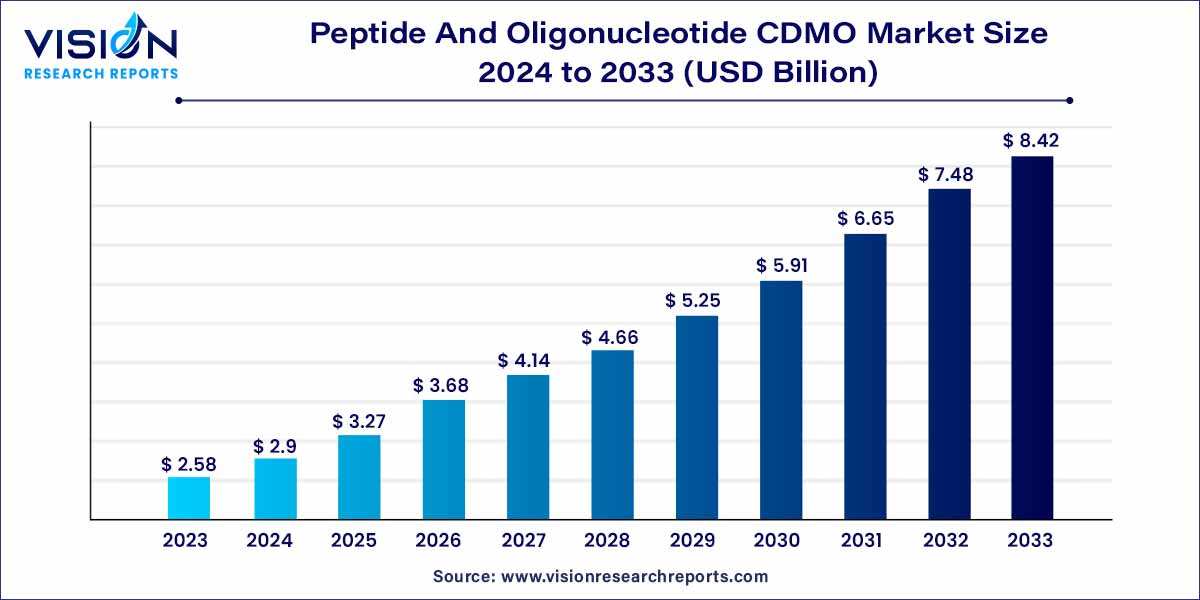

The global peptide and oligonucleotide CDMO market size was estimated at around USD 2.58 billion in 2023 and it is projected to hit around USD 8.42 billion by 2033, growing at a CAGR of 12.56% from 2024 to 2033. The peptide and oligonucleotide CDMO market is driven by the growing adoption of personalized medicine, strategic outsourcing for cost-efficiency, and demand for personalized medicine.

The peptide and oligonucleotide contract development and manufacturing organization (CDMO) market plays a crucial role in the biopharmaceutical industry, offering specialized services for the development and production of peptides and oligonucleotides. This overview will delve into key aspects of this dynamic market, providing insights into its current state and future trends.

The growth of the peptide and oligonucleotide contract development and manufacturing organization (CDMO) market is propelled by various factors contributing to its expanding influence in the biopharmaceutical sector. One primary driver is the increasing prevalence of chronic diseases and the growing adoption of personalized medicine, stimulating the demand for innovative therapeutic solutions. This trend prompts pharmaceutical companies to seek the expertise of CDMOs, leveraging their specialized services for the development and manufacturing of peptides and oligonucleotides. Additionally, advancements in manufacturing technologies, such as solid-phase peptide synthesis and high-throughput synthesis for oligonucleotides, play a pivotal role in enhancing the efficiency and scalability of production processes. The dynamic regulatory landscape underscores the significance of compliance with stringent quality standards, prompting CDMOs to invest in robust quality management systems to ensure the safety and efficacy of manufactured products. As the pharmaceutical industry continues to explore the therapeutic potential of peptides and oligonucleotides, the Peptide and Oligonucleotide CDMO market is poised for sustained growth, with emerging trends including a focus on bioconjugation technologies and expanding collaborations between CDMOs and pharmaceutical companies.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.56% |

