telehealth market, commanding the largest revenue share at 22%. This growth is primarily driven by the increasing awareness of mental health issues, spurred by various factors including substance abuse. Additionally, numerous healthcare institutions and market players are initiating programs to promote the use of telehealth for raising awareness and managing mental health concerns. For example, in November 2022, the Governor of Illinois introduced a new program aimed at assisting pediatricians and healthcare providers in addressing the mental health needs of children.

Meanwhile, the substance-use segment is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period, fueled by the escalating prevalence of substance use among adolescents aged 10 to 19. Nicotine vapes, alcohol, and marijuana have become increasingly common among this demographic, as reported by the American Academy of Pediatrics in 2022. Moreover, insights from the Monitoring the Future survey in 2022 revealed that 32.6% of 12th graders, 11% of eighth graders, and 21.5% of 10th graders reported using illicit drugs. To address substance-use issues remotely, many organizations and government entities are integrating telehealth services into their treatment strategies. In a bid to cater to rural communities, U.S. representatives launched at-home virtual substance use and mental health services in December 2023.

By Product Type

By Delivery Mode Type

By End-use

By Disease Area

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others