Personalized Retail Nutrition and Wellness Market Size and Growth 2024 to 2033

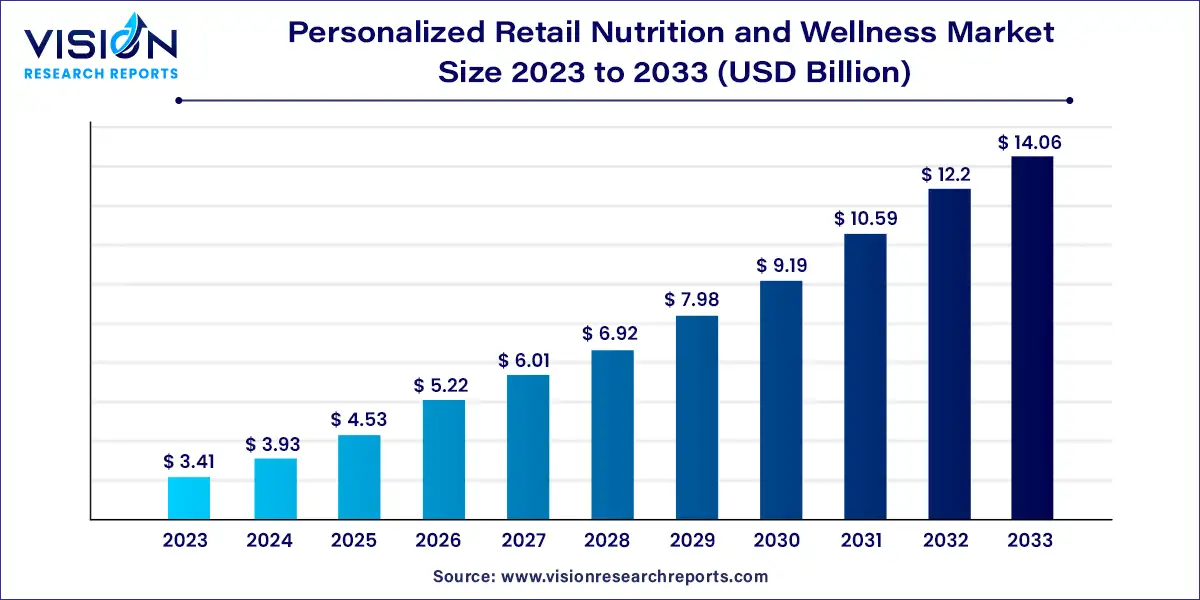

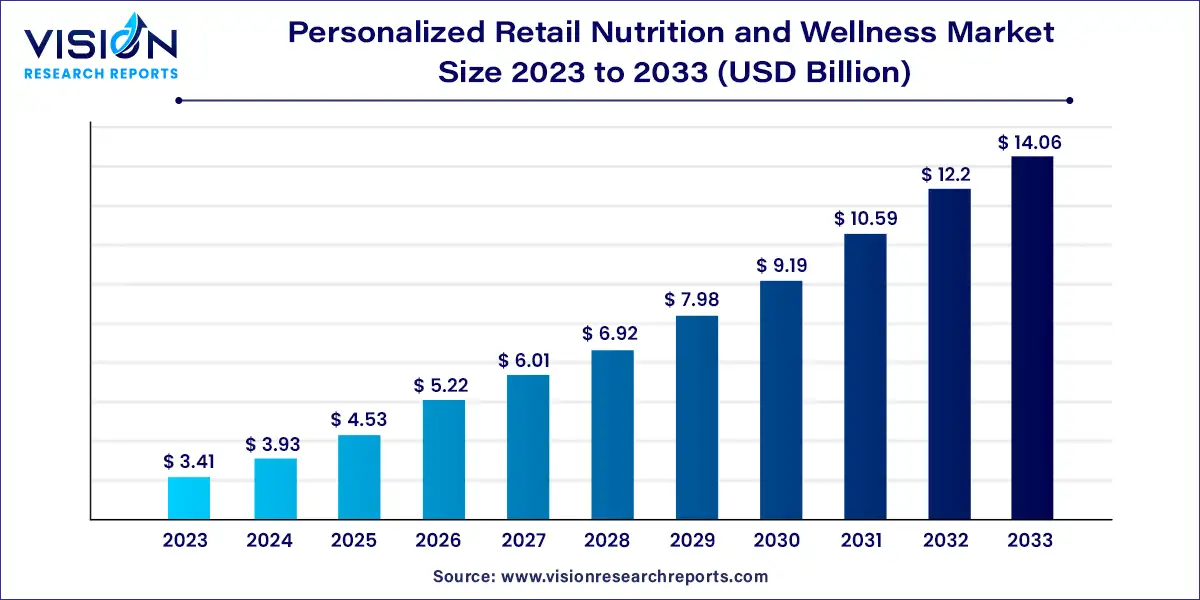

The global personalized retail nutrition and wellness market size was estimated at around USD 3.41 billion in 2023 and it is projected to hit around USD 14.06 billion by 2033, growing at a CAGR of 15.22% from 2024 to 2033. The personalized retail nutrition and wellness market is experiencing significant growth driven by a surge in consumer demand for tailored health solutions. This market encompasses a wide range of products and services, from customized dietary supplements and meal plans to individualized fitness programs and wellness consultations. The convergence of advanced technology, such as AI and data analytics, with an increasing focus on personalized health has created a dynamic and evolving landscape.