| Market Revenue by 2033 | USD 8.42 billion |

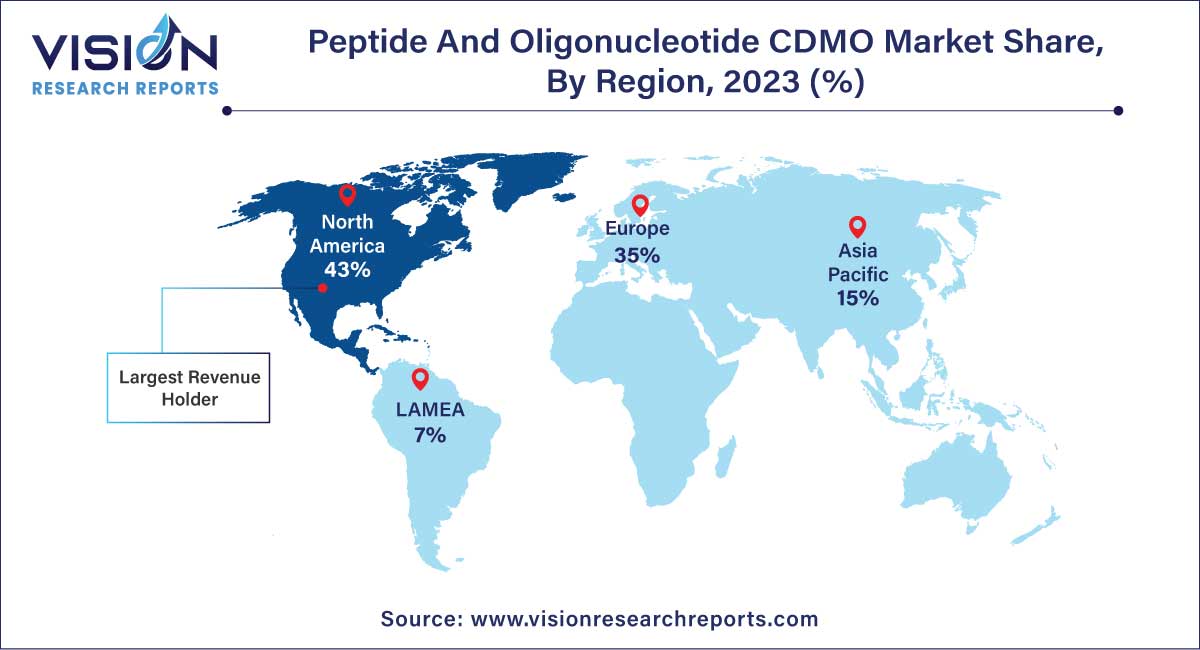

| Revenue Share of North America in 2023 | 43% |

| CAGR of Asia Pacific from 2024 to 2033 | 13.47% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Increasing Prevalence of Chronic Diseases: The rising incidence of chronic diseases is a significant driver for the Peptide and oligonucleotide contract development and manufacturing organization (CDMO) market. As the need for innovative therapeutic solutions intensifies, pharmaceutical companies turn to CDMOs for specialized services in developing peptides and oligonucleotides.

Demand for Personalized Medicine: The growing adoption of personalized medicine further fuels the demand for CDMO services. Tailoring treatments to individual patient profiles necessitates the production of customized peptides and oligonucleotides, positioning CDMOs as vital partners in meeting this evolving need.

Rapidly Evolving Technologies: While technological advancements are a driving force, the rapid evolution of manufacturing technologies poses a challenge for CDMOs. Staying abreast of the latest advancements requires continuous investment in research and development, and failure to do so may lead to obsolescence and hinder competitiveness.

Supply Chain Disruptions: The peptide and oligonucleotide CDMO market is susceptible to supply chain disruptions, impacting the timely availability of raw materials and specialized equipment. External factors, such as geopolitical events, natural disasters, or global health crises, can disrupt the supply chain, affecting production schedules and potentially causing delays.

Expanding Therapeutic Applications: The peptide and oligonucleotide contract development and manufacturing organization (CDMO) market holds significant opportunities in the expansion of therapeutic applications. As research uncovers new therapeutic targets, CDMOs can seize the opportunity to collaborate with pharmaceutical companies in developing novel peptides and oligonucleotides for a wide range of medical conditions.

Advancements in Bioconjugation Technologies: The growing focus on bioconjugation technologies offers a promising opportunity for CDMOs. Bioconjugation enhances the therapeutic properties of peptides and oligonucleotides, opening avenues for the development of innovative drug modalities. CDMOs investing in and mastering these technologies can position themselves as leaders in this specialized field.

In 2023, the peptides segment secured the largest share of revenue, accounting for 67%. This dominance is attributed to the increasing focus of various biopharmaceutical and pharmaceutical companies on pipeline products related to peptides. There is a noticeable surge in investments from these companies, specifically in the development of peptides targeting various disease indications. This trend is expected to drive the growth of the peptides segment consistently throughout the analysis period. A notable example is EUROAPI's announcement in October 2022, wherein they invested USD 19.1 million in state-of-the-art manufacturing equipment at their Frankfurt facility, focusing on Contract Development and Manufacturing Organization (CDMO) services for peptides and oligonucleotides. This move represents a substantial enhancement of EUROAPI's operations in Germany.

