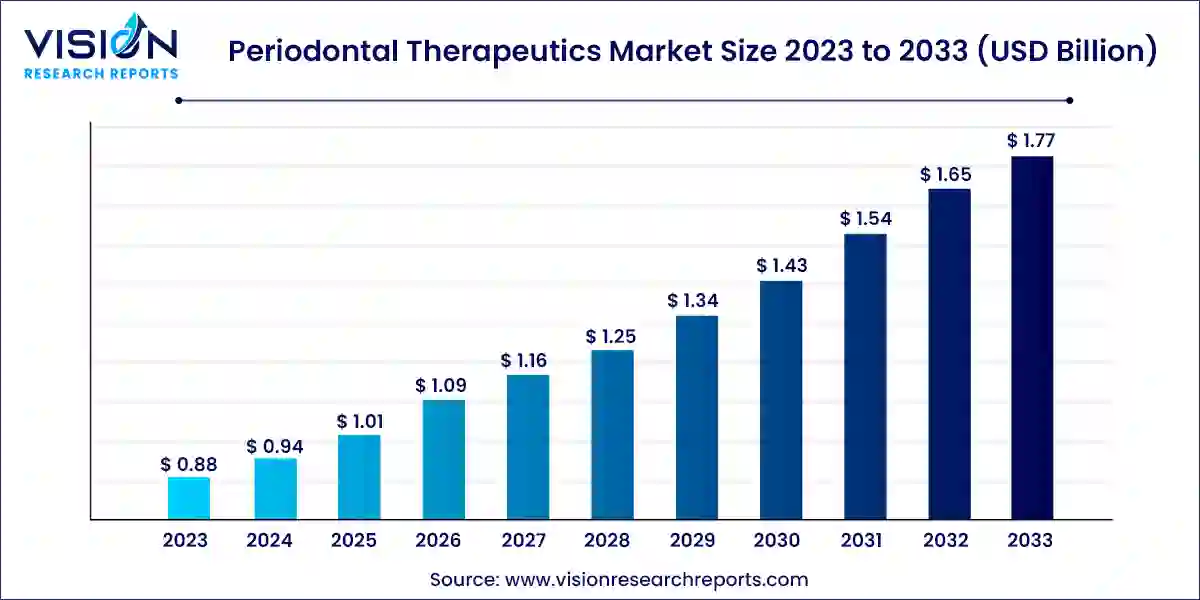

The global periodontal therapeutics market size was valued at USD 0.88 billion in 2023 and is anticipated to reach around USD 1.77 billion by 2033, growing at a CAGR of 7.23% from 2024 to 2033.

The periodontal therapeutics market is a dynamic sector within the healthcare industry that focuses on the treatment of gum diseases and related conditions. With an increasing awareness of oral health and advancements in dental technology, the market for periodontal therapeutics continues to evolve.

At its core, the periodontal therapeutics market encompasses a wide range of products and treatments aimed at managing and treating periodontal diseases such as gingivitis and periodontitis. These may include antimicrobial agents, antibiotics, anti-inflammatory drugs, and surgical interventions, among others.

The growth of the periodontal therapeutics market is propelled by the rising prevalence of periodontal diseases globally, fueled by factors such as poor oral hygiene habits and the aging population, drives the demand for effective treatment options. Additionally, increasing investments in research and development by pharmaceutical and dental companies lead to the development of innovative therapies, enhancing the efficacy of existing treatments and introducing novel therapeutic approaches. Moreover, the growing adoption of preventive dental care practices and the rising demand for cosmetic dentistry procedures contribute to the expansion of the market.