Key Pointers

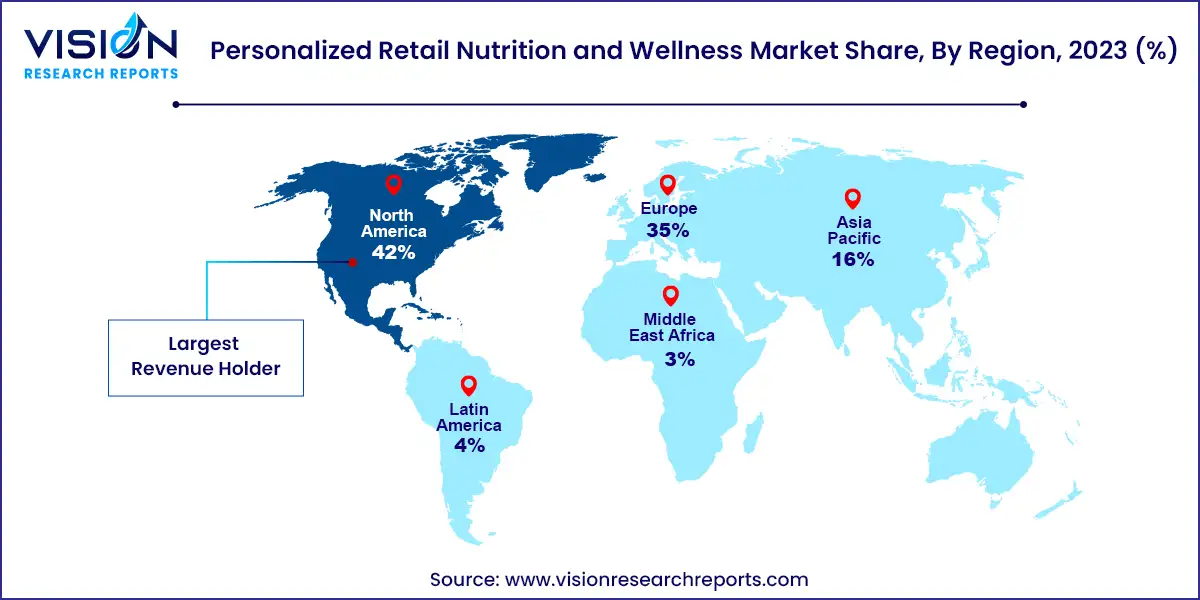

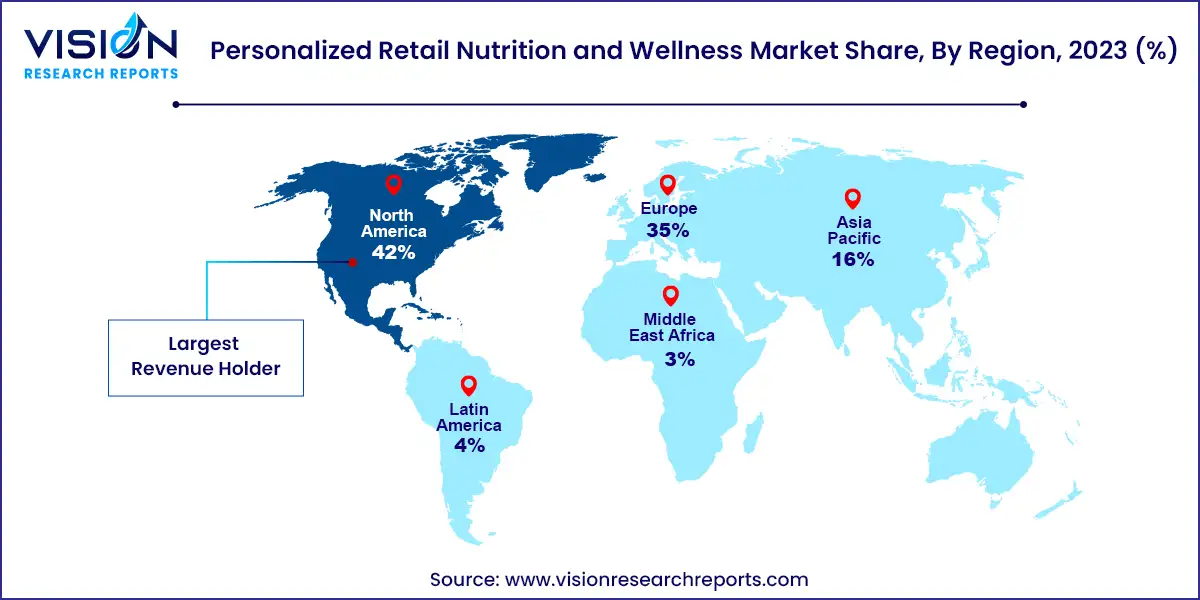

- North America dominated the global market with the largest market share of 42% in 2023.

- The Asia Pacific region is expected to grow at the fastest CAGR of 17.08% from 2024 to 2033.

- By Type, the repeat recommendations segment captured the maximum market share of 47% in 2023.

- By Type, the personalized testing segment is estimated to expand the fastest CAGR of 16.29% from 2024 to 2033.

What are the Growth Factors of Personalized Retail Nutrition and Wellness Market?

The personalized retail nutrition and wellness market is expanding rapidly due to several key growth factors. First, there is a heightened consumer awareness of the importance of tailored health solutions, driven by a growing understanding of how individualized nutrition and wellness plans can significantly impact overall well-being. Advances in technology, including wearable devices and genetic testing, have further fueled this growth by enabling more precise and personalized health assessments. Additionally, the rise of digital health platforms has made customized wellness solutions more accessible, allowing consumers to seamlessly integrate personalized nutrition and fitness plans into their daily lives. Increased investment in research and development by companies striving to innovate and meet the diverse needs of consumers also contributes to the market's expansion. Collectively, these factors are propelling the personalized retail nutrition and wellness sector into a dynamic phase of growth and development.

What are the Trends in Personalized Retail Nutrition and Wellness Market?

- Customized Nutritional Supplements: There is a growing demand for dietary supplements tailored to individual health profiles. Companies are leveraging data on genetic markers, lifestyle habits, and health goals to create bespoke vitamin and mineral formulations that address specific nutritional needs.

- Tailored Meal Planning: Retailers are offering personalized meal plans that cater to individual dietary preferences, health conditions, and fitness goals. This trend is supported by meal delivery services that provide convenient, customized food options designed to enhance overall well-being.