On the other hand, the oligonucleotides segment is projected to experience a lucrative CAGR of 14.63% during the forecast period. The robust growth in this segment is linked to the increasing number of pipeline products for oligonucleotide therapeutics. Factors such as heightened clinical investments in novel therapies, the entrance of numerous CDMOs into the industry, and a rise in the count of pipeline oligonucleotide products contribute to the segment's expansion.

In 2023, the contract manufacturing segment held the largest revenue share of 66%. The substantial market share is primarily attributed to the increasing influx of CDMOs into the peptide and oligonucleotide therapeutics industry. Additionally, the high production costs associated with these therapeutics drive the demand for outsourcing services to contract manufacturers. The in-house manufacturing expenses for peptide and oligonucleotide-based drugs are notably elevated, prompting sponsor companies to outsource large-scale manufacturing services to contract manufacturers. This strategic shift contributes significantly to the growth of the contract manufacturing sector.

The contract development segment is expected to expand at the highest CAGR of 12.93% during the forecast period. The substantial growth in this segment is primarily driven by the increasing demand for specific expertise and technology in the development of peptide and oligonucleotide-based drugs. Contract development organizations, equipped with specialized knowledge, emerge as preferred partners for drug development initiatives. Additionally, the expanding pipeline of peptide therapeutics stands as a significant factor fueling the demand for contract development services.

In 2023, the category of biopharmaceutical companies segment had the largest market share of 43%. This significant presence is a result of the escalating investments made by biopharmaceutical companies in the field of peptide and oligonucleotide drugs. A noteworthy example is the collaboration announced in September 2022 between Vanda Pharmaceuticals Inc. and OliPass Corporation. Their joint research and development effort aimed to create a collection of antisense oligonucleotide molecules utilizing OliPass' exclusive modified peptide nucleic acids.

Conversely, the pharmaceutical companies segment is projected to experience a steady Compound Annual Growth Rate (CAGR) of 12.53% during the forecast period. The robust growth in this segment is primarily attributed to the increasing involvement of pharmaceutical companies in novel drug development endeavors. Furthermore, a growing number of pharmaceutical companies are opting to outsource their manufacturing and development services to Contract Development and Manufacturing Organizations (CDMOs).

North America holds the largest market share of 43% in 2023, largely attributed to the presence of well-established Contract Development and Manufacturing Organizations (CDMOs) specializing in peptide and oligonucleotide development and manufacturing services. Notable entities such as PolyPeptide Group, STA Pharmaceutical Co. Ltd., Bachem, and others contribute to the region's dominance. The United States, in particular, stands as the leading market for peptide and oligonucleotide CDMO services. Many pharmaceutical companies opt to delegate their manufacturing services to Contract Research Organizations (CROs) situated in the U.S. This preference is motivated by the consistent track record of U.S.-based CROs in delivering high-quality products and services.

Asia Pacific region is poised to register the fastest CAGR of 13.47% during the forecast period. The appeal of the Asia Pacific region lies in its conducive environment for conducting clinical trials, driven by favorable regulatory changes and cost-effective options for clinical research, particularly in countries like China and India.

By Product

By Service Type

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Peptide And Oligonucleotide CDMO Market

5.1. COVID-19 Landscape: Peptide And Oligonucleotide CDMO Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Peptide And Oligonucleotide CDMO Market, By Product

8.1. Peptide And Oligonucleotide CDMO Market, by Product, 2024-2033

8.1.1 Peptides

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Oligonucleotides

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Peptide And Oligonucleotide CDMO Market, By Service Type

9.1. Peptide And Oligonucleotide CDMO Market, by Service Type, 2024-2033

9.1.1. Contract Development

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Contract Manufacturing

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Peptide And Oligonucleotide CDMO Market, By End Use

10.1. Peptide And Oligonucleotide CDMO Market, by End Use, 2024-2033

10.1.1. Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Biopharmaceutical Companies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Peptide And Oligonucleotide CDMO Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End Use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End Use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 12. Company Profiles

12.1. PolyPeptide Group.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. STA Pharmaceutical Co. Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bachem.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Creative Peptides.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Aurigene Pharmaceutical Services Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Merck KGaA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. EUROAPI.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Curia Global, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CordenPharm.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Sylentis, S.A.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others