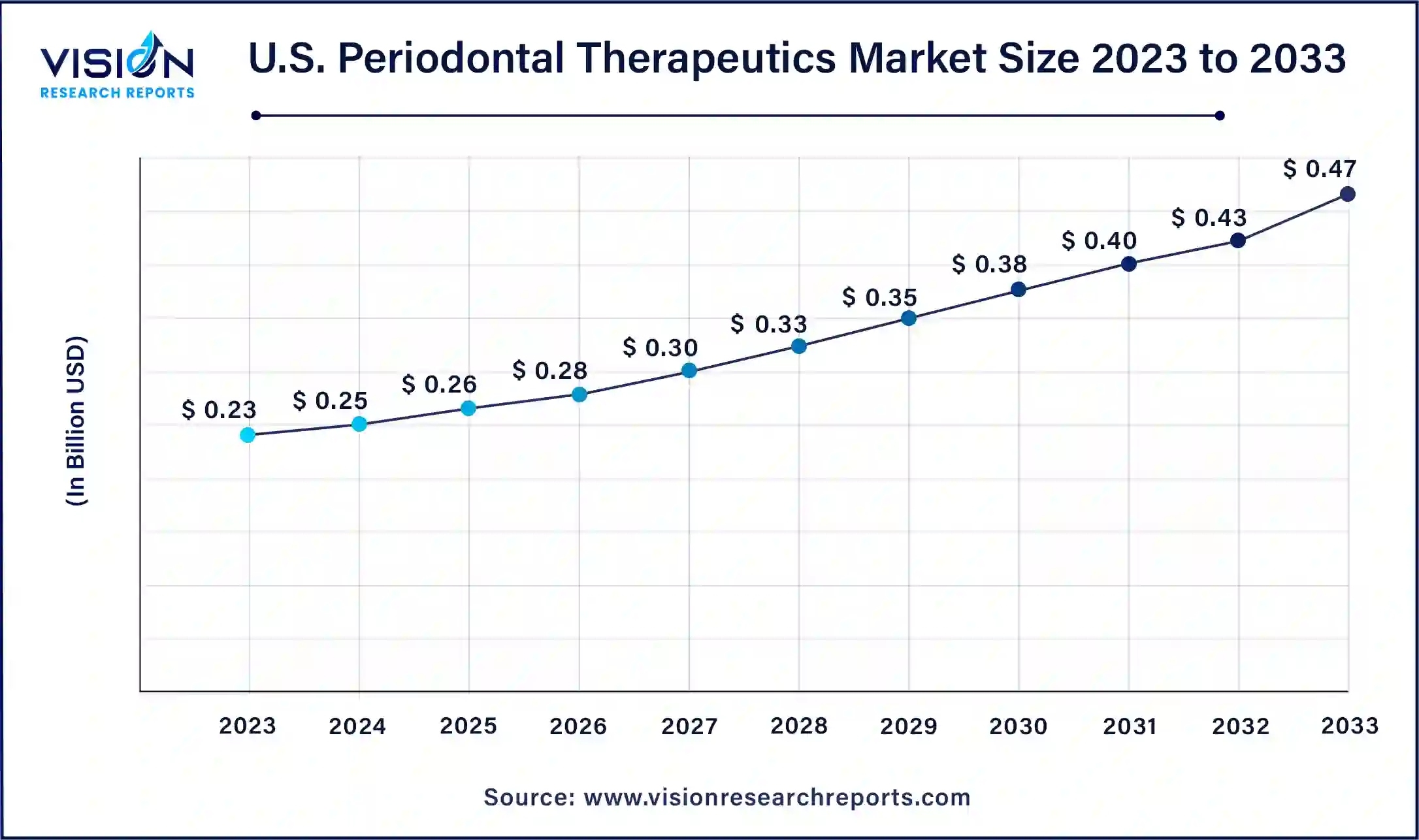

The U.S. periodontal therapeutics market size was estimated at USD 0.23 billion in 2023 and is expected to surpass around USD 0.47 billion by 2033, poised to grow at a CAGR of 7.41% from 2024 to 2033.

The market in the U.S. is poised for rapid expansion over the forecast period, fueled by advancements in dental research and technology, resulting in the emergence of more efficacious and innovative treatment modalities for periodontal diseases. Additionally, heightened awareness of oral health and the significance of preventive dental care among the populace is driving the demand for periodontal therapeutics.

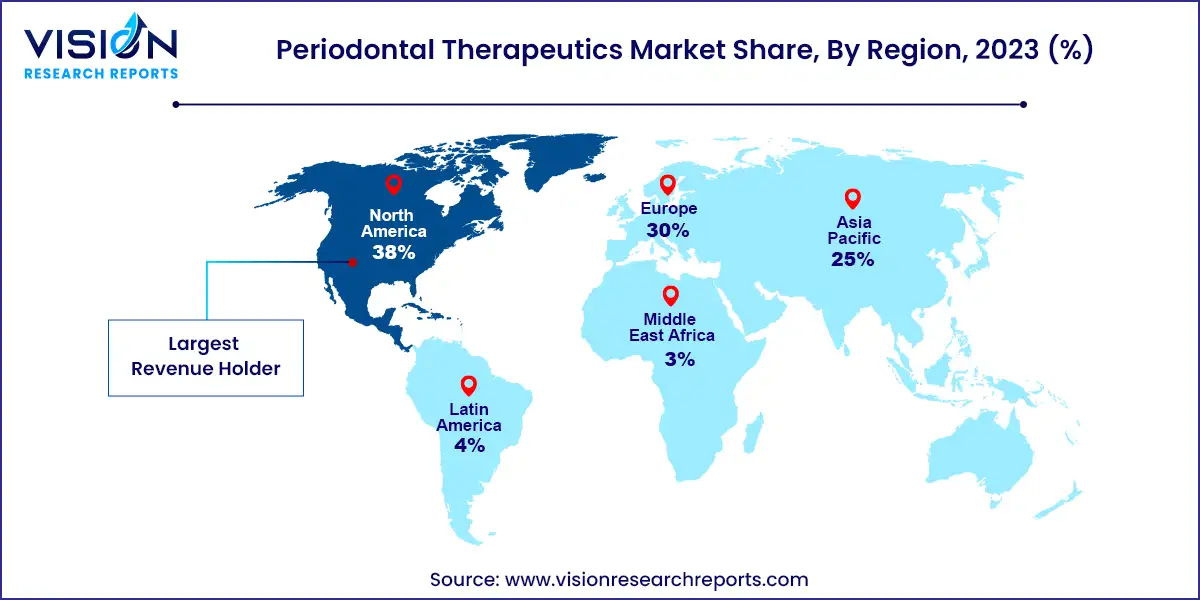

The North American market held a significant share of 38% in 2023, attributable to factors such as the high prevalence of periodontal diseases and increasing favorable government initiatives. Periodontal disease (PD) is a widespread oral health concern affecting a substantial portion of the U.S. population, with research indicating approximately 42% of adults in the U.S. grappling with this condition. Moreover, market growth is spurred by proactive measures undertaken by industry players to meet the escalating demand for dental disease management in the region.