- Integration of AI and Data Analytics: Artificial intelligence and data analytics are increasingly used to refine personalization in nutrition and wellness. AI algorithms analyze health data to offer precise recommendations, optimize supplement formulations, and adjust wellness plans in real-time.

- Holistic Wellness Approaches: There is a rising trend towards integrative wellness solutions that combine nutrition, physical fitness, and mental health. Personalized programs that address multiple aspects of well-being are becoming more prevalent, reflecting a comprehensive approach to health.

What are the Key Challenges Faced by Personalized Retail Nutrition and Wellness Market?

- Privacy and Data Security Concerns: The collection and analysis of personal health data pose significant privacy and security challenges. Ensuring robust data protection and compliance with regulations such as GDPR and HIPAA is crucial to maintaining consumer trust.

- High Costs and Accessibility: Personalized nutrition and wellness solutions often come with higher price points compared to generic alternatives. This cost disparity can limit access for some consumers, creating barriers to widespread adoption.

- Regulatory and Compliance Issues: Navigating the complex regulatory landscape is a major challenge for companies in the personalized wellness sector. Regulations can vary by region, affecting the development, marketing, and distribution of personalized health products and services.

- Integration of Disparate Data Sources: Effectively integrating and analyzing data from various sources, such as genetic tests, lifestyle tracking, and medical records, can be challenging. Ensuring accurate and comprehensive insights requires sophisticated data management and analytics capabilities.

Which Region Dominates the Personalized Retail Nutrition and Wellness Market?

North America led the personalized retail nutrition and wellness market with a significant revenue share of 42% in 2023. The region's growth is supported by the presence of major industry players, the introduction of new products, and increasing FDA approvals for functional food items. Companies in the sector are also engaging in strategic business activities such as acquisitions and partnerships. For example, Nature’s Way acquired Baze in February 2021 to enhance its portfolio with evidence-based, personalized nutrition solutions, leveraging Baze’s platforms to develop high-quality, customized health products.

What is the Contribution of North America to Personalized Retail Nutrition and Wellness Market?

| Attribute |

North America |

| Market Value |

USD 1.43 Billion |

| Growth Rate |

15.24% CAGR |

| Projected Value |

USD 5.90 Billion |

The European market for personalized retail nutrition and wellness is thriving, driven by rising awareness of personalized health solutions, greater adoption of digital health tools, and supportive regulatory environments that encourage health and wellness innovations.

The Asia Pacific region is expected to grow at the fastest CAGR of 17.08% from 2024 to 2033. This growth is fueled by increasing consumer awareness of health and wellness, rapid urbanization, rising disposable incomes, and advancements in digital health technologies. Additionally, the growing prevalence of lifestyle-related diseases and a rising demand for preventive healthcare measures are contributing to the market’s expansion. Key industry players are investing significantly in research and development to offer innovative personalized nutrition products and services.

The market in the Middle East and Africa is anticipated to grow at a moderate CAGR during the forecast period. This growth is driven by rising health and wellness awareness, an increasing prevalence of lifestyle-related diseases, and growing interest in preventive healthcare solutions.

Type Insights

In 2023, the repeat recommendations segment emerged as the market leader, commanding a substantial revenue share of 47%. This dominance is attributed to the introduction of commercial applications designed to monitor daily routines and lifestyle, thereby generating highly personalized recommendations. For example, Nestlé introduced a new lifestyle app in August 2020 that offers live coaching and tailored nutrition plans to help users achieve their wellness goals. Similarly, ZOE launched an AI-driven test kit and app in June 2020, which creates personalized eating plans based on an individual's dietary inflammation and gut microbiome.

The personalized testing segment is projected to experience the highest growth rate, with a compound annual growth rate (CAGR) of 16.29% over the forecast period. This rapid expansion is driven by increasing consumer awareness of personalized nutrition benefits, advancements in genomic and microbiome testing technologies, and a rising demand for customized health solutions.

Recent Developments

- Meijer’s Virtual Personalized Nutrition Coaching: In January 2024, Meijer unveiled a new virtual personalized nutrition coaching service. Initially launching exclusively in Michigan, the service is designed to provide individualized nutritional guidance through digital platforms. The company has plans to expand this service to its other Midwest locations in the future, aiming to enhance customer wellness with personalized support.

- GenoPalate and Earth Fare Partnership: Also in January 2024, GenoPalate announced a strategic partnership with Earth Fare, a leading clean grocery store. This collaboration marks GenoPalate’s entry into retail, where they will leverage advanced technology and data to offer personalized nutrition solutions. The partnership aims to transform grocery wellness by integrating customized dietary recommendations into the shopping experience.

Who are the Top Manufactures in Personalized Retail Nutrition and Wellness Market?

- Nature's Lab

- Cargill, Incorporated

- Nature's Bounty

- Bayer AG

- PlateJoy LLC

- Better Therapeutics Inc.

- Viome Life Sciences, Inc.

- Noom, Inc.

- Savor Health

- Nutrigenomix

- DNAfit (Prenetics Global)

Personalized Retail Nutrition and Wellness Market Segmentation:

By Type

- Fixed Recommendation

- Dietary Supplements & Nutraceuticals

- Vitamins

- Proteins

- Minerals

- Amino Acids

- Enzymes

- Others

- Functional Foods

- Proteins

- Vitamins

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Carotenoids

- Traditional Botanicals

- Repeat Recommendation

- Dietary Supplements & Nutraceuticals

- Vitamins

- Proteins

- Minerals

- Amino Acids

- Enzymes

- Others

- Functional Foods

- Proteins

- Vitamins

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Carotenoids

- Traditional Botanicals

- Continuous Recommendation

- Dietary Supplements & Nutraceuticals

- Vitamins

- Proteins

- Minerals

- Amino Acids

- Enzymes

- Others

- Functional Foods

- Proteins

- Vitamins

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Carotenoids

- Traditional Botanicals

- Personalized Testing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Frequently Asked Questions

The global personalized retail nutrition and wellness market size was reached at USD 3.41 billion in 2023 and it is projected to hit around USD 14.06 billion by 2033.

The global personalized retail nutrition and wellness market is growing at a compound annual growth rate (CAGR) of 15.22% from 2024 to 2033.

The North America region has accounted for the largest personalized retail nutrition and wellness market share in 2023.

The leading companies operating in the personalized retail nutrition and wellness market are Nature\'s Lab; Cargill, Incorporated; Nature\'s Bounty; Bayer AG; PlateJoy LLC; Better Therapeutics Inc.; Viome Life Sciences, Inc.; Noom, Inc.; Savor Health; Nutrigenomix; DNAfit (Prenetics Global).

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others