The Asia Pacific market is forecasted to experience the swiftest growth over the projection period. The region boasts a sizable target population, substantial unmet clinical needs, and burgeoning healthcare infrastructure, offering considerable growth prospects. Major industry players in the region are consistently concentrating on developing periodontal therapeutic solutions owing to the escalating prevalence of the aging population and a rising incidence of chronic diseases.

The segment of chronic periodontal disease emerged as the market leader, representing a share of 35% in 2023. Chronic periodontitis (CP) is a severe gum condition characterized by inflammation, tissue damage, and bone loss surrounding the teeth. Initially manifesting as gingivitis, it can progress to advanced periodontitis. Research published in March 2023 indicates a correlation between CP and systemic diseases such as diabetes, cardiovascular problems, respiratory infections, and chronic kidney disease (CKD). Interestingly, there's a mutual relationship between CKD and CP: as CKD worsens, susceptibility to CP increases, and patients with poor kidney function often display inferior oral hygiene and a higher prevalence of moderate to severe CP. From a business standpoint, this highlights the significance of comprehensive oral healthcare and the potential for dental enterprises to devise holistic solutions addressing both the disease and its systemic effects, thereby expanding their market presence and enhancing patient outcomes.

The gingivitis segment is projected to witness rapid growth during the forecast period. Gingivitis, a common gum ailment, occurs when bacteria in the mouth infect the gums near a tooth, resulting in inflammation. This typically transpires due to the accumulation of plaque, a bacterial film, on teeth. While regular brushing and flossing aid in plaque reduction, gingivitis may still develop if an infection arises. Despite available dental interventions, many individuals refrain from seeking care, allowing the condition to deteriorate. This presents an opportunity for dental industry entities to educate the populace about gingivitis prevention and treatment options, potentially stimulating increased demand for dental products and services.

Doxycycline claimed dominance in the market with a share of 38% in 2023. Even at lower concentrations, doxycycline has been observed to inhibit matrix metalloproteinase-8 (MMP-8), an enzyme prevalent in periodontitis. A preliminary study, detailed in a November 2022 article by BioMed Central Ltd, explored a modified form of tetracycline-3 in periodontal patients undergoing scaling and root planning. Administering this antimicrobial at a low dose (10 mg/day) demonstrated moderate reductions in interleukin-1-beta and MMP-8 levels in gingival crevicular fluid. Other research studies have suggested that sub-antimicrobial doses of doxycycline can lead to decreased pocket depth (PD) and improvements in clinical attachment level (CAL) in periodontal disease patients.

The minocycline segment is poised for rapid growth over the forecast period. Minocycline, an antibiotic belonging to the tetracycline class, is commonly used to treat various bacterial infections, including acne, and periodontal diseases. As per an MDPI article published in April 2022, delivering minocycline directly to the periodontal site resulted in significant alterations in the types of bacteria present beneath the gumline. This suggests that localized administration of minocycline can impact bacterial composition, potentially contributing to the positive therapeutic outcomes observed in periodontitis patients.

The hospital pharmacies segment secured the largest share of 43% in 2023. Hospital pharmacies play a pivotal role in patient care by dispensing medications and treatments directly within the hospital premises. With increasing recognition of diseases for their systemic implications, hospitals are incorporating comprehensive oral care into their treatment protocols, including the utilization of periodontal therapeutics. Many hospitals are expanding their dental departments or establishing specialized oral health clinics to address the growing prevalence of these diseases. This trend propels the demand for periodontal therapeutics within hospital pharmacies, as they emerge as key suppliers of these medications for inpatient and outpatient dental procedures. Hospital pharmacies frequently collaborate closely with dental professionals, including periodontists and oral surgeons, to ensure optimal medication management for patients undergoing periodontal treatments.

In 2023, retail pharmacies secured the second-largest share of the market. These pharmacies play a pivotal role by offering access to a diverse array of oral care products, including medications for treating periodontal diseases. They provide convenience and accessibility to patients seeking over-the-counter oral hygiene products as well as prescription medications recommended by dentists or healthcare providers. With a range of periodontal therapeutics like antimicrobial mouth rinses, toothpaste, and locally administered antibiotics, retail pharmacies cater to individuals aiming to maintain or enhance their oral health. Additionally, they often serve as educational hubs, where pharmacists offer advice and suggestions on proper oral hygiene practices and medication use.

By Disease

By Drug Type

